Abundant Polk

Intro

Activision Blizzard ( NASDAQ: ATVI) has actually been at the leading edge of video gaming for rather a long time. Being house to a few of the world’s biggest names in computer game Activision Handled to power through the pandemic with no slump. And although profits have actually not been the most steady due to developing customer choices and strong competitors, Activision has actually handled to broaden into various categories of interactive home entertainment to hedge versus the losses. Drivers such as the growing computer game neighborhood and current assistance from Microsoft leave the chance for Activision to stay at the cutting edge of the computer game world.

Business Introduction

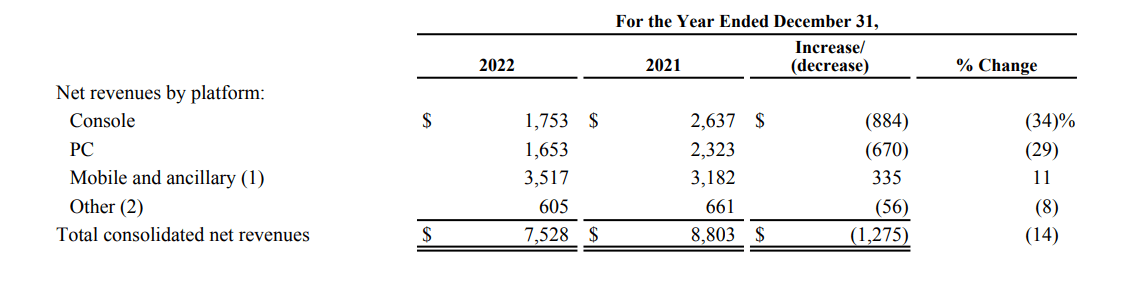

Activision Blizzard is a leading home entertainment business that concentrates on the advancement, publishing, and circulation of computer game. The business is renowned for a few of the video gaming market’s greatest names such as Call of Responsibility, Wow, Diablo, Sweet Crush, and Overwatch. Their income originates from the several platforms they disperse to such as Console, PC, Mobile, and Leagues. Reported financials from 2022 expose that 46.7% of their overall income that year originated from mobile items. 23.3% from console, and 22% from PC. The staying 8% can be sourced back to esports leagues and other various circulation approaches.

Market Introduction

The worldwide online video gaming market has actually shown to be vibrant with each year bringing something brand-new to the video gaming neighborhood. Individuals have actually extensively accepted computer game as a popular type of home entertainment, indicates of socializing, and even as a competitive sport. The video gaming market was approximated to be worth $ 204.63 billion USD and is anticipated to grow to $440.89 billion USD by 2032 with a CAGR of 7.97%. Activision Blizzard presently holds a 3.32% market share in Q1 of 2023. As more individuals welcome video gaming as a part of daily life, the Interactive Show business reveals no indications of decreasing.

Competitive analysis

If there is something that Activision does right its diversity. Their strong portfolio of franchises brings a devoted fan base and supplies constant income streams throughout numerous categories of computer game. On top of that Activision Blizzard produces income from several sources within each franchise consisting of sales, in-game purchases, memberships, licensing, and esports occasions. This diversity increases the stability of Activision’s profits by not making them too dependent on any one income stream. One fantastic chance that occurs with owning a franchise is the capability to broaden copyrights and construct on currently effective titles.

Financials

Activision Blizzard launched its 2021 and 2022 segmented profits. The typical profits from each platform throughout these 2 years come out to 41% mobile sales, 26.9% console, 24.3% PC, and 7.8% from other circulation approaches.

Activision Blizzard 2022 Yearly Report

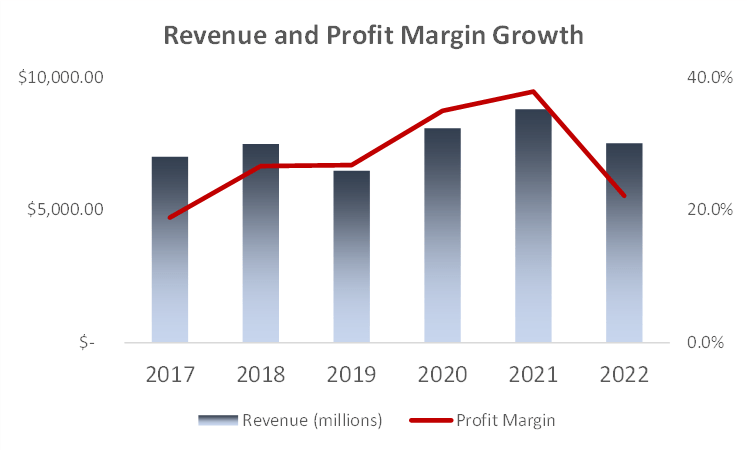

Over the previous 5 years, Activision Blizzard has actually seen a number of years where income development was unfavorable however has actually handled to keep a five-year typical development rate of 2.5%. The 14% reduction in profits from 2021 to 2022 can generally be credited to lower profits from Call of Responsibility: Lead compared to the previous year’s release Call of Responsibility: Black Ops Cold War. This reduction was a little balanced out by the success of Call of Responsibility: Modern Warfare ll, compared to Call of Responsibility: Lead.

Author’s Product

Secret Driver: Imminent Acquisition

One substantial driver that’s going to drive Activision’s development even further is the acquisition of the business by Microsoft which settled the regards to the handle Might of 2023. This all-cash deal was valued at $ 68.7 billion USD and comes out to around $95 per share of Activision Stock. This is simply over $ 20 more than what the stock was trading at when the regards to the offer were settled. This can bring a significant benefit to both Microsoft and Activision Blizzard by partnering Activision with Microsoft’s Xbox. Microsoft prepares to consist of Activision Blizzard video games in its video game pass membership which has more than 25 million customers. This will expose Activision Blizzard to Microsoft’s practically 85% market share of the Software application and Programs market. Earnings for 2023 are anticipated to strike $ 9,526.02 million USD, an 11.9% boost from 2022. As great as this appears for the business, this offer does not come without dangers. Although the offer is settled, the acquisition has actually been postponed by the Federal Trade Commission[FTC] On Thursday June 22, 2023 the FTC was approved an initial injunction to momentarily obstruct the acquisition due to speculation by Sony and the FTC that Microsoft had strategies to make Call-of-Duty Xbox unique. Microsoft has actually consented to sign an agreement that states Call-of-Duty will be offered to other platforms for ten years. Despite the fact that the block is short-term, the period of this trial might press the offer past its termination date of July 18 triggering a re-negotiation or Microsoft will pay Activision Blizzard a termination cost. Fortunately both Microsoft and Activision Blizzard are big sufficient business to where they can pay for to suffer the trial without suffering too significantly. however, it is something to think about as a possible threat.

Evaluation

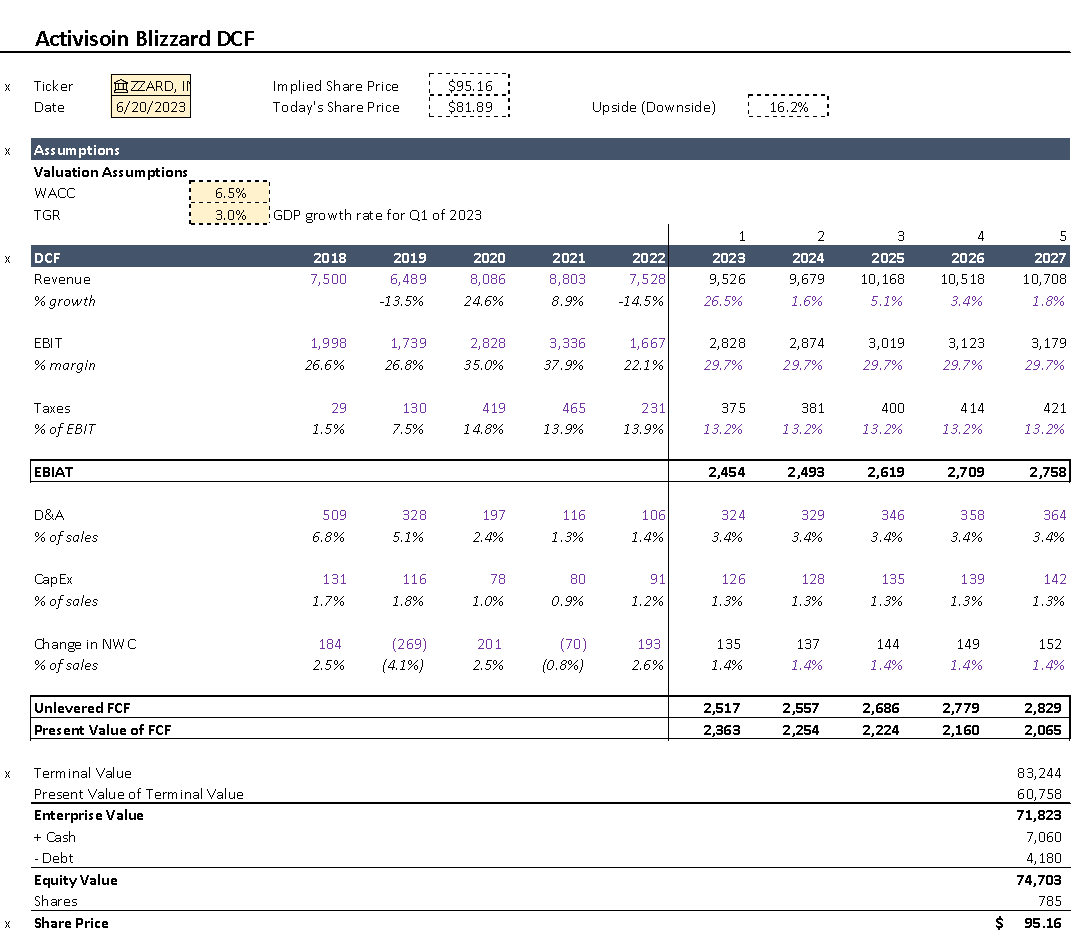

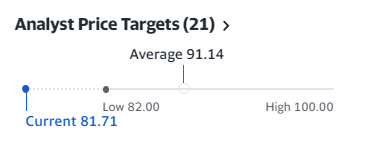

After carrying out an affordable capital [DCF] utilizing a 6.5% discount rate and a 3.0% terminal development rate, Activision Blizzard holds a suggested worth of $95.16 USD per share. In addition to the anticipated market size development of 7.97%, It is sensible to presume that Activision Blizzard has the possible to reach this cost. Other Experts from yahoo financing are approximating the worth of the stock to be in between $82 and $100 USD per share.

Author’s Product Yahoo Financing

ESG

Although Activision Blizzard has actually been on the radar of the SEC for failure to sufficiently track and report workplace grievances, they have actually been making efforts to enhance their effect on their staff members and the neighborhood around them. In February of 2023, the business consented to a $ 35 million settlement to fix the claims for labor force grievances. Throughout the course of 2022, Activision was acknowledged with lots of awards consisting of the LA Times CFO Management Award, Range 500 Award, and the Profiles in Variety Journal Award. Eagerly anticipating 2023, Activision Blizzard specifies that they intend on increasing their worldwide protection of staff member relations support, increasing chance for development and acknowledgment of DEI operate in their groups, and continuing their objective to accomplish net absolutely no carbon emissions by 2050.

Dangers

Though Activision Blizzard has an excellent structure for development and is profiting from its chances, there are a couple of possible dangers to think about. Activision Blizzard has actually had unfavorable promotion in the previous associated to workplace culture and a hostile workplace. While the business has actually taken steps to enhance these things, unfavorable attention can hurt the business’s track record even after the problems have actually been solved. Another threat originates from the developing choices of customers. The video gaming market has actually started to see a shift in what customers like. The huge boom of fight royale design video games has actually brought business like Impressive Games into the competitors that supply video games such as Fortnite and Fall People. No matter how varied Activision Blizzard is, the computer game market is an exceptionally competitive market with online influencers who enormously manage what their audiences are playing.

Conclusion

No matter the competitors Activision Blizzard deals with, the growing approval of computer game in daily life is leading the way for the development of business like Activision. The business has actually revealed the capability to remain strong through market recessions while making forward-thinking choices that support its growth. With the business’s acquisition by Microsoft settled previously this year, Activision’s worth has actually not caught the development it is going to get from Microsoft’s impact. Computer game are just growing and the business that can capitalize appropriately are bound to see a generous return.

Expert Suggestion By: Kevin Caballero