-

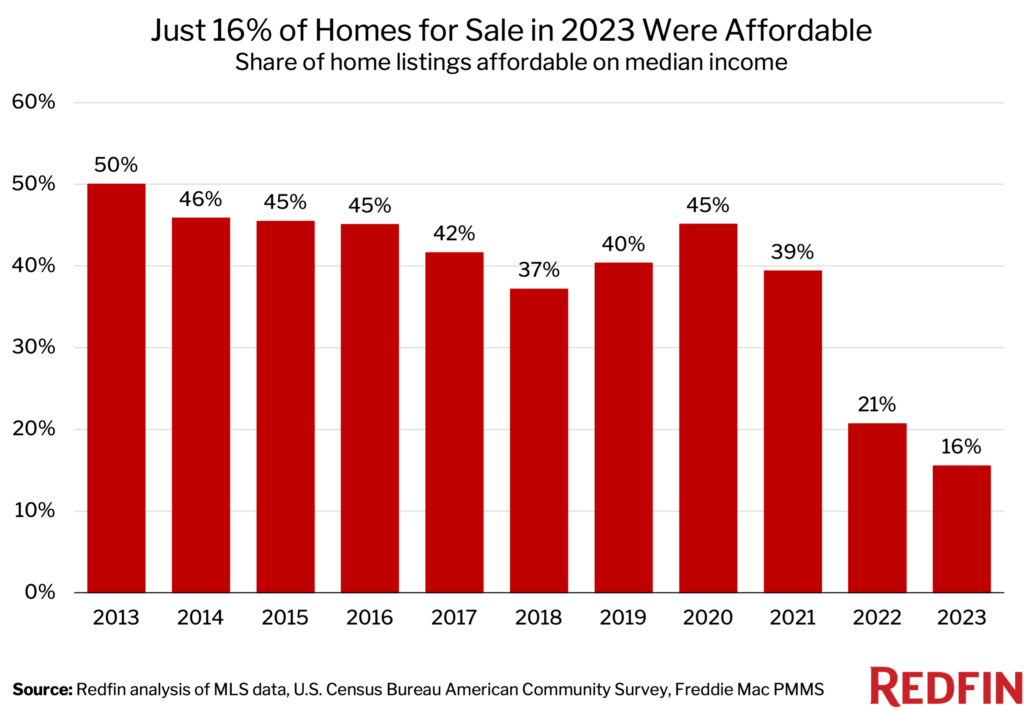

That’s the most affordable share on record, below 21% in 2022 and over 40% before the pandemic homebuying boom.

-

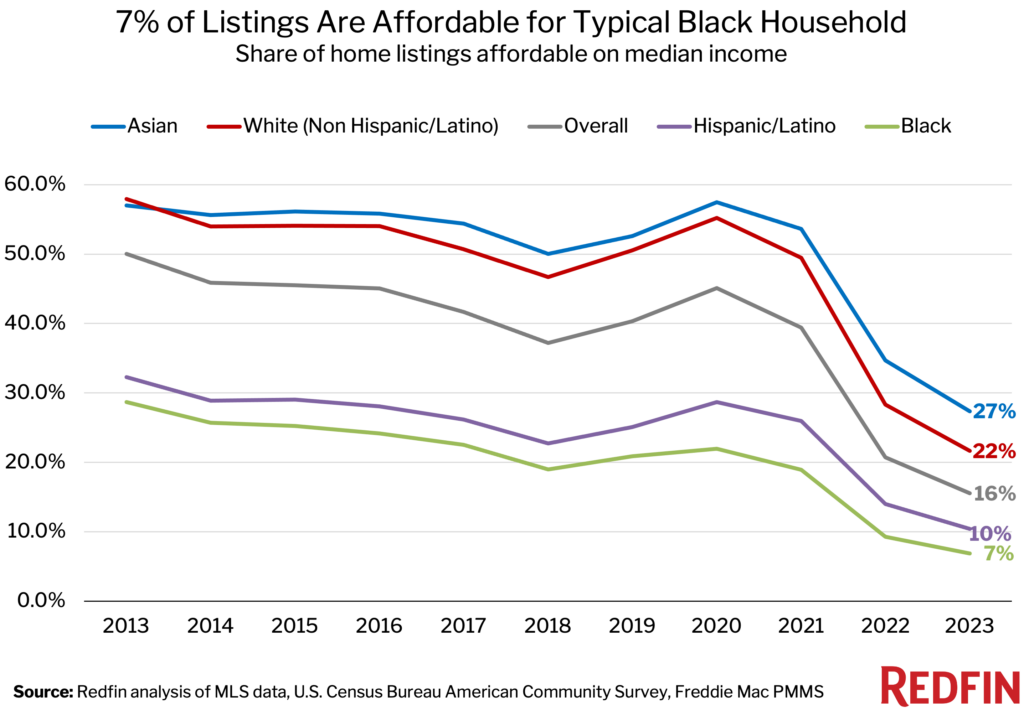

White families had 3 times more economical alternatives than Black families this year.

-

Real estate cost is anticipated to enhance in 2024 as home loan rates fall and more homes increase for sale.

Simply 15.5% of homes for sale in 2023 were economical for the common U.S. family– the most affordable share on record. That’s below 20.7% in 2022 and more than 40% before the pandemic homebuying boom.

This is according to a Redfin analysis of brand-new listings in 97 of the most populated U.S. cities. A listing is thought about economical if the approximated month-to-month home loan payment disappears than 30% of the regional county’s mean family earnings. The nationwide share was computed by taking the amount of economical listings in the cities Redfin examined and dividing it by the amount of all listings in those cities. Information for 2023 goes through November, while information from previous years covers the complete year. Redfin’s records go back to 2013.

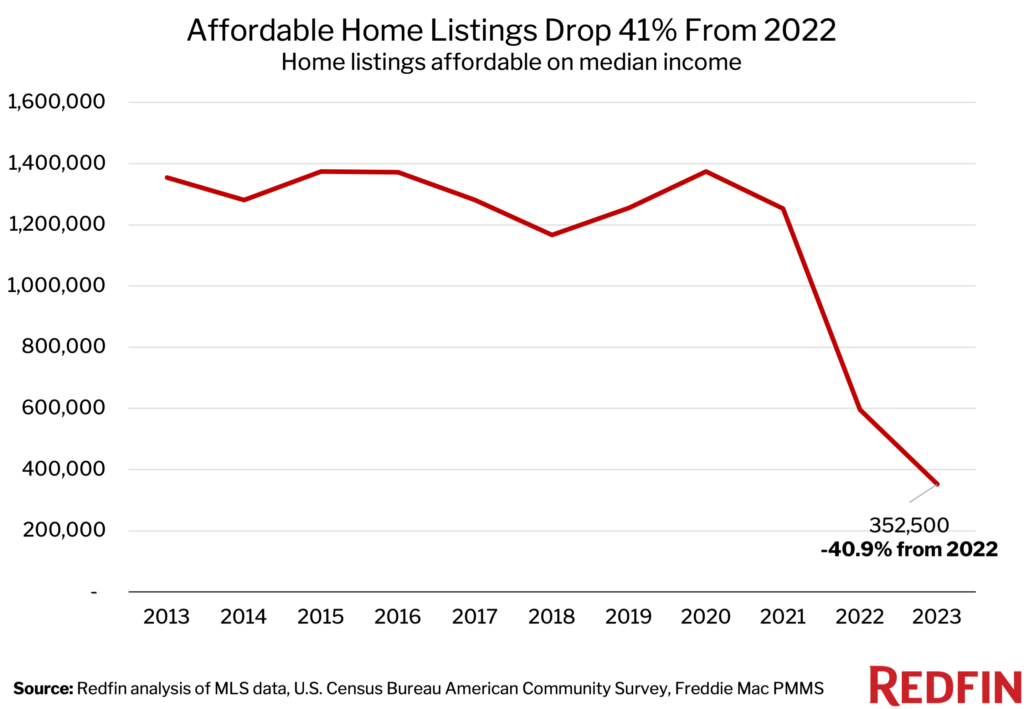

The number of economical homes for sale likewise dropped to the most affordable level on record. There were 352,500 economical listings in 2023, down 40.9% from 596,135 in 2022 and below over a million annually throughout the previous years. While the decrease is partially due to a drop in listings in basic– listings in general fell 21.2% year over year– it’s likewise due to the truth that raised home loan rates and stubbornly high rates made the listings striking the marketplace more pricey.

Home mortgage rates have actually fallen from their October peak, however stay greater than they remained in 2022; the common property buyer’s month-to-month payment is approximately $250 more than it was a year back. Raised home loan rates have actually likewise propped up real estate expenses by restricting supply. Numerous property owners are sitting tight rather of offering due to the fact that they do not wish to lose their ultra low rates of interest. That’s strengthening home rates due to the fact that it implies purchasers are contending for a minimal swimming pool of homes.

Fortunately is that real estate cost has actually currently begun to enhance, and Redfin anticipates it to continue enhancing in 2024.

” A lot of the elements that made 2023 the least economical year for homebuying on record are reducing,” stated Redfin Elder Economic expert Elijah de la Campa “Home mortgage rates are under 7% for the very first time in months, home rate development is slowing down as lower rates trigger more individuals to note their homes, and total inflation continues to cool. We’ll likely see a dive in home purchases in the brand-new year as purchasers make the most of lower home loan rates and more listings after the vacations.”

Real Estate Price Was 3 Times Worse for Black Families Than for White Households

Just 6.9% of homes for sale in 2023 were economical for the common Black family, compared to 21.6% for the common white family. The share was almost as low for Hispanic/Latino families (10.4%) and was greatest for Asian families (27.4%).

Real estate has actually ended up being unaffordable for a great deal of Americans, however Black and Hispanic/Latino households have actually been struck specifically hard due to the fact that they’re frequently less rich to start with. Usually, these groups make less cash, have less generational wealth, and have lower credit report (and in some cases no credit report at all) than white Americans due to years of discrimination. That makes it harder to pay for a deposit and get approved for a low home loan rate. Black Americans, in specific, likewise regularly deal with racial predisposition throughout the homebuying procedure.

The racial real estate cost space exists across the country, from the least economical cities to the most economical cities. In Detroit, which has the most affordable home loan payments in the nation, 31.8% of listings were economical for the common Black family this year and 50.2% were economical for the common Hispanic/Latino family, however that’s much lower than the 66% economical for the common white family. In Anaheim, CA, among the most pricey markets in the nation, individuals throughout the board have a difficult time discovering economical real estate. Still, Black and Hispanic/Latino home hunters have less alternatives. Less than 0.5% of listings were economical for the common Black family and the common Hispanic/Latino family in 2023, compared to 1.8% for the common white family.

It deserves keeping in mind that earnings have actually grown much faster for nonwhite families than for white families this year, assisting to diminish the earnings space. Leas have actually likewise begun to fall, which disproportionately affects neighborhoods of color due to the fact that they’re most likely to be occupants.

Budget Friendly Markets Ended Up Being Much Less Budget Friendly in 2023

In Kansas City, MO, 27.9% of homes for sale in 2023 were economical for the common regional family, below 42.8% in 2022. That 14.8 portion point decrease is the biggest amongst the cities Redfin examined. Next came Greenville, SC (-14.1 ppts), Worcester, MA (-13.7 ppts), Cincinnati (-13.7 ppts) and Little Rock, AR (-13.5 ppts).

Fairly low-cost cities have actually seen cost wear down rapidly due to the fact that real estate expenses have reasonably more space to increase, and regional earnings are frequently climbing up at a portion of the speed that home loan payments are.

In San Francisco, 0.3% of homes for sale in 2023 were economical for the common regional family, below 0.4% in 2022. That’s the tiniest decrease amongst the cities Redfin examined. Next came Detroit (-0.2 ppts), Los Angeles (-0.2 ppts) Boise, ID (-0.3 ppts) and Oakland, CA (-0.5 ppts).

Markets that have actually long been pricey like San Francisco, Oakland and Los Angeles currently had so couple of economical homes that the share didn’t have much space to fall. In the 5 abovementioned cities aside from Detroit, less than 5% of listings were economical for the common family in 2023.

Metro-Level Summary: Share of Residences Affordable for Normal Home

The table listed below consists of the 100 most populated U.S. cities, with the exception of 3 Connecticut cities, which we got rid of due to inadequate information.

| U.S. city location | 2023: Share of listings economical | 2022: Share of listings economical | Modification in variety of economical listings (2022-2023) |

|---|---|---|---|

| Akron, OH | 51.2% | 56.2% | -27.4% |

| Albany, NY | 26.0% | 36.5% | -42.3% |

| Albuquerque, NM | 5.8% | 14.3% | -69.1% |

| Allentown, PA | 23.3% | 33.5% | -48.0% |

| Anaheim, CA | 1.1% | 1.9% | -59.2% |

| Atlanta, GA | 13.8% | 20.8% | -48.9% |

| Austin, TX | 4.2% | 4.7% | -25.2% |

| Bakersfield, CA | 8.4% | 10.3% | -40.7% |

| Baltimore, MD | 29.6% | 41.1% | -45.0% |

| Baton Rouge, LA | 26.4% | 36.5% | -45.5% |

| Birmingham, AL | 34.5% | 39.1% | -32.6% |

| Boise City, ID | 1.0% | 1.3% | -52.3% |

| Boston, MA | 4.7% | 8.7% | -58.2% |

| Buffalo, NY | 35.0% | 40.9% | -24.5% |

| Camden, NJ | 34.4% | 45.1% | -42.1% |

| Cape Coral, FL | 4.7% | 9.5% | -52.4% |

| Charleston, SC | 5.9% | 13.7% | -64.6% |

| Charlotte, NC | 10.5% | 19.2% | -53.6% |

| Chicago, IL | 30.6% | 36.7% | -37.2% |

| Cincinnati, OH | 34.8% | 48.5% | -46.7% |

| Cleveland, OH | 46.5% | 50.2% | -24.3% |

| Colorado Springs, CO | 2.5% | 8.7% | -78.7% |

| Columbia, SC | 19.0% | 30.1% | -46.7% |

| Columbus, OH | 24.2% | 34.7% | -43.4% |

| Dallas, TX | 11.0% | 12.6% | -24.1% |

| Dayton, OH | 49.4% | 53.1% | -24.0% |

| Denver, CO | 3.8% | 7.8% | -62.8% |

| Des Moines, IA | 36.6% | 46.4% | -34.2% |

| Detroit, MI | 51.4% | 51.6% | -14.7% |

| El Paso, TX | 5.1% | 11.9% | -62.8% |

| Elgin, IL | 34.0% | 42.4% | -38.5% |

| Fort Lauderdale, FL | 11.3% | 15.9% | -39.6% |

| Fort Worth, TX | 7.9% | 11.9% | -42.7% |

| Frederick, MD | 22.0% | 28.6% | -44.7% |

| Fresno, CA | 5.8% | 9.1% | -52.8% |

| Gary, IN | 33.3% | 44.2% | -38.8% |

| Grand Rapids, MI | 24.5% | 36.5% | -46.6% |

| Greensboro, NC | 21.5% | 33.4% | -51.1% |

| Greenville, SC | 10.1% | 24.2% | -65.8% |

| Honolulu, HEY | 2.5% | 5.1% | -64.0% |

| Houston, TX | 15.4% | 19.3% | -31.9% |

| Indianapolis, IN | 30.9% | 44.1% | -42.9% |

| Jacksonville, FL | 16.1% | 19.8% | -34.0% |

| Kansas City, MO | 27.9% | 42.8% | -47.7% |

| Knoxville, TN | 10.7% | 22.7% | -62.2% |

| Lake County, IL | 38.7% | 48.2% | -39.0% |

| Lakeland, FL | 8.1% | 9.3% | -22.6% |

| Las Vegas, NV | 6.3% | 7.3% | -43.8% |

| Little Rock, AR | 31.2% | 44.6% | -44.5% |

| Los Angeles, CA | 0.3% | 0.5% | -55.2% |

| Louisville, KY | 30.6% | 43.2% | -42.0% |

| McAllen, TX | 8.8% | 12.8% | -35.0% |

| Memphis, TN | 32.6% | 35.0% | -20.8% |

| Miami, FL | 1.7% | 3.2% | -58.5% |

| Milwaukee, WI | 24.9% | 32.8% | -38.2% |

| Minneapolis, MN | 22.1% | 34.0% | -47.3% |

| Montgomery County, PA | 23.9% | 35.2% | -46.5% |

| Nashville, TN | 3.4% | 8.8% | -68.0% |

| Nassau County, NY | 5.6% | 9.2% | -52.9% |

| Brand-new Brunswick, NJ | 14.1% | 20.6% | -48.5% |

| New Orleans, LA | 19.8% | 24.2% | -32.6% |

| New York City, NY | 3.1% | 4.5% | -46.3% |

| Newark, NJ | 13.2% | 16.4% | -40.2% |

| North Port, FL | 6.6% | 8.0% | -18.5% |

| Oakland, CA | 2.0% | 2.5% | -43.6% |

| Oklahoma City, OKAY | 30.1% | 42.1% | -40.8% |

| Omaha, NE | 29.9% | 37.9% | -32.2% |

| Orlando, FL | 7.6% | 10.9% | -42.1% |

| Oxnard, CA | 0.3% | 1.1% | -81.3% |

| Philadelphia, PA | 28.9% | 33.2% | -31.0% |

| Phoenix, AZ | 3.8% | 8.1% | -67.0% |

| Pittsburgh, PA | 45.2% | 52.8% | -27.7% |

| Portland, OR | 2.3% | 3.9% | -57.0% |

| Providence, RI | 6.1% | 8.9% | -47.7% |

| Raleigh, NC | 12.5% | 18.6% | -50.5% |

| Richmond, VA | 21.1% | 31.3% | -44.9% |

| Riverside, CA | 3.1% | 4.3% | -49.7% |

| Rochester, NY | 40.8% | 49.9% | -30.6% |

| Sacramento, CA | 2.8% | 4.4% | -55.2% |

| Salt Lake City, UT | 2.6% | 4.6% | -56.2% |

| San Antonio, TX | 10.1% | 14.9% | -41.4% |

| San Diego, CA | 0.4% | 0.9% | -70.6% |

| San Francisco, CA | 0.3% | 0.4% | -32.6% |

| San Jose, CA | 0.4% | 1.4% | -79.0% |

| Seattle, WA | 3.0% | 5.4% | -62.6% |

| St. Louis, MO | 47.5% | 53.7% | -24.1% |

| Stockton, CA | 5.2% | 6.9% | -48.6% |

| Tacoma, WA | 2.3% | 3.8% | -60.5% |

| Tampa, FL | 7.9% | 10.9% | -38.1% |

| Tucson, AZ | 3.7% | 9.3% | -69.9% |

| Tulsa, OKAY | 26.5% | 38.9% | -45.4% |

| Virginia Beach, VA | 20.2% | 32.9% | -53.8% |

| Warren, MI | 38.2% | 45.7% | -35.3% |

| Washington, D.C. | 17.1% | 25.9% | -50.6% |

| West Palm Beach, FL | 10.2% | 14.4% | -39.2% |

| Wilmington, DE | 35.3% | 38.5% | -29.8% |

| Worcester, MA | 7.6% | 21.2% | -72.1% |

| National– U.S.A. | 15.5% | 20.7% | -40.9% |

Method

This analysis utilized MLS noting information and county-level information from the U.S. Census Bureau’s American Neighborhood Study on mean family earnings for non Hispanic/Latino white families, Black families, Asian families, Hispanic/Latino families and families in general. To approximate the share of homes economical in 2023, we utilized earnings information from 2022– the most current information readily available. To approximate the share of homes economical in 2022, we utilized earnings information from 2021.

The nationwide share of homes economical was computed by taking the amount of economical brand-new listings in 97 of the most populated U.S. cities and dividing it by the amount of all brand-new listings in those cities. We utilized a weighted average of mean earnings throughout those cities. Metro-level estimations determine the share of homes economical for the common family within the city, based upon the regional mean earnings.

We specify an “economical” listing as one where the month-to-month home loan payment would disappear than 30% of the county’s mean earnings. We approximated the month-to-month home loan payment for each listing utilizing the typical 30-year-fixed home loan rate throughout the month the home struck the marketplace, according to Freddie Mac’s Main Home mortgage Market research. We presumed a 5% deposit, personal home loan insurance coverage of 0.75% of the sale price and house owner’s insurance coverage of $70 monthly. We likewise factored in real estate tax information, presuming a tax rate of 1.25% of the sale price if no record was readily available. We limited our analysis to single-family homes, apartments and townhouses with 2 bed rooms or more.