Justin Sullivan

Seagate Innovation ( NASDAQ: STX) has actually when again captured my attention as the business financials and evaluation are struggling with a drop in the memory storage market. Seagate has actually seen its share cost reduction around 27.5% from 52-week highs even though the business has actually redeemed 8.6% of its share count in 2022 and presently yields a 4.8% dividend yield. Seagate is a business I have actually purchased prior to back in 2015-2016 when it was going through a cyclical earnings swing and the chance seems emerging once again. Last I evaluated this business in Aug 2020. This post will have a look at Seagate’s historical success and dividend protection while likewise examining what totally free money streams yields appears like.

Newest Lead To a Cyclical Market

Seagate launched financial Q3 2023 outcomes back on April 20 th which dissatisfied financiers as they were shining with sights of a market contraction and even possible a bigger worldwide economic downturn. In Q3, Seagate saw adjusted earnings reduction enough to swing to a bottom line of $58 million from earnings $401 million in 2015 Q3 2022. The adjusted incomes significantly omit a $300 million charge for declared infractions of U.S. Export Administration Laws.

Just Recently on March 8 th, Seagate’s CEO likewise talked about an “extended client stock correction” that resulted in weaker need and the loss of $0.28 per share in Q3. Financiers ought to keep in mind to keep a long-lasting view of cyclical business such as Seagate as the CEO even kindly advised financiers of throughout Morgan Stanley’s Innovation, Media, and Telecom conference Let’s get into discussing the long-lasting success now of this cyclical business.

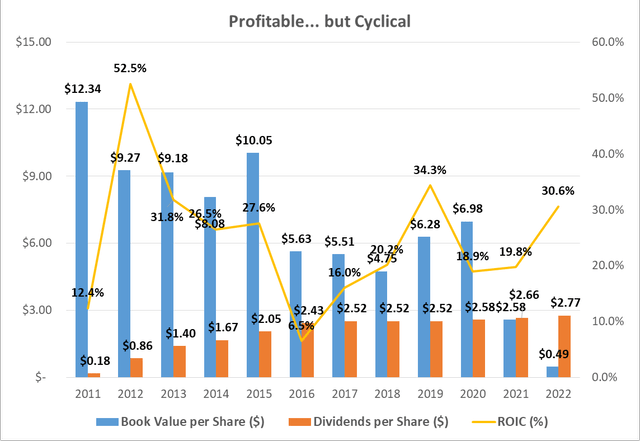

Successful, however Cyclical

By concentrating on its functional strengths in the disk drive memory market, Seagate has actually had the ability to attain a return on invested capital of 22.5% considering that 2011. While cyclical in addition to the memory market, Seagate has actually not had one unprofitable year in the previous twelve years of information I have actually gradually put together. This level of success is well above my guideline of 9% ROIC, enabling me to be positive that, in my viewpoint, the business has the ability to keep its intrinsic worth over business cycle.

Put together from Seagate financials

The reduction in book worth in the most recent couple years is not due to bad efficiency at the business however rather the mathematical impact of Seagate buying their shares at much greater worths than the price-to-book worth as computed from the financials. This reduction in equity on the balance sheet business due to great deals of repurchases likewise makes the ROE metric not helpful, so the above chart just highlights the more pertinent ROIC metric.

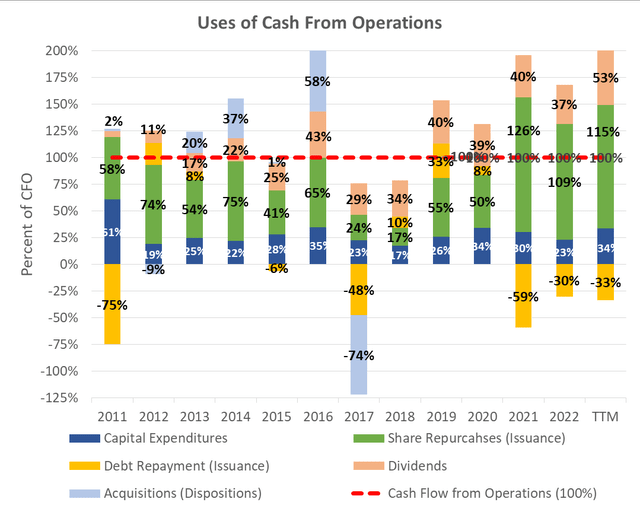

Great Capital Generation at Seagate

Seagate does a fantastic task of returning money to investors. In their newest 2022 ended June 2022, the business returned $2.4 billion to investors in the type of dividends and share repurchases. To get a concept of the sustainability of dividends and share repurchases, we can have a look at what percent of capital from operations is readily available to be gone back to investors after making the required capital investment.

As can be seen listed below, capital investment and acquisitions just consumed typically 34% of capital from operations over the previous years. This leaves around 66% to be gone back to financiers in the type of dividends and share repurchases. With typical capital from operations of $1.7 billion over the previous 5 years and consisting of the TTM duration, this 34% would indicate totally free capital to investors of $1.1 billion for around a 9.5% totally free capital yield at the present $11.6 billion market capitalization.

Put together from Business financials

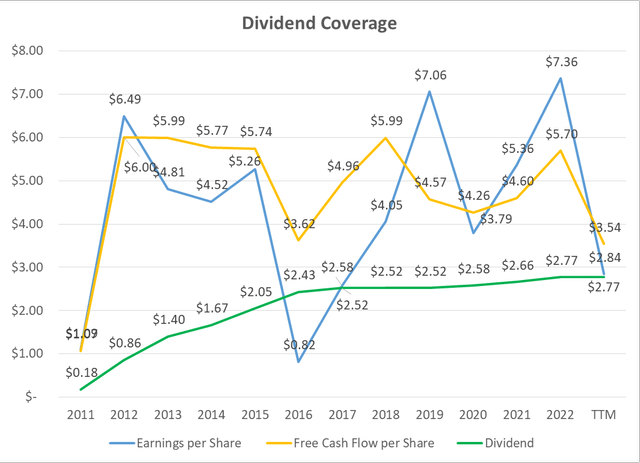

As this capital analysis would recommend, the dividend is well-covered. In regards to both incomes per share and totally free capital per share, Seagate’s dividend payment ratio was just 37.6% and 48.6%, respectively, in the most recent complete financial 2022 year. In the TTM duration and present bad organization environment, Seagate still had an EPS and FCF payment ratio of 97.5% and 78.3% respectively. As can be seen in the chart listed below, the business’s payment rate can increase above 100% in the depths of business cycle. Long-lasting financiers ought to be gotten ready for this and utilize any market pessimism as a chance to revitalize their research and possibly invest.

Put together from Business financials

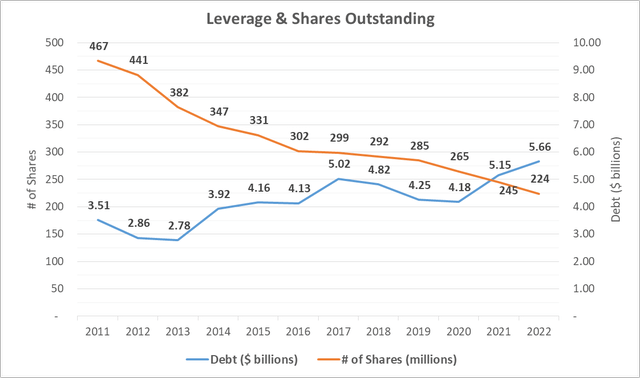

What About the Capital Structure?

Monetary utilize is additional essential when thinking about a financial investment in a cyclical business. While Seagate’s financial obligation has actually increased over the previous years, the business still looks properly funded with an interest protection ratio of 6.1 x in the most recent year. As pointed out formerly in the conversations of capital, Seagate has actually likewise been buying great deals of shares. Because 2011, the business has actually reduced its quantity of impressive shares from 467 million to 224 million for a typical yearly share repurchases rate of 5.96%. When integrated with the present dividend yield of 4.91%, this would show outstanding overall investor yields of around 10.87%.

Put together from Business financials

Takeaway

Seagate appears like a fantastic worth chance in an altering market with a dividend yield of 4.91% and overall totally free capital yields of 9.5% as shown by an analysis of 5-year averages. The business does a fantastic task of returning money to investors in the type of both dividends and share repurchases. With interest protection ratios of 6.1 x in the year leading up to the turn in the cycle, the business looks set to manage a turn in business cycle.