CreativaImages

The chances of going to the shop for a loaf of bread and bring out just a loaf of bread are 3 billion to one“– Erma Bombeck

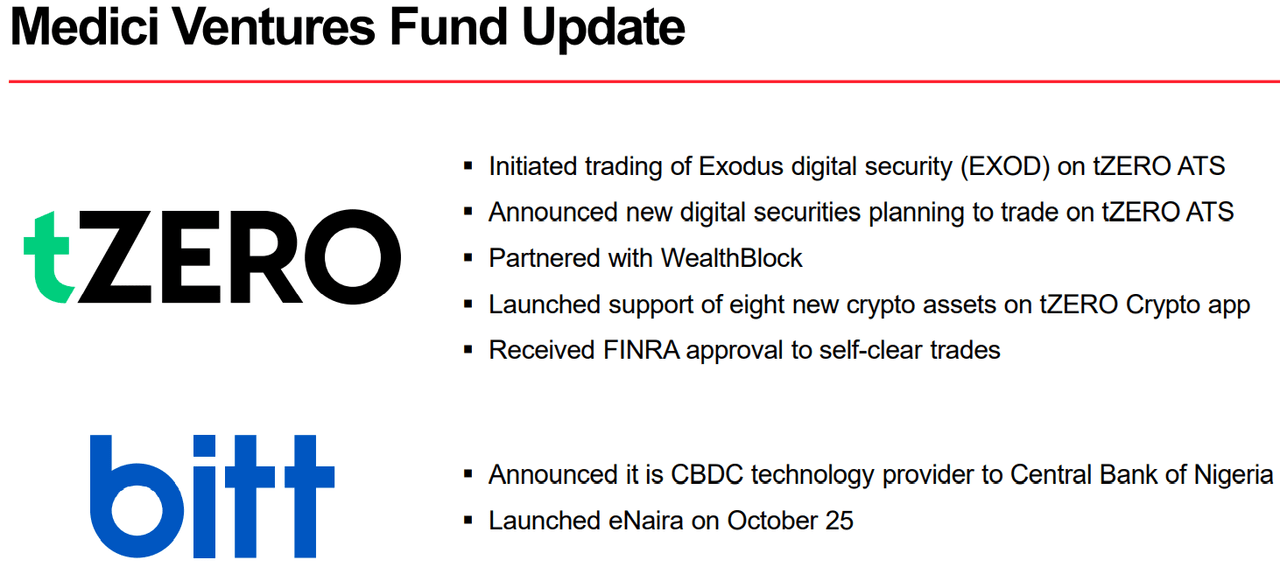

Today, we shine the spotlight on merchant Overstock.com, Inc. ( NASDAQ: OSTK). The stock was a high leaflet throughout the pandemic. Nevertheless, considering that the start of 2022, the equity has actually lost over 80% of its worth. Part of this is because of the business got sidetracked by its venture into blockchain/Crypto in late 2021. Overstock invested some $15 million in this tZERO effort in 2022, however our analysis will concentrate on the retail side of business. An short article from October of 2021 enters into more information about this effort.

Financier Relations

February Business Discussion

There were likewise huge modifications on the core retail side of business in 2022. Can the freefall in the shares be jailed in 2023? An analysis follows listed below.

Business Introduction:

This online merchant is headquartered simply beyond Salt Lake City, UT. The business uses products such as furnishings, design, rug, bed linen and bath, house enhancement, outside, and cooking area and dining products. 2022 was a transformative year for Overstock as management finished the elimination of all the non-home product products from their website and increased variety of home-related items by over 50%. While this added to a big drop in sales in FY2022 (which likewise wasn’t assisted by a considerable wear and tear in the real estate sector), the business goes into FY2023 as a more concentrated retail issue. The stock presently trades around $19.50 a share and sports an approximate market capitalization of $875 million.

4th Quarter Outcomes:

On February 22nd, the business published its 4th quarter numbers They were bad. Overstock had a non-GAAP loss of 4 cents a share, the agreement was trying to find losses to be half that. Worse, profits fell roughly 34% from the very same duration a year ago to simply under $405 million, more $40 million listed below expectations.

February Business Discussion

Management attempted to highlight some positives:

February Business Discussion

Typical order worth for the quarter was $215, a boost of 4% over 4Q2021. Net income per active consumer over the previous 12 months was $374, a boost of 9% year over year. Over half of the business’s general orders (52%) are now originating from mobile phones too. For FY2022, the business had a bottom line of $35 million as sales dropped 30% on a year-over-year basis to $1.9 billion.

February Business Discussion

Expert Commentary & & Balance Sheet:

Because 4th quarter numbers were published, Bank of America ($ 19 cost target, below $23 formerly), Raymond James, and Barclays ($ 19 cost target) have actually all reissued Hold/Neutral scores on the stock. D.A. Davidson ($ 91 cost target), Wedbush ($ 26 cost target, below $42 formerly) and Piper Sandler ($ 29 cost target, below $34 formerly) have all preserved their Buy/Outperform scores on Overstock.

Roughly 13% of the exceptional float in these shares is presently held short. 2 experts, consisting of the CEO, bought simply over $300,000 worth of shares in the 4th quarter of in 2015 jointly. Up until now in 2023, numerous experts have actually offered simply over $140,000 worth of equity in aggregate.

February Business Discussion

The business ended FY2022 with simply over $370 million worth of money and valuable securities on its balance sheet versus almost $35 countless long term financial obligation after publishing a bottom line of $16 million in the 4th quarter. Overstock redeemed some $80 million in stock (at greater rates) throughout the . The business has roughly $20 million left on its existing stock purchase permission.

Decision:

The present expert agreement has the business losing 15 cents a share in FY2023 as profits fall in the mid-teens to simply over $1.6 billion. Experts’ task profits will rebound in the mid-single digits in FY2024 and losses will be halved. Provided the present unpredictable financial outlook, I would take all expert forecasts in the retail area with a considerable grain of salt.

February Business Discussion

It is difficult to get too thrilled about Overstock’s future till we see more indications of a turn-around at the beleaguered retail issue. I personally want management would have utilized its money stockpile to snuff out all financial obligation in 2022 rather of greatly redeeming its own stock, which is a simple employ retrospection.

Overstock’s effort to end up being a ‘ home-only‘ online merchant play is a sensible relocation in my viewpoint. The business must benefit with time as increasingly more of this area moves to the online channel. That stated, the timing of the relocation was unfortunate as it occurred as typical home loan rates more than doubled in 2022, which showed to be a significant headwind to the whole real estate sector.

Sadly, greater rates are most likely to be with us for a while as the Federal Reserve continues its efforts to squash rising rates throughout the economy. With the typical customer losing purchasing power to inflation for 23 straight months now, the retail sector is most likely to stay under pressure in FY2023. Overstock’s fortress balance sheet will guarantee it survives these obstacles as a going issue. Nevertheless, till fortunes enhance for the customer and real estate sector, the stock is most likely to continue to underperform the general market.