Pekic/E+ by means of Getty Images

Description

In basic, I believe Rentokil’s ( NYSE: RTO) ( OTCPK: RKLIF) choice to focus on the pest-control market is sensible due to the fact that the sector is anticipated to proliferate both now and in the future. Over the next couple of years, I prepare for that the bug control market will continue to combine and grow in the low to mid single digits vary. The closing of the Terminix acquisition in 3Q22 is especially amazing for RKLIF. The greater route-density synergies will supply an increase to profits and likewise offer RKLIF the chance to overtake Rollins’ ( ROL) development rates. In conclusion, Rentokil is an excellent business and I am suggesting a buy ranking on RTO stock.

4Q22 outcomes

I wish to applaud management for sounding so ensured throughout the profits call prior to we dive into the numbers. The call consisted of vital info, consisting of specifics on synergies, combination, long-lasting development potential customers, and the offer itself. Management did not supply any info relating to natural development for FY23, however they did state that the year is off to a great start which they prepare for underlying margins will enhance also.

In regards to the outcomes, profits followed the agreement quotes, and the changed PBT surpassed expectations, primarily due to enhanced synergies. The Group’s changed EBIT totaled up to ⤠571 million, which was 4% greater than the anticipated agreement, leading to an implied margin of 15.4%. The Group’s natural development for the complete year was 6.6%, with The United States and Canada displaying a development rate of 5.7%. The natural development in the 4th quarter for Insect Control in The United States and Canada enhanced to 5.6% from 3.5% in the 3rd quarter. FCF was ⤠374 million, which grew by 6% compared to the previous year, and DPS for FY22 were 7.55 p. In general, I view the outcomes as noise, as the boost in synergy assistance shows that the management has actually efficiently performed the offer combination. In addition, I anticipate agreement and financiers to modify their FY25 targets, as such ought to press the stock greater.

Market and development

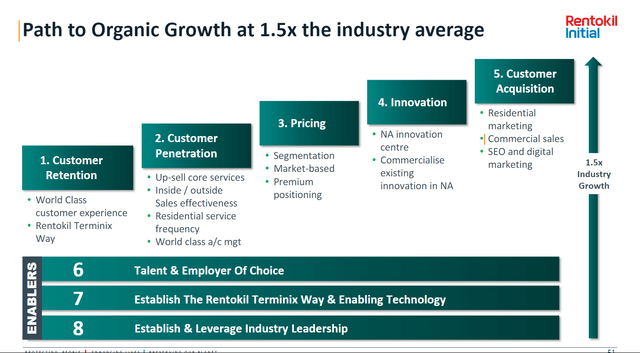

From the 4Q22 profits ppt, information shows that the worldwide Insect Control market will broaden at a CAGR in the mid single digits through 2027, with the United States growing at approximately 5% of and the rest of the world at 6%. Majority of the world market remains in the United States, and 65% of the United States market is comprised of property and termite treatments alone. The most essential thing I gained from this is that the present RKLIF penetration rate amongst United States customers is less than 15%. It is essential to keep this in mind due to the fact that, although having a smaller sized share (RKLIF has a smaller sized United States share than ROL) would lead to weaker economics, this in no chance shows that RKLIF is poor organization. With a smaller sized share, it suggests RKLIF can continue to grow at a quicker rate, and real enough management likewise thinks they can grow at a rate that’s 1.5 times the United States market average.

4Q22 profits ppt

Terminix offer and synergies

The previous synergy target of $150 million for FY25 has actually been increased to $200 million. The upgraded guide has actually effectively resolved my previous confusion relating to whether this synergy takes place prior to or after reinvestments. To be more accurate, the objective is to accomplish a $275 million in gross synergy, of which $75 million will be utilized to reinvest in the business. I value management being transparent about this, as I believe it will increase financier optimism about the business’s long-lasting margin development. When it comes to the probability of RKLIF accomplishing this synergy, I discover it to be relatively possible. In my viewpoint, when these 2 services are integrated, there will be lots of overlapping areas in their branch workplace network. As complete usage of each office/node considerably enhances system economics, path performance is a crucial consider the success of this organization. On the whole, there are presently 600 branches in The United States and Canada, however management has actually shown they wish to cut that number to about 400 in the future. If we accept these numbers at stated value, it suggests that the combined organization will be 1.5 times more effective than it is right now.

Assistance

The very first couple of months of FY23 have actually gone swimmingly. RKLIF’s prices structure is robust enough to continue balancing out inflation. Management is preparing for continual robust hidden trading momentum throughout the year. Till FY25, the business’s brand-new mid-term objectives require a natural development rate of a minimum of 5% and an adjusted EBITA margin of a minimum of 19.0%. Restructuring and greater funding expenditures are 2 examples of what I considered as one-offs occasions that will take place in FY23 prior to going back to typical levels afterwards.

Evaluation

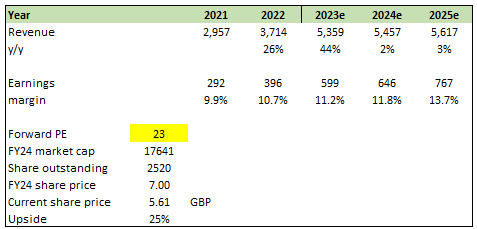

The present evaluation of 23x forward PE is likewise not extremely costly. Presume RKLIF can fulfill agreement assistance in FY25, which ought to be simple if the synergy succeeds and RKLIF continues to grow naturally. One might likewise argue that the discount rate compared to ROL is substantial, and RKLIF has the possible to have its evaluation re-rated greater if it carries out as prepared. RKLIF, for instance, utilized to trade at 40x simply 2 years earlier. As an outcome, the possibility of increased upside from evaluation re-rating ought to not be dismissed.

Author’s quotes

Summary

All in all, the 4Q22 outcomes were sound, with profits satisfying agreement quotes and changed PBT going beyond expectations. The current Terminix acquisition is especially amazing, as it will supply RKLIF with greater route-density synergies and the chance to overtake ROL development rates. The boost in synergy assistance shows that management has actually efficiently performed the combination, and I anticipate agreement and financiers to modify their FY25 targets, pressing the stock greater. In general, I advise a buy ranking for RKLIF.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers related to these stocks.