Jaromir Ondra

As the majority of you understand, oil withdrawals from the U.S. Strategic Petroleum Reserve – in addition to collaborated releases by other member nations of the International Energy Company (” IEA”) – were utilized by the Biden Administration to reduce the effect of Russia’s intrusion of Ukraine on worldwide oil supply and the resulting pain-at-the-pump customers felt in addition to that, and associated high inflation throughout the economy Today, I’ll take a more detailed take a look at the SPR and whether President Biden’s method was a success. I’ll likewise go over whether the SPR today is almost as “tactical” as it remained in the late 1970s/early 1980s when it entered into operation.

The SPR

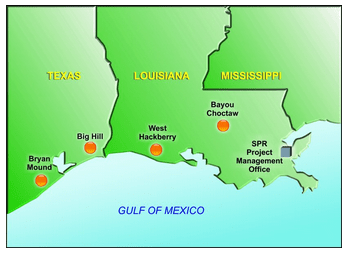

U.S. Department of Energy

As displayed in the graphic above, the SPR’s oil reserves are kept in 4 big underground salt caverns – 2 in Louisiana and 2 in Texas. In aggregate, these websites have a combined authorized storage capability of 714 million bbls:

- Bayou Choctaw – a licensed storage capability of 76.0 million barrels.

- West Hackberry – a licensed storage capability of 220.4 million barrels.

- Big Hill – a licensed storage capability of 170.0 million barrels.

- Bryan Mound – a licensed storage capability of 247.1 million barrels.

The hidden system utilized to move oil in and out of the SPR salt caverns counts on the truth that oil drifts on water. That holding true, withdrawing oil from the SPR is as easy as pumping fresh water into the bottom of a cavern. That successfully forces petroleum to the surface area where pipeline connections can transfer it to terminals and refineries around the country (however usually to those along the Gulf Coast nearby to the caverns themselves).

The “Biden Drawdown”

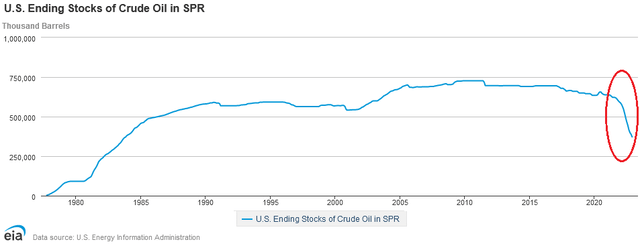

While the SPR level had actually been slightly decreasing for many years, the considerable draw-down in the SPR started in earnest right after Russia got into Ukraine in February of 2022. That’s kept in mind by the red oval (included by the author) listed below:

EIA

That was essential due to the fact that the intrusion, and the subsequent sanctions put on Russia by America and its democratic and NATO allies, led to Russia weaponizing gas supply by closing down the huge pipelines serving the EU. That successfully broke the worldwide energy supply chain – an international supply chain that has actually given that been practically completely reconfigured. At this moment, I question the EU will ever rely on Russian oil and gas supply once again – a minimum of not as long as Putin and the existing routine supervises.

Regardless, information from the EIA show the SPR held 578.9 million bbls in February of in 2015 when the intrusion started and ended 2022 with 372.0 million bbls. That shows withdrawals of 206.9 million bbls over that time period – or a decrease of an approximated 35.7%. Even even worse, state Biden’s critics, the SPR is now down to just 29% of its licensed capability.

That triggered numerous energy experts and right-leaning political leaders to associate their hair-on-fire and alert of upcoming doom due to the fact that the U.S. was in some way at severe threat due to an SPR drawdown to levels not seen given that the early 1980s. I definitely concur with the levels observation, after all – that is just a quickly verifiably truth (like the graphic above).

Nevertheless, the “doom” situation was (and still is …) method off base in my viewpoint (see thinking listed below). However in an age where incorrect stories can rapidly get headings on social networks, numerous otherwise unknowing financiers purchased in to what in some quarters was a preferred line of idea. The exact same held true concerning the EU: Its member countries were allegedly going completely freeze last winter season due to its pivot to renewables. That ended up being an incorrect story also (not to point out that what got the EU in difficulty in the very first location was undoubtedly its reliance on nonrenewable fuel sources materials from Russia, not renewables).

See my current Looking for Alpha post The Death of NYMEX Gas on why the EU had the ability to make it through the winter season (Tip: we reside in a brand-new “Age of Energy Abundance” and shale is still “brief cycle” despite what some self-serving political leaders and energy business CEOs are stating). Certainly, keep in mind that T he United States Gas ETF ( UNG) is presently trading down another 15% because that post was released on Looking for Alpha 2 weeks back.

However let’s return to looking much deeper into the SPR withdrawal concern to see why the popular “end ofthe world” situation story showed to be incorrect.

Was The Release Technique A Success?

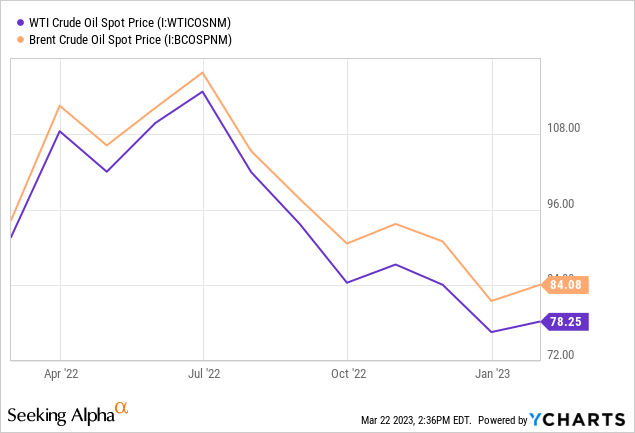

I expect the main aspect to think about regarding whether the withdrawal method was a success is just the cost action of WTI and Brent from Feb. 24 of in 2015 to today:

As can be seen in the graphic, the cost of both criteria surged dramatically straight after the intrusion – both discussing $120/bbl. Nevertheless, as the graphic likewise reveals, given that their peaks the costs of both criteria went directly below July to October and have actually normally continued to trend lower to the existing cost. Today WTI is trading $13/bbl lower than it was prior to the intrusion ($ 91.60/ bbl). Keep in mind likewise that the relative Brent/WTI discount rate mostly stayed undamaged over the previous year, however explain that the existing spread (~$ 6/bbl) is in fact larger than it was at the start of the intrusion. That’s an included benefit for American motorists as compared to the rest-of-the-world customers.

Certainly, the cost of fuel in the U.S. has actually come by more than $1/gallon given that the SPR started launching oil onto the marketplace straight after the intrusion.

Meantime, the typical cost the Department of Energy got for the SPR bbls withdrawn was $ 96/bbl That is ~$ 25/bbl greater than the cost of WTI today.

Now, I’m not what sure what specifies “success” in the eyes of Biden’s critics (if anything …), however an unbiased analysis would need to conclude that – a minimum of up until now – the “Biden withdrawal” has actually definitely succeeded from a financial viewpoint. Unless obviously, you take place to purchase into the political leaders that set their hair-on-fire and obviously desired oil and fuel costs to remain high so that American customers would continue to experience Putin’s intrusion and would continue to fan the inflation fire that those exact same political leaders were likewise grumbling about. It’s difficult for me to square that sort of circular “reasoning,” however that does not keep others from getting headings and continuing to attempt to press that story.

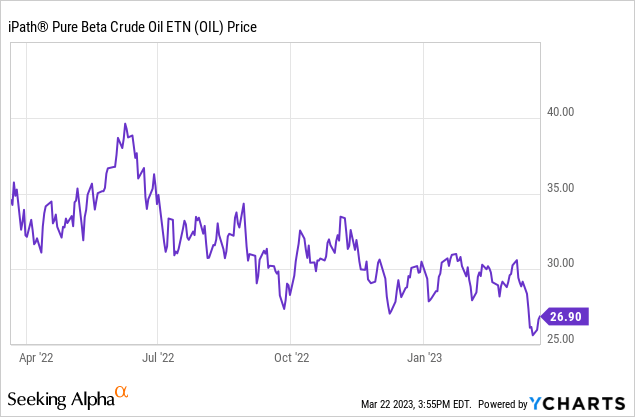

Meantime, keep in mind the iPath Pure Beta Petroleum ETN ( NYSEARCA: OIL) is down 24% over the previous year:

Filling Up the SPR

Last October, the Biden administration revealed its strategy to fill up the SPR and motivate domestic production by putting a flooring under the cost:

… the President is revealing that the Administration means to buy petroleum for the SPR when costs are at or listed below about $67-$ 72 per barrel …

The existing WTI cost at pixel time is $70.80/ bbl, which is definitely within the buyback variety. As an outcome, the DOE revealed in December that it started redeeming oil to fill up the SPR beginning with 3 million bbls acquired at set costs. Reuters reported those shipments were anticipated in February (i.e. last month) after securing “set quotes” from providers. It takes a while for SPR withdrawals and additions to be reported through the system, so let’s not leap to conclusions up until we in fact see the SPR level increase.

Still, that’s just 3 million bbls out of the 180 million bbls due to the “Biden drawdown”. (KEEP IN MIND: the balance was due Congressional mandated releases as an outcome of the Bipartisan Spending Plan Act of 2015) So, there’s still a long method to go and it is a lot easier to make withdrawals from the SPR as compared to refilling it. While up until now the “Biden withdrawal” has actually probably been rather effective, the crust-of-the-biscuit will be the expense per bbl to fill up the SPR also the advantages of reducing inflation (my fans understand I have actually long stated that the main reason for inflation in the U.S. has actually traditionally been straight connected to the cost of oil).

How “Strategic” Is The SPR?

As I reported in a current Looking for Alpha post, today we reside in a brand-new ” Age of Energy Abundance.” That is, the worldwide energy supply today is much various (and plentiful …) than it was when OPEC controlled the worldwide oil market back in the late 1970s and early 1980s.

That’s since that was prior to the Canadian oil sands came online. For instance, in December the U.S. imported more than 4 million boe/d from Canada. And there are 10s of billions of barrels of tested tar sands reserves … a lot, in truth, that some researchers state if we burn them all we’ll burn up the world at the same time.

Meantime, the significant modification from the last 1970s was the technological disturbance of the worldwide oil and gas market by the mix of horizontal drilling and fracking. That has actually resulted in – when again – 10s of billions of bbls of tested U.S. shale reserves (at $40/bbl WTI, not to mentioned $70/bbl …) that can be really financially drilled with a near 100% success rate and brought online to existing pipelines within a matter of a number of months. That innovation disturbance resulted in the U.S. being the No. 1 petroleum manufacturer in the world.

That holding true, I would argue that the U.S. currently has a “tactical petroleum reserve,” and it’s the enormous shale oil and gas reserves that reside in the shale rocks rather of in the salt caverns of the SPR. Does it take a bit longer to produce? Naturally. However shale O&G is still “brief cycle” regardless of what a few of the energy business CEO’s are stating nowadays. Paradoxically, keep in mind these exact same CEOs marketed shale as “brief cycle” possessions for over a years throughout the “drill infant drill” days. Obviously, a few of them have actually altered their mind given that Biden took workplace and stated it was difficult to react to Russia’s actions with greater production. The ramp-up in gas supply for LNG exports to the EU in 2015 basically negated that story in spades.

Meantime, the EIA’s Weekly Status Report released Wednesday early morning reported that U.S. business stocks ( leaving out the SPR) stood at 481.2 million bbls – a boost of 1.1 million bbls from the previous week and a level that is ~ 8% above the five-year typical level for this time of year. That definitely does not appear like a “dooms-day” situation to me.

Meantime, Chevron ( CVX) is still on target to raise Permian production to 1 million boe/d by 2025 and after that the business prepares to hold it above 1 million boe/d up until a minimum of 2040. Exxon ( XOM) continues to establish the enormous Guyana elephant field with an ultimate production target of over 1 million boe/d. Exxon likewise is increasing its Permian production at a quick rate.

The truth is, we reside in an “Age of Energy Abundance,” and if you do not think me, please checked out formerly referenced post as I enter into a lot more depth on the topic.

President Biden – Progressive or Merely Practical?

Another incorrect story is that President Biden dislikes oil and gas. Yet history reveals that just is not the case. I state that due to the fact that:

- U.S. oil production grew much faster under Obama/Biden than it did under either Bush administration or Trump.

- It was the Obama/Biden administration that raised the years old crude-oil export restriction.

- It was the Obama/Biden administration that certified all the U.S. LNG export terminals now in operation that made it possible for short-cycle U.S. gas manufacturers to provide the EU with severely required gas in 2015.

As an outcome, and in the face of the incorrect stories being spun by self-serving political leaders and some oil business CEOs:

- The U.S. is the No. 1 petroleum manufacturer in the world.

- The U.S. took control of as the No. 1 LNG exporter in the world in 2015.

These exact same political leaders like to explain that the U.S. still imports countless bbls of foreign unrefined every day, which holds true. What they do not comprehend and do not inform you is that this oil is imported just due to the fact that U.S. refiners invested 100s of countless dollars years ago to configure their refineries to run a slate of heavy/sour crude from sources like the Canadian tar sands, Venezuela, and Saudi Arabia. That was prior to the technological disturbance of Hz-drilling and fracking and when those nations were believed to be the main sources of oil for years to come. Certainly these refineries are not enhanced to run light-sweet shale oil – which is amongst the greatest quality oil on the planet. Domestic production of light-sweet shale oil long back surpassed domestic refining capability and, as an outcome, the U.S. is a growing petroleum exporter This is what the political leaders do not inform you in their 10-second noise bites when they wish to encourage you that the U.S. is in some way in deep danger due to the fact that it is not energy independent. Absolutely nothing might be even more from the reality.

More evidence that Biden has a practical mindset with regard to energy policy is his current approval of ConocoPhillips’ ( POLICE OFFICER) Willow Job in Alaska. I blogged about this topic in Might 2021 and discussed to financiers that this task was a lot more than just about another oil field – it had to do with nationwide security and keeping throughput on the Trans-Alaskan Pipeline high-enough to avoid needing to shut it down (see Why Biden Authorized police officer’s Willow Job: It’s Everything about Protecting the TAPS). Keep in mind that police officer stock is +80% because that BUY ranked post. This was just more of the exact same from Biden: Practical energy policy that considers nationwide security and economics.

Now the progressives went entirely nuts over approval of the Willow task. However they too just do not comprehend the difficulty and magnitude of the shift to renewals and EVs and the time it will take. Nor do they comprehend the number of shale wells would need to be drilled to equate to the 160,000 bpd production target that police officer has for Willow. That would be a great deal of shale wells (and much higher emissions). The point is, that oil is going to be taken in whether the U.S. produces it or not, and the Willow task is probably among the most affordable emissions sources in the world – definitely much less so as compared to the tar sands from Canada or shale oil from the Permian.

Summary and Conclusion

Merely due to the fact that Biden comprehends that worldwide warming is an existential risk to world – and wishes to speed up the shift to renewables and EVs – does not indicate he is incapable of making hard, practical energy policy choices. Biden’s record definitely reveals that he’s an extremely practical energy policymaker, and the release 180 million bbls of petroleum from the SPR is just another example of his pragmatism management. And, up until now, Biden’s method has actually exercised to the excellent advantage of the American customer along with offering a great revenue for the U.S. federal government.

That stated, we remain in the shoulder season and there were some monetary “hijinx” behind the current sell-off in oil. Certainly, Jeff Currie of Goldman Sachs, who has actually been among the outright bullish experts on oil, discussed that on CNBC today (see this video). A minimum of some of it. Nevertheless, note Currie invested a long time making a bullish contrast in between today and the 2008 spike to $150/bbl. Regardless of some resemblances with regard to banking drama, the huge distinction in between once in a while, obviously, is that today we have U.S. Shale and Currie ignored to point out that the previous oil spike was probably brought on by Bush’s choice to get into Iraq. That took countless bbls of oil off the worldwide market at the specific very same time that China was increase imports. That holding true, I do not purchase into Jeff’s story.

Nevertheless, I do think that – disallowing a tough landing in the U.S. economy – we’ll likely see another strong driving season and an ongoing ramp-up in China oil imports. Presuming that China’s President Xi does not choose to slice off his economy (and the worldwide economy …) at the knees by offering Russia military support, I would anticipate WTI in the 2nd half of the year to be closer to $85/bbl as compared to today’s $70/bbl. Regardless, keep in mind that tier-1 shale manufacturers like police officer, CVX, and XOM are break-even in the Permian at under $40/bbl (likely closer to $35). That holding true, these business are going to kip down another year of enormous revenues and complimentary capital generation despite which situation in fact takes place.