In brief: High inflation and a foreboding economic forecast for 2023 had consumers shifting spending away from luxury items such as high-end smartphones to more necessary purchases like gas and food in 2022. While giants like Apple and Samsung picked up a few points in market share, the overall industry saw declines in the fourth quarter not seen in 10 years.

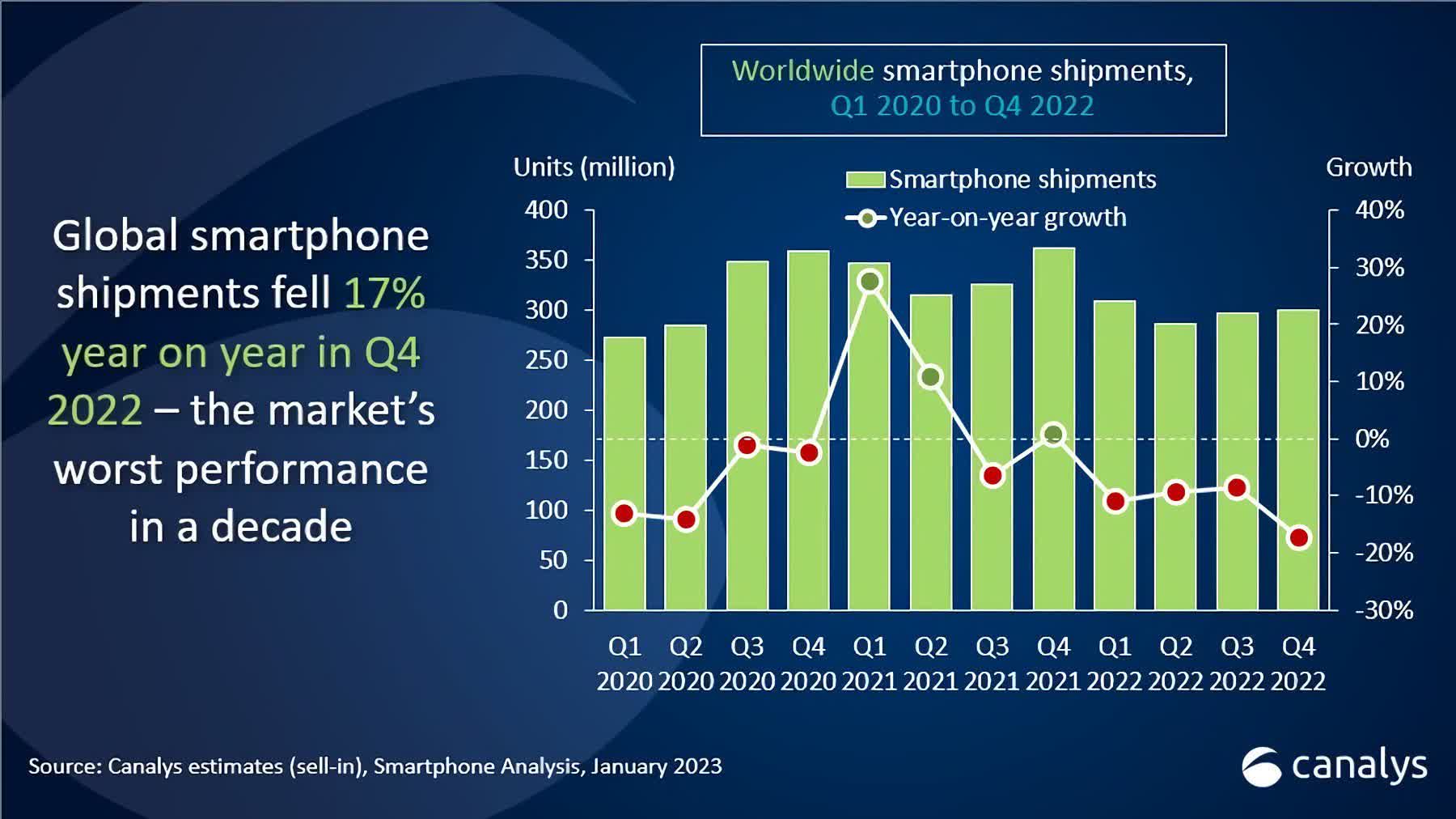

Smartphone vendors are licking their wounds after an all-around lousy year in sales. Analysts at Canalys estimate worldwide shipments for Q4 2022 dipped 17 percent compared to 2021. Full-year sales were down to less than 1.2 billion, a decline of 11 percent year-over-year. The worst performance the industry has seen in a decade.

Apple and Samsung faired slightly better than the rest, with the Cupertino powerhouse wresting away 25 percent of the market over the Korean OEM’s 20 percent — both gains in the industry. Chinese manufacturers Xiaomi, Oppo, and Vivo all took a hit, falling to 11, 10, and 8 percent market share, respectively. Apple’s recent release of the iPhone 14 line contributed to it stealing Samsung’s thunder, at least until the Galaxy S23’s upcoming release.

That said, all vendors have had a rough year regardless of the gains made in market share. The economy is teetering on the brink of a recession, and the tech sector, in particular, has seen a significant contraction, as Canalys Research Analyst Runar Bjørhovde points out.

“Smartphone vendors have struggled in a difficult macroeconomic environment throughout 2022. Q4 marks the worst annual and Q4 performance in a decade. The channel is highly cautious with taking on new inventory, contributing to low shipments in Q4.”

Manufacturers were able to reduce inventory on high-end inventories through the holiday season, but overall, “Q4 2022 stands in stark contrast to Q4 2021’s” high demand and ebbing supply constraints. Even low- to mid-range demand fell sharply in the first three quarters. Folks in 2022 were more concerned with paying their rising bills rather than upgrading to the latest and greatest.

Canalys expects OEMs to protect their market share throughout 2023, prioritizing profitability and cutting costs. At best, it predicts marginal growth in the sector, with the possibility of sales remaining flat in the new year.

“Though inflationary pressures will gradually ease, the effects of interest rate hikes, economic slowdowns, and an increasingly struggling labor market will limit the market’s potential,” said Research Analyst Le Xuan Chiew. “This will adversely affect saturated, mid-to-high-end-dominated markets, such as Western Europe and North America.”

Chiew adds that Southeast Asia is the only region expected to see significant positive growth, but this won’t come until the second half of 2023.

Image credit: Trusted Reviews