Darren415

This short article was very first launched to Systematic Earnings customers and complimentary trials on June 6.

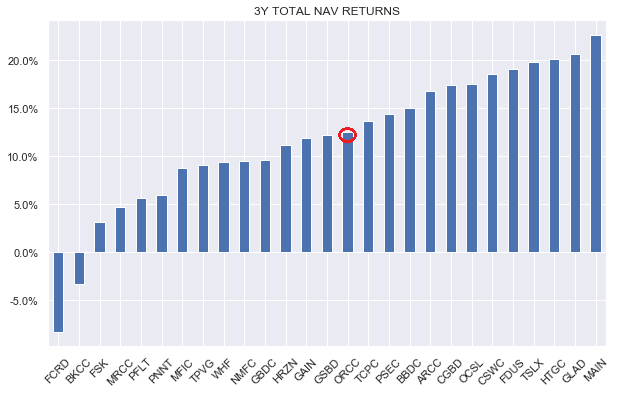

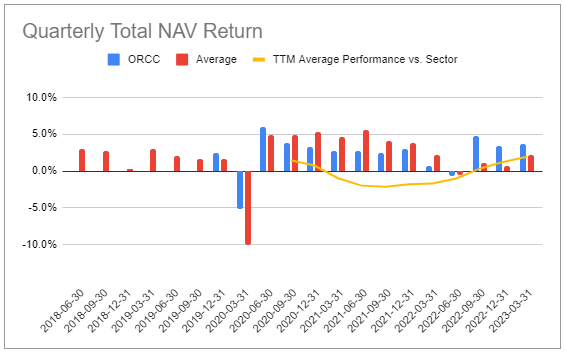

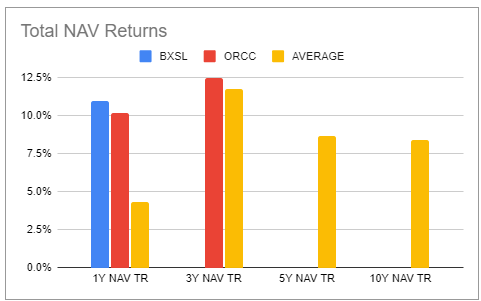

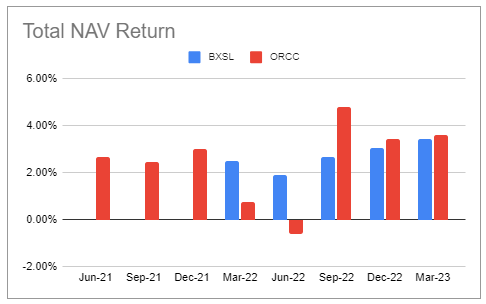

In this short article we have a look at business Advancement Business Owl Rock Capital Corporation ( NYSE: ORCC). The business has actually extended its fantastic run of efficiency with a +3.6% overall NAV return in Q1. Over the previous year the business provided a +10.2% overall NAV return, outshining the mean BDC in our protection by 4.3% (i.e. 10.2% vs 5.9% mean 1Y overall NAV return).

This run of outperformance along with a below-average assessment is one reason we started a position in ORCC previously in the year. We would aim to contribute to it on additional assessment cheapening.

Quarter Update

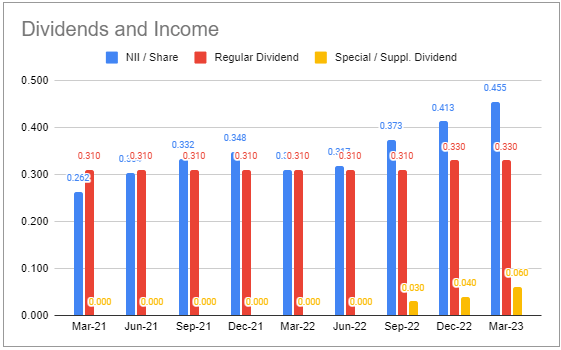

Earnings increased to $0.45 – a 10% boost from the previous quarter and a brand-new record for the business.

Methodical Earnings BDC Tool

ORCC stated the very same base dividend of $0.33 and a formulaic $0.06 unique dividend for an overall of $0.39. Overall dividend protection stands at 117%. The business’s earnings cost yield of 13.33% is a little listed below the sector average of 13.5%.

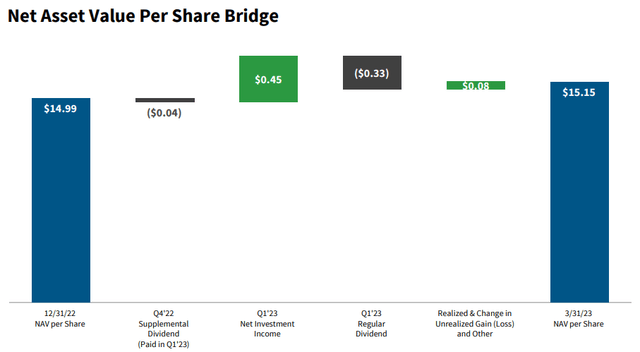

The NAV increased by 1.1% – well above the 0.1% mean for the sector. The increase was because of both maintained earnings and a mark-up in portfolio holdings from 97% to 97.6%.

ORCC

The business has actually redeemed $49m since early May out of the formerly revealed $150m share redeemed strategy. The overall quantity redeemed consisting of shares purchased by the Blue Owl staff member financial investment lorry was $74m at a typical cost of $12.22. This exercises to an almost 20% discount rate on NAV and 11% listed below the cost since this writing. The buybacks are appealing as they are both accretive to the NAV and a shareholder-friendly act by management.

Earnings Characteristics

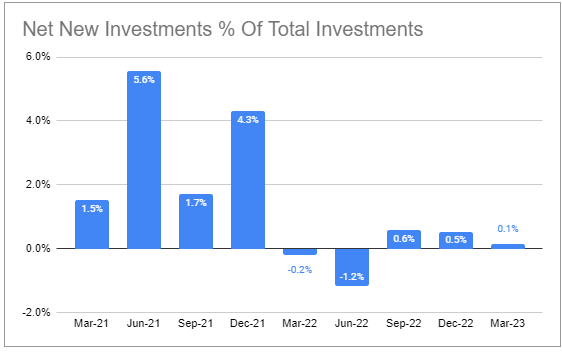

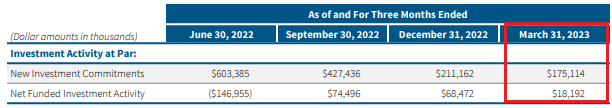

Net brand-new financial investments were a little up as general financed activity was extremely modest. This is a direct function of a low level of payment activity.

Methodical Earnings BDC Tool

Readers might remember our issue that BDCs were not going to have the ability to completely benefit from banks possibly stepping far from business loaning due to the fact that an environment of minimized bank loaning would likewise be among minimized prepayments. So unless BDCs were all set to raise take advantage of considerably greater they were not going to remain in position to completely enter bank shoes. This appears to be playing out, not simply for ORCC, however for the wider sector likewise.

ORCC

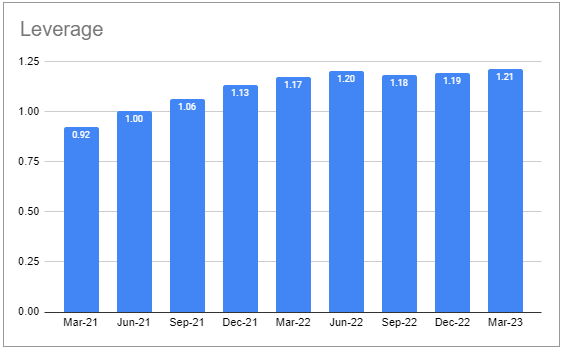

Utilize was very little altered at 1.21 x, practically in line with the sector mean level of 1.19 x. Current take advantage of is close to the leading end of the 0.9-1.25 x target variety which recommends restricted even more earnings benefit in this regard.

Methodical Earnings BDC Tool

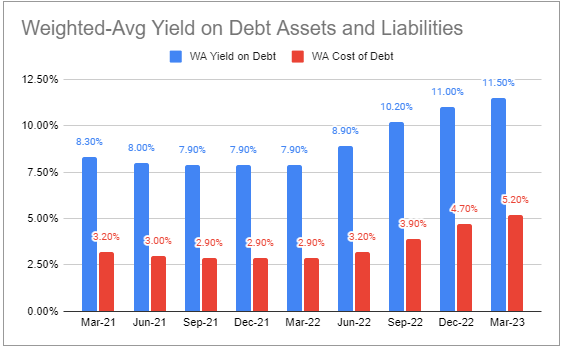

Portfolio yield ticked up by 0.5% while interest expenditure increased by the very same quantity. Net internet this is a gain for general earnings as a bit less than half of the fund’s overall possessions are unleveraged. Both metrics are listed below the sector mean level while the yield spread of 6.3% is a touch above the sector mean level.

Methodical Earnings BDC Tool

Portfolio Quality

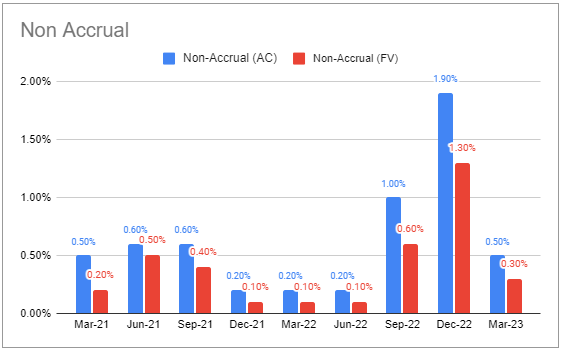

There were just 2 names on non-accrual at the end of the quarter, corresponding to simply 0.3% on fair-value – well listed below the 2.3% mean figure in the sector.

Methodical Earnings BDC Tool

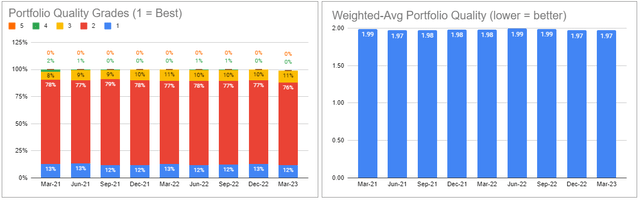

Portfolio quality as determined by internal scores has actually been quite steady.

Methodical Earnings BDC Tool

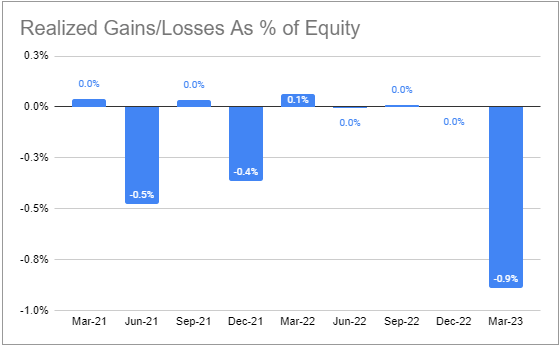

Understood losses was available in at -0.9%, a metric that bears viewing.

Methodical Earnings BDC Tool

Management stated that they do not see any early indications of difficulties throughout the portfolio customer base. Particularly, earnings and EBITDA are increasing however at a slower speed than in the past. Interest protection was 2.2 x at quarter-end and is anticipated to be up to 1.5 x by the end of Q2.

Assessment and Returns

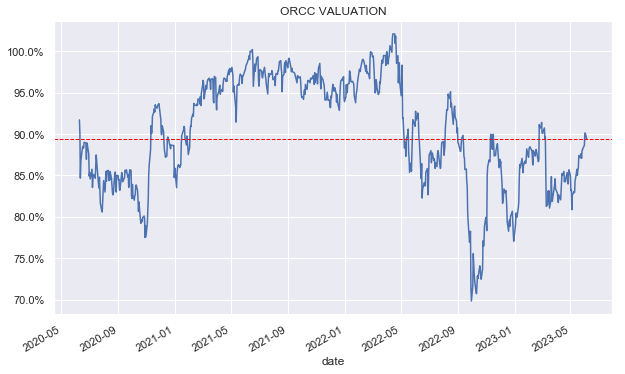

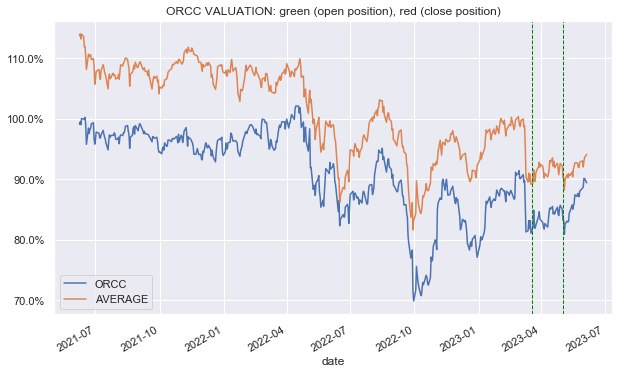

The business’s assessment has actually been unstable over the last 3 years, varying from around 105% all the method to 70%.

Methodical Earnings

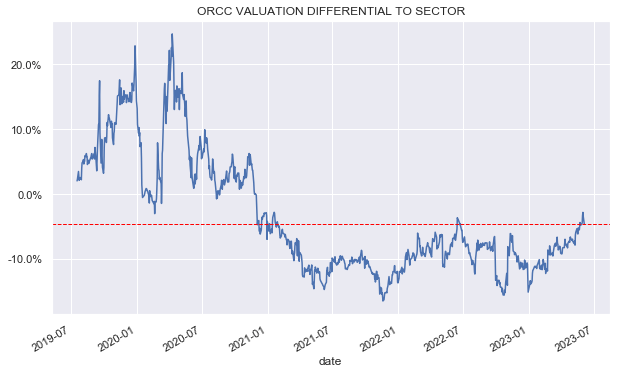

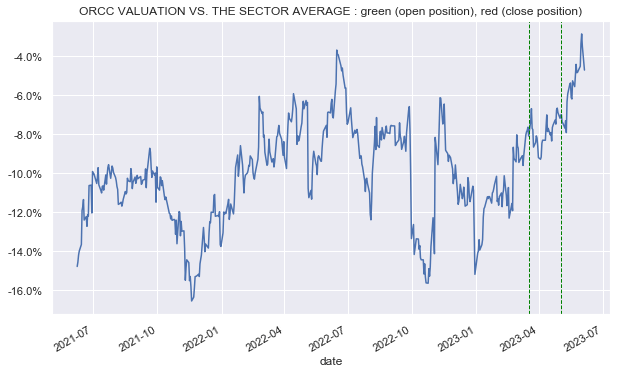

Assessment has actually traded regularly more affordable to the sector (i.e. listed below absolutely no in the chart listed below) given that around 2021.

Methodical Earnings

Its 3Y overall NAV return is relatively decent remaining in the middle of the pack.

Methodical Earnings

The business’s efficiency has actually not been extremely constant – it underperformed through 2021, however has actually just recently started to outshine as soon as again.

Methodical Earnings BDC Tool

In general, this mix of typical longer-term efficiency, below-average assessment and current outperformance (in a progressively tough credit environment) makes the stock appealing in our view.

Position and Takeaways

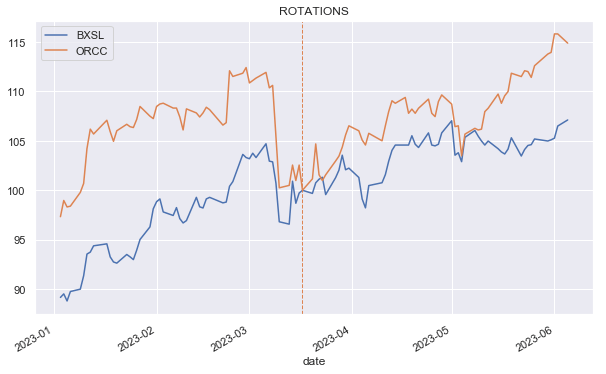

Our just 2 trades including ORCC were 2 rotations made into the stock this year, both from BXSL. The chart listed below programs that both took place when ORCC traded at an evaluation in the low 80s.

Methodical Earnings

In regards to assessment differential to the sector, the rotations were done when ORCC traded at discount rates of 8% and 7% to the sector typical assessment. This assessment differential has actually given that compressed to about 5%.

Methodical Earnings

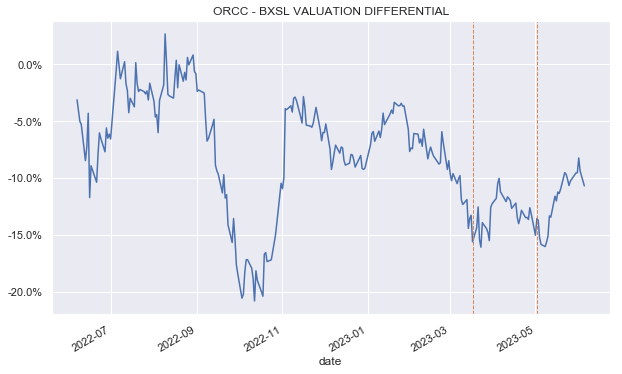

If we take a look at the ORCC/BXSL assessment differential, the chart listed below programs that we turned from BXSL to ORCC when BXSL traded at around a 15% greater assessment than ORCC, something which looked too broad in our view.

Methodical Earnings

Lastly, if we outline overall returns from our preliminary rotation we see that ORCC is ahead by around 8% ever since (the overall returns are stabilized to 100 at the time of the rotation for clearness).

Methodical Earnings

In regards to overall NAV returns, BXSL is a little ahead of ORCC over the previous year.

Methodical Earnings BDC Tool

Nevertheless, ORCC has actually outshined for 3 quarters in a row.

Methodical Earnings BDC Tool

In our view, ORCC is no longer especially inexpensive so we see it as a Hold If its assessment differential opens to 10% or more listed below the sector average, we will think about contributing to the position.