Wirestock

I offer regular monthly summaries for orders, cancellations, shipments, and other order book anomalies for The Boeing Business ( NYSE: BACHELOR’S DEGREE). While the release of regular monthly orders and other order news does not constantly straight affect the stock cost, it is very important to keep an eye on orders and shipments since this supplies the tiniest blocks of info from which we can evaluate how things are opting for the U.S. jet maker and discover patterns early on. The regular monthly pieces likewise are the foundation for the longer term, making a cautious research study of the numbers very significant. In this report, I will be evaluating the Boeing orders for May 2023 along with its shipments.

Boeing Stock Efficiency

|

Boeing Stock Cost Advancement |

|||

|

Timeframe |

Boeing |

Market |

Efficiency |

|

May |

+0.9% |

+0.3% |

Outperformance |

|

Year-to-date |

+14% |

+13.6% |

Market efficiency |

In May, Boeing surpassed the marketplace. There was no significant factor that validates an instant greater stock cost, as the majority of the news and forecasts are very forward looking. What may have enhanced the stock was the rate boost on the Boeing 787 program, which is Boeing’s broad body golden goose, in spite of present shipment hold-ups. In addition, there likewise are reports that Cathay Pacific ( OTCPK: CPCAF) is surrounding an order for the Boeing 777-8F. Year-to-date, Boeing likewise has actually been outshining the wider market, however that outperformance has actually considerably narrowed given that Boeing 737 MAX shipment hold-ups emerged.

In spite of the near-term pressures, I have actually contributed to my position in Boeing, which financial investment has actually not failed me up until now. I am likewise considering Jet SE ( OTCPK: EADSF) stock, as its year-to-date efficiency has actually been more powerful, however throughout the Might month the stock underperformed the marketplace. In any case, both stocks have actually surpassed the wider market and plainly show the attract purchase both names, though it requires to be stated that Boeing’s stock cost seems running ahead of its present basics.

Why I Purchased More Boeing Stock

One might question why I would even trouble purchasing a stock that I think is running ahead of its basics. In my view, it is in fact really basic: any stock cost weak point provides a chance for the long-lasting financier. Purchasing bachelor’s degree stock has actually been a simpler choice for the following factors:

- Boeing has a stockpile of over 5,000 planes valued at almost $400 billion.

- Its net orders are up 10x compared to pre-crisis levels.

- The shipment profile is enhancing.

- The return of Boeing 737 MAX planes in China is trending highly leading the way to shipments and eventually brand-new orders from Chinese operators.

- Complimentary capital will be utilized to lower financial obligation and cut interest expenses.

- Boeing will open a 4th assembly line for the Boeing 737 MAX, which might see the business pressing single aisle production towards 80 planes a month in the 2nd half of the years.

While Boeing has a lot to capture up on to validate its stock cost, I think that simply the above potential customers do use an engaging factor to place yourself for Boeing’s rise in capital. There will be obstacles along the method, as we saw in current months, and the Defense company stays rather frustrating. Nevertheless, the long-lasting image stays intense, and you may in fact fail (or aircraft) if you await Boeing to trade at warranted rates.

Having actually seen the marketplace throughout the pandemic and throughout limit crisis, something that ended up being very clear is that it needs huge crises to bring bachelor’s degree stock down, and at this time I do not see a crisis or mix of crises that might as soon as again bring Boeing down. Macroeconomic elements might end up being a concern, however even that ought to not have a substantial effect if we were to compare it to the scale of the 2 other crises that Boeing has actually dealt with in the last few years.

Outcomes clearly vary till a position is liquidated, however my current buy at the $201 level has actually currently surpassed, with an 8% return compared to 6% for the wider markets.

Boeing Might 2023 Plane Order News

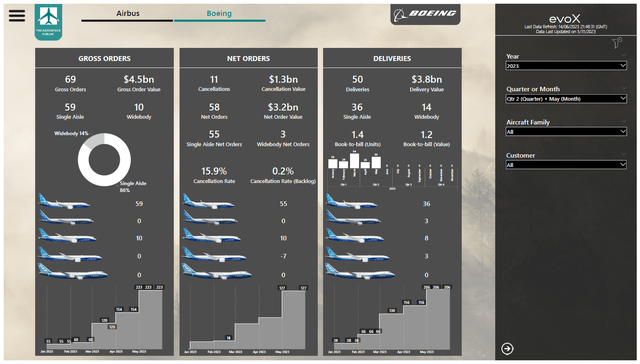

In Might, Boeing scheduled 69 gross orders, marking a consecutive boost of 35 orders, with 86% of the order inflow for single aisle jets and 14% for broad body planes:

- Air Niugini bought 2 Boeing 787-8s.

- One or numerous unknown consumers bought 59 Boeing 737 MAX planes.

- An unknown client bought 8 Boeing 787-9s.

Throughout the month, the following modifications were made to the order book:

- Air Niugini cancelled 4 orders for the Boeing 737 MAX.

- BOC Air Travel ( OTCPK: BCVVF) was recognized as the client for one Boeing 737 MAX.

- China Southern Airlines ( OTCPK: CHKIF) was recognized as the client for one Boeing 777F.

- American Airlines Group ( AAL) took control of 2 orders for the Boeing 787-8 from Boeing Capital Corporation as the jets were shipments.

- An order from Hong Kong International Air travel for 6 Boeing 777Fs was cancelled.

- An order from an unknown client for one Boeing 777-300ER was cancelled.

Might was not an extremely huge month from gross order viewpoint, however the orders for 59 Boeing 737 MAX planes was definitely a welcome one protecting around 2 months of production rates and little over a month at future rates. It may not appear huge, however bagging these type of orders supplies a varied base to build a production schedule and evaluate future rate boosts. The order from Air Niugini covers half a month of production, therefore it was not a substantial offer, however in general we see 10 Boeing 787s being offered throughout the month, which is a month’s worth of production at future rates also.

So, we are seeing how Boeing is constructing the horizon and paving the roadway, from need viewpoint, towards greater future production rates. Boeing likewise ditched orders. The 4 Boeing 737 MAX cancellations from Air Niugini were basically balanced out by the Dreamliner order when determining versus the worth of the offer, while the cancellations for Hong Kong International Air travel was currently expected, and the cancellation of one Boeing 777-300ER likewise does not come as a surprise.

Throughout the month, Boeing scheduled 69 orders valued at $4.5 billion, while it ditched 11 orders valued at $1.3 billion from the books, bringing the net orders to 58 orders with a worth of $3.2 billion. A year earlier, Boeing scheduled 23 orders and 9 cancellations, bringing its net orders to 14 systems, with a net order worth of $2.2 billion, marking a 45% boost in the net order inflow.

Year to date, Boeing scheduled 223 orders and 96 cancellations, bringing its net orders to 127 valued $11.8 billion. As a recommendation, in 2015 Boeing scheduled 236 gross orders and 171 net orders valued at $13.6 billion. So, year-over-year, Boeing is tracking in 2015’s figures, however with an air program coming this month it will be intriguing to see whether Boeing has any sales in the pipeline. The record order from Air India will likely be visited June, as Air India shared that a pre-delivery payment has actually been made, suggesting that a company purchase agreement remains in location.

Throughout the month, ASC 606 decreased by 59 systems, 49 of which were for the Boeing 737 MAX, 6 for the Boeing 777, and 4 for the Boeing 787. ASC 606 modifications changes for orders for which a purchase arrangement exists however extra requirements beyond the presence of a purchase agreement are not satisfied. A boost implies that more orders are skeptical, while a reduction implies that the extra requirements are satisfied or the order that was thought about skeptical was cancelled. Throughout the month 6 orders for the Boeing 777 that were thought about skeptical were certainly cancelled. Boeing presently has 717 orders for which the extra requirements are not satisfied.

Boeing May 2023 Airplane Shipment News

In May, Boeing provided 50 jets compared to 26 in the previous month. The U.S. jet maker provided 36 single-aisle jets and 14 wide-body airplane with a combined worth of $3.8 billion:

- Boeing provided 36 Boeing 737 planes consisting of 35 Boeing 737 MAX planes and one Boeing P-8A.

- Boeing provided 3 Boeing 767-300Fs, one to FedEx ( FDX) and 2 to UPS ( UPS).

- Boeing provided 3 Boeing 777Fs.

- Boeing provided 8 Boeing 787s including 2 -8 s, 3 -9 s and 3 -10 s.

Boeing shipments were strong throughout the month with 36 Boeing 737 shipments, more than doubling compared to the previous month. This offers a strong sign that Boeing is getting more adhering fuselages, which examinations on already-built jets are advancing well.

Compared to in 2015, Might shipment numbers increased by 15 systems from 35 shipments to 50 shipments, while the worth of those shipments increased from $2.4 billion to $3.8 billion, showing a beneficial shipment mix. Single aisle shipments increased by 6 systems while broad body shipments increased by 9, led by greater Boeing 787 shipments. Year-to-date, Boeing provided 206 planes valued $14.5 billion compared to 165 shipments valued $10.9 billion in 2015.

The book-to-bill ratio for the month was 1.4 in regards to orders and 1.2 in regards to worth, while the cancellation rate was 15.9% determined versus the order inflow, and 0.2% when determined versus the stockpile. The book-to-bill ratio for the year is looking very strong, with a ratio of 1.1 determined by systems and 1.2 determined by worth. As I kept in mind formerly, we’re searching for book-to-bill ratios greater than one, however even when that’s attained, these ratios ought to likewise be positioned in context, as we see strong need however substantial pressure from the supply side to equate orders into shipments.

What Is Boeing’s Shipment Target For 2023?

For 2023, Boeing has actually not offered a main shipment target, however the business anticipates 400 to 450 Boeing 737 shipments and around 70-80 Boeing 787 shipments. In general, I’m anticipating around 535-595 shipments.

How Do Boeing Plane Deliveries Compare To Jet?

Boeing provided 50 planes to consumers in May, while Jet provided 63 planes. In the very first 5 months of 2023, Boeing provided 206 jets compared to 244 for Jet. Boeing and Jet have actually been providing approximately the exact same variety of planes in the very first quarter, however due to the concerns with the Boeing 737 MAX, the U.S. jet maker is now tracking its European competitor. What, nevertheless, ought to be kept in mind is that Boeing is seeing the much better development numbers in shipments, up 25% compared to 3.3% for Jet.

Conclusion: Boeing Stock Is A Buy For the Future

Boeing stock has actually gotten over 75% over the previous 12 months while its shipments are not up as much, and its totally free capital development will be up at many 61% this year according to its assistance. So, you might state that the business’s stock cost grew ahead of its efficiency which does not make the stock appealing in the near-term.

Nevertheless, by 2024 the totally free capital ought to have more than doubled compared to the 2022 totally free capital and be favorable capital. This totally free capital ought to make it possible for Boeing to considerably deleverage, which contributes to the long-lasting appeal of the stock. So, in the short-term, Boeing stock most likely is more a hold, however I would state that the long-lasting chauffeurs are what make the stock appealing – which likewise implies that at present you can not purchase Boeing stock at a discount rate.

What we are presently already seeing is strong need for business planes and a strong boost in shipment volumes. Looking for Alpha authors have a Hold score on the stock, while Wall Street experts have a Buy score

While financiers may not be incorrect for softening their bullish view on Boeing for the short-term, I do believe that if you concentrate on what Boeing may or may not provide in the 2nd quarter, you will ultimately miss out on the larger image for this year and likewise the larger image for the longer term. Difficulties stay in all amount of time, however the patterns and outlooks are favorable, and they’re larger positives than the near-term pressures Boeing faces.

Valuing Boeing at 16 to 17 times totally free capital generation offers a $265 to $280 cost target based upon the detailed trajectory towards the mid-decade targets. So, Boeing is definitely not inexpensive, however around 30% advantage does exist as it performs on its targets. With the market and stock exchange being positive, that cost target might be struck earlier than mid-decade on favorable momentum for Boeing stock.

Editor’s Note: This short article goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers related to these stocks.