Stock has actually published its most significant decrease in over a year, with house owners hanging onto their relatively low home loan rates. That pattern will most likely continue, as the Fed’s statement that it might trek rate of interest a couple of more times is most likely to keep home loan rates raised. Low supply is suppressing sales, however lots of purchasers are still revealing early indications of interest.

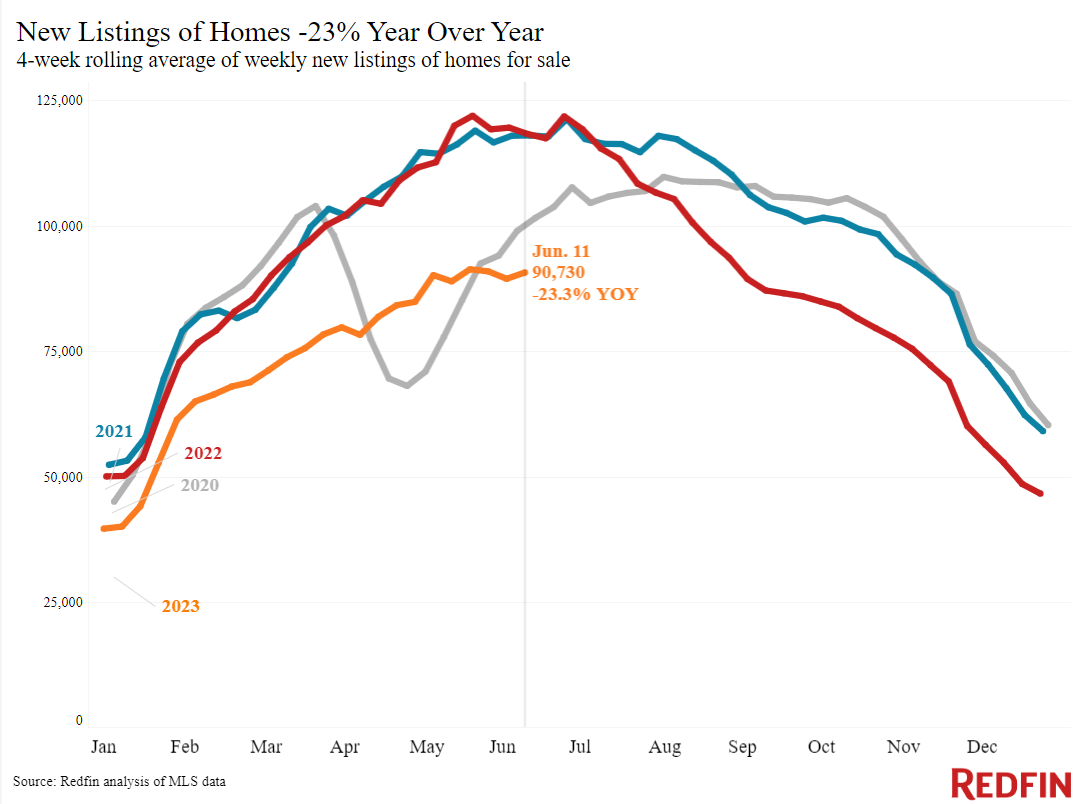

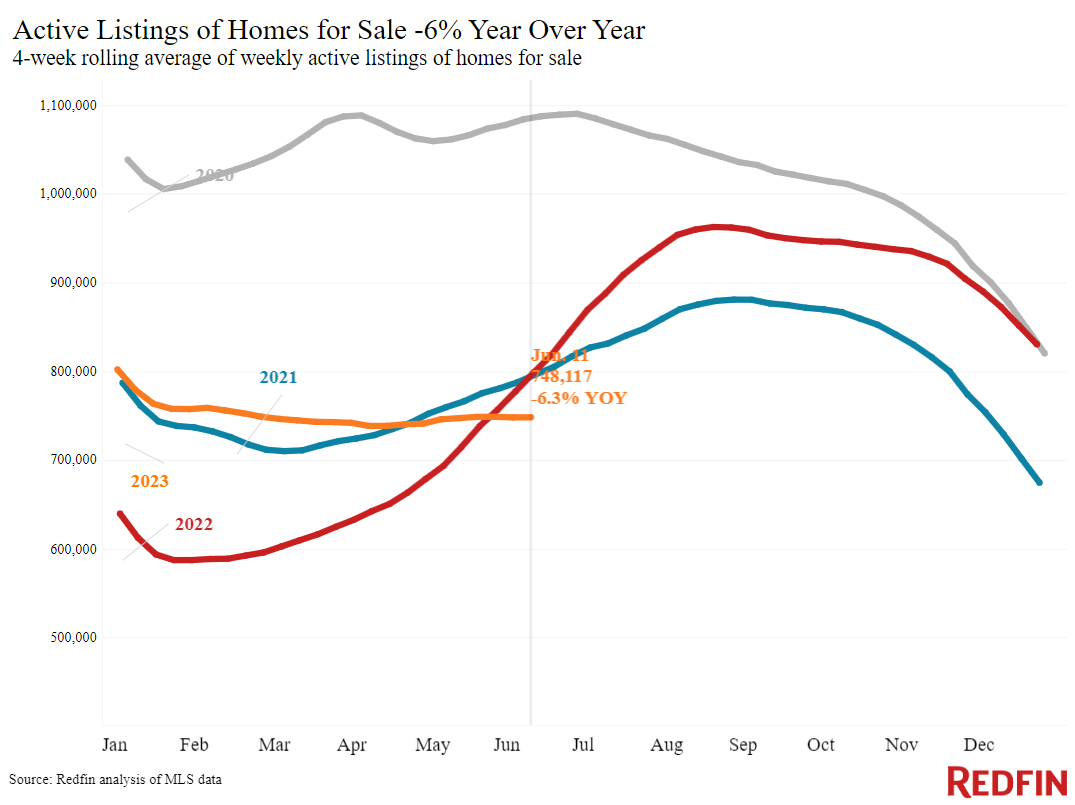

The overall variety of U.S. houses for sale dropped 6% from a year previously throughout the 4 weeks ending June 11, the most significant decrease in 13 months. New listings dropped 23%, continuing a 10-month streak of double-digit decreases. Those contribute to the deepening post-pandemic stock lack; there are 39% less houses for sale now than there were 5 years back, in June 2018.

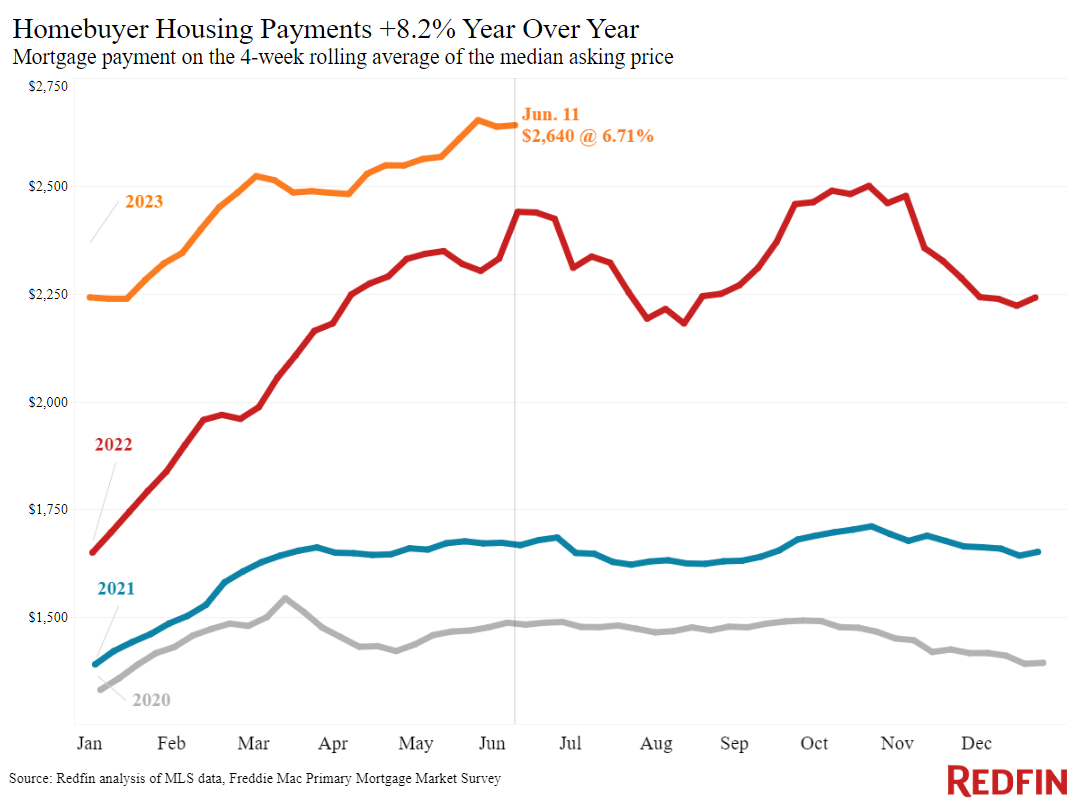

The stock crunch is partially due to a homebuilding downturn that’s lasted for over a years and partially to home loan rates being up to record-low levels throughout the pandemic, then soaring. Home mortgage rates have more than doubled given that 2021, landing at near to 7% today. The record-low home loan rates of 2020 and 2021 drove a homebuying boom, diminishing stock. When rates began increasing in the start of 2022, lots of prospective sellers withdrawed, stopping working to fill the stock hole. Raised rates dissuade house owners who would choose to keep a relatively low rate from selling.

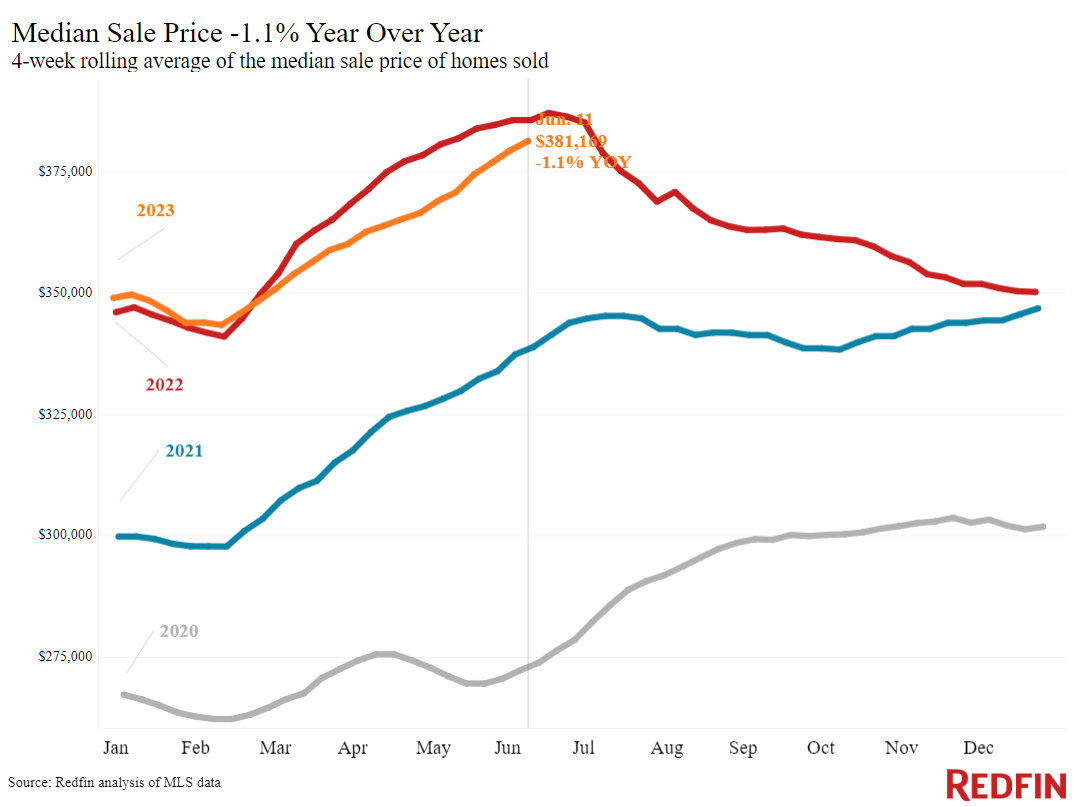

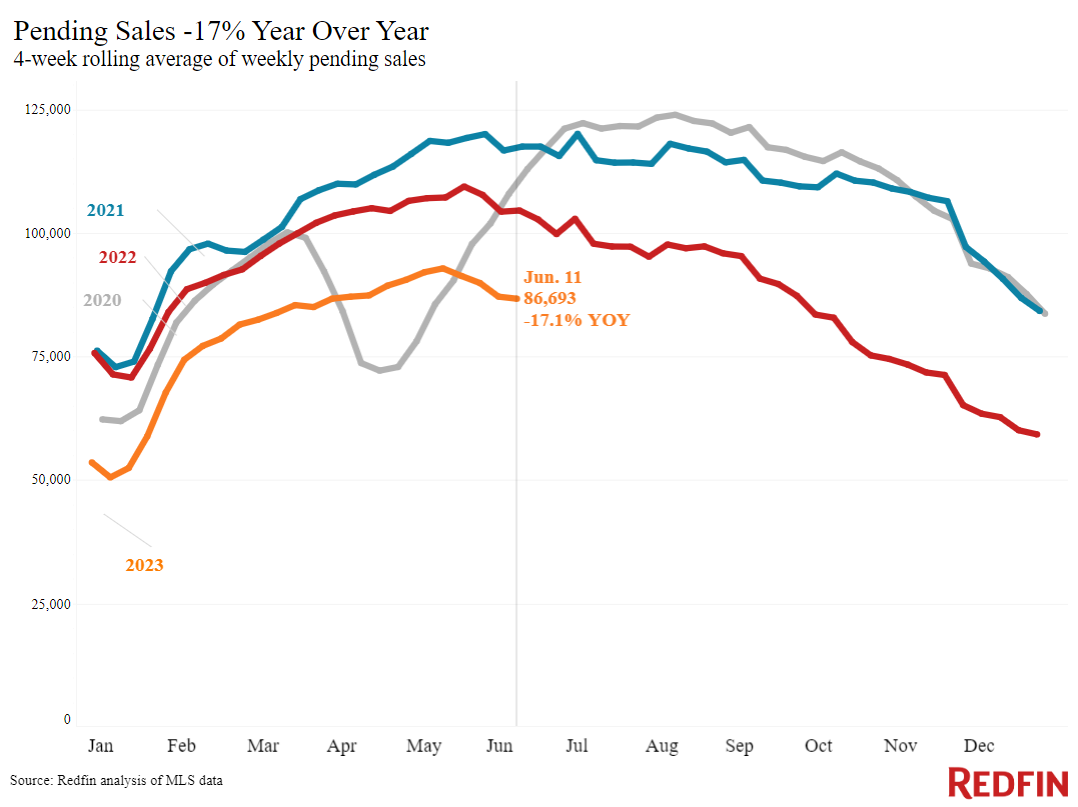

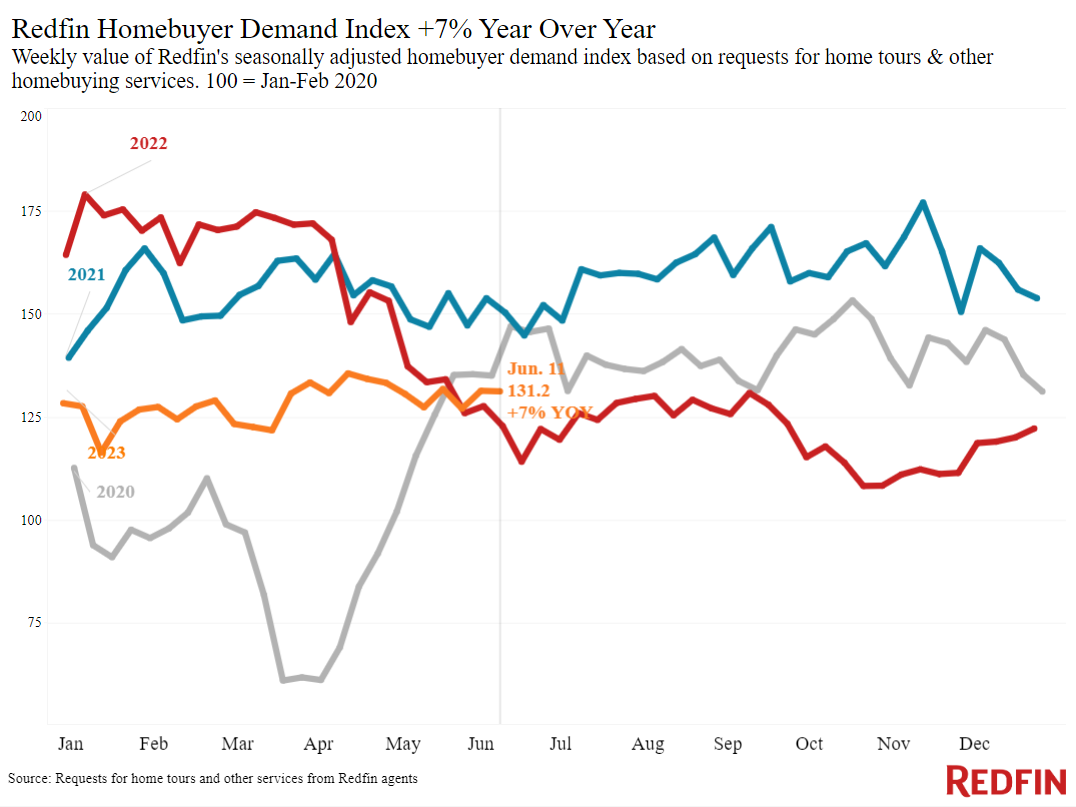

Pending house sales are down 17% year over year, the most significant decrease in over 4 months, however it isn’t all due to an absence of need. Individuals are still revealing interest in purchasing. Mortgage-purchase applications increased 8% over the recently, and Redfin’s Property buyer Need Index– a step of ask for trips and other services from Redfin representatives– is up over the last 2 weeks and near its greatest level in a year. That implies there’s a reasonable quantity of bottled-up need, and lots of purchasers will be prepared to attack when more houses struck the marketplace. Need surpassing supply is avoiding house rates from falling dramatically: The typical list price is down simply 1.1%, the tiniest yearly decrease in 3 months.

Today’s financial news suggests that home loan rates are not likely to decrease in the next couple of months, which might indicate brand-new listings remain low for the time being and the stock lack deepens. The most recent inflation report reveals that rate boosts have actually continued to cool, and the Fed revealed that it will time out interest-rate walkings this month after almost a year of boosts however might trek a couple more times this year.

” The Fed’s indicator that there are more rate walkings to come is not what property buyers wish to hear. It’s most likely to keep home loan rates raised and might even press them up a bit,” stated Redfin Economics Research study Lead Chen Zhao “Individuals who are resting on the sidelines, waiting on home loan rates to decrease, ought to understand that’s not likely to occur in the foreseeable future. If a house that remains in your rate variety and has whatever on your wishlist strikes the marketplace, there’s no excellent factor to wait.”

Leading signs of homebuying activity:

- The day-to-day average 30-year set home loan rate was 6.95% on June 14, below a seven-month high of 7.14% 3 weeks previously however up from about 6.6% a month previously. For the week ending June 8, the typical 30-year set home loan rate was 6.71%, down a little from 6.79% the week prior to however still near to the greatest rate given that November.

- Mortgage-purchase applications throughout the week ending June 9 increased 8% from a week previously, seasonally changed. Purchase applications were down 27% from a year previously.

- The seasonally changed Redfin Property buyer Need Index– a step of ask for house trips and other homebuying services from Redfin representatives– was basically the same from a week previously throughout the week ending June 11, however up from 2 weeks previously. It was up 7% from a year previously, the 3rd successive yearly boost. Need was dropping at this time in 2022 as home loan rates increased.

- Google look for “ houses for sale” were up 15% from a month previously throughout the week ending June 10, and down about 10% from a year previously.

- Exploring activity since June 11 was up 20% from the start of the year, compared to a 4% boost at the exact same time in 2015, according to house trip innovation business ShowingTime Trips decreased throughout this time in 2015 as home loan rates soared.

Secret real estate market takeaways for 400+ U.S. city locations:

Unless otherwise kept in mind, the information in this report covers the four-week duration ending June 11 Redfin’s weekly real estate market information returns through 2015.

Information based upon houses noted and/or offered throughout the duration:

For bullets that consist of metro-level breakdowns, Redfin examined the 50 most populated U.S. cities. Select cities might be omitted from time to time to make sure information precision.

- The typical house list price was $381,169, down 1.1% from a year previously, the tiniest decrease in more than 3 months. Rate decreases have actually been diminishing for the last 7 weeks.

- Home-sale rates decreased in 31 cities, with the most significant drops in Austin, TX (-13.1% YoY), Las Vegas (-9%), Oakland, CA (-7.4%), Phoenix (-6.9%) and Los Angeles (-6.7%).

- Price increased most in Miami (8.9%), Cincinnati (8.3%), Fort Lauderdale, FL (6.1%), Milwaukee (5.9%) and Virginia Beach, VA (4.8%).

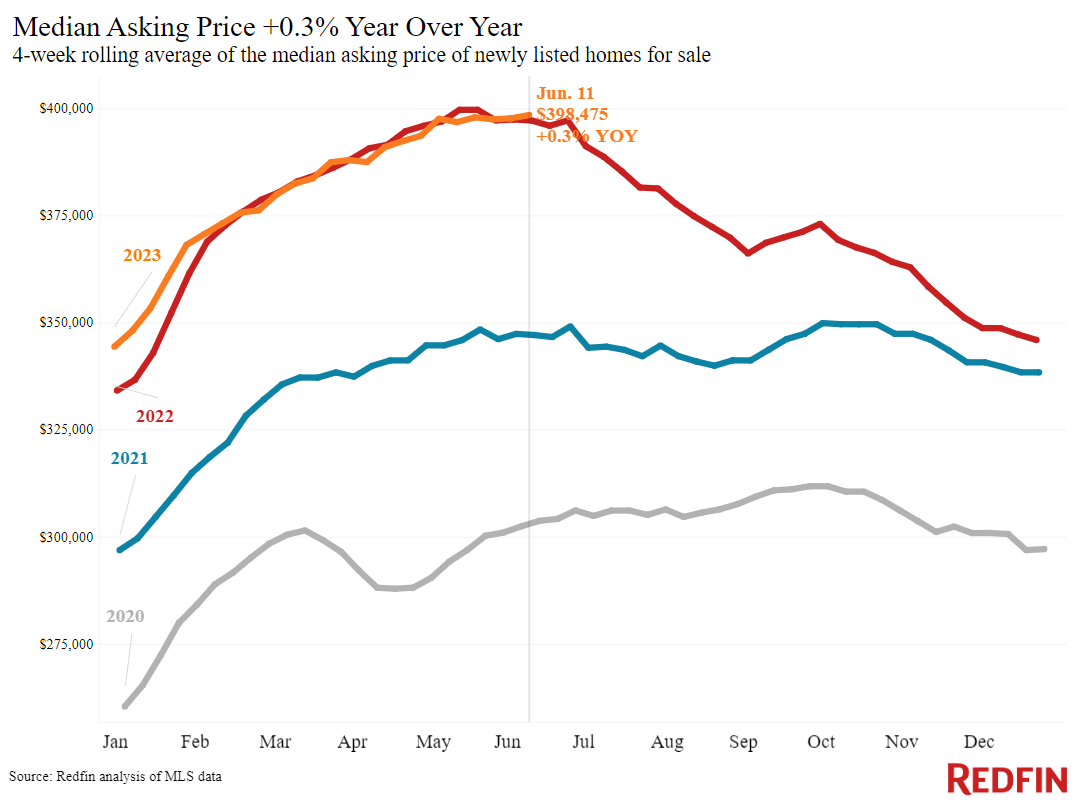

- The typical asking rate of freshly noted houses was $398,475, up 0.3% from a year previously.

- The regular monthly home loan payment on the median-asking-price house was $2,640 at a 6.71% home loan rate, the average for the week ending June 8. That’s down a little from the record high struck 2 weeks previously, however up 8% ($ 200) from a year previously.

- Pending house sales were down 17.1% year over year, the most significant decrease in more than 4 months.

- Pending house sales fell in all cities Redfin examined. They decreased most in Providence, RI (-30.8% YoY), Portland, OR (-29.1%), Milwaukee (-28.2%), Seattle (-26.9%) and San Diego (-26.6%).

- New listings of houses for sale fell 23.3% year over year, approximately on par with the decreases over the last 2 months.

- New listings decreased in all cities Redfin examined. They fell most in Phoenix (-40.9% YoY), Las Vegas (-40.5%), Oakland (-39.6%), Seattle (-35.9%) and Anaheim, CA (-34.7%).

- Active listings (the variety of houses noted for sale at any point throughout the duration) dropped 6.3% from a year previously, the 3rd successive yearly decrease and the most significant drop in over a year. Active listings were basically the same from a month previously; normally, they publish month-over-month boosts at this time of year.

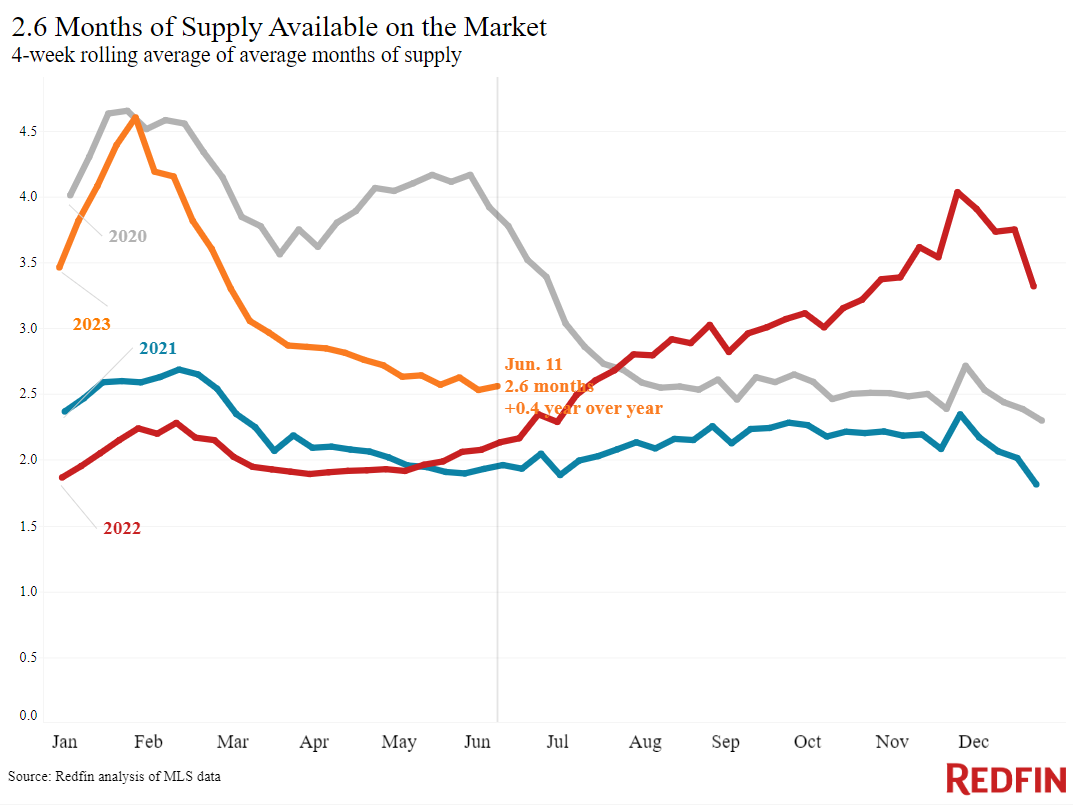

- Months of supply– a step of the balance in between supply and need, computed by the variety of months it would consider the existing stock to cost the existing sales speed– was 2.6 months, up from 2.1 months a year previously. 4 to 5 months of supply is thought about well balanced, with a lower number showing seller’s market conditions.

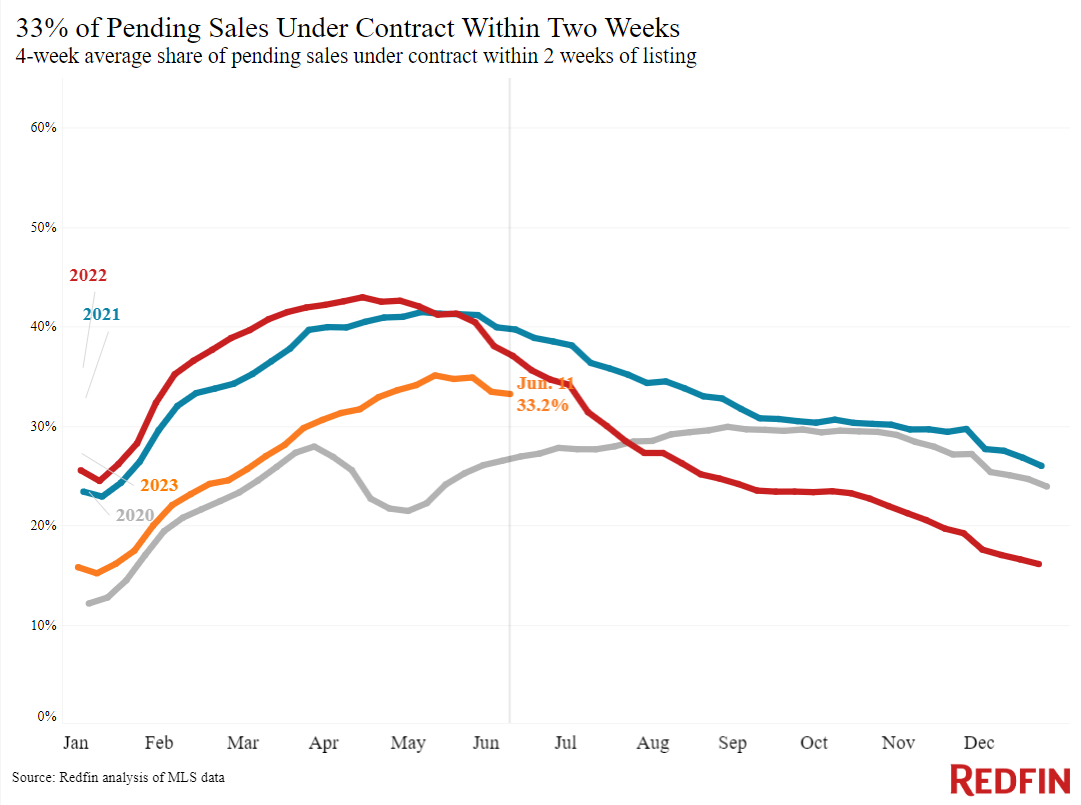

- 33.2% of houses that went under agreement had actually an accepted deal within the very first 2 weeks on the marketplace, below 37% a year previously.

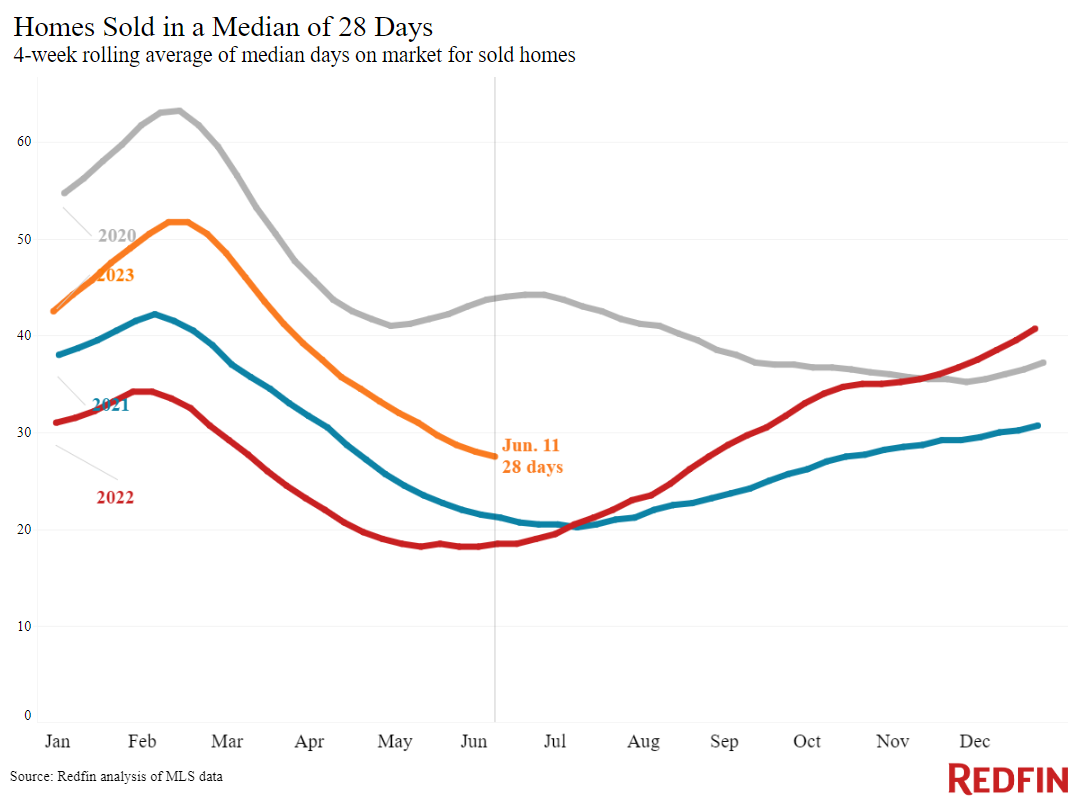

- Houses that offered were on the marketplace for an average of 28 days, the quickest period given that September. That’s up from a near-record low of 19 days a year previously.

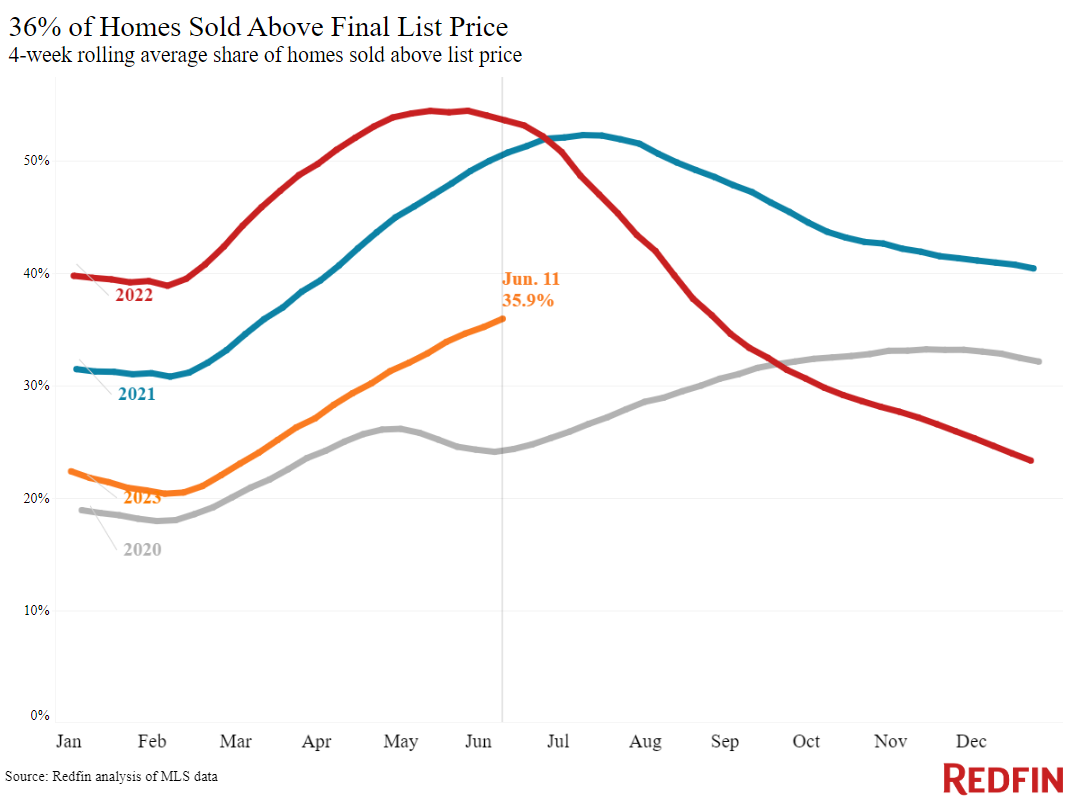

- 35.9% of houses offered above their last market price. That’s the greatest share given that last August however is below 54% a year previously.

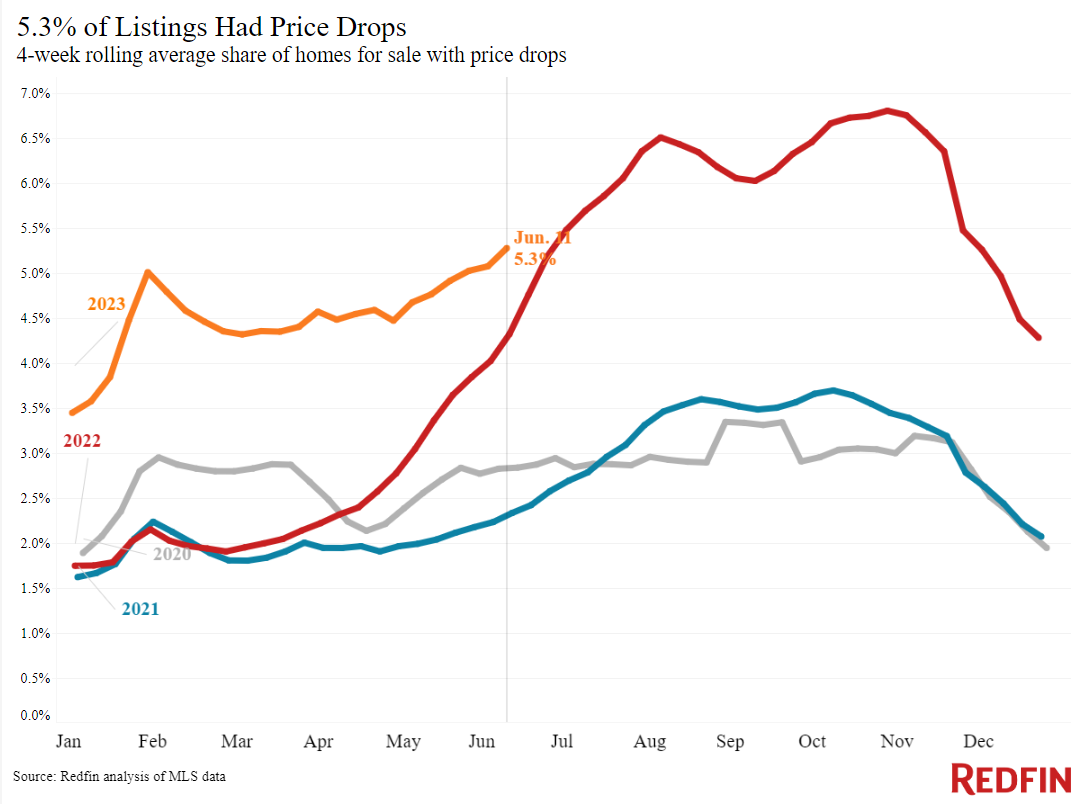

- Usually, 5.3% of houses for sale weekly had a cost drop, up from 4.3% a year previously.

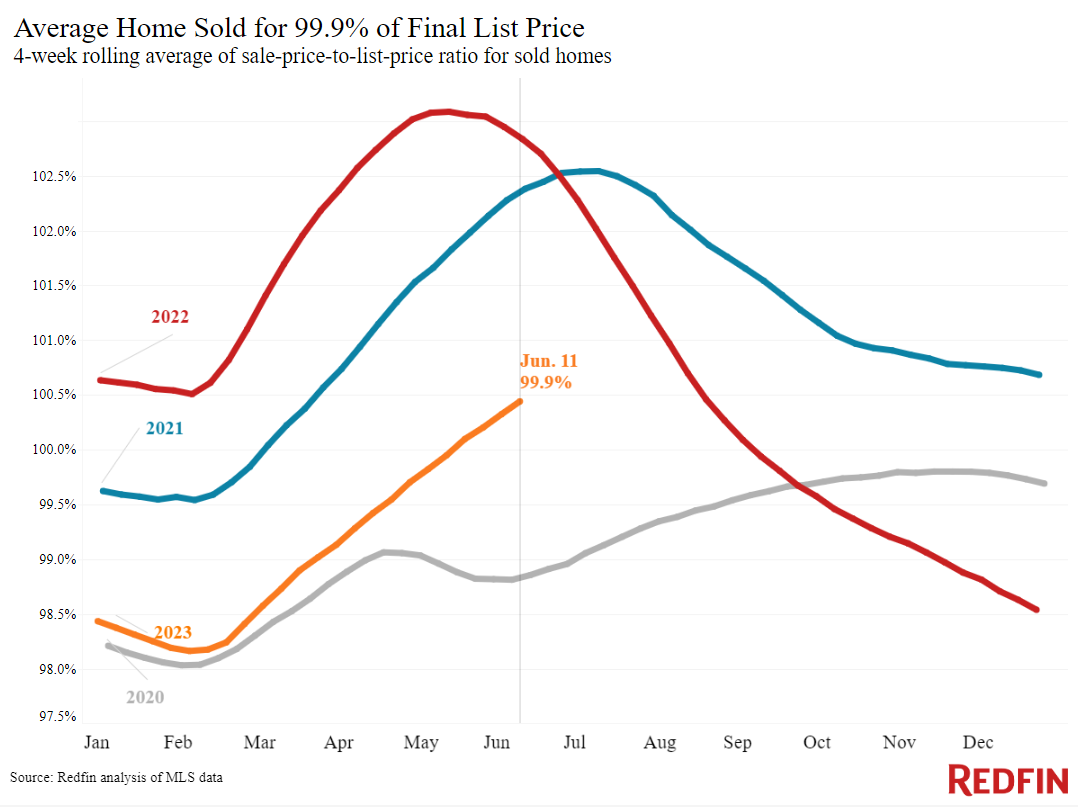

- The typical sale-to-list rate ratio, which determines how close houses are offering to their last asking rates, was 99.9%. That implies houses are costing practically precisely their asking rate, usually. That’s the greatest level given that August however is below 102.3% a year previously.

Describe our metrics meaning page for descriptions of all the metrics utilized in this report.