Devrimb

The AR/VR Fight Has Actually Just Begun

We have actually formerly covered Meta ( NASDAQ: META) in Might 2023, discussing its excellent FQ1 ’23 double beats and exceptional FY2023 assistance. Integrated with the return of marketing dollars as soon as the macroeconomic outlook stabilizes, its predicted NTM EV/ EBIT of 9.42 x does not appear costly then.

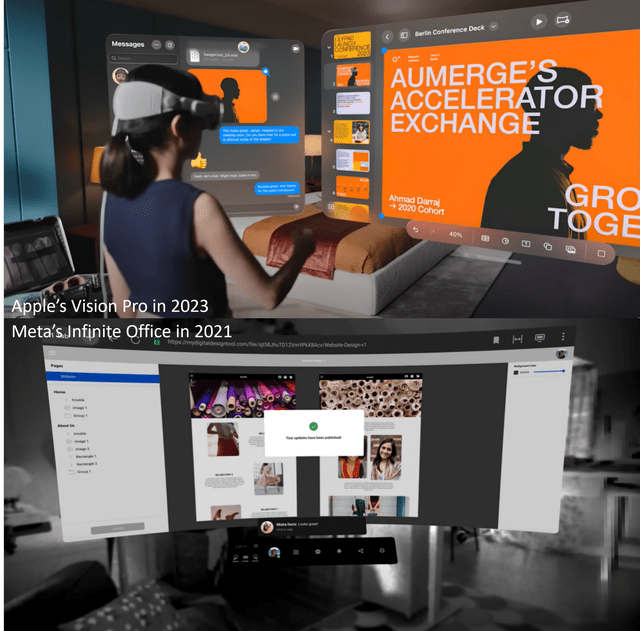

In the meantime, META has actually lastly fulfilled its match in the AR/VR competitors, in our viewpoint, with the long-awaited Apple ( AAPL) Vision Pro spatial headset lastly presented by early June 2023. In simply the period of a week, the web and market experts are currently abuzz with the brand-new computing platform, a buzz that has actually regrettably avoided the Mission series.

AAPL & & META’s Comparable Offerings, However Different Marketing Technique

Most notably, our company believe Mark Zuckerberg has actually stopped working to efficiently communicate Mission Pro’s abilities, which allegedly currently use a relative computing platform because 2021.

Meta 2022 & & 2023 Super Bowl Commercial

As likewise highlighted by other retail analysts and customers, lots of had actually been puzzled about Mission Pro’s complete offerings, with Meta choosing to choose uncertain commercials, leaving the audience with very little takeaways on its hardware/ software application Metaverse technique.

META’s Mission Marketing Videos

Even now, the more frequently highlighted usage cases for the Meta Mission VR headset are game-centric and, really periodically, e-sports on the YouTube page. With this technique, it appears that the target market is primarily retail-based rather of the next-generational computing and/or expert method that AAPL has actually chosen.

This is most likely credited to Mark Zuckerberg’s choice to concentrate on the mass market through enhanced price and the “expected” social interaction from the Metaverse, as just recently highlighted in Meta’s company-wide conference after the release of AAPL’s Vision Pro spatial headset:

We innovate to make certain that our items are as available and inexpensive to everybody as possible, which is a core part of what we do. And we have actually offered 10s of countless Missions.

More notably, our vision for the metaverse and existence is essentially social. It has to do with individuals engaging in brand-new methods and sensation more detailed in brand-new methods. Our gadget is likewise about being active and doing things. By contrast, every demonstration that they ( AAPL) revealed was an individual resting on a sofa by themself. I imply, that might be the vision of the future of computing, however like, it’s not the one that I desire. ( The Brink)

While some might have revealed interest to use Meta’s lower-priced choices, the Mission Pro provides a reasonably poorer show quality of 1,800 x 1,920 pixels per eye, compared to AAPL Vision Pro’s 2,160 x 3,840 pixels per eye, or “ 23 million pixels– almost 3 times as lots of as in a 4K display screen.” This is on top of the previous’s 22 Pixels Per Degree [PPD], compared to the latter at “around 50 to 70 PPD.”

Long story short, you will get the quality that you spend for.

Moreover, Mark Zuckerberg chose to take the Mission hardware section as a loss leader, using considerable discount rates by March 2023 to allegedly enhance need.

Nevertheless, it stays to be seen how Meta’s Mission Shop might ultimately offset the deficiency, with Truth Labs just reporting FQ1 ’23 earnings of $339M ( -53.3% QoQ/ -51.2% YoY), with the deceleration primarily credited to slowing Mission sales. While the Mission Shop has actually tape-recorded $ 1.5 B in overall earnings by October 2022, the Truth Labs stays unprofitable, with FQ1 ’23 operating losses of $4B (-6.9% QoQ/ +33.3% YoY).

While the bulls might indicate Mission Shop’s robust library offerings, it is obvious that AAPL users likewise tape-recorded greater international in-app costs at $86.8 B in 2022 ( +1.9% YoY). For that reason, our company believe the space in their brochures might ultimately narrow, with the latter most likely to command enhanced in-app earnings in the long term.

Moreover, with the release of AAPL’s Vision Pro by 2024 and, likely, Alphabet’s ( GOOG) ( GOOGL) AR headset at the very same time, it doubts how Meta might maintain its edge in the AR/VR market moving on. This is on top of the marketplace forecast of 500K systems in Vision Pro sales by 2024, possibly setting off need headwinds to the incumbent.

In addition, the sales for AR/VR gadgets are anticipated to just strike 10.35 M systems in 2023, minimally enhanced from the 8.58 M reported in 2022 (-5.3% YoY). With Meta just taping cumulative sales of 20M gadgets throughout Mission 1, 2, and Pro designs because 2019, most likely credited to duplicate clients, we expect the real usage cases have actually been less than remarkable, compared to the international set up base of AR/VR headsets at 34.7 M in 2022 (+21.7% YoY).

We expect this is a chicken-and-egg issue, because Meta’s mission for price has actually activated a less-than-impressive display screen resolution, setting off the more game-centric usage cases, compared to AAPL’s well-rounded functions, expert target market, and premium/ engaging experience.

However, things might alter for excellent from Mission 3 onwards, provided the management’s claim about “ Much better screens and resolution – Next-gen Qualcomm chipset with 2x the graphics efficiency,” and “ High-fidelity color Passthrough, ingenious artificial intelligence, and spatial understanding let you communicate with virtual material and the real world at the same time, producing endless possibilities to check out.”

Presuming a considerably enhanced efficiency compared to the previous designs and reliable presentation in Meta’s upcoming Link conference on September 27, 2023, we might see Mission install a note-worthy battle in the AR/ VR fight ahead. Just time might inform.

So, Is META Stock A Buy, Offer, or Hold?

META 2Y Stock Cost

In the meantime, META has actually just pulled away minimally post-AAPL-launch, suggesting that Mr. Market might be encouraged about the 2 business’ various techniques and, likely, unique end markets

While we stay positive about the marketing/ social networks business’s execution, the rally has actually been positive undoubtedly, offering us very little upside possible to the cost target of $301.74. This is based upon its NTM P/E appraisals of 21.31 x and market experts’ FY2024 adj. EPS of $14.16.

As an outcome, we choose to rank the META stock as a Hold here. We will likewise be waiting for more clearness from the upcoming occasion in September. On The Other Hand, Mark Zuckerberg might be discovering a couple of beneficial pointers from Vision Pro’s marketing product.