Klaus Vedfelt

It’s okay to hand down distressed stock chances. Not whatever is a “purchase” even if it’s down or since it appears low-cost. That was our take the last time around when we covered Dream Workplace ( TSX: D.UN: CA). While we acknowledged the incredible efforts made by management to turn this around, we simply might not get ourselves to a “purchase score.” Particularly we stated,

If we back that out and change for the financial obligation, the suggested cap rate is close to 7.4%. That looks reasonable for the existing market conditions and provides financiers a great benefit if workplace does return. We still believe this is not an engaging buy as the threats simply do not balance out the benefits. Financiers have a somewhat much better risk-reward in H&R REIT (HR.UN: CA), ( OTCPK: HRUFF) due to their big property and commercial residential or commercial property holdings, and we even handed down that

Source: 4% Cap Rates In Workplace Residence Need To Be A Dream

In the beginning it appeared that we had actually missed out on a crucial trough as the stock rallied from those levels. Today things deviated for the even worse.

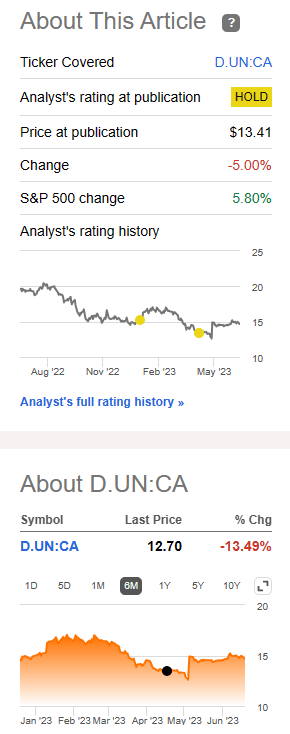

Looking For Alpha

Let’s take a look at the Q1-2023 results, the significant provider quote and review them because of what’s taking place in the property markets.

Q1-2023

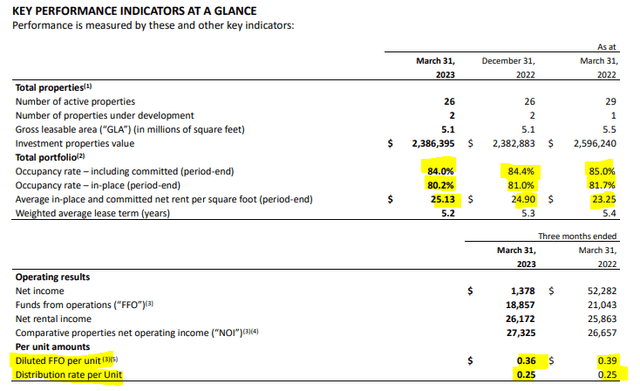

Dream’s Q1-2023 outcomes had to do with in line with expectations. This is normally the case with the very first quarter as the Q4-2022 outcomes are launched rather late into Q1 and there are not a surprises. Still, financiers need to have been dissatisfied to see yet another quarter where devoted and in-place tenancies decreased. At 80.2% we’re entering into actually low area for the latter.

Dream Workplace Q1-2023 Financials

Funds from operations (FFO) decreased to 36 cents a share, though they stayed easily above the circulation do note what we reveal next.

Dream Workplace Q1-2023 Financials

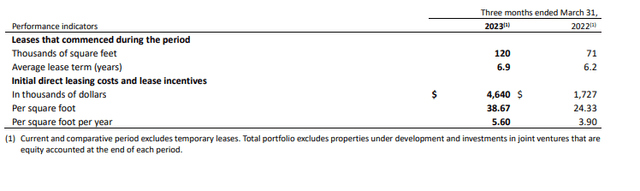

Those are the leasing expenses and tenant/lease rewards. This is an occupant’s market and Dream Workplace administered relatively large amounts this quarter relative to in 2015. If you simply deducted these quantities out from the FFO, you would get a Changed FFO (AFFO) of near 27 cents a share, hardly above the circulation level.

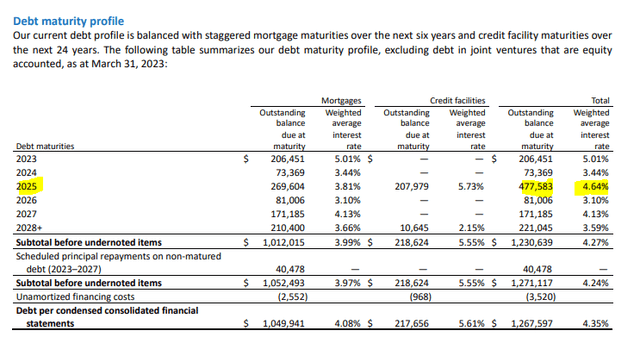

2 other noteworthy points that we wish to make about the outcomes. The very first being that the financial obligation maturity profile continues appearance actually brief relative to the threats the REIT deals with. There’s half a billion turning up in 2025 and another $300 million prior to that.

Dream Workplace Q1-2023 Financials

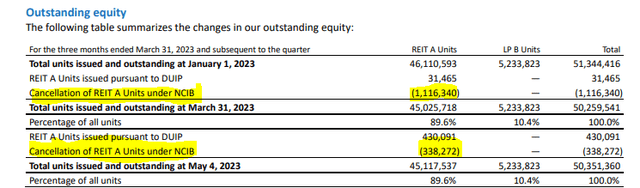

The REIT continued to eliminate systems at a furious speed in Q1-2023 and about 1.5 million systems were bought till Might 4, 2023.

Dream Workplace Q1-2023 Financials

What this indicates is that the REIT was utilizing excess liquidity to attempt and boost system worth. While that might appear like a strong undertaking by itself, Dream Workplace took it one level greater.

Considerable Company Quote

Dream Workplace had actually just recently offered Dream Industrial ( DIR.UN: CA) systems it held. Following this it revealed the significant provider quote to redeem its own systems.

The Trust means to utilize the net profits from the Secondary Offering, together with money on hand and illustrations under the Trust’s existing credit center to money the start of a considerable provider quote (the “SIB Deal”) pursuant to which the Trust will provide to buy approximately 12,500,000 of its impressive REIT systems, Series A (” REIT A Units”) at a purchase cost of $15.50 per REIT A System in money (the “Purchase Rate”). Constant with the Trust’s method of optimizing net possession worth (” NAV”) per system for our unitholders, the Trust’s Board of Trustees has actually licensed the start of the SIB Deal as it permits the Trust to generate income from a part of its holdings of 26,039,307 systems of Dream Industrial REIT and to provide our unitholders the choice to either gain access to liquidity by offering their REIT A Units for money at a premium to the existing trading cost of the REIT A Units or possibly increase their ownership in the Trust

Source: Dream Workplace

This statement was a surprise to us. We would have thought that the REIT would simply fortify its liquidity by transforming its sibling business holdings into money. The significant provider quote looked like a bad option for funds. Well they continued anyhow and today we got the outcomes of that. The quote was enormously oversubscribed, i.e. individuals were actually pleased to go out at $15.50. More remarkably, Dream Unlimited Corp. ( DRM: CA), the moms and dad and supervisor revealed the other day that it anticipated that 7.0 countless its Dream Workplace systems will be used up by this procedure. This will net it about $110 million. This indicated that DRM tendered its whole stake.

Effect

Presuming you think the NAV that was launched with the Q1-2023 results, this switch is rather accretive. Dream Industrial systems were cost a little discount rate to NAV, however Dream Workplace systems were gotten at a far bigger discount rate to NAV. Great from that perspective. What is bothersome is that net financial obligation to EBITDA increases after this. We were currently teetering near 10.5 X at the end of Q1-2023. Dream Workplace raised the ante here. With the money or money equivalent (Dream Industrial systems) gone, we are taking a look at near 12.0 X net financial obligation to EBITDA. Simply how does one validate this level of take advantage of in a market in distress? Yes a great deal of that is residential or commercial property level home mortgages, however that 12.0 X number ought to send out chills down your spinal column.

Similarly bothering here is that DRM was prepared to offer all their systems. Now, they need to understand that there will be other deals, however it’s not motivating them to be prepared to leave here. Eventually their relative stake was mostly the same, however it does eliminate some self-confidence from the marketplace. As we head into Q3-2023 the difficulties for Dream Workplace will likely get more intense. In all probability renter rewards and renting commissions will increase. FFO run rate must fall off even more. This is partly balanced out with this significant provider quote which eliminates a great deal of systems out of flow and enhances both FFO and AFFO. In general, we believe both FFO and AFFO stay flat however the larger story is the financial obligation load and we stay worried.

Decision

Dream Workplace is trading at an 8.0% suggested cap rate. This has to do with what we believe is reasonable for workplace residential or commercial properties in today’s market. Yes their own NAV reveals over $30 per share. The bulk of the expert neighborhood believes that the mid $20’s is where NAV stands. We need to simply disagree on that. There’s no purchasing interest here and the 12.0 X financial obligation to EBITDA number makes a larger discount rate necessitated. We would not be shocked to see the systems struck single digits at some time when main economic crisis metrics are verified. We would avoid. There are much better and much safer REITs being cost a discount rate and there is no requirement to capture this falling knife.

Editor’s Note: This short article talks about several securities that do not trade on a significant U.S. exchange. Please know the threats connected with these stocks.