Romain Maurice

Among the trademark qualities of 2021 was what I ‘d call the insane evaluation. Numerous business throughout numerous sectors swelled to historic share rates accompanied by also inflated appraisals. Nevertheless, in hindsight, the quick healing from COVID, the trillions of dollars pumped into the economy, and the consistent zero-interest rate environment offered a background for those stocks that didn’t always verify the appraisals however a minimum of described them. Today, it is 2023: the Fed has actually treked rates to over 5%, capital expenses have actually increased, and appraisals (for the many part) have actually gone back to more affordable levels as financiers accept that the zero-rate age has actually ended. Yet, specific business are still trading at incredible multiples and record highs, underpinned by rather positive and optimistic presumptions about the future. Celsius Holdings ( NASDAQ: CELH) characterizes this phenomenon.

In August 2022, Celsius traded around $110, which appeared enthusiastic offered the development expectations baked into the cost in juxtaposition to the Fed continuing to trek rates and economic crisis ending up being significantly most likely. Now, Celsius trades at an all-time high, near $145 per share. Keep in mind, I believe that Celsius has a terrific item with great deals of capacities offered its circulation handle PepsiCo ( PEP) and the general marketing of Celsius as a health and health beverage instead of the standard high-sugar energy beverage. Nevertheless, I likewise think that excellent business with excellent items can make suboptimal financial investments at specific times which is where I see Celsius at its present cost and evaluation.

Relative Assessment Does Not Validate Rate

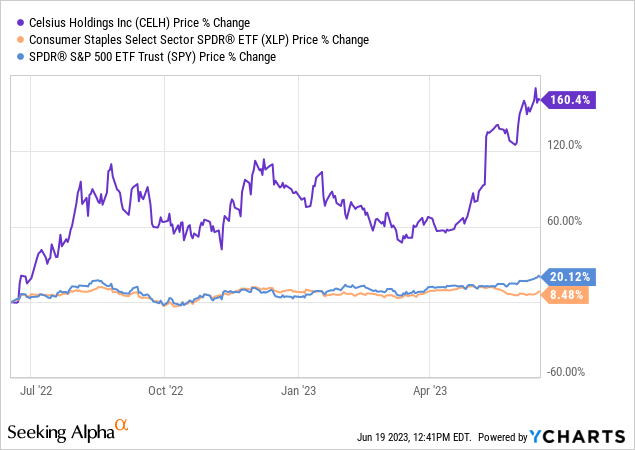

Regardless of combined macroeconomic signs and greater funding expenses arising from rates of interest boosts, Celsius has actually seen a meteoric increase this year, up 44% YTD and 160% in 2015. The current huge run-up started in early Might with the business revealing record quarterly earnings and subsequent upgrades from organizations like BofA. In addition, the AI boom supporting the marketplace over the previous couple of months most likely offered an extra tailwind for Celsius as it reached record highs.

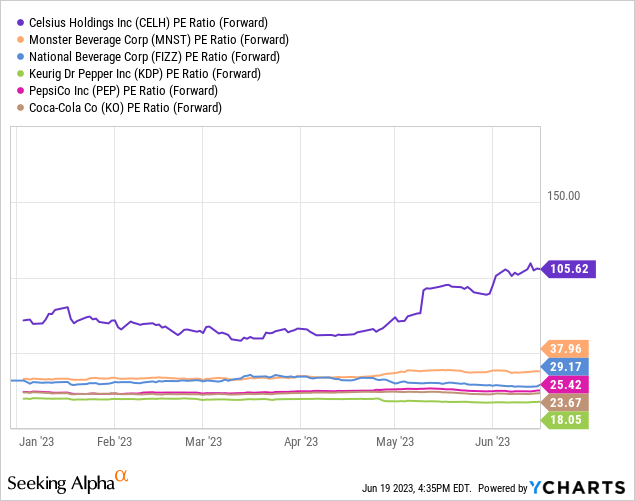

While the stock has actually had (and may still have) momentum to press greater, the underlying appraisals have actually likewise increased quickly to levels that are more difficult to justify. Presently, Celsius trades 105.6 x forward profits and 10x forward sales. Now, there is no concern that Celsius has actually shown strong leading and bottom line development over current years: earnings has actually grown at a 78% CAGR considering that 2017, money from operations topped $100MM in FY 2022, and profits for Q1 2023 were the greatest in business history.

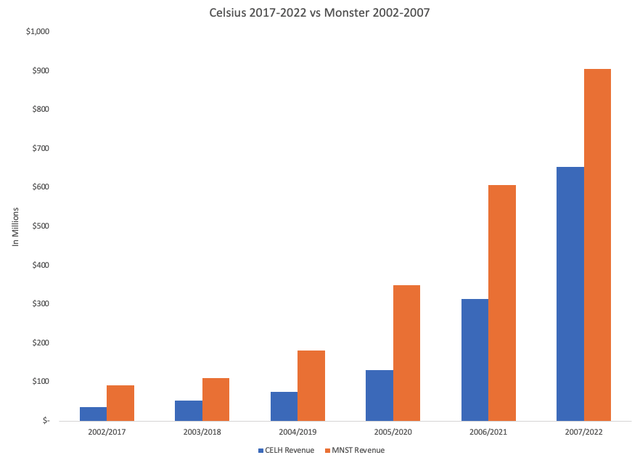

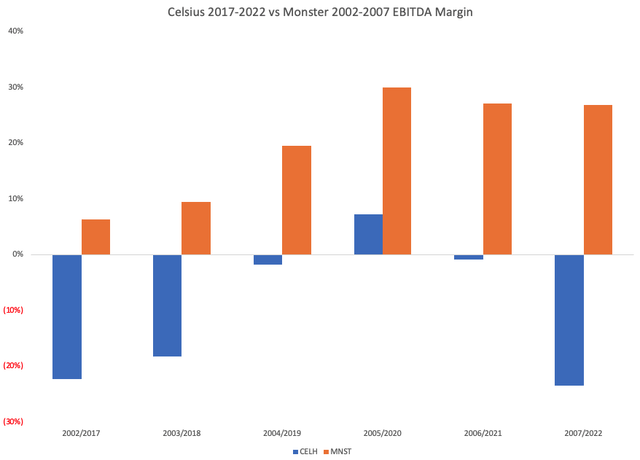

Nevertheless, regardless of all these enhancements on the bottom line and the quick development on the leading line, even these remarkable numbers do not appear to validate the multiples Celsius is trading. This does not imply Celsius must not command a premium; it should, offered its development potential customers and enhancing circulation network. The uncertainty emerges when one observes the magnitude of the premium. One business financiers frequently compare Celsius to is Beast Drink Corp. ( MNST). Like Celsius, Beast traded at raised multiples while experiencing quick earnings development and increasing success in the late 2000s.

Nevertheless, in comparing magnitudes, Celsius’s evaluation, compared to Beast’s, is more improbable. From 2002 to 2007, Beast grew its sales at a 57% CAGR (and unlike Celsius, had favorable EBITDA and complimentary capital in 2007). In 2007, Beast traded at a high of 35.5 x forward profits and 7.4 x sales; at the time, Beast likewise had a comparable cap structure to Celsius with practically totally equity financing. And as formerly mentioned, Beast was likewise complimentary capital favorable and rewarding in 2007 whereas Celsius was not in 2015; in reality, Beast created more levered FCF in 2007 than Celsius created in money from operations in 2022. Celsius would trade at around $107 per share if it had a comparable forward sales several to Beast’s in 2007.

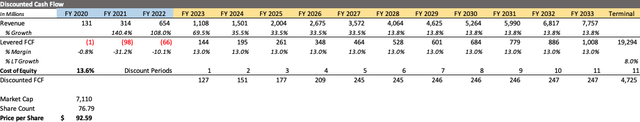

If we take a look at these 2 through a DCF structure, Celsius’s share cost starts to look a lot more suspicious. Presume that, beginning this year, Celsius creates levered FCF with the very same margin Beast did back in 2007, approximately 13%. In addition, I utilize earnings development rates for 2023, 2024, and 2025 to match agreement earnings quotes and after that permit earnings to grow at the 2025 earnings development rate for 2 extra years prior to slowing to 13.8% through 2033 (which was Beast’s 2007-2022 earnings CAGR). I utilize 8% as a long-lasting development rate (which is 100 bps greater than Beast’s levered FCF development rate). Lastly, I utilize a basic CAPM presumption for the expense of equity (ERP = 5.5%, safe rate = 3.8%, beta = 1.79). Utilizing these presumptions and worths, I reach a rate per share of $92.59, well listed below the present market value.

S&P CapIQ Pro, Investing.com, SeekingAlpha

Nevertheless, even these presumptions appear rather generous and presume that Celsius will follow in Beast’s success. Keep in mind, Beast created the biggest cumulative return of any S&P 500 stock over the last 25 years. Moreover, Beast’s strong earnings development over the last years took place throughout the zero-interest rate environment of the early to mid-2010s. And lastly, the presumption that Celsius will match Beast does not show Wall Street beliefs considering that agreement FCF forecasts for this year indicate an 8% margin listed below my presumption of 13%. Keep in mind the design has a high level of sensitivity to modifications in the discount rate, especially relating to the safe rate (United States 10 Year). If the 10 Year yield was up to 3%, the evaluation would increase to $110 per share.

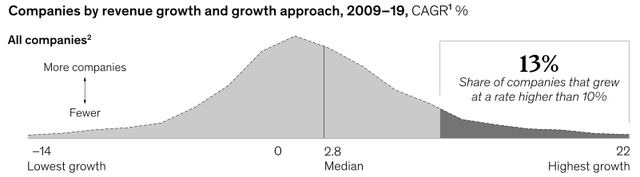

At $140 per share and presuming earnings forecasts for 2023-2025 match agreement quotes, this cost suggests 26.4% yearly earnings development from 2026 through 2033. While possible, development of this magnitude for 7 years and the >> 30% top-line development presumed for the next 3 years is unlikely. According to McKinsey, just 12.5% (1 in  of business grew sales by 10% yearly from 2009 through 2019. Theorize this information when thinking about Celsius’s >> 20% development requirement through the years’s end, and the likelihood looks much slimmer.

of business grew sales by 10% yearly from 2009 through 2019. Theorize this information when thinking about Celsius’s >> 20% development requirement through the years’s end, and the likelihood looks much slimmer.

Therefore, to wrap up, when comparing Celsius’s present multiples to Beast’s when it was experiencing comparable development, Celsius trades even more pricey and with less to display in regards to success and capital. Celsius’s cost likewise presumes earnings development and abrupt money generation that surpasses experts’ expectations and brings a low likelihood.

Increased Competitors Will Make Development Harder

Celsius’s circulation contract with Pepsi in 2015 provides the business a competitive benefit; nevertheless, the energy beverage area in which Celsius has actually made substantial strides will end up being more crowded. For example, various other low or zero-sugar, “much healthier” energy beverages like Alani Nu, ZOA Energy, Prime Energy, and Gatorade Quick Twitch have actually come onto the marketplace. So, as these other brand names grow and brand-new brand names get in the market, Celsius will need to combat more difficult to acquire market share and may experience top-line development listed below present expectations, regardless of its huge gains in market share over the previous couple of years. In numerous methods, Celsius and comparable items that stress health and health have actually interfered with the energy beverage market, comparable to tough seltzers in the beer market considering that the late 2010s. Celsius has actually taken market share from generally high-sugar Beast and Red Bull like how White Claw and Really took market share from standard beers. Nevertheless, Really’s moms and dad business Boston Beer displayed in 2021 that it overstated the anticipated tough seltzer development, and, as an outcome, Boston Beer experienced quick share cost decreases. In part, Really struggled with growing competitors in the tough seltzer area as the variety of items took off following the preliminary success of White Claw and Really. While no example is best, a comparable fate might fall upon Celsius as more items get in and decrease prospective gains in market share.

” Markets can stay unreasonable longer than you can stay solvent.”

I think Celsius is misestimated, and the expectations about the business’s future are extremely positive. That being stated, I will not challenge the momentum behind the stock or the possibility of a brief capture offered the >> 20% brief interest. I would not be delving into brief positions or places on the basis that Celsius will implode over the coming weeks or months; nevertheless, I definitely would not be purchasing into the stock today and would seriously think about taking earnings and waiting to see what results Celsius emerges over the coming quarters.

Celsius has tailwinds that might assist sustain or increase the present share cost over the near term. For one, the business hasn’t broadened to worldwide markets, marking a substantial point of prospective development (nevertheless, the majority of Europe and Asia still consume coffee or tea over energy beverages as the favored caffeinated drink). In the United States, the fascination with Celsius’s health and weight advantages likewise assists the business develop its item as an energy beverage and a health item that can reach a wider audience.

Celsius makes an excellent item that has actually increased in appeal and showed a few of the most robust development over the 12 months. The business certainly will continue to grow the leading line and ideally emerge constant money generation and success over the coming quarters and years. Nevertheless, the level of earnings and profits development indicated by the trading multiples appears unlikely offered the brand-new macroeconomic scene and growing competitors in the market. Therefore, I see Celsius as a sell due to the overvaluation and uncertainty of the stock’s momentum. The primary motorist of a modification in viewpoint would be a growth to and success in worldwide markets and proof of constant success over the coming quarters and years as marketing and advertisement expenses increase to keep an one-upmanship over rivals.