Cinefootage Visuals

The electrical cars and truck transformation has actually been underway for over a years now, with all significant gamers establishing and promoting a minimum of one complete electrical design. While just representing 7% of brand-new sales in the United States in 2022, the forecast is half of brand-new cars and truck sales around the world will be electrical by 2035. One business that reveals pledge as a recipient from the need for increased, tidy electrical output to assist power these electrical lorries is Centrus Energy ( NYSE: LEU). From the business’s tactical position in the nuclear fuel market to its current development potential customers, we will look into why LEU has the possible to produce long-lasting development for financiers and has a set-up for a much shorter term swing trade.

Centrus Energy is a leading supplier of enriched uranium for the nuclear power market. As a relied on provider, the business plays a crucial function in supporting international atomic energy programs, particularly in the United States, Japan, and Belgium. The increasing need for tidy and sustainable energy services has actually placed Centrus Energy at the leading edge of the nuclear fuel market. With a recognized consumer base and long-lasting agreements, the business take advantage of steady income streams and constant need.

Centrus Energy runs through 2 main sectors: the LEU sector and the Agreement Providers sector. The LEU sector concentrates on the production, sale, and shipment of low-enriched uranium (LEU), mainly utilized in atomic power plants. The Agreement Providers sector offers a variety of technical, seeking advice from, and management services to federal government and industrial consumers. This diversity alleviates threats connected with reliance on a single income stream and boosts the business’s durability. For example, the business has a long-lasting agreement with the U.S. Department of Energy (DOE) for the supply of uranium. Such agreements and collaborations highlight the trust and self-confidence positioned in Centrus Energy’s abilities, making sure a consistent circulation of organization chances.

The international push for tidy energy and minimizing carbon emissions has actually rejuvenated interest in nuclear power. With its low carbon footprint and capability to supply trustworthy base load power, atomic energy is anticipated to play a considerable function in the energy shift. As federal governments around the world look for to decarbonize their economies, Centrus Energy stands to gain from increased need for its product or services. This beneficial market outlook develops a favorable environment for LEU’s development and success.

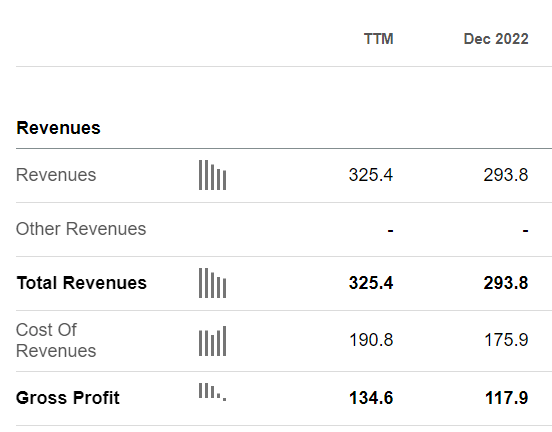

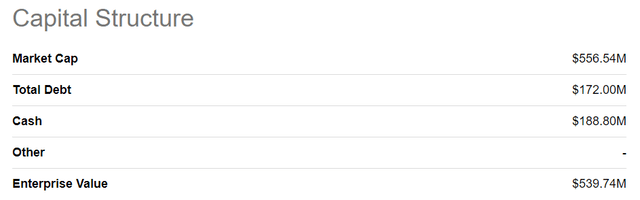

Taking a look at Centrus Energy’s monetary efficiency exposes favorable patterns that signify development capacity. The business has actually reported constant income development over the previous couple of years, with tracking twelve months currently surpassing 2022’s income by over 10%, highlighting its capability to take advantage of market chances. Foreign sales have actually likewise doubled considering that 2021 offering it strong diversity from guideline threat from one federal government which is constantly a concern in the atomic energy sector. Furthermore, Centrus Energy has actually effectively minimized its financial obligation problem, boosting its monetary stability and offering more space for financial investment and growth, as the business presently has more money than financial obligation on hand. These aspects, combined with a robust market outlook, recommend appealing long-lasting development potential customers for the business and with a present rate to revenues ratio of 9, an appealing appraisal also.

Looking For Alpha Looking For Alpha

It is very important to attend to the Russian Uranium import restriction, as it might have ramifications for Centrus Energy. Last month, Congress passed legislation enforcing constraints on the import of uranium from Russia. The restriction is intended to safeguard nationwide security interests and domestic uranium production. While this restriction impacts the import of uranium, it likewise develops possible chances for domestic uranium manufacturers like Centrus Energy. By minimizing competitors from Russian imports, Centrus Energy can possibly gain from increased need for locally produced uranium, supporting its development potential customers.

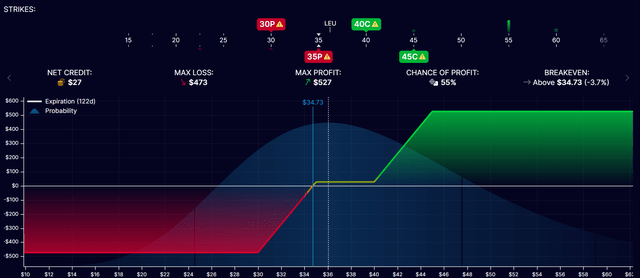

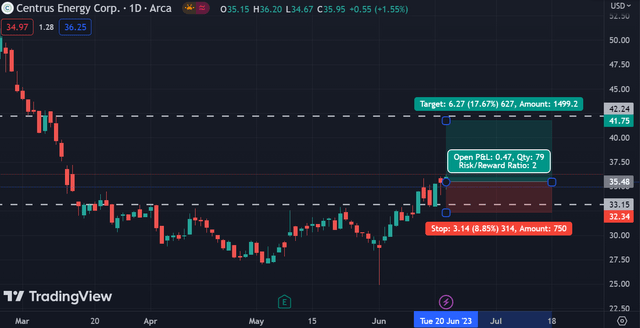

Studying LEU‘s chart from a technical perspective reveals it coming out of a rounding bottom, with the highlighted date (June 1st) being the news statement about the Russian uranium import restriction. That day saw a good bullish rejection of lower lows, sending out the stock greater. While I generally like choices trades, Centrus regrettably has extremely low volume with large quote ask spreads. If I were to make an alternatives play, however, I would utilize a double bullish put credit spread out with call debit spread that would look something like this:

BUY TO OPEN: $30 PUT and $40 CALL October Expiration

OFFER TO OPEN: $35 PUT and $45 CALL October Expiration

However with choices volumes being so low and quote ask spreads being large, I will avoid of the choices and choose regular shares purchase. With present rates at ~$ 35 and a strong assistance level, I am targeting a 2:1 threat to reward ratio with revenue target simply listed below previous resistance and a stop loss secured by previous assistance.

Centrus Energy ( LEU) is well-positioned to gain from the increasing need for tidy electrical output to power electrical lorries and the more comprehensive push for tidy energy services. As a leading supplier of enriched uranium for the nuclear power market, Centrus Energy plays a crucial function in supporting international atomic energy programs. Its tactical position, varied income streams, and long-lasting agreements supply stability and development chances. Furthermore, the business’s monetary efficiency, with constant income development, minimized financial obligation problem, and strong diversity, indicate appealing long-lasting potential customers. In addition, the current Russian uranium import restriction develops possible chances for Centrus Energy as it minimizes competitors and increases need for locally produced uranium. From a technical perspective, LEU’s chart reveals indications of a bullish turnaround, additional supporting the capacity for a shorter-term swing trade. With an appealing appraisal and a beneficial market outlook, Centrus Energy provides a luring financial investment chance for both long-lasting development and shorter-term trades.