However BTIG/ Homesphere‘s newest study from little- and mid-sized homebuilders casts a light shadow on this intense summary. The regular monthly BTIG Study suggests that structure activity amongst smaller sized homebuilders cooled somewhat from April to Might, though belief stays much greater than in 2015.

The study obtains the viewpoint of around 75-125 little- and mid-sized system homebuilders nationally about sales, client traffic, and prices patterns (117 actions this month).

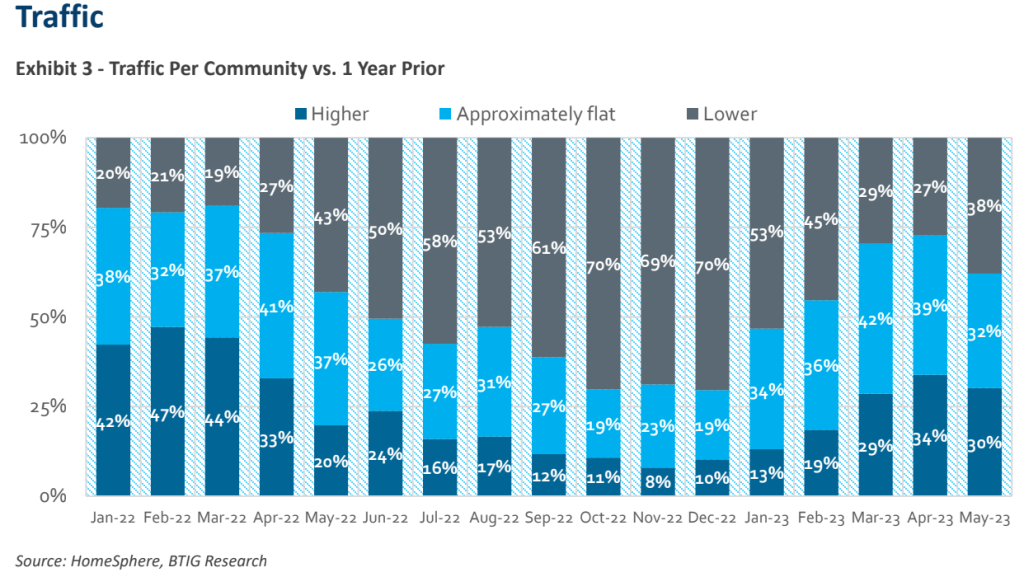

Sales and traffic patterns were a variety in Might. After huge dives in sales patterns considering that the winter season depression, the variety of contractors reporting year-over-year development was 34% in Might, up from 31% in April 2023. Traffic was down somewhat, with 30% of contractors reporting greater neighborhood traffic year-over-year compared to 34% in April 2023. Both metrics are substantially much better than Might 2022. On the other hand, 39% saw a drop in orders vs. 34% in April and 53% in Might 2022.

” Our study recommends brand-new house need momentum slowed in Might. We had actually anticipated more powerful outcomes this month offered alleviating contrasts and favorable anecdotal public home builder commentary … the Might uptick in 30-year home loan rates might have likewise affected patterns,” commented Carl Reichardt, an expert at BTIG.

Sales and traffic relative to expectations compromised a bit also, with 37% of participants seeing sales as much better than anticipated vs. 38% last month. On the other hand 26% saw sales as even worse than anticipated, vs. 20% last month. On traffic, 35% saw better-than-expected traffic, with 23% reporting worse-than-expected traffic (compared to 42% and 15%, respectively, last month).

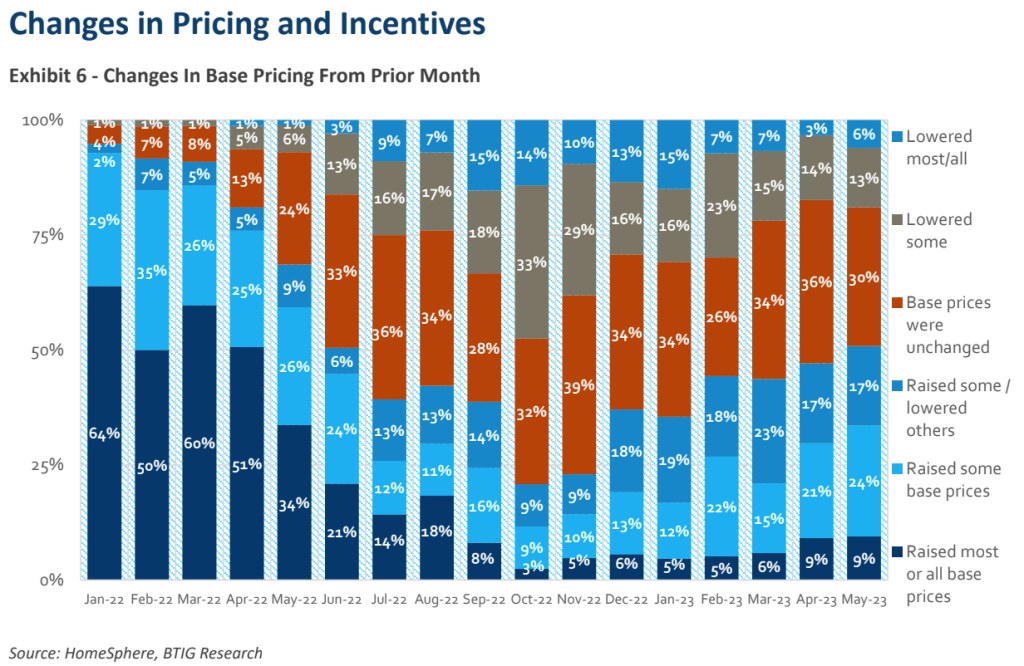

Home builder prices activity stayed blended. One-third of contractors reported raising either “most/all” or “some” base costs, up from 30% in April. And 19% of contractors decreased “most/all” or “some” base costs compared to 17% in April. Per the study, 27% of participants reported increasing “most/all” or “some” rewards, versus 22% in April. Just 3% reported reducing “most/all” or “some” rewards compared to 7% in April. No home builder reported reducing “most/all” rewards in May.

” Our company believe contractors have most likely kept a cautious eye on costs and rewards as they tracked traffic and purchaser interest throughout the crucial spring selling season (normally February through May),” Reichstadt composed. “Our company believe this is most likely especially real for personal contractors with more concentrate on mid level cost points instead of low-end, volume-oriented public contractors, who our company believe have actually normally been really aggressive on pricing/incentives.”