Teka77

Dear readers/subscribers,

It is essential to diversify your portfolio, I think, in connection to the stability you wish to have in the face of market adversity/volatility – such as the one we are dealing with now. An essential element for me in my portfolio has actually constantly been financial investments in energy business. Energies are a few of the most safe money streams you can discover due to their controlled nature and the structure/organization of their capital. While it’s completely possible for these business to see decreases and even dividend cuts, they are far less typical than in other sectors.

At the exact same time, these business do not have the development possible other business do. They are, for absence of a much better word, bond-like financial investments.

My present biggest position in any one energy is my financial investment in Enel ( OTCPK: ENLAY). This Italian stalwart, the majority of which I purchased listed below EUR5/share has actually produced substantially market-beating returns while paying remarkable quantities of money, making it possible for more financial investment.

I’m favorable about energies – and in this post, I’m going to take a look at E.ON ( OTCPK: ENAKF) and see what we have opting for us with this business.

Is it a “BUY” here, what can we anticipate, and what do we wish to see?

E.ON – The evaluation is now high

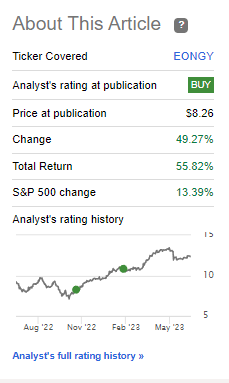

My returns on E.ON have actually been excellent. In the last post on the business published, I held a favorable position on this energy, which inclusive of dividends has actually led to 18% RoR in less than 4 months at a time throughout which the S&P 500 has actually returned about 5%. That’s more than a 3x and is strong for my own objectives. Because my post in October 2022, when I went “back in”, the RoR appears like this.

Looking For Alpha E.ON RoR ( Looking For Alpha)

As you may anticipate, I’m really delighted with a 4x RoR above the S&P 500. However that is likewise why I am reviewing this financial investment here. The time has actually come for me to alter my score on E.ON, and think about cutting and possibly turning this financial investment for more beneficial financial investments in the sector or nearby sectors. E.ON at 7.5 x stabilized was something, and it’s a “BUY”. E.ON at over 11-12x typical weighted P/E, that’s a various story completely.

Let’s summarize what we have here and what we can anticipate over the next couple of years. The business reported full-year lead to March, about 3 months back. Those outcomes were exceptional, and part of what drove the business even greater.

What I imply by exceptional is that every section provided at the leading end of the assistance variety.

E.ON IR ( E.ON IR)

With overall group EBITDA on an adjusted basis along with Earnings for the group, the outcomes were even above the assistance variety for the complete year – beyond simply “excellent” outcomes.

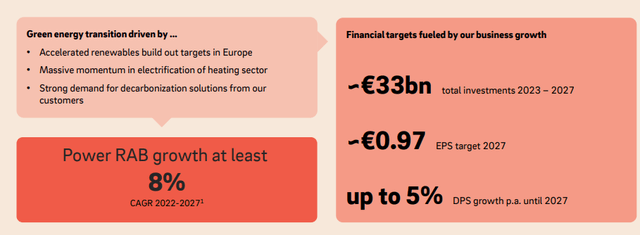

I wish to advise you that E.ON, is the biggest operator of mission-critical energy facilities in Western Europe. This consists of being the biggest provider of electrical power. To buy E.ON, while some presume it to be dangerous, is to buy a market leader. Which market leader is anticipating stability moving forward, brand-new financial investments, and excellent returns from an energy shift that remains in full blast.

E.ON IR ( E.ON IR)

As I have actually carried out in previous short articles, I’m going on and calling the business dividend “safe” here. There is the capacity for a cut – there constantly is – however the business’s main position and projection is an as much as 5% payment development each year up until 2027. This indicates that it will not be reduced.

If the business was less expensive, this would be excellent news. However as it stands with today’s share cost, the yield is in fact listed below 5%, which compared to my own YoC of over 7% is beginning to look rather weak.

Forward development is to be brought by the green development velocity. 2022 was a great example of how E.ON is growing in an unstable macro. The business’s negatives for the year can be found in the type of milder weather condition, which results in reduce volumes in the energy networks section, along with increasing expenses for network losses. Nevertheless, this remains in turn balanced out by greater natural RAB development and the continuous awareness of organizational synergies that are being provided throughout the whole business.

Client services saw comparable negatives, once again, reorganizing advantages are beginning to actually reveal outcomes. Regardless of all of the negatives in 2015, the business ended with a EUR170M greater EBITDA than 2021 the complete year. The business likewise does not anticipate payment behavior/nonpayment to end up being a concern due to strong governmental assistance. Electricity/heat is not something you can go without, and the federal governments in the appropriate locations understand this. E.ON stays, as I see it, safe here – even if they have actually increased the allowances for what is thought about “bad” financial obligation.

Nevertheless, this ratio is still less than 1% of the business’s income – just 20 bps greater than in 2021.

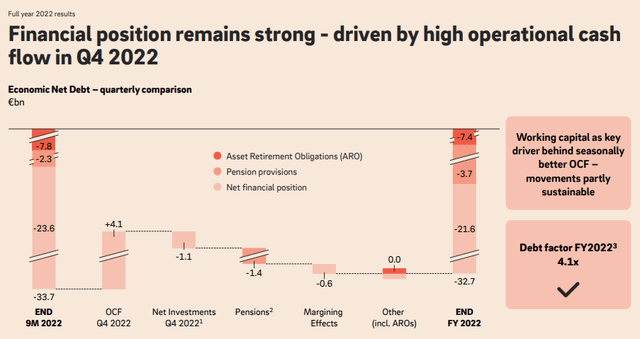

The business’s monetary position is really strong.

E.ON IR ( E.ON IR)

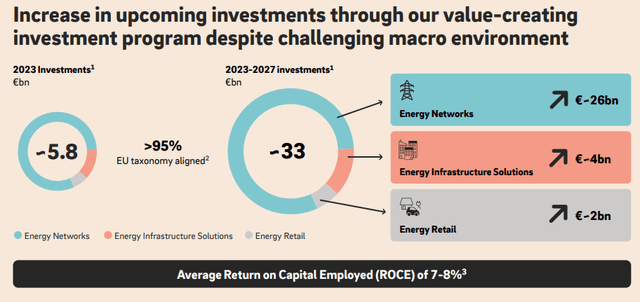

E.ON stays BBB ranked, with a financial obligation element target of listed below 5x. E.ON predicts no profits development problems to continue to balance out the development in take advantage of from its strong financial investment targets. These financial investment targets, moving forward, are as follows.

E.ON IR ( E.ON IR)

With the appropriate ROCE, the business is mainly exceeding a reasonable WACC, if just hardly. The maybe biggest concern for the business is the increasing rate of interest – and these are not going anywhere. This raises the bar for what the business should make in order to accomplish fundamental development. The business anticipates a 2027E EPS of near a euro on a per-share.

Secret efficiency chauffeurs moving forward are continued natural RAB development, effectiveness, much better healing of losses, development in the solutions-based organization, and change in markets that have actually not yet seen the remarkable change seen in others – such as the UK, Romania, and others. For the Energy Facilities, anticipate natural development from brand-new tasks, along with upside from property optimization.

The issue I’m rather having with this is as follows – I think the dividend will not be cut lower, and might even follow carefully that 5% per share and each year development. Nevertheless, to assist for any sort of RAB certainty in development, or any sort of certainty at all in the energy or energy markets is a little a leap. That’s why I just buy energies when they are inexpensive, at this time. Even if the business is excellent, the large volatility from European macro, consisting of the Russo/Ukrainian war indicates we might be in a greatly various circumstance than we believed. This volatility is on complete screen in expert projections, with a precision of less than 35% (leaving out favorable beats) for a 1-year basis with a 10% margin of mistake. We just need to go back to 2016 to discover a more than 35% expert EPS miss out on.

I do not wish to provide the impression that E.ON is not bewaring about assistance and targets – since they are. However there are a great deal of favorable one-offs and synergy presumptions baked in. The business for 2023 is presuming that they’re dealing with the 3Q and 4Q margin levels for 2022 – while this is possible, those are likewise arises from a record year. The business formally does not presume an end to the energy crisis in 2023.

We’re likewise not making any allowances for abrupt and possibly unforeseen legal expenses or modifications, such as the one coming out of Germany in combination with 1Q. Such relocations can definitely effect E.ON adversely also.

The mix of all of these dangers, and the truth that we remain in an environment where federal governments will be needed to secure consumer interests and expenses above the revenues of energies leads me to take an usually careful position on these financial investments – and I would not overdo it in my targets.

This leads me to evaluation.

E.ON Evaluation – We’re reaching an inflection point, and it’s time to alter the score

If you remember my last post, my PT at the time was conservative and affected EUR10.5/ share.

I am not altering my PT since this post. This makes E.ON a “HOLD”.

The factor I am not altering my PT is, above all, the dangers I discussed above. Nevertheless, I can show to you the case I see for E.ON if things even go less than anticipated – since FactSet analyses/targets take place to mirror my own presumptions for the disadvantage in E.ON.

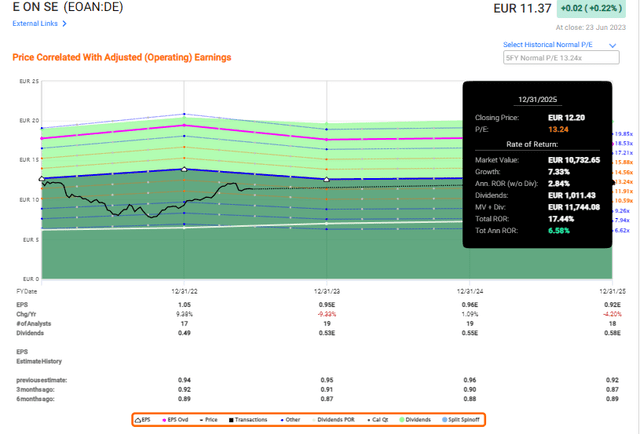

If we see any sort of disadvantage, and even presuming a 12-13x P/E evaluation, which is the average for this energy, then you’re taking a look at below-market possible RoR.

E.ON Projection ( F.A.S.T Graphs)

Which’s inclusive of dividends. Keep in mind the RoR without dividends. Do I think these projections are most likely? Clearly, other experts have other projections that they are dealing with. A fast glimpse at the S&P Global expert averages informs us they start at EUR6.6/ share (oh, how I ‘d like to see the presumptions for that expert) and approximately EUR14/share (really favorable, however not outrageous if essentially, whatever ends up strong gold for E.ON). The average is now EUR12.17. That’s up from EUR10.4 back in October when I made my buys and developed my PT.

See any patterns here?

Out of the 20 experts following the business, we’re now down to 4 “BUY” and 1 “OFFER” – with the staying at a mix of “HOLD” or “Underperform” or comparable positions. The modification to me is really clear here, and it mirrors my own belief modification. The truth is, that at today’s evaluation and presumption, a clear advantage for the business needs macro to go the business’s method – and I wish to be open to the danger that it might not. If it does not, and the marketplace acknowledges this, you remain in for non-market pounding RoR.

This is not the case for all energies. Regardless of a high climb for my biggest position, Enel, there is a lot of advantage because energy which still trades listed below E.ON and uses a 6.6% yield. Enel is likewise higher-rated with a BBB+, while not having precisely the exact same size as E.ON. Nevertheless, its mix and strategies imply that I see the advantage in Enel as much more most likely than I see the advantage in E.ON at this evaluation.

And it is because of that, that I am altering my thesis and my belief for this business.

Here is my upgraded thesis for E.ON – not a modification in PT, however a modification in score.

Thesis

- E-ON is a market-leading energy business in Europe with a few of the very best and biggest facilities networks in the continent. I have actually effectively bought the business a number of times, suggesting that I have actually substantially exceeded the marketplace by buying E.ON

- The business is now completely valued for the possible headwinds the business is dealing with.

- E.ON is a “HOLD” now based upon its evaluation and an ongoing conservative PT of EUR10.5

- I’m transferring to “HOLD” and am beginning to take a look at possible options for investing and reinvesting. I’m not altering my cost target here

Keep In Mind, I’m everything about:

- Purchasing underestimated – even if that undervaluation is minor and not mind-numbingly huge – business at a discount rate, enabling them to stabilize gradually and harvesting capital gains and dividends in the meantime.

- If the business works out beyond normalization and enters into overvaluation, I gather gains and turn my position into other underestimated stocks, duplicating # 1.

- If the business does not enter into overvaluation however hovers within a reasonable worth, or returns down to undervaluation, I purchase more as time enables.

- I reinvest earnings from dividends, cost savings from work, or other money inflows as defined in # 1.

Here are my requirements and how the business satisfies them (italicized).

- This business is general qualitative.

- This business is essentially safe/conservative & & well-run.

- This business pays a well-covered dividend.

- This business is presently inexpensive.

- This business has a reasonable advantage based upon profits development or several expansion/reversion.

The business is now a “HOLD” for me due to an undesirable evaluation.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please know the dangers connected with these stocks.