An economic expert who provided a prescient caution about the health of the U.S. banking system previously this year is now stating a long-awaited U.S. economic crisis might lastly show up in the months ahead.

Steve Blitz, primary U.S. economic expert at TS Lombard, stated in a research study note shown MarketWatch on Wednesday that “the economic crisis view stays quite undamaged” as banks control loaning while business’ revenues appear to have actually deteriorated when again throughout the quarter ending in June.

Both are indications that the U.S. economy is slowing, and the stock exchange’s “fantasize,” which has actually assisted to move the S&P 500 index

SPX,.

almost 14% greater up until now this year, according to FactSet information, may concern an abrupt end.

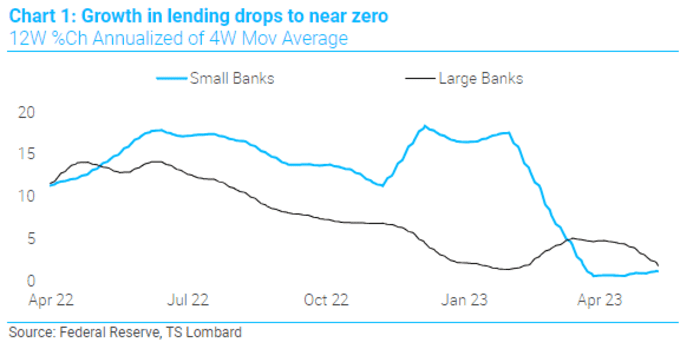

The rate of providing development at little and big U.S. banks has actually slowed to nearly absolutely nothing, according to TS Lombard’s analysis of Federal Reserve weekly information on bank loaning. It is the most recent turning point in a pattern that has actually continued for the majority of this year, and even longer for big banks, the information reveal.

TS LOMBARD.

On The Other Hand, the U.S. Treasury’s strategy to release a flood of T-bills to renew its coffers now that the federal financial obligation ceiling has actually been raised might divert a lot more cash far from markets and the economy.

Treasury has actually currently begun the procedure, and it is anticipated to release $1 trillion in costs prior to completion of August, according to a price quote from BofA Worldwide strategists. T-bills are Treasury bonds with maturities of in between 4 and 52 weeks.

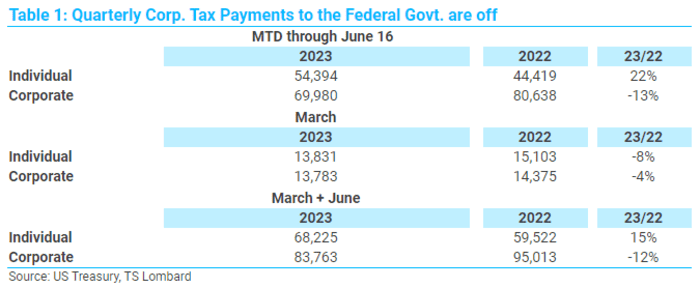

Lastly, indications of slowing business incomes development might press the economy over the edge. Even as Wall Street experts have actually been raising their expectations for business revenues, a downturn in quarterly tax payments recommends that incomes have really continued to droop in 2023. This follows revenues for S&P 500 companies formerly diminished on a year-over-year basis throughout the very first quarter of 2023 and 4th quarter of 2022, according to FactSet information.

U.S. Treasury Department information reveal business tax invoices are down 12% to date in 2023 through June 16, according to a TS Lombard analysis.

Lower tax payments implies lower revenues, Blitz stated. And weaker revenues will likely cause more layoffs and a downturn in wage development, which might intensify the effect from slowing credit development and the flurry of T-bill issuance.

” Lower business incomes are an essential sign indicating lower individual earnings and work earlier instead of later on. Helping and abetting this procedure is the rate of providing slowing to a crawl– and after that Treasury pulling 9% of GDP, annualized, out of the economy in the existing quarter,” Blitz stated.

TS LOMBARD.

Hopes that the U.S. economy may prevent an economic downturn have actually assisted to raise stocks this year, and financiers are holding on to indications that the U.S. economy, especially the labor market and the real estate market, stays robust.

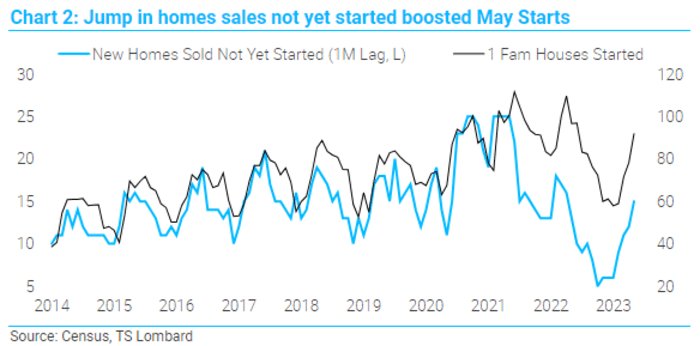

Blitz resolved a few of these issues, stating that business revenues will cause lower work, while dismissing a rise in real estate starts last month as a one-time “outlier.”

According to Commerce Department information launched Tuesday, the carefully seen step of U.S. home-building increased 21.7% in May to a seasonally changed yearly rate of 1.631 million, blowing away economic experts’ expectations for a modest decrease.

” Real estate is crucial in getting to an economic downturn, just 2001 saw an economic downturn without a significant contraction in house building and construction. It is possible for this to happen once again, offered the anticipated mildness of the decline. Still, economic crises seldom establish when building and construction is roaring ahead,” Blitz stated.

” To this point, Might appears like an outlier rooted in a dive in April houses offered that weren’t yet begun,” he included.

TS LOMBARD.

Blitz likewise pointed out a drop in railcar loadings of lumber and metal items as an indication that a current uptick in the health of the making economy is currently fading.

And even if the U.S. does handle to postpone an economic downturn, the Federal Reserve and markets might deal with other issues, like a a revival of inflation. “Missing an economic downturn, inflation will reaccelerate later on in the year. Not to 8% approximately,” he stated, including that “5% is most likely.”

A long time chronicler of the U.S. economy, Blitz kept in mind back in February that little U.S. banks might be susceptible due to a variety of aspects, consisting of a scarceness of reserves and an inequality in between the periods of their loans and the short-term nature of their deposit responsibilities.

The asset-liability inequality in specific ended up being a significant issue when Silicon Valley Bank collapsed into federal receivership a couple of weeks later on after a desperate effort to raise financing set off a destructive bank run

Wall Street economic experts had actually anticipated a U.S. economic crisis would start as quickly as the very first quarter of 2023, however, up until now, the economy has actually been suddenly resistant to the Fed’s interest-rate walkings, even with the reserve bank having actually raised loaning expenses by 5 portion points considering that March 2022.

.