PhonlamaiPhoto

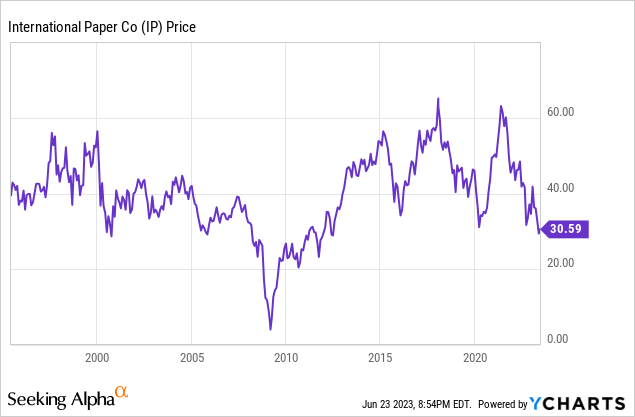

A leading paper, box and pulp manufacturer in America is International Paper ( NYSE: IP). It is likewise among the more cyclical services on Wall Street. The stock flourished in the early rebound after the pandemic throughout 2020 into the start of 2021, however has actually faded in rate because that point. The share quote has actually decreased from $60 to $30 over 2 years, marking down a Wall Street forecasted economic crisis in paper need.

So, the concern for ownership today is which instructions will the economy head entering into 2024, as the stock exchange tends to mark down the future by a great 6 months? The bright side is International Paper is sitting at its greatest evaluation and running setup, possibly considering that 2012, if not the once-in-a-generation Excellent Economic crisis bottom of 2009. So, if we get a moderate economic crisis and even a soft landing without a material drop in processed paper/pulp need, investigating the business for financial investment today makes good sense.

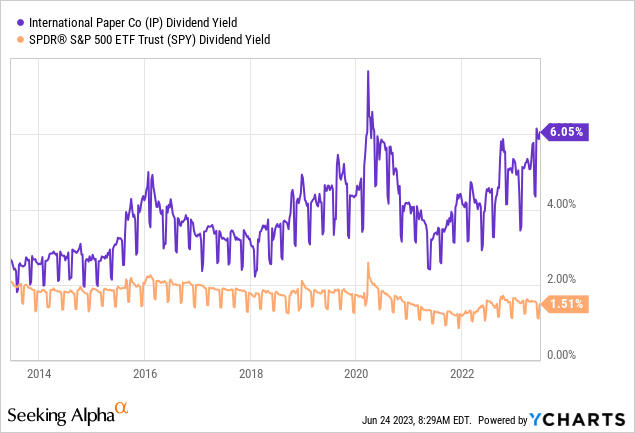

My conclusion is IP might be getting in purchase area, as the chart pattern might be bottoming in June. While I personally think the chances of a deep economic crisis are simply as most likely as a soft landing, one method to hedge a brighter result for U.S. GDP development is to acquire shares now. The business is forecasted to stay well rewarding into 2024, and a tracking 6% dividend yield is rewarding to hold. In reality, the present dividend spread in favor of IP vs. the S&P 500 index money circulation is higher today than any other point over the last years.

YCharts – International Paper vs. SPDR S&P 500 ETF, Dividend Yield, ten years

Improving Functional Profile

What I like about International Paper finest today is the business’s underlying monetary health has actually enhanced significantly with tight pandemic management of expenses and financial obligations. Typically at a peak in the financial cycle, this service and other deep cyclicals have actually participated in unnecessary/unusual acquisition and capital investment techniques, with increased financial obligation loads (on overconfidence about the financial outlook). Not this time around for IP.

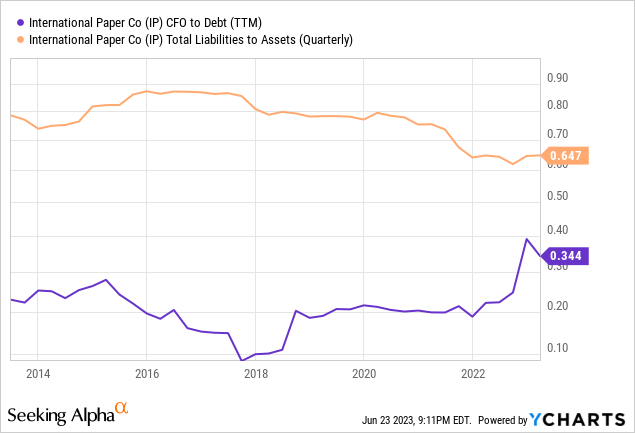

The information points that stand apart to me are the decrease in financial obligations and overall liabilities considering that 2017. The balance sheet has actually enhanced significantly with net equity and properties supplying an exceptional structure for record success in the next financial upcycle. Overall liabilities vs. properties, for instance, have actually decreased from a ratio of 0.88 x to 0.65 x over 6 years. Over approximately the exact same period, tracking 12-month capital protection of financial obligation increased from a low of 0.10 x to as high as 0.39 x a couple of quarters back.

YCharts – International Paper, Capital to Financial Obligation, Overall Liabilities to Possessions, ten years

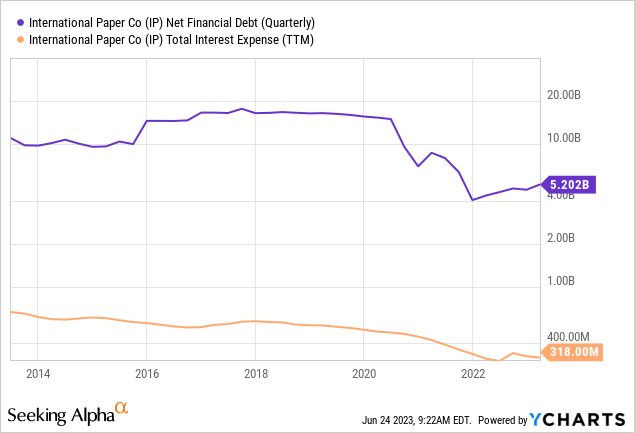

You can see listed below the 50% decrease in financial obligation over ten years and 70% drop over 6 years has actually slashed interest expenditure significantly. Falling from a financial obligation peak of $18 billion in 2017 to simply $5 billion in 2023 opens all sort of monetary versatility, and might move earnings margins to brand-new heights.

YCharts – International Paper, Web Financial Financial Obligation and Trailing Yearly Interest Cost, ten years

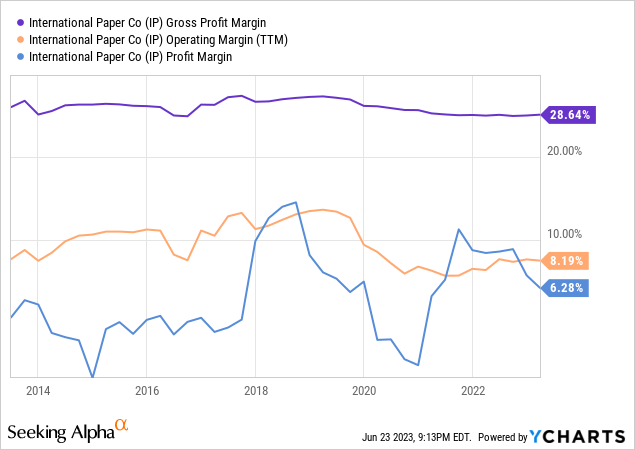

While gross earnings margins have actually been regularly around 30% over the previous years, running margins do have space to grow from the present 8% reading. If running margins increase back to 2019’s 13% high in the next financial healing stage, last earnings margins above 10% might end up being the brand-new regular for a reduced-debt International Paper operation.

YCharts – International Paper, Numerous Revenue Margins, ten years

And, if a sustainable 9% to 12% last margin variety on sales is the future (vs. sub-5% margins a years back), I can argue a far richer evaluation ought to be placed on shares by Wall Street.

Assessment Story

You can evaluate the swings up and down in share rates considering that 1995 listed below. To be sincere, the business runs in a paper market that has actually not grown much in years. The outcome has actually been financiers utilize this name as cyclical swing trade and dividend earnings banner. Beyond the tank in rate throughout the Great Economic Crisis, the 2-year rate slide of 2021-23 is the next biggest drawdown doing not have a significant bounce. Is this weak point warranted, particularly if a deep economic crisis is prevented?

YCharts – International Paper, Weekly Share Rate, Because 1995

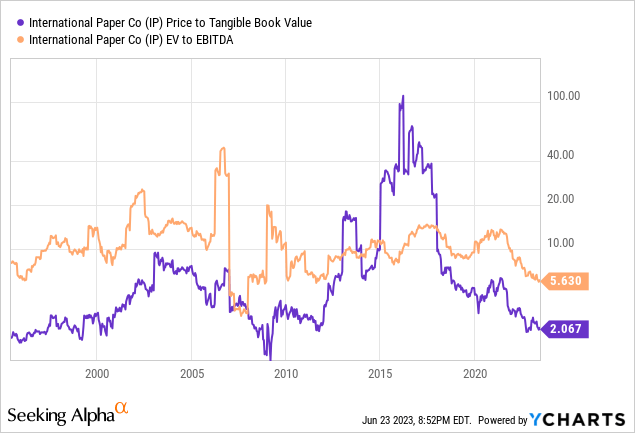

The 2 information points of basic worth drawing me to IP are the rate to “concrete” book worth setting and business evaluation on fundamental money EBITDA. The last time both were valued this low at the exact same time was 2012, prior to rate moved from $25 to $48 over less than 12 months.

YCharts – International Paper, Rate to Concrete Book Worth, EV to EBITDA, Because 1995

Initially, for cyclical services, rate to concrete book worth is very important as it discusses the theoretical accounting-cost worth of its plant & & devices, money, receivables and stock after all liabilities are deducted. It’s an easy liquidation worth, provide or take, in numerous scenarios. In truth, real net possession selling worths are frequently greater with inflation increasing the marketplace rate of properties past the expense to obtain them, presuming operations are creating earnings. The only time over the last thirty years IP has actually traded considerably under 2x concrete book worth was throughout the worst of the Great Economic crisis. Otherwise, the present evaluation has to do with as inexpensive as the business gets traditionally.

2nd, the significant decrease in financial obligation has actually slashed the overall business worth of the business, while capital have actually been stable the in 2015. The outcome has actually been a remarkably low EV to EBITDA ratio of 5.6 x. The only circumstances experiencing a lower multiple was 2007. I can argue IP at $30 in June 2023 has to do with as affordable as it has actually traded on this contrast considering that the early 1980s.

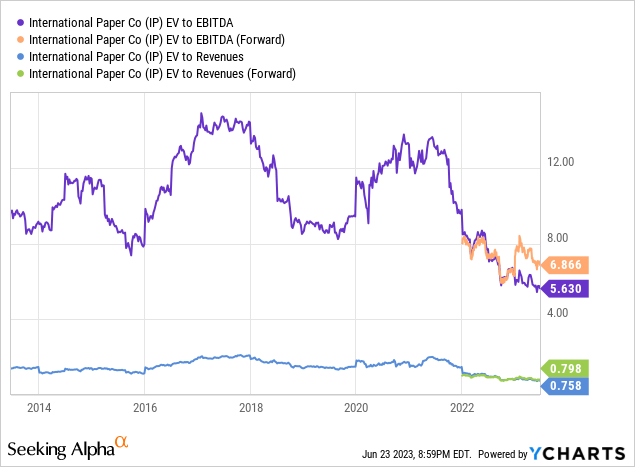

Once Again, when we take a look at a 10-year chart of EV vs. EBITDA and consist of a take a look at tracking sales, International Paper seems extremely inexpensive. If the economy does not topple difficult in the 2nd half of 2023, you may even state the evaluation setup represents a deal in June.

YCharts – International Paper, EV to EBITDA & & Incomes, ten years

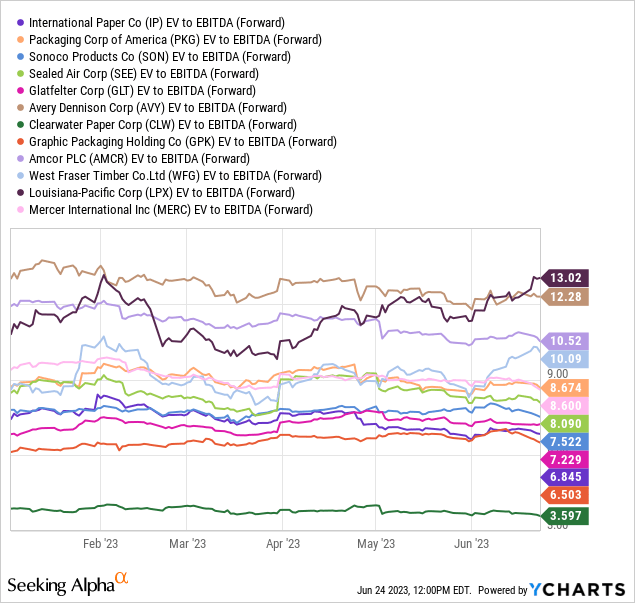

Determined versus other paper manufacturers, lumber providers, and specialized shipping item makers, IP is on the low end for EV to EBITDA ratios taking a look at “forward” 2023 anticipated outcomes by experts. Just Clearwater Paper ( CLW) is materially more economical. I blogged about the upside capacity of Clearwater in February here

YCharts – IP vs. Paper Item Rivals, EV to Forward Approximated EBITDA, 6 Months

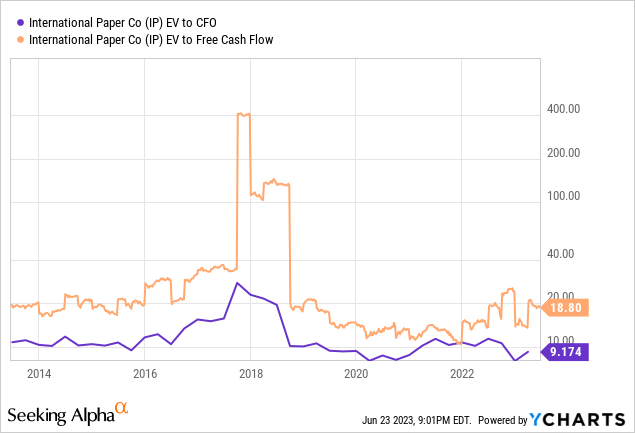

Even More, EV to capital and complimentary capital is likewise unappreciated by financiers today. Both are trading on the lower end of the 10-year spectrum, with EV to conventional capital at a 30%+ discount rate today to long-lasting averages.

YCharts – International Paper, EV to Capital & & Free Capital, ten years

Technical Chart

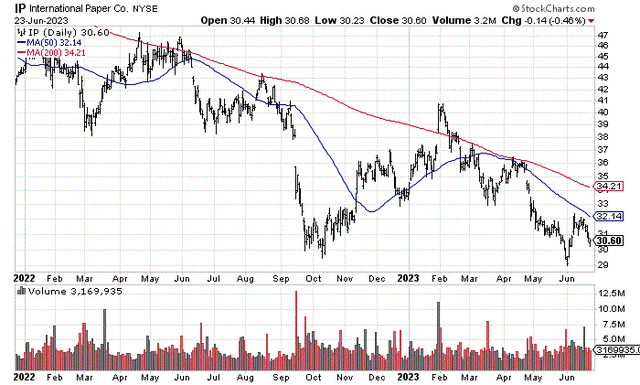

The technical trading chart pattern and momentum photo deal no idea of a bottom yet. If more powerful momentum was clearer, I would think about a really bullish take on International Paper. The Renko chart is showing rate lows might be taking shape (not envisioned), and something of a double-bottom development in rate around $30 with October’s level might appear. Both would inform a momentum turnaround story and be rather bullish if a cost rebound above the 50-day moving average appears this summertime. Even much better, a dive above the 200-day moving typical approaching $34 next week would truly get my attention, as it has actually stopped working to hold above this overhead pattern resistance for practically 2 years running (neglecting a couple of days occasionally).

StockCharts.com – International Paper, 18 Months of Daily Rate & & Volume Modifications

Last Ideas

Subsequently, my IP position is rather little, as I wait for verification of a pattern turnaround. With chances still preferring a downturn in the U.S. economy throughout the 2nd half of 2023, I do not suggest an aggressive position size in the stock. Including on weak point and/or on strength with a cost-average trading method must decrease the threat of another huge equity market swoon normally.

In time, the Federal Reserve will need to pivot to lower rate of interest to avoid an extended and deep economic crisis. When they do (under a variety of possible situations), International Paper will practically undoubtedly carry out highly, as the “growth” part of the financial cycle ends up being the brand-new Wall Street dispute. An economy working on near-record aggregate financial obligation to GDP levels is particularly strained by greater rates. With inflation rates currently in decrease, any tip of increasing joblessness and weaker business revenues will likely be fulfilled by another round of aggressive cash printing by the world’s primary reserve bank.

Smart financiers must be incrementally contributing to cyclical concepts in my view. You do not wish to be holding restricted cyclical direct exposure later on in the year. Names like International Paper typically fly greater right after Fed relieving policy is revealed. We might be getting near stock exchange gamers marking down a brighter future, the reverse of 2022-23 which has actually been marking down a downturn.

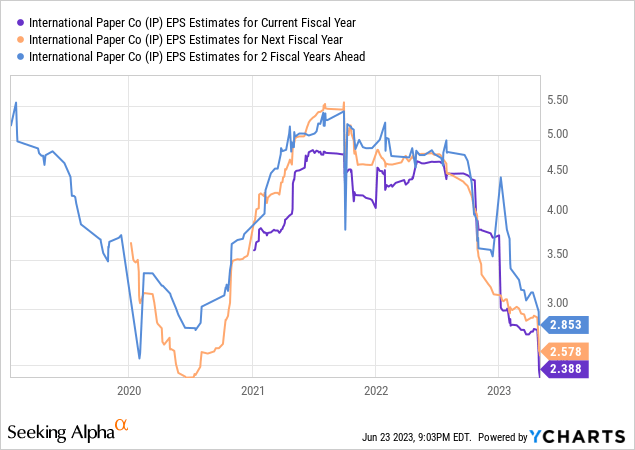

My thinking is EPS might bottom in the $2 to $3 annualized variety over the next 6-12 months, and after that start to increase on more powerful financial development in the 2nd half of 2024. You can evaluate the swings in expert forecasted revenues per share listed below over the last 5 years. I am approximating EPS over the next 5 years will balance closer to $4, with peak profits of $6 to $7 most likely by 2025. So, a share rate of $30 might be rather preferable for the long-lasting buy and hold crowd. The present 6% dividend yield will be a bonus offer for handling economic crisis threat.

YCharts – International Paper, Forward Multi-Year Expert EPS Quotes, 5 Years

And, if we get a Fed pivot with a soft landing, a go back to the IP highs of 2021 in between $50 and $60 a share might end up being truth. A leaner operating structure, more powerful balance sheet, and still rewarding operations at the cycle bottom might support a big ramp for earnings generation in 2024. A minimum of that’s the bullish argument today.

I am pegging drawback threat is restricted to $20 a share, simply above concrete book worth of $15. To trade any lower, we would require an extended and deep economic crisis. My approximated drawback threat on financial investment capital of -25% for an overall return, consisting of the 6% dividend, vs. best-case upside capacity of +100% appears to greatly tilt in favor of ownership over the next 12-18 months. I rank shares a Buy

Thanks for reading. Please consider this post a primary step in your due diligence procedure. Consulting with a signed up and experienced financial investment consultant is advised prior to making any trade.