Sakorn Sukkasemsakorn

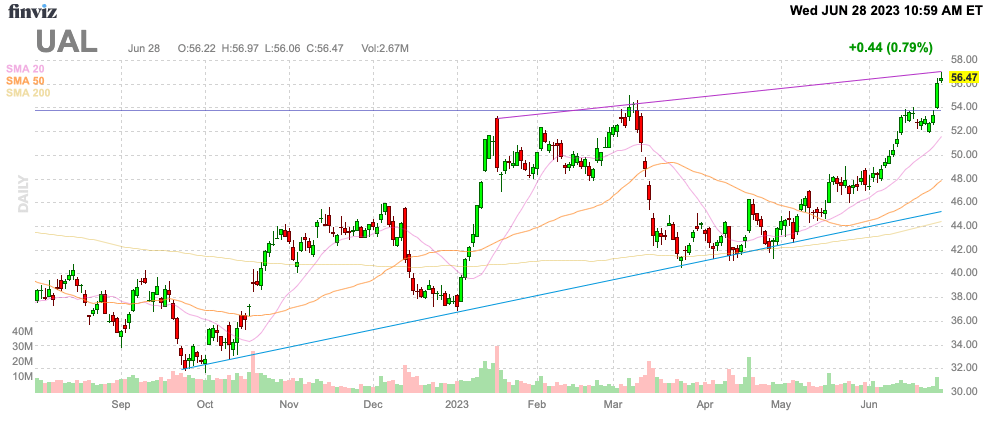

While United Airlines Holdings, Inc. ( NASDAQ: UAL) has actually currently seen a strong rally in the last number of months, the stock still has the capacity for considerable advantage from here. The airline companies have actually gotten in a duration of strong earnings and complimentary capital while the marketplace continues to leave out the sector from the basic commercial transport appraisals. My financial investment thesis stays extremely Bullish on the airline company stock.

Source: Finviz

Topping 2019 Levels

While a great deal of airline companies acquired big financial obligation levels throughout the Covid downturns back in 2020 and 2021, the business are now creating huge earnings and complimentary money streams with sights on topping 2019 levels. United Airlines really continued to anticipate a huge EPS of $ 10 to $12 for 2023, yet the stock just trades at $56 following a significant breakout today.

The airline company, together with the sector, reported a little loss throughout Q1 entirely shaking off the stock exchange. In some way the losses in the seasonally weak quarter tossed financiers off track in spite of the consistent big annual EPS target of $10+.

At the time of the Q1 ’23 earrings report, United Airlines targeted a $3.50 to $4.00 EPS for Q2 ’23 alone. The marketplace at first overlooked this number, however Delta Air Lines ( DAL) hammered house the capacity for a record Q2 EPS at their Financier Day on June 27.

The marketplace was really favorable on the airline company stocks heading into the Delta conference, however the assistance appears to have actually lastly modified the state of mind on the stocks. Regardless of all the current gains, a significant disconnection stays on appraisals.

Jefferies expert Sheila Kahyaoglu went on CNBC after raising her rate target on Delta to $50 from $45. The expert made the following difficult declaration:

If you value Delta on its 2025 complimentary capital target, it’s trading at a 13% complimentary capital yield. The marketplace is at 5.5. We might see upside of approximately $100 on Delta shares, if they strike their targets.

Regardless of an extremely bullish declaration concerning the advantage on Delta based upon confessed conservative 2025 complimentary capital targets of $4+ billion, Ms. Kahyaoglu has a cost target simply above the existing stock rate. In reality, the Jefferies rate target on the stock would usually just necessitate a Hang on the stock the expert recommends might more than double to reach $100.

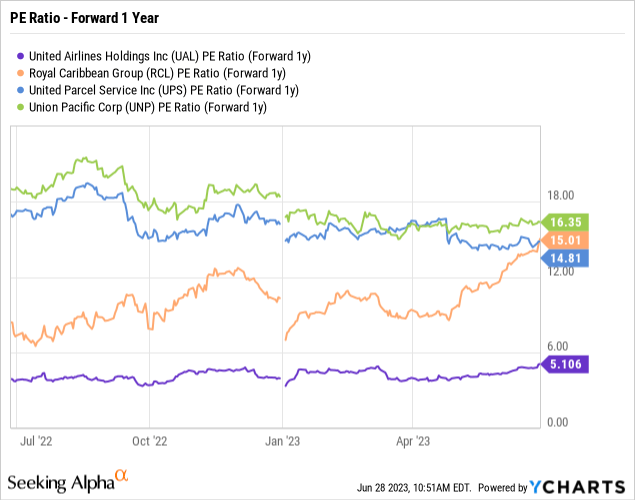

Industrial Transport Comps

The commercial transport market is a varied group from airline companies to railways to cruise lines to package shipment services. The sector presently has a typical style of associated stocks trading around 15x forward profits quotes beyond the airline companies.

The incredible part is that Covid had actually differed influence on the sector. The cruise lines were closed down up until 2022 and are just now striking complete capability in early 2023 while plan shipment companies saw a huge increase in need resulting in a present downturn.

The airline companies began reporting huge earnings in 2015, yet a cruise line like Royal Caribbean Group ( RCL) has actually currently doubled this year prior to reporting anticipated big earnings. In addition, United Parcel Service ( UPS) and Union Pacific ( UNP) have actually all gone back to a 15x P/E several.

United Airlines might double to $112 and the stock would just strike a 10x froward P/E several. The airline company stock would still trade at a huge discount rate to the other commercial transportation stocks.

In addition, this forward P/E target is based upon United Airlines making an $11 EPS in 2024. The airline company has actually currently directed to striking this level in 2023, recommending the business might reach a $13 EPS in 2024 and the stock would need to strike $130 to reach a 10x forward P/E several.

United Airlines ended last quarter with a net financial obligation overall of just $13.5 billion due to creating favorable money streams from rising advance ticket sales up almost 50% YoY to $10.2 billion, while the cruise line stocks have actually rallied in spite of comparable or bigger financial obligation concerns. Naturally, dangers exist, however the other commercial transport stocks deal with a great deal of the exact same dangers without the stocks being kept back.

Takeaway

The crucial financier takeaway is that United Airlines stock stays a remarkably inexpensive stock. The airline company sector absolutely isn’t without threat, however the stock ought to be purchased on this breakout due to the strong risk/reward circumstance where United might still double from there.