In these times, double down– on your abilities, on your understanding, on you. Join us August 8-10 at Inman Link Las Vegas to lean into the shift and gain from the very best. Get your ticket now for the very best rate

Property buyer need for purchase loans got recently to the greatest level considering that Might even as rates on jumbo home loans rose, according to a weekly study of lending institutions by the Home loan Bankers Association (MBA).

The MBA’s Weekly Home loan Applications Study reveals applications for purchase home loans were up by a seasonally changed 3 percent recently when compared to the week prior to however down 21 percent from a year earlier. Demands to re-finance were likewise up 3 percent week over week however down 32 percent from a year earlier.

Joel Kan

” New house sales have actually been driving purchase activity in current months as purchasers search for alternatives beyond the existing-home market,” MBA Deputy Chief Economic expert Joel Kan stated in a declaration “Existing-home sales continued to be kept back by an absence of for-sale stock as numerous possible sellers are hanging on to their lower-rate home loans.”

In a projection launched Monday, financial experts at Fannie Mae forecasted Fed tightening up is most likely to cause a “modest economic crisis” in the last 3 months of 2023, which sales of existing houses will fall by 16.2 percent this year to 4.213 million. However Fannie Mae forecasters see new-home sales growing by 1 percent to 647,000, as stock lacks stimulate house rates and need for brand-new houses.

According to home loan rate lock information tracked by the Optimum Blue Home Mortgage Market Indices, rates on 30-year fixed-rate adhering home loans have actually been holding consistent in June with Tuesday’s average of 6.69 percent below a 2023 high of 6.85 percent seen on Might 26.

However rates on jumbo home loans too huge for purchase by Fannie Mae and Freddie Mac were at 6.99 percent Tuesday, a “spread” of 30 basis points over adhering loans.

For the week ending June 23, the MBA reported typical rates for the list below kinds of loans:

- For 30-year fixed-rate adhering home loans (loan balances of $726,200 or less), rates balanced 6.75 percent, up from 6.73 percent the week in the past. With points staying at 0.64 (consisting of the origination cost) for 80 percent loan-to-value ratio (LTV) loans, the reliable rate likewise increased.

- Rates for 30-year fixed-rate jumbo home loans (loan balances higher than $726,200) balanced 6.91 percent, up from 6.80 percent the week in the past. With points increasing to 0.69 from 0.49 (consisting of the origination cost) for 80 percent LTV loans, the reliable rate likewise increased.

- For 30-year fixed-rate FHA home loans, rates balanced 6.63 percent, below 6.74 percent the week in the past. Although points increased to 1.08 from 1.03 (consisting of the origination cost) for 80 percent LTV loans, the reliable rate likewise reduced.

- Rates for 15-year fixed-rate home loans balanced 6.23 percent, below 6.26 percent the week in the past. With points reducing to 0.69 from 0.71 (consisting of the origination cost) for 80 percent LTV loans, the reliable rate likewise reduced.

- For 5/1 variable-rate mortgages, rates balanced 6.28 percent, up from 6.09 percent the week in the past. Although points reduced to 1.02 from 1.40 (consisting of the origination cost) for 80 percent LTV loans, the reliable rate likewise increased.

The typical spread in between jumbo and adhering rates expanded to 16 basis points recently, the 3rd week in a row that the jumbo rate was greater than the adhering rate, Kan kept in mind.

” To put this into viewpoint, from Might 2022 to Might 2023, the jumbo rate balanced around 30 basis points less than the adhering rate,” Kan stated.

Fannie Mae financial experts alerted in March that worries on local banks stimulated by the failures of Silicon Valley Bank, Signature Bank and Very First Republic Bank might make jumbo loans surpassing Fannie and Freddie’s $ 727,200 adhering loan limitation more difficult to come by.

While adhering loans are mainly funded by securitizing them into mortgage-backed securities (MBS) and offering them to financiers, jumbo home loans are moneyed nearly totally by banks, and some local banks are more focused in jumbo home loan financing than others, Fannie Mae forecasters alerted

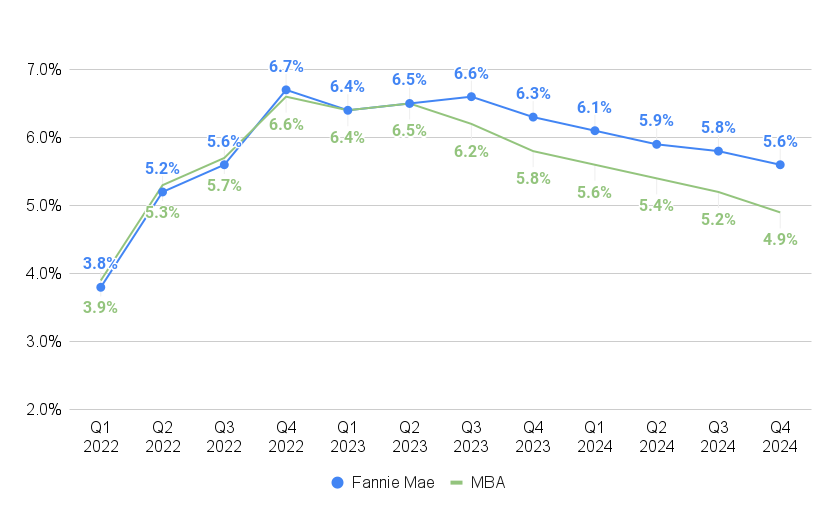

Home loan rates anticipated to reduce

Source: Fannie Mae and the Home Mortgage Bankers Association projections

Federal Reserve policymakers anticipate 2 more rate boosts this year, and after that most anticipate to see the benchmark federal funds rate boiling down next year.

Financial Experts at Fannie Mae and the MBA anticipate home loan rates will reduce this year and next. In a June 20 projection, MBA financial experts forecasted rates on 30-year fixed-rate home loans will drop to approximately 5.8 percent throughout the last 3 months of this year. In their most current projection, Fannie Mae financial experts do not see that occurring up until the 3rd quarter of 2024.

Get Inman’s Home Mortgage Short Newsletter provided right to your inbox. A weekly roundup of all the greatest news on the planet of home loans and closings provided every Wednesday. Click on this link to subscribe.