sankai

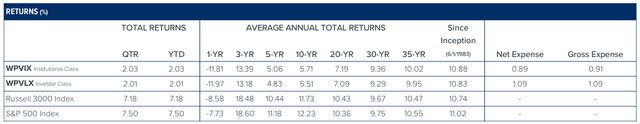

The Partners Worth Fund’s Institutional Class returned +2.03% for the very first quarter compared to +7.18% for the Russell 3000. For the ended March 31, 2023, the Fund’s Institutional Class returned -11.81% compared to -8.58% for the Russell 3000.

The very first quarter was typically a great one for stocks and other threat properties, though conditions were far from placid. The March failures of Silicon Valley Bank and Signature Bank ( OTCPK: SBNY) triggered a wave of issue throughout monetary markets. While quick action by the Federal Reserve, Federal Deposit Insurance Coverage Corporation (FDIC), and Treasury Department guaranteed that depositors of those organizations would not lose cash, self-confidence was shaken in all however the biggest banks.

At a minimum, the Fed’s inflation-fighting formula simply ended up being more made complex– as banks fix their balance sheets, monetary conditions will even more tighten up. Afraid of economic downturn and chastened by 2022’s market decreases, Wall Street has actually ended up being much more determined that the Fed needs to stop briefly rate walkings now and transfer to cut rate of interest later on this year. This commonly held agreement view is directly at chances with the Fed’s mentioned intents, establishing a face-off that will keep things fascinating for the foreseeable future. In our view, the case for owning long lasting, durable, and versatile services has actually never ever been more powerful.

Meta Platforms ( META), Alphabet ( GOOG, GOOGL), and Heico ( HEI) were the Fund’s biggest quarterly factors. Meta was the standout as the business’s “Year of Effectiveness” (an effort to restructure and enhance monetary efficiency) drove a remarkable stock rate rebound from depressed levels. Meta continued to adjust to Apple’s ( AAPL) iOS modifications that had impaired its advertisement targeting abilities. We are motivated by the mix of strong engagement patterns, boosted tools for marketers, and sensible expenditure management. First Republic Bank ( OTCPK: FRCB), Liberty SiriusXM ( LSXMK), Charles Schwab ( SCHW), and CoStar Group ( CSGP) were the Fund’s biggest quarterly critics. Monetary stocks were especially affected as banking issues flared.

LKQ, CoStar Group, Axalta Covering Systems ( AXTA), and IDEX were the Fund’s biggest factors for the . The Fund’s commercial stocks held up far better than the more comprehensive market as the economy stayed durable in spite of installing pressures. First Republic Bank, Liberty SiriusXM, Alphabet, and Liberty Broadband ( LBRDK) were the Fund’s most considerable critics for the .

Essential capital expense cycles at Liberty Sirius XM (brand-new satellites and streaming innovation) and Liberty Broadband (fiber competitive speed upgrades and network growths at Charter Communications) dissatisfied financiers trying to find fast wins. The costs will no doubt crowd out some share repurchases in the brief run. Still, we believe these financial investments are sensible and need to reinforce business’ competitive positions with appropriate returns, and we stay positive in the long-lasting capacity of both stocks.

We offered the Fund’s First Republic position at a considerable loss. Our group appropriately had concerns about a few of First Republic’s current balance sheet options, however we likewise believed the business’s relationship banking design would assist shelter its traditionally sticky deposit base. We merely were not creative sufficient about the possibility of a bank run, stimulated and sustained by serious issues at a various bank. As self-confidence deteriorated and deposits ran away, the business rapidly lost control of its fate. We offered the stock in the high $30s, which was suboptimal however kept a bad result from ending up being even worse.

We likewise left the Fund’s Charles Schwab position, for various factors. Our issues were mostly connected to the depth and length of a prospective profits valley. As the Fed rose short-term rate of interest, cash market funds and Treasury costs offered savers with clear options to banks’ ultra-low yielding deposits. Schwab’s near-term expense of financing promised to increase materially, one method or the other. Some profits disintegration is shown in the stock rate, however we offered as our view of the risk/reward structure moved significantly. Unlike First Republic, Schwab was an extraordinary factor to Fund returns over the previous 3 years.

With the reorganization of the Hickory Fund into Partners Worth in late March, we invited numerous brand-new business– and investors– to the Fund. New portfolio holdings consisted of ACI Worldwide ( ACIW, payments software application), Dolby Laboratories ( DLB, audio signal processing), Ingersoll-Rand ( IR, circulation control devices), LICT Corporation ( OTCPK: LICT, rural telecom), Live Country ( LYV, performances & & ticketing), and Boundary Solutions ( PRM, fire retardants). This varied collection of services includes breadth to the portfolio, increases the Fund’s direct exposure to mid-cap stocks, and provides distinguished return capacity.

After a frustrating where much of the financial discomfort was front-loaded, we are positive about the potential customers for the next numerous years. We see outsized return capacity from a handful of beaten-down stocks like Liberty SiriusXM, CarMax, and Liberty Broadband, in addition to some other business whose appraisals have reset to reduced levels, particularly in the mid-cap location. We believe the Fund’s business will continue to adjust and discover methods to grow organization worth over the 2023 to 2025 timeframe. In time, our company believe worth development will eventually exceed any short-term trading sound for client financiers. Our company believe that buying services of all sizes, utilizing our Quality at a Discount rate structure, is a sustaining benefit of a multi-cap technique. Assessment stays our North Star, and we believe our stocks are priced at healthy discount rates to organization worth. Our present quote is that the portfolio trades at a price-to-value in the mid 70s– a level that recommends sufficient long-lasting return capacity from both our mid- and large-cap holdings.

Leading Relative Factors and Critics

|

LEADING FACTORS (%) |

||||

|

Return |

Typical Weight |

Contribution |

% of Net Possessions |

|

|

Meta Platforms, Inc. |

76.12 |

3.62 |

1.95 |

3.4 |

|

Alphabet, Inc. |

17.21 |

6.75 |

1.19 |

5.5 |

|

Guidewire Software Application, Inc. |

30.55 |

2.53 |

0.71 |

3.3 |

|

HEICO Corp. |

14.23 |

4.11 |

0.49 |

4.7 |

|

Texas Instruments, Inc. |

13.37 |

3.80 |

0.46 |

3.0 |

|

LEADING CRITICS (%) |

||||

|

Return |

Typical Weight |

Contribution |

% of Net Possessions |

|

|

FIRST REPUBLIC BANK ORD |

-69.08 |

1.96 |

-1.77 |

0.0 |

|

Liberty Media Corp-Liberty SiriusXM |

-28.49 |

4.50 |

-1.43 |

4.1 |

|

CHARLES SCHWAB ORD |

-30.54 |

2.66 |

-1.03 |

0.0 |

|

CoStar Group, Inc. |

-10.45 |

5.20 |

-0.55 |

5.3 |

|

Black Knight, Inc. |

-6.79 |

2.48 |

-0.19 |

2.5 |

| Information is for the quarter ending 3/31/2023. Holdings undergo alter and might not be representative of the Fund’s present or future financial investments. Contributions to efficiency are based upon real everyday holdings. Returns revealed are the real returns for the given duration of the security. Extra securities referenced herein as a percent of the Fund’s net properties since 3/31/2023: ACI Worldwide, Inc., 1.0%; Apple, Inc., 0.0%; Axalta Covering Systems Ltd., 1.0%; CarMax, Inc., 3.2%; Charter Communications, Inc., 0.0%; CoStar Group, Inc., 5.3%; Dolby Laboratories, Inc., 1.3%; IDEX Corp., 2.3%; Ingersoll Rand, Inc., 0.9%; Liberty Broadband Corp., 4.7%; LICT Corp., 1.6%; Live Country Home Entertainment, Inc., 0.8%; LKQ Corp., 4.4%; Boundary Solutions SA, 0.9%; SVB Financial Group, 0.0%; Signature Bank, 0.0%. |

The viewpoints revealed are those of Weitz Financial Investment Management and are not suggested as financial investment suggestions or to anticipate or forecast the future efficiency of any financial investment item. The viewpoints are present through 04/20/2023, undergo alter at any time based upon market and other present conditions, and no projections can be ensured. This commentary is being offered as a basic source of details and is not planned as a suggestion to acquire, offer, or hold any particular security or to take part in any financial investment technique. Financial investment choices need to constantly be made based upon a financier’s particular goals, monetary requirements, threat tolerance and time horizon.

Information priced quote is previous efficiency and present efficiency might be lower or greater. Previous efficiency is no warranty of future outcomes. Financial investment return and primary worth of a financial investment will vary, and shares, when redeemed, might deserve basically than their initial expense. Please see weitzinvestments.com for the most current month-end efficiency.

Financial investment results show relevant costs and costs and presume all circulations are reinvested however do not show the reduction of taxes a financier would pay on circulations or share redemptions. Internet and Gross Expenditure Ratios are since the Fund’s newest prospectus. Particular Funds have actually participated in cost waiver and/or expenditure repayment plans with the Financial investment Consultant. In these cases, the Consultant has actually contractually accepted waive a part of the Consultant’s cost and repay specific costs (leaving out taxes, interest, brokerage expenses, obtained fund costs and costs and remarkable costs) to restrict the overall yearly fund operating costs of the Class’s typical everyday net properties through 07/31/2023.

The Gross Expenditure Ratio shows the overall yearly operating costs of the fund prior to any cost waivers or compensations. The Net Expenditure Ratio shows the overall yearly operating costs of the Fund after taking into consideration any such cost waiver and/or expenditure repayment. The net expenditure ratio represents what financiers are eventually credited be purchased a shared fund. On 12/31/1993, Partners Worth Fund prospered to considerably all of the properties of Weitz Partners II Limited Collaboration. The financial investment goals, policies and limitations of the Fund is materially comparable to those of the Collaboration, and the Collaboration was handled at all times with complete financial investment authority by the Financial investment Advisor. The efficiency details consists of efficiency for the Collaboration. The Collaboration was not signed up under the Investment firm Act of 1940 and, for that reason, were exempt to specific financial investment or other limitations or requirements enforced by the 1940 Act or the Internal Profits Code. If the Collaboration had actually been signed up under the 1940 Act, the Collaboration’s efficiency may have been negatively impacted.

Efficiency priced quote for Institutional Class shares prior to their beginning is stemmed from the historic efficiency of the Financier Class shares and has actually not been changed for the costs of the Institutional Class shares, had they, returns would have been various.

Index efficiency is theoretical and is revealed for illustrative functions just. You can not invest straight in an index. The Russell 3000 procedures the efficiency of the biggest 3,000 U.S.

business representing around 98% of the investable U.S. equity market. The S&P 500 is an unmanaged index including 500 business typically agent of the marketplace for the stocks of large-size U.S. business.

Think about these threats prior to investing: All financial investments include threats, consisting of possible loss of principal. These threats consist of market threats, such as political, regulative, financial, social and health threats (consisting of the threats provided by the spread of contagious illness). In addition, since the Fund might have a more focused portfolio than specific other shared funds, the efficiency of each keeping in the Fund has a higher effect upon the total portfolio, which increases threat. See the Fund’s prospectus for an additional conversation of threats connected to the Fund. Financiers need to think about thoroughly the financial investment goals, threats, and charges and costs of a fund prior to investing. This and other crucial details is consisted of in the prospectus and summary prospectus, which might be gotten at weitzinvestments.com or from a monetary consultant. Please check out the prospectus thoroughly prior to investing. Weitz Securities, Inc. is the supplier of the Weitz Funds.

Editor’s Note: The summary bullets for this short article were picked by Looking for Alpha editors.