In these times, double down– on your abilities, on your understanding, on you. Join us Aug. 8-10 at Inman Link Las Vegas to lean into the shift and gain from the very best. Get your ticket now for the very best cost

Home loan rates might be headed to brand-new 2023 highs as great news about the economy– a fall in unemployed claims, an upward modification to second-quarter GDP and the Federal Reserve providing passing grades on bank tension tests– increases the chances of future Federal Reserve rate walkings.

Yields on 10-year Treasury notes, which are typically an excellent indication of where home loan rates are headed next, spiked Thursday to the greatest level considering that March as financiers responded to the altering photo on inflation.

10-year Treasury yield surges Thursday

Thursday’s high yield on the 10-year note of 3.87 percent lacked the 2023 high of 4.09 percent seen on March 2. However 10-year yields are majority a portion point greater than the low for the year of 3.25 percent signed up on April 6, when there was less certainty about future Fed rate walkings.

In their efforts to fight inflation, Federal Reserve policymakers have actually been concentrated on a tight task market that’s put upward pressure on earnings. Thursday’s report from the Department of Labor revealing joblessness claims published the greatest drop in 20 months recently captured numerous experts by surprise and might be worrying to Fed policymakers if the pattern holds.

The Department of Labor stated unemployed claims throughout the week ending June 24 dipped by 26,000 to a seasonally changed 239,000. Economic Experts surveyed by Reuters had actually anticipated there would be 265,000 joblessness claims.

The four-week moving average for unemployed claims stays at 257,500– the greatest considering that the week ending November 13 2021– and the numbers for private weeks constantly “need to be seen with hesitation, specifically when they move versus the recognized pattern in claims and other information,” experts with Contingent Macro Research study stated in a note to customers.

On June 2, the Labor Department reported that companies included 339,000 tasks in Might. While the joblessness rate increased by 0.3 portion indicate 3.7 percent, payroll development went beyond numerous economic experts’ expectations and significant 29 successive months of favorable task development.

Contributing to the case that Fed policymakers will still be stressed over inflation at their July 26 conference was another unexpected report Thursday from the Commerce Department, which revealed the U.S. economy grew at a 2 percent yearly speed throughout the very first quarter of the year.

Genuine GDP development surprises to the advantage

While financial development as determined by genuine gdp (GDP) is decreasing, first-quarter development went beyond a previous price quote of 1.3 percent.

” Compared to the 4th quarter, the deceleration in genuine GDP in the very first quarter mainly showed a recession in personal stock financial investment and a downturn in nonresidential set financial investment,” the Commerce Department’s Bureau of Economic Analysis stated in an statement Those patterns were “partially balanced out by a velocity in customer costs, an upturn in exports, and a smaller sized reduction in property set financial investment. Imports showed up.”

While the Fed has actually been attempting to check customer costs by making it more pricey to obtain, customer costs increased at a 4.2 percent yearly rate in Q1, the most considering that the 2nd quarter of 2021.

Another piece of great news for the economy that might contribute to inflationary pressure, the Federal Reserve on Wednesday released the outcomes of its yearly tension tests of banks, which reveals the 23 banks based on screening might sustain an extreme economic downturn while continuing to provide.

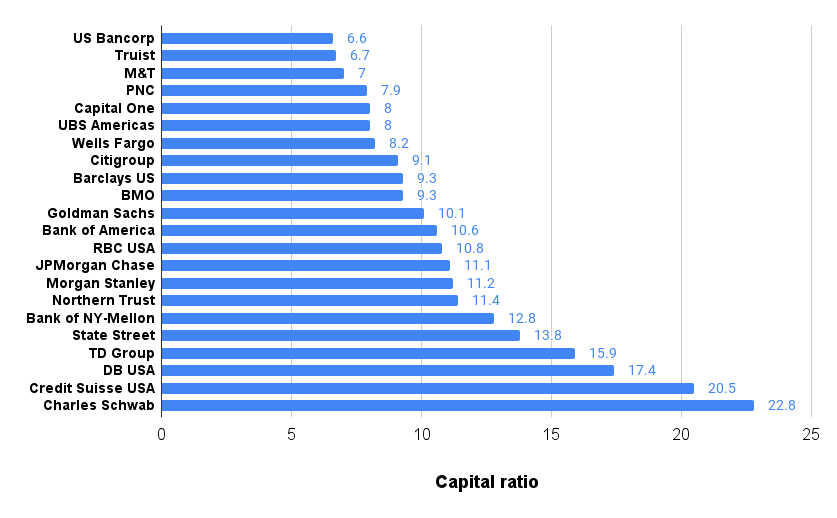

Huge bank capital ratios under ‘significantly unfavorable’ financial circumstance

Source: 2023 Federal Reserve Tension Test Outcomes

The 2023 tension test reveals that the 23 big banks based on the test “have enough capital to soak up more than $540 billion in losses and continue providing to homes and companies under difficult conditions,” regulators stated.

Under the significantly unfavorable circumstance, the aggregate typical equity tier 1 (CET1) capital ratio of the 23 banks would fall from a real 12.4 percent in the 4th quarter of 2022 to its minimum of 10.1 percent, prior to increasing to 10.7 percent at the end of the forecast.

The Fed wishes to see CET1 capital ratios remain above 4.5 even if the stock exchange were to crash by 45 percent and joblessness skyrocketed to 10 percent. All of the banks passed that test, with variation in between banks due to distinctions in their organization lines, portfolio structure and securities and loan threat attributes that drive modifications in the magnitude and timing of loss, income and cost forecasts, regulators stated.

” It’s not the 23 biggest banks that were checked that individuals are stressed over,” Annex Wealth Management Chief Financial Expert Brian Jacobsen informed Reuters “It’s the more than 4,000 smaller sized banks that individuals wonder about.”

Federal Reserve policymakers have actually stated tensions on local banks triggered by the failures of Silicon Valley Bank, Signature Bank and Very First Republic Bank might suppress financing and aid cool inflation. Fannie Mae economic experts alerted in March that jumbo loans going beyond Fannie and Freddie’s $ 727,200 adhering loan limitation might get difficult to come by, for instance.

For much of June, rates on jumbo loans have actually been greater than those for adhering home loans qualified for purchase by Fannie and Freddie, with the typical spread in between jumbo and adhering rates expanding to 16 basis points recently, according to the Home loan Bankers Association.

However the outcomes of the Federal Reserve’s newest bank tension test recommend that huge banks, a minimum of, aren’t dealing with capital restraints that would require them to draw back on providing to customers and companies.

July Fed rate trek now viewed as specific

Today’s great financial news has financiers purchasing stocks and offering bonds over concerns that Fed policymakers will continue treking rates to fight inflation. Contributing to the inflationary pressures are current strengths in house rates driven by stock lacks in numerous markets.

Treking rates to combat inflation

The Federal Free Market Committee has actually authorized 10 boosts in the federal funds rate considering that March 2022, bringing the short-term federal funds rate to a target of in between 5 percent and 5.25 percent. Federal Reserve policymakers anticipate 2 more 25-basis point rate boosts this year, prior to bringing the benchmark rate pull back next year.

The CME FedWatch Tool, which keeps an eye on futures markets to determine financier expectations about the Fed’s next relocations, puts the chances of another 25-basis point Fed rate trek in July at 87 percent. However futures markets anticipate just a 24 percent possibility of another rate trek in September.

In a projection launched Monday, economic experts at Fannie Mae anticipated that while the economy is carrying out much better than anticipated, Fed tightening up is most likely to cause a “modest economic downturn” in the last 3 months of 2023 and sales of existing houses will fall by 16.2 percent this year to 4.213 million.

Get Inman’s Home Mortgage Short Newsletter provided right to your inbox. A weekly roundup of all the greatest news worldwide of home loans and closings provided every Wednesday. Click on this link to subscribe.