Anatoly Morozov/iStock through Getty Images

Financial Investment Rundown

Universal Show Corporation ( NASDAQ: OLED) is a business at the leading edge of establishing and making sophisticated natural light-emitting diode innovations and products. These ingenious items are made use of in numerous customer electronic gadgets, varying from smart devices and tablets to tvs and lighting components. Universal’s exclusive phosphorescent PHOLED innovation provides a clear edge over traditional OLED innovation by offering brighter, longer-lasting, and more energy-efficient screens. As an outcome, Universal is well-positioned to continue to be a significant gamer in the OLED market and drive development in the market.

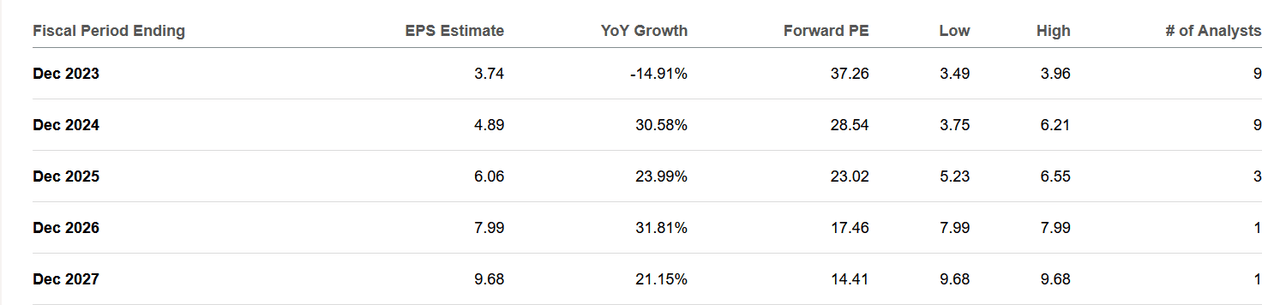

Revenues Quotes ( Looking For Alpha)

The business has like numerous other tech business seen a minor decrease in the profits to begin of 2023 compared to 2022. The management kept in mind macro unpredictabilities as a factor for the drop in income and maybe a softer market too. This hasn’t stopped the business from making both acquisitions and revealing dividends The balance sheet remains in great shape with properties greatly surpassing the liabilities, and margins are not too worn-out either with net margins around 33%. The quality of the business can’t be downplayed however that does not always make it a buy all the time. The forward profits several sits rather high at 37 today. It would not be up until 2026 that OLED would have an appraisal more in line with the market and be at a rate I feel comfy investing. This makes me rate it a hold in the meantime. A buy case might be made when the appraisal compresses into something more practical.

Development Chance

Taking a look at the capacity for the OLED market it is rather considerable. Universal has actually had the ability to participate in strong collaborations and supply show screens to a few of the biggest business on the planet. However I do fear there is the possibility of disturbance coming as Apple has revealed they will start making their own screens internal. Restricting the TAM greatly for a business like OLED.

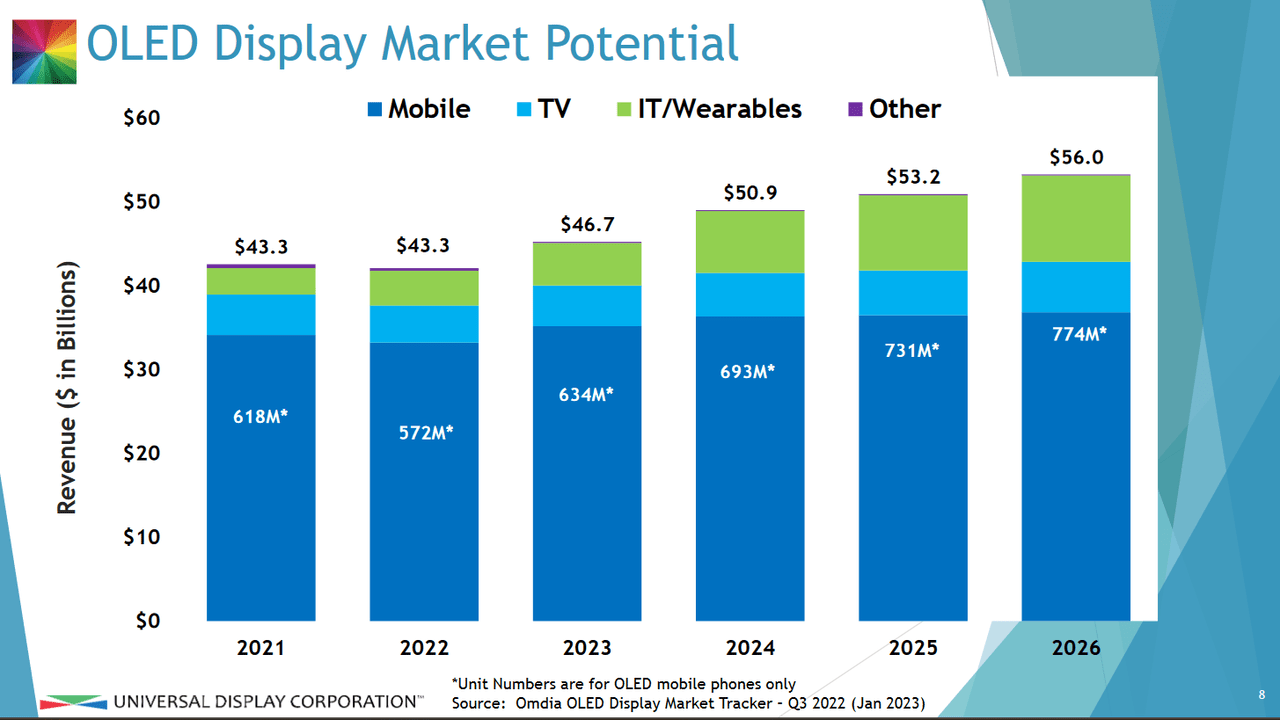

Market Possible ( Financier Discussion)

In Spite Of that though, OLED is anticipating its TAM to be around $56 billion in 2026. Where I am anxious is that sales of smart devices are decreasing in 2023. I believe these short-term discomforts will have some result on the order stockpile for OLED however it stays to see if this pattern is sticking or not. As discussed prior to however, the balance sheet of the business is extremely strong and I do not anticipate it to install any difficulties. Rather, the business has the chance to continue making acquisitions and set itself up for success when the tide turns and need resumes when again.

The Financial State

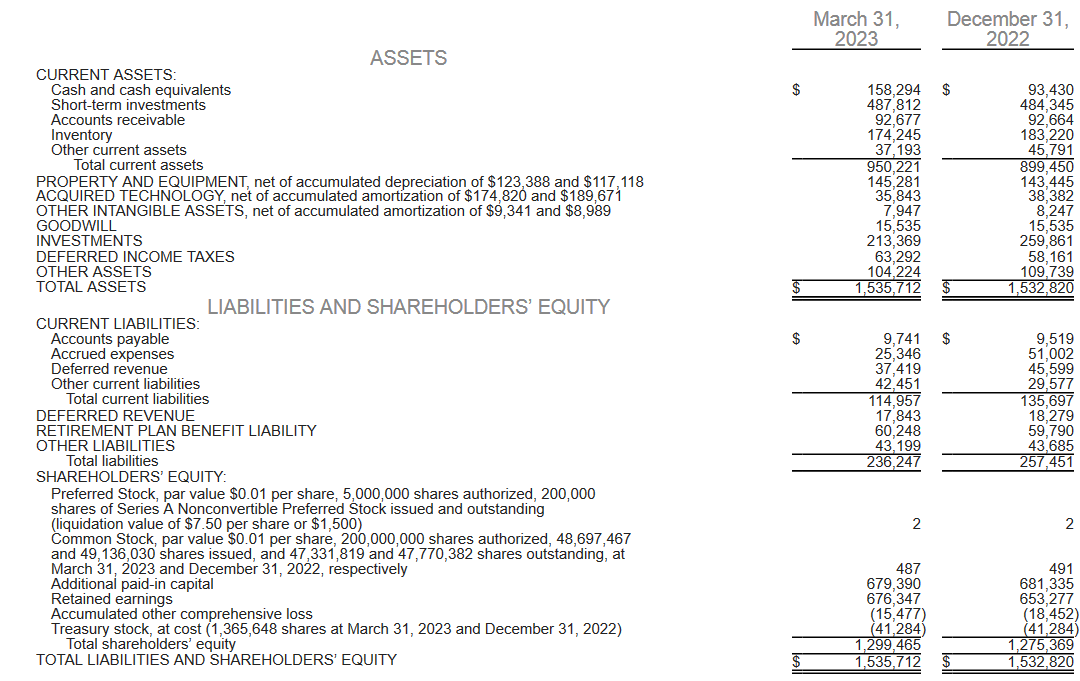

As discussed formerly was that OLED remains in a wonderful monetary position today where long-lasting financial obligation is nonexistent and the money position is extremely strong at $150 million. In my viewpoint, without any financial obligations, the money position size does not play an as crucial function to develop a cushion for when financial obligation maturities would occur. Rather taking a look at the money streams would be much better. The TTM levered FCF margin sits at 14% today which is rather excellent however believe there might be a disadvantage here in my viewpoint, as a downturn in the market is extremely possible. Current reports from business recommended that sales were decreasing which reduces the need for production and in turn the items that OLED makes.

Balance Sheet ( Revenues Report)

What OLED can do in the meantime is continue with its acquisitions and collaborations to set itself up as the leader in the market. The properties surpass the liabilities by 6.5 x which regrettably still does not indicate you are getting a lot at these rates. The p/b still sits at a high of 4.73.

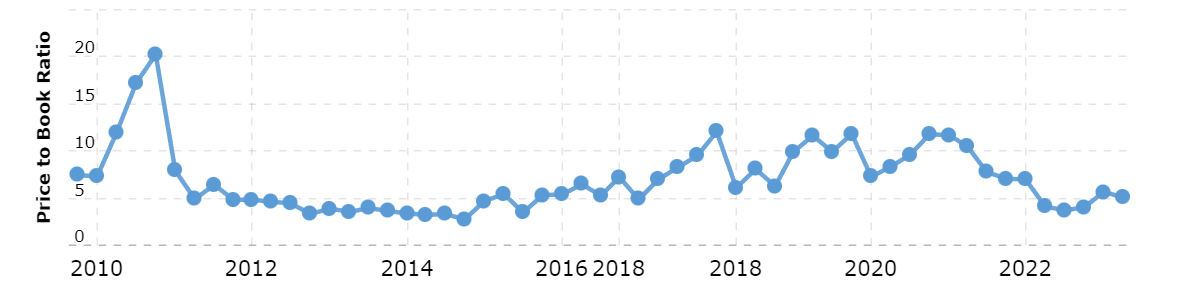

P/B Ratio ( Macrotrends)

Historically the business hasn’t always been trading at a low p/b several either. 3.3 appears to have actually been the most affordable back in 2014. The market does have a typically rather high p/b several with the forward one relaxing 3.56 today. I believe this shows even more why I am not comfy buying the business today. The appraisal does not shout an offer precisely. With 2023 anticipated to be rather hard for numerous business, I believe it’s much better to wait on the sideline to see the advancement of OLED.

Financial Investment Threats

I have actually stated at the start of the post that the sales of smart devices and tech that utilizes OLED screens appear to be reducing. This positions a danger that income and orders are going to reduce for Universal. This suggests the present appraisal may be even greater as we see the coming quarter work out. If sales continue to reduce like they carried out in Q1 of 2023, I do not see anything holding up the share cost. it’s trading a reasonable bit over the market and although development is anticipated to be strong up till 2026, and after that lessen to around 10% every year, the 37x profits multiple is rather high, and compression down to 19 is possible. That would put the share cost around $71 utilizing the approximated EPS of $3.74 for 2023. As a financier, I never ever wish to handle unneeded danger for my portfolio, and today I believe that is what OLED is using regrettably.

Last Words

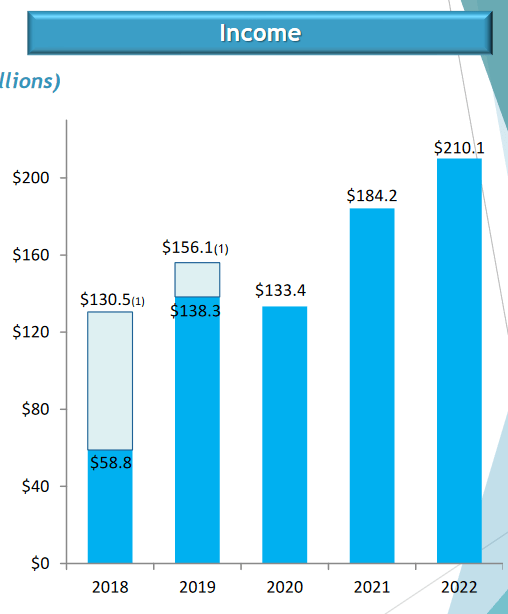

Universal Show Corporation has a huge $56 billion market to take in 2026 based on their own price quotes. The business has actually been growing tremendously over the last couple of years as they are participating in a growing number of crucial collaborations with business and signing long-lasting agreements to protect profits.

Earnings History ( Financier Discussion)

However as appraisal matters, paying 37x forward profits is rather high although the business has actually had great margins traditionally. I believe the disturbance that Apple is bring on by them making their own screens in-house will continue to other business too. This harms the long-lasting potential customers of OLED and makes the future unpredictable about the effect it will have on profits. Usually that would indicate a really low multiple would be used to the business, however the reverse holds true for OLED today. My view is that OLED is a hold in the meantime and maybe might end up being a buy when the business trades likewise to the sector and we have some profits outcomes come out to offer some insights about how the profits are impacted.