peterschreiber.media

Lovely, yet awful, inconsistent, however it’s amusing how,

things might look so stunning, however below all that glamour,

they’re awful. MacroT

The lyrics above show the existing circumstance in the labor market, in addition to the stock exchange. On the surface area, the labor market is really strong, however the leading indications such as the claims for work are, in what traditionally has actually been, a recessionary state. Likewise, the tech-heavy NASDAQ 100 ( QQQ) has the very best H1 efficiency ever, while the cyclically-heavy Dow Jones ( DJI) is basically flat for the year.

The context

The Fed has actually been tightening up financial policy because March 2022 – for 18 months now, and it has actually been among the most aggressive tightening up projects ever.

Throughout this procedure, the Fed inverted the yield curve 10Y-3mo yield curve spread out by the record quantity – and this indicates a really deep economic downturn. Presently we are awaiting the results of this financial policy tightening up, which include lags. This is among the secret anticipated financial policy tightening up transmission systems:

- The inverted yield curve triggers credit tightness, or restricts the external capital to companies.

- Therefore, companies, and especially risky/overleveraged companies, reduce their financial investment, and lower work.

- The resulting spike in joblessness triggers an economic crisis.

The work circumstance

Well, the current GDP report reveals that the genuine gross personal financial investment reduced by 3.1% in Q1 23 from Q4 22, and reduced by 8.1% YOY from Q1 22. That’s the result on financial policy tightening up on set financial investment – we are going into an economic crisis based upon this information.

The next shoe to drop is greater joblessness. On the surface area, the labor market is still really tight, however it’s anticipated to follow the unfavorable set financial investment information and considerably deteriorate. Nevertheless, these are the existing 2 heading labor market metrices:

- Joblessness rate: 3.4% in April, however surged to 3.7% in Might – anticipated to fall back to 3.6% in June. This actually shows a complete work circumstance.

- Payrolls: there were 339K non-farm brand-new tasks produced, based upon the Facility Study in Might, and this is anticipated to reduce to 225K in June. So, some small amounts is anticipated.

Bottom line to enjoy

- As formerly discussed, the joblessness rate increased from 3.4% to 3.7% in May, and the variety of used individuals reduced by 310K in May, which suggests that 310K tasks were lost.

- On the other hand, the Facility Study reveals that there were 339K tasks included Might. So, this is conflicting information.

- Therefore, it’s intriguing to see if there are modifications to both studies for June, and which trend the brand-new information verifies – task losses or task gains. Is the joblessness rate currently beginning to show the lagged results of financial policy tightening up?

The leading labor market indications

The leading labor market indications are recommending that the labor market is considerably damaging, which follows the start of an economic crisis. Keep in mind, the joblessness rate and the payrolls are both delayed indications, and both turn unfavorable as the economic downturn is well in progress.

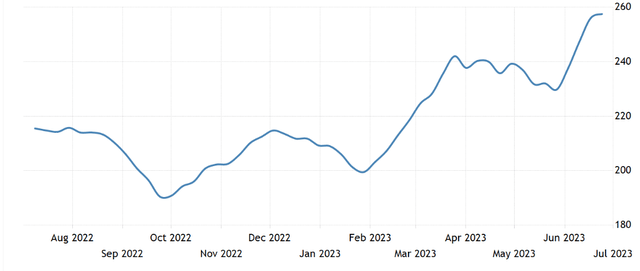

Here is the 4-week average of the preliminary claims for joblessness – the pattern has actually been slowly increasing because October 2022.

FRED

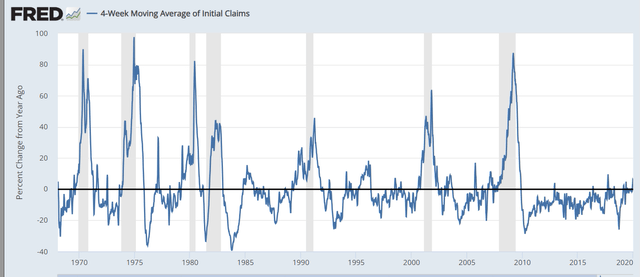

More notably, the number (for the claims) recently was 20% greater than the number in 2015. To put this in point of view, a 20% spike YOY in claims has traditionally just took place in economic crises. Here is the chart that increases to 2020, it does disappoint the existing duration due to the fact that the covid duration misshaped the photo.

FRED

The truth that the preliminary claims are surging 20% YOY is verifying the financial policy tightening up transmission system as explained above – the work information is damaging.

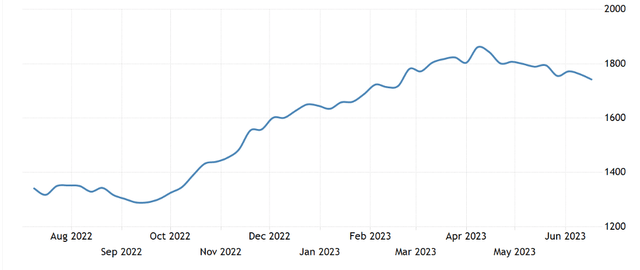

Let’s take a look at the continued out of work claims – the pattern has actually likewise been greater because October 2022. In truth, the existing number is 30% greater compared to the very same duration in 2015.

Trading Economics

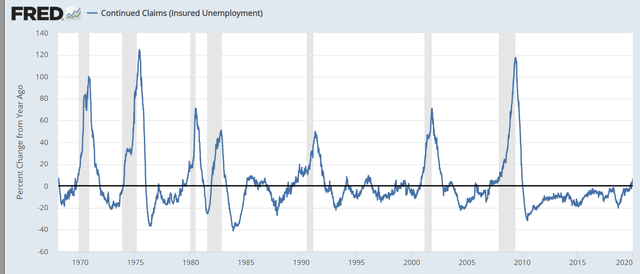

Here is the long-lasting chart that likewise goes to 2020 ( does disappoint the existing duration), which plainly shows that a 30% boost in the ongoing claims YOY is just related to economic crises.

FRED

Integrated, the claims information reveals that a lot more individuals have actually been losing their tasks, and it’s taking a lot longer to discover a brand-new task. This follows the start of an economic crisis.

The out of work claims information is launched on Thursday, and the expectation is that the preliminary claims will increase to 245K from 239K recently. However, recently there was a substantial drop from 262K to 239K, so it’s likewise essential to see if there are any modifications.

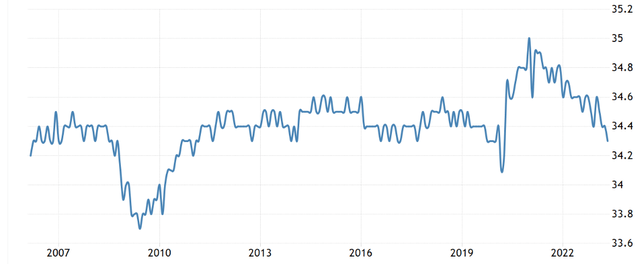

The weekly hours worked is another leading sign, as the chart listed below programs, the number has actually been falling from 35hr/week to presently 34.3 hr/week, which indicates a weakening labor market. The hypothesis is that business initially lower the variety of hours worked, prior to lowering the headcount. The expectation is that the variety of hours dealt with stay consistent at 34.3 in June.

Trading Economics

What about the labor lack?

In addition to a low joblessness rate, there are still about 10 million task openings, which shows a strong labor market, and likewise a major labor lack.

Nevertheless, the task opening likewise reduced by about 20% because in 2015, and this is likewise a sign of a weakening labor market.

At the very same time, about 40% of all task openings remain in the location of healthcare and education. These are not cyclical tasks, and they have actually not reduced much because the peak. Due to demographics and social patterns, the lack of health employees and instructors will likely continue.

The cyclical tasks associated with production and building and construction are the ones reducing the most – and these follow the tightening up financial policy.

The JOTLs information will be launched in Thursday, and it’s anticipated to reveal a modest decrease in June to 9.9 mil.

The significant ramification of the task lack is increasing incomes, which keeps the labor-intensive core inflation sticky and increases the threat of the wage-price inflationary spiral. The typical wage per hour incomes are anticipated to dip to 4.2% in June from 4.3% in Might, which is still well above the 3.5% wage development constant with the 2% target inflation.

Therefore, the Fed is still anticipated to continue tightening up financial policy, treking a minimum of an extra 50bpt in 2023, and perhaps more, regardless of the truth that the economy is currently going into an economic crisis. Not just are we awaiting the lagged results of the previous financial policy tightening up, however we require to think about the results of future financial policy tightening up. This suggests that the existing early phases of an economic crisis will likely extend and intensify in 2024.

Financial investment ramifications

Much like the labor market, the stock exchange has actually been on the surface area really strong in 2023, with S&P 500 ( SP500) up by over 16% ytd. Nevertheless, under the surface area, the stock exchange is still in the bearish market that began in Jan 2022. Particularly, the Dow Jones Industrials is up just by 3% ytd.

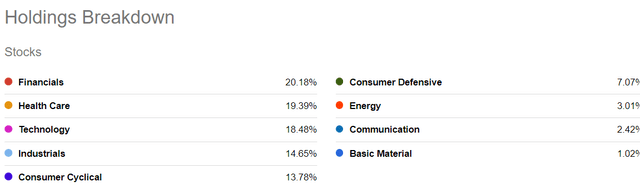

The ETF that tracks Dow Jones ( NYSEARCA: DIA) is greatly exposed to cyclical sector, about 55% of DIA is cyclical. Particularly, about 20% of index are Financials (conscious greater rates of interest, inverted yield curve and economic downturn), about 20% are Industrials, Products, and Energy (all conscious service financial investment), and about 14% are Customer Cyclical business (conscious labor market). Any gains in DIA in 2023 were likely due to about 19% direct exposure to Innovation.

Looking For Alpha

The significant bullish thesis is the catch up trade – indicating the weak parts of the marketplace, such as DIA will overtake the strong parts of the marketplace, which will extend the “brand-new booming market”.

This is really not likely to occur, considered that the leading indications are indicating a weakening labor market, and we are basically simply going into an economic crisis. On top of that, the Fed is still most likely to continue to tighten up financial policy. The catch down trade is most likely.

Wall Street Journal

With regard to DIA, the evaluation is high, provided the truth that we are awaiting the velocity of the recession as the lagged results of the financial policy tightening up start to get more powerful. The existing ttm PE ratio for DIA is practically 23, and it was 17 in 2015. So, the cyclical DIA index is likewise considerably miscalculated. For this factor, the existing strength in the market is the chance to go out.