This previous year has actually plainly been difficult on financiers– from clock-watchers to high-net-worth people– and the latter have actually revealed a significant modification in habits. Falling stock rates, increasing rates of interest, an unsure financial outlook and the consistent drumbeat of economic crisis have actually led high-net-worth people (HNWIs) to alter their investing routines: they’re keeping their cash in money and money equivalents at the greatest rate in more than a years.

The increase in rates of interest over the previous 12-18 months was the fastest Federal Reserve tightening up on record, after a long decrease over a 30-year duration where the 10-year decrease from 15% in 1981 to under 1% in 2021, Paul Karger, co-founder and handling partner of TwinFocus, a wealth advisory company, informed MarketWatch.

” After rates hovering around no for so long, this lastly produced a chance for savers to make a yield on their money, where efficiently the banks are now taking on Uncle Sam for deposit,” he stated. “As it stands today, the 6-month T-bill is the greatest on the yield curve, paying about 5.45% while the 10-year is paying approximately 3.71%.”

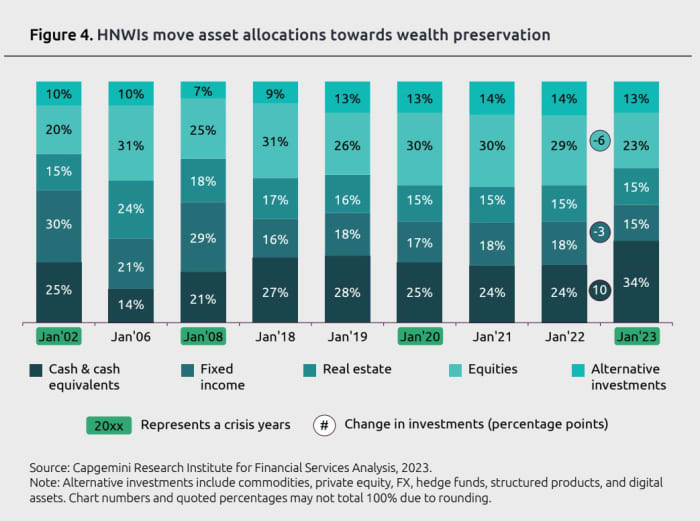

“ High-net-worth people kept 34% of their wealth in money and money equivalents in 2022, up 10 portion points on 2021.“

The Capgemini Research Study Institute, an international think tank, has more information on a fortunate group of financiers. It tracks the habits of HNWIs, and examines the possession allotment from the most conservative financier to the most aggressive. In its most current yearly report, the variety of the world’s HNWIs has actually been up to 21.7 million in 2022 from 22.5 million in 2021, mainly due to a fall in stock rates, the current report discovered. (Other sources have greater price quotes for the world’s HNWI population.)

Here’s a breakdown of the numbers: HNWIs kept 34% of their wealth in money and money equivalents in 2022, up 10 portion points from 24% throughout the previous year, according to Capgemini’s yearly wealth report, which was launched this month. It’s likewise 20 portion points lower than the 14% kept in money and money equivalents in 2006, a number of years prior to the Great Economic crisis. What’s more, money is anticipated to stay high– in addition to rates of interest.

” We have actually never ever seen this previously– banks are resting on lots of money, sitting idle, waiting on the best chance,” Elias Ghanem, international head of Capgemini Research study Institute for monetary services, informed MarketWatch. “The quantity of cash kept in money has actually never ever been so high, and the dive year-over-year has actually never ever been so high. They’re putting their cash into short-term money allotment, inspecting accounts, cost savings accounts, and CDs.”

High-net-worth people are keeping their cash in money and money equivalents at the greatest rate in more than a years.

MarketWatch illustration/iStockphoto.

Holding back on buying equities

Almost 70% of HNWIs mentioned “wealth conservation” as their No. 1 focus. “I have actually existed this report to banks around the world,” Ghanem stated. “All of them are validating what I have actually informed you.”

These routines seem shown by retail financiers who do not have countless dollars to invest (or burn). “A few of our customers are reluctant to invest money in this environment and, more frequently than I can keep in mind in the last couple of years, are requesting for T-bill and CD ladders while they wait,” Lorraine Ell, president and senior monetary advisor of Better Cash Choices, a monetary advisory company near Albuquerque, N.M.

” We do not advise waiting, however this is a time when customers are asking for to hold back buying equities, most likely an outcome of high rates of interest for holding money and money equivalents and unpredictability about rates of interest and economic crisis and their influence on markets,” she included. Circulations into exchange-traded funds this year have actually entered into protective equities and bonds– and not more aggressive equities, she included.

“ Streams into exchange-traded funds this year have actually entered into protective equities and bonds– and not more aggressive equities.“

Certainly, overall ETF streams up until now this year recommend “financiers’ decreased cravings for danger,” a June report by State Street Global Advisors concluded. ETFs took in $44 billion in Might, in line with the 5-year average of $44 billion, however listed below the 3-year average of $54 billion. “However just 47% of ETFs had inflows– 15 portion points listed below the historic mean,” it stated. “Equities were 17 portion points listed below their historic mean (44% versus 61%).”

Provided the financial background and the number of Americans are living income to income, there is one huge issue for those who wishes to stash their money: they do not have the money to start with. In reality, just 48% of U.S. grownups state they have enough emergency situation cost savings to cover a minimum of 3 months’ worth of expenditures, a current Bankrate study discovered That portion has actually stayed practically the same because it was 49% in 2022 and when inflation was at a 40-year high.

High-net-worth people kept 34% of their wealth in money and money equivalents in 2022, up 10 portion points from 24% throughout the previous year.

Source: Capgemini Research Study Institute.

Rich people, on the other hand, are particularly well-placed to make the most of high rates of interest. “High-net-worth people and household workplaces tend to hold higher money balances than the majority of for a couple of factors– mostly for running requirements of their lives and their organizations,” Karger stated. “They likewise tend to have much greater allotments towards alternative financial investments, which typically need money financing in time.”

And for those who do have cash to invest? The year left to an appealing start with a stock-market rally, however it just recently appeared to run out of steam. The S&P 500.

SPX,.

has actually rallied more than 14% up until now in 2023 and is up almost 15% over the last 12 months. The rally has actually been focused, nevertheless, in megacap tech stocks, leaving much of the marketplace behind. An equal-weight step of the S&P 500 is up simply 4.4% up until now this year and 8.8% over the last 12 months, according to FactSet.

” We do not believe the rally is over, however it might be challenging” for that earlier rally to continue in the weeks ahead “with liquidity coming out of the system,” Michael Arone, handling director of State Street Global Advisors, informed MarketWatch in a phone interview previously today. A lot for FOMO– “worry of losing out”– by those financiers resting on the sidelines.

Worldwide stocks reported their worst efficiency because the 2008 monetary crisis with almost $18 trillion eliminated in 2022, the Capgemini report stated. Just 23% of their investible wealth was kept in equities, down 6 portion points from 29% in 2021. Property seemed another fairly safe house with a 15% allotment, a portion that has actually not altered because 2020. Ditto alternative financial investments, which hovered at 13% to 14% for the last 4 years.

Searching for a happy medium

While reasonable, the transfer to money has actually been expensive to numerous this year. Cash market financiers have actually most likely made 2% -2.5% year-to-date, and have actually absolutely lost out on a 15% rally in equities, stated Tim Urbanowicz, head of research study and financial investment technique at Innovator ETFs. “This is among the factors we have actually been huge supporters for being danger conscious, and not run the risk of off,” he included.

Andrew Schuler, financial investment handling director at PNC Private Bank, concurs. “When money was yielding no, simply from a financial investment viewpoint, customers had little reward to hold money,” he stated. “Now, provided economic crisis worries and the considerable increase in rates, numerous customers are more comfy holding money yielding around 5% rather of taking threats in the markets.”

However he too stated that the cautionary technique features a drawback. “We do inform our customers that the danger you do not see is the loss of buying power,” he included. “When inflation is running 4% -5%, your genuine yield is close to recovering cost. This is not likely to accomplish the financial investment results the customers’ longer-term objectives and goals need.”

“‘ We do inform our customers that the danger you do not see is the loss of buying power.’“

” It does not need to be all-or-nothing choices,” Schuler stated. “Sure, you can hold a greater money reserve, however that does not imply you need to be all money or all invested– there is a happy medium utilizing greater yields to your benefit as part of your possession allotment. We constantly advise that customers preserve enough money to please present way of life requirements and other recognized expenditures.”

Capgemini, on the other hand, thinks about high-net-worth people anybody with investible possessions of $1 million and above, omitting their main house, and divides these HNWIs into a number of classifications: “millionaires next door” with $1 million to $5 million in investible possessions, mid-tier millionaires with $5 million to $30 million, ultra-HNWIs with $30 million or more. Their net worth was up to $83 trillion at the end of 2022 from $86 trillion in 2021, Capgemini’s report discovered.

Some areas were struck more difficult than others. “Hard macroeconomic conditions caused bearish international markets and considerable decreases in indices throughout areas. Doing the same, internationally, high-net-worth wealth and population overalls visited 3.6% and 3.3%, respectively, as compared to the previous year,” the report included. “While still the wealth leader, The United States and Canada signed up 2022’s steepest decreases, with overall high-net-worth wealth falling by 7.4% and population by 6.9%.”

Lots of money financiers are taking a look at 5%- plus rates of interest “This is where individuals are today,” Ghanem stated. “High-net-worth people are taking a wait-and-see technique, all set to make the next financial investment when the best chance emerges.” However he stays positive about equities in the long term. “Everybody is stating, ‘Something favorable will occur, and I wish to have the ability to act quickly on it,'” he included. “They’re conserving their possessions to do the task.”