JHVEPhoto

Financiers in Eli Lilly and Business ( NYSE: LLY) have actually gained from its strong execution in its well-diversified portfolio and pipeline as the marketplace rewarded LLY for its capability to drive possibly considerable benefit.

Eager financiers must understand that Lilly is a leading huge pharma with a leading portfolio in dealing with diabetes, weight problems, Alzheimer’s illness, and autoimmune conditions.

The marketplace has actually rewarded the business’s prospective developments in its brand-new and development items, which boosted its efficiency in Q1. In addition, Lilly’s competitive benefit in its core diabetes items assists to support its broad financial moat, producing considerable barriers to entry for generics in trying to reproduce its scale.

The business’s capability to drive scale effectiveness through massive production procedures can not be additional overemphasized. Management upgraded in a current June conference that “ production and supply choices are tactical and made well in advance of item launches.”

As such, Lilly’s $1.7 B financial investment in its brand-new North Carolina center was prepared prior to the business had “complete information on tirzepatide and comprehending market need.”

Mounjaro (Tirzepatide) and Trulicity are very important development chauffeurs for Lilly. Mounjaro is “ presently in Stage 3 scientific trials for weight problems,” with the current favorable information highlighting the prospective to fight weight problems successfully.

In addition, Lilly worried that the “real information went beyond expectations.” As such, it supported more powerful adoption and underlying need for Tirzepatide, offering the incentive for health care financiers in a tough year up until now.

Appropriately, Healthcare Select Sector SPDR ETF ( XLV) has substantially underperformed the S&P 500 ( SPY) ( SPX) in 2023, with an overall return of -4.3% compared to SPY’s 15.6% uptick. As such, I evaluated the broad health care sector stays underestimated, as a number of leading stocks were damaged in the very first half of 2023.

Nevertheless, LLY bucked the sector’s pattern in 2023, providing a YTD overall return of 24.3%. Especially, LLY has actually substantially outshined XLV over the previous 5 to 10 years in overall return terms, showing the marketplace’s self-confidence in Lilly’s execution and portfolio capacity.

Wall Street experts are likewise positive about the business’s capability to drive topline development and running utilize over the next 3 to 4 years. Lilly is predicted to attain a 5Y profits CAGR of 15.5% from 2022-27. In addition, it’s anticipated to provide an adjusted operating earnings development of 24.3% over the exact same duration. I evaluated that these are incredible development metrics for a huge pharma gamer, with profits anticipated to reach $31.4 B in 2023.

Looking for Alpha Quant likewise ranked LLY’s development profile with a “B+” grade, recommending that LLY is priced for development. Supported by strong success (ranked “A+” by Quant), Lilly is well-positioned to take advantage of its portfolio and pipeline as it continues to make R&D a core focus of its costs profile.

Nevertheless, the important concern dealing with financiers is whether the existing levels are still sensible for them to include even more?

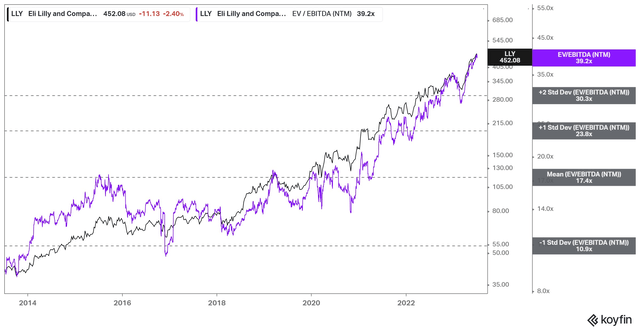

LLY forward EBITDA multiples pattern ( Koyfin)

As seen above, LLY last traded at a forward EBITDA multiple of more than 39x, well above its 10Y average of 17.4 x. Considering its possibly considerable operating earnings development, I obtained that the marketplace has actually most likely priced in a reasonably effective result of its existing portfolio and pipeline over the next 4 years.

Based Upon its FY27 forecasts, LLY is evaluated to trade at an FY27 EBITDA multiple of 17x. For that reason, the marketplace appears to have actually shown its development profile over the next 4 years, leaving little space for execution or market meaning difficulties.

In spite of its overvaluation, LLY’s cost action stays well-anchored in a long-lasting uptrend, without any strong sell signals. While I obtained that a pullback is significantly most likely to assist absorb a few of its current optimism, I have yet to see a factor for financiers to cut considerable direct exposure in LLY.

As such, financiers must think about holding through prospective near-term volatility and including on sharp pullbacks to enhance the risk/reward profile. In the meantime, remain on the sidelines.

Score: Hold.

Crucial note: Financiers are advised to do their own due diligence and not count on the info offered as monetary recommendations. The score is likewise not planned to time a particular entry/exit at the point of composing unless otherwise defined.

We Wished To Speak With You

Have extra commentary to enhance our thesis? Found a crucial space in our thesis? Saw something essential that we didn’t? Concur or disagree? Remark listed below and let us understand why, and assist everybody in the neighborhood to discover much better!