curraheeshutter/iStock through Getty Images

GEOS Is Event Steam

My previous post on Geospace Technologies Corporation ( NASDAQ: GEOS) discussed its company and techniques. In 2023, the business’s possession usage was enhanced following increased interest in its newest ocean bottom node innovation offerings. Just recently, it extended a rental agreement period for Mariner for a possible $20 million contract. As the cost-cutting steps executed in Q1 worked, its operating margin broadened extremely in Q2. The other appealing location for the business is keeping an eye on and analytics in carbon capture innovation.

Nevertheless, the business will likely stay careful and await a more motivating energy market environment prior to increasing its rental fleets. Money streams stay an issue, although its robust balance sheet will assist it prevent monetary dangers. The stock is fairly underestimated compared to its previous evaluation multiples. I believe financiers need to “hold” the stock till a more beneficial energy market circumstance progresses.

Offshore Activity Increase

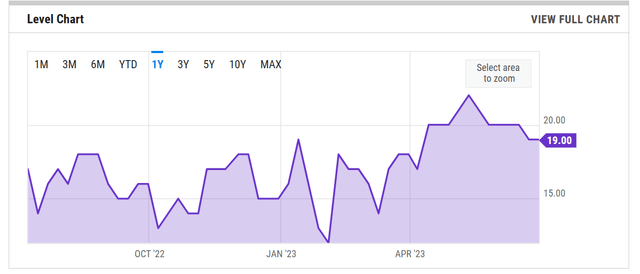

YCharts

The business’s oil & & gas company has actually just recently gained from greater usage of the OBX rental fleets and greater need for seismic sensing units following increased offshore energy activity. The United States overseas rigs increased by 27% over the previous 6 months, causing the enhanced usage of the fleets. The business’s newest ocean-bottom node innovation offerings can conjure up more interest in this sector. I anticipate improved market conditions to continue the foreseeable future, decreasing business efficiency volatility. A few of these jobs are anticipated to extend in 2024.

In June, the business extended a period rental agreement for Mariner, its shallow water seabed cordless seismic information acquisition node. The approximated worth of the contract is $20 million. Mariner permits professionals to fit ~ 25% more nodes into a download/charge container. In Q3 2023 and the rest of 2023, its rental fleets (oil and gas seismic devices) would run near complete usage with these agreements.

The Obstacles

Nevertheless, GEOS’s capex price quote for FY2023 has actually been lowered. In this context, financiers might keep in mind that earlier in the year, it had actually prepared to invest ~$ 6 million in capex on the rental fleet in FY2023. While it continues to include rigs, the business is now taking a look at the expense more minutely. Following the restricted schedule of the procurement of some elements, it has actually discovered methods to solve the concern through much better style.

Nevertheless, the business will likely stay careful and await a more motivating energy market environment (greater energy rates and need circumstances) prior to devoting to positioning brand-new properties and fleets. For an extensive understanding of its threat aspects, please read my previous post

Non-energy Service Drivers

The sale of water meter cable televisions, adapters, and commercial sensing unit items increased in its Adjacent Market sector. The domestic towns seek to continue to upgrade their wise meter facilities. These facilities updates can increase the variety of agreements for its Aquana wise water shut-off valves. In 1H 2023, GEOS sees headwinds in its emerging market sector. This can alter following the current DARPA (Defense Advanced Projects Research study Firm) agreement and some possibly concealed significant defense professionals in the future using its SADAR acoustic selections.

The other appealing location for the business is carbon capture innovation. It does not prepare to get associated with the core carbon recording procedure like capture, transportation, or other high-cost efforts however concentrates on keeping an eye on the sequestration to comprehend whether the strategies satisfy the expectations. It has actually constructed a system to keep track of at low expense with accuracy. It has actually established extremely exact tracking abilities utilizing the variety method and analytics.

Evaluating Q2 Chauffeurs

GEOS’s filings

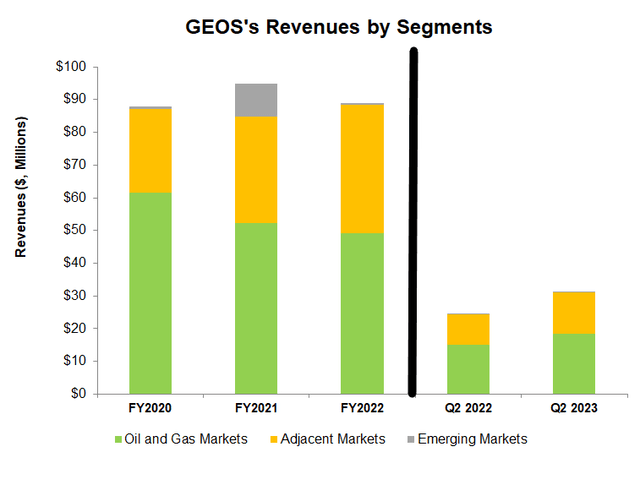

From Q2 2022 to Q2 2023, the business’s profits increased by 27%. Incomes from the Oil and Gas Markets sector saw a 22% increase since usage of its OBX leasing fleets, and need for the seismic sensing units increased. In the near term, the business anticipates the pattern to continue, which will minimize volatility in its company.

Incomes from the Adjacent Markets sector increased by 38% in the previous year till Q2 2023. A high increase in commercial item profits mainly represented the development. The business’s sales of water meter cable televisions, adapters, and commercial sensing unit items increased in Q2. While sales in the emerging market sector are not substantial, it has $2.1 million in stockpile here, which can add to considerable profits exposure in 2H 2023.

A Margin Conversation

Looking For Alpha

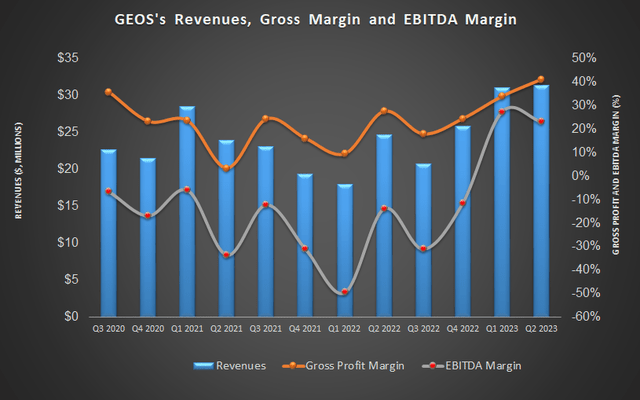

The business’s business expenses reduced by 7% in Q2 2023 (leaving out modifications in contingent earn-out liabilities). The business’s cost-cutting steps that started in Q1 caused the operating expense decline in Q2. From Q2 2022 to Q2 2023, the business’s gross margin broadened substantially (by 1360 basis points), while its EBITDA likewise turned favorable in Q2 2023 compared to unfavorable EBITDA a year back.

Money Streams And Liquidity

In 1H 2023, GEOS’s capital from operations and totally free capital enhanced however stayed in unfavorable area compared to the previous year. Greater profits primarily represented the small enhancement in capital. As its rig fleet stagnates, The business has actually modified its anticipated capex to $2 million in FY2023. GEOS has no financial obligation – an useful position over a few of its peers (FTI and SLB). Its liquidity was $28 million on March 31.

What Does The Relative Evaluation Imply?

GEOS’s present EV/EBITDA several (7.1 x) is much lower than its five-year average (13.7 x). So, it seems underestimated versus its past.

Why Do I Keep My Score Unchanged?

In my previous post, I recognized GEOS’s strategies associated to the combination of its OBX leasing operations and decreasing expenses. It was expected to take advantage of a just recently struck defense sector offer associated to sophisticated marine seismic acoustic innovation. Nevertheless, its financials were still struggling with the ongoing bottom lines over the previous a number of years. I composed:

The business likewise intends to diversify far from the common border security deal with Quantum’s Analytics Innovation applications. As an outcome of these favorable modifications, the business’s gross and running margins grew in Q1 2023. Nevertheless, financiers require to be worried about the operating dangers.

Over the previous 6 months because I last released, the overseas market has actually enhanced in the United States, which substantially enhanced possession usage. The sale of water meter cable televisions and associated items increased in its Adjacent Market sector. However its management has actually ended up being more careful over the oil and gas seismic devices fleet addition strategies and will likely keep it the same till the energy environment enhances. So, I keep its ranking the same at “hold” versus the previous call.

What’s The Handle GEOS?

Looking For Alpha

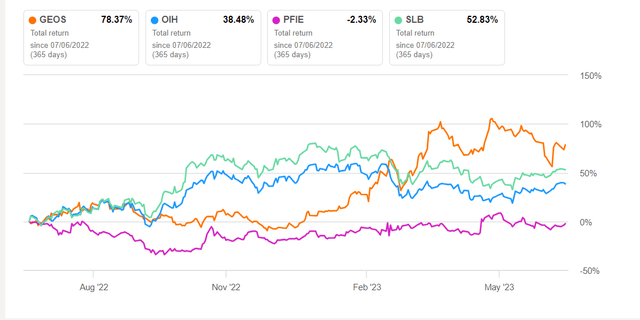

GEOS’s main motorist in FY2023 would be greater usage of the OBX rental fleets and greater need for seismic sensing units. Just recently, it has actually signed a prolonged rental agreement for Mariner, possibly including $20 million to its profits. In the Adjacent Market sector, need for its water meter cable television and adapter items will remain robust following domestic towns’ wise meter facilities upgrade procedure. Plus, there can possibly be a couple of concealed significant defense agreements in the future. So, the stock surpassed VanEck Vectors Oil Providers ETF ( OIH) in 2015.

Nevertheless, the business’s oil and gas seismic devices fleet size will likely stay the same in the near term. So, it downsized its capex prepare for FY2023. It likewise sees headwinds in its emerging market sector. Although capital revealed some enhancements in 1H 2023, they stayed unfavorable. Offered the relative evaluation, I recommend financiers “hold” it with an expectation of greater returns in the medium-to-long term.