Getty Images

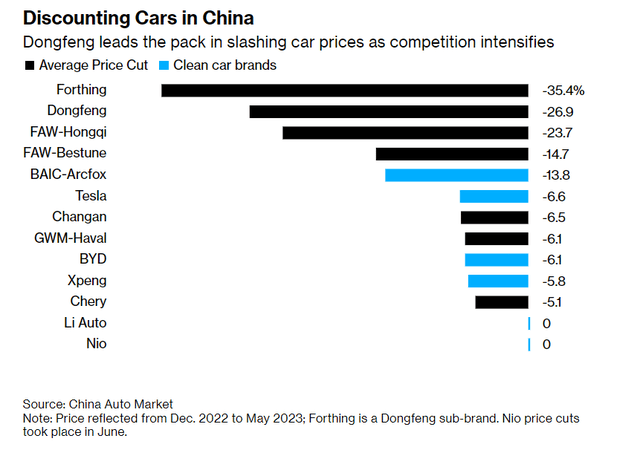

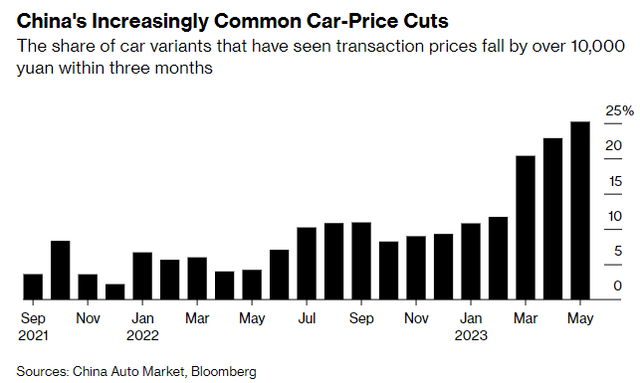

NIO Inc. ( NYSE: NIO) stock has actually restored some ground over the previous month, with remaining power in the $10 variety in spite of fairly weak 2nd quarter shipment numbers launched recently that recommended delayed development behind domestic competitors Li Automobile ( LI) and BYD Business ( OTCPK: BYDDF/ OTCPK: BYDDY). In our previous protection, we had actually gone over a couple of immediate-term headwinds dealing with NIO, counting a weakening post-COVID healing in China that runs the risk of tempering the need environment for its superior offerings, increasing competitors, an escalating cost war, stalling penetration in its target higher-tier cities, and barriers to entry in lower-tier cities (e.g., price; absence of public charging centers). While our direct observations recommend that NIO automobiles are no longer an unusual sighting on the roadways, with its brand name awareness being no less than both foreign and domestic leaders like Tesla ( TSLA) or BYD, the ongoing divergence of its relative development story in current quarters highlight price and EV variety stress and anxiety as essential headwinds to adoption still, which have actually been worsened by degrading financial conditions and repeating cost cuts throughout the car market in the area this year.

However the stock’s durability at present levels, which is proven by the steady uptrend in spite of modest 2nd quarter shipment numbers and the speedy healing after Thursday’s (July 6) high (-7.6%) intra-day decreases, is likely an outcome of market’s mindful optimism on early indications of reducing cost cuts and possible for more financial stimulus to buoy the Chinese EV market. Acknowledging the underlying threats to China’s rate of financial healing, both the main federal government and public companies at the local level have actually been particularly encouraging of the EV market with policy assistance covering tax breaks and other fiscal monetary rewards.

In the most recent advancement, the Ministry of Market and Infotech (” MIIT”) has actually likewise dealt with the China Association of Vehicle Manufacturers (” CAAM”) in a goal to apprehend the continuous EV cost war, motivating 16 car manufacturers to sign up with hands in a “ truce” Unlike a regulative overhaul, nevertheless, the joint contract does not impose positive controls on rates, however rather, communicates the federal government’s displeasure over the aggressive cost cuts that have actually resulted in instability in the EV market’s need environment.

While the contract is not likely to bring instant break to price-driven pressures on NIO’s efficiency in the near term, we believe the business still has some levers up its sleeves – consisting of the current launch of updated brand new trims for its flagship ES6 and ES8 SUVs – to match decreased costs and fortify shipment volumes in the meantime. However we anticipate NIO’s top- and bottom lines to be more pressured in the near term by cost decreases and unsure macroeconomic conditions, nevertheless, worsening ramp-up expenses of just recently presented designs. This might possibly press NIO’s timeline to GAAP earnings even more out into the future, and moisten belief on the stock, compromising the toughness to its newest gains.

NIO Shipment and Rates Update

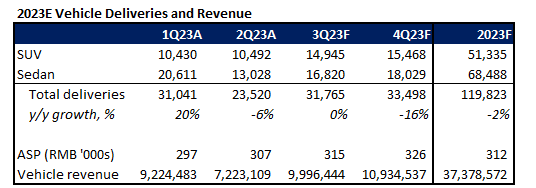

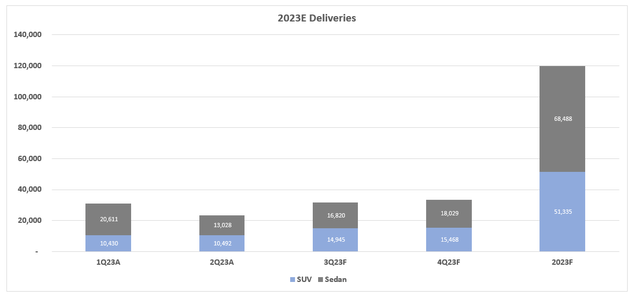

NIO ended up the 2nd quarter with shipments of 23,520 automobiles (-6% y/y; -24% q/q). The outcomes were within management’s earlier assistance for shipment of 23,000 to 25,000 automobiles for the 2nd quarter, albeit on the lower end, however represents both a y/y and consecutive decrease. This continues to suggest a diverging development story from its better-performing domestic peers such as Li Automobile and BYD, as gone over in our previous protection on the stock. It likewise puts NIO’s earlier goals to offer 250,000 EVs this year even more out of reach.

Nevertheless, management has actually been positive for a more powerful 2nd half concerning volumes, assisted by the intro of brand-new designs consisting of the upgraded ES6 and ES8, and EC7 coupe SUV based upon the NT 2.0 platform, along with its line-up of sedans consisting of the most recent ET5 Touring. In addition to the just recently presented premium sedans, NIO has actually begun providing the EC7 Coupe SUV in April, the brand new ES6 based upon the NT 2.0 platform in Might, along with the brand new ES8 and ET5 Touring – likewise based upon the NT 2.0 platform – in late June.

The brand-new design intros have actually likely been a crucial chauffeur to m/m development in SUV sales throughout the 2nd quarter, in line with earlier issues that “internal cannibalization or competitors” – especially on older versus more recent designs – may have suppressed sales. Particularly, management has actually revealed optimism for the production run-rate on stated designs to jointly reach 20,000 systems each month beginning in July, with expectations for incremental boosts to shipment volumes in the 2nd half based upon robust appointment orders observed to date:

Relating To the ET5, ET5 Touring and ES6 total volume, our company believe there is chance for us to still attain 20,000 systems in one month … After the shipment of EC7, we can see the need is in fact rather steady. When it comes to the ES6, recently I have actually discussed that we are really positive about the sales efficiency of ES6 after the item ramp-up. And after that, for this year, we are really positive of our promoting all the brand-new items we introduced this year, consisting of the ES8. We will begin the shipment of the ES8 in the near term. And presently, we can see that the appointment order efficiency is in fact greater than our expectations.

Source: NIO 1Q23 Incomes Call Records

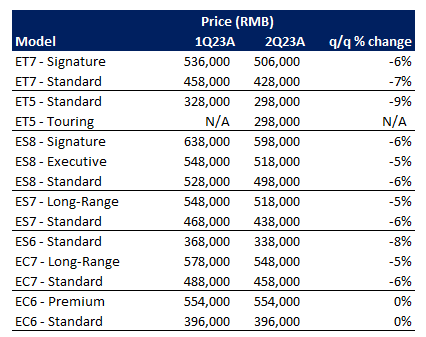

On The Other Hand, on the rates front, MSRPs throughout NIO’s line-up have actually dropped lower in June compared to levels previously this year, highlighting the consistent pressure of a continuous cost war in the wider Chinese car market. The business “slashed costs on all of its designs in China by [RMB 30,000]” in early June. And based upon costs noted on NIO’s sales site, the decreases relate to 6% typically since early July compared to early June when we last covered the stock.

Information from nio.cn

This indicates that the just recently presented brand new ES6 and ES8 designs are now costing an even lower cost than the tradition versions, possibly countering management’s earlier objectives to reduce pressure on car gross margins by leveraging sales of the brand-new, higher-priced designs based upon the NT 2.0 platform:

… with the shipment of our NT2.0 item with greater cost from Q2 and Q3, the typical market price and gross earnings margin per cars and truck will recuperate. So, we are positive that the gross earnings margin will begin to recuperate to double-digits in Q3 and over 15% in Q4.

Source: NIO 1Q23 Incomes Call Records

And not just will the cost decreases weigh on the 2nd quarter’s typical market price – particularly offered the higher share of SUV sales in NIO’s combined income mix throughout the duration – however likewise more incentivize potential purchasers to wait on incremental discount rates, successfully making the most of heightening competitors among the Chinese car manufacturers.

A Prospective “Truce” in the Chinese EV Rate War

In the most recent advancement, NIO, together with 15 other car manufacturers in China – consisting of Tesla – have actually jointly accepted stop the execution of unreasonable rates methods under the needs of the MIIT and CAAM. The pact describes 4 significant efforts to “assist support development and play it safe” in the Chinese car market:

- adhere to existing market policies to make sure reasonable competitors without the execution of “unusual rates”;

- avoid overstated or incorrect marketing;

- focus on quality in product or services provided to clients; and

- contribute properly to “keeping consistent development, enhancing self-confidence and avoiding threats” in the Chinese car market.

Nevertheless, the finalizing of the pact – nor the 4 points noted within – is not anticipated to drive positive enhancements to the remaining pressure on costs throughout the Chinese car market. Not just is the contract non-binding – which suggests it is just symbolic of the federal government and the market’s main recognition of a magnifying competition-driven cost war – there is likewise an absence of structural regulative order to hold car manufacturers responsible for their aggressive rates methods.

Limitations to the pact’s efficiency in stemming the cost war is more proven by the CAAM’s retraction of the contract’s recommendation to “rates” simply 2 days after the preliminary finalizing event, mentioning the term’s incompliance with China’s antitrust policies. The advancement highlights the intricacy of stemming a competition-driven cost war that has some car manufacturers slashing their MSRPs by as much as 35% this year. The current advancement is nearly like a repeat of the CAAM’s alerting to the market previously this year that cost cuts do not represent a “long-lasting service” for supporting car sales, and required car manufacturers to “go back to regular order as quickly as possible”, which has actually done little to stop aggressive marking down projects from turning up throughout the Chinese car market to date.

While some car manufacturers like BYD and Tesla have actually carried out upward cost modifications to a few of its much better selling designs throughout the 2nd quarter, much of the associated activities have actually been driven by their particular basic strength instead of in reaction to calls from regulative bodies in the market. On the other hand, most of domestic names such as NIO have actually yet to seen a structural healing in take-rates that would enable upward modifications to car costs, particularly in the middle of a degrading need environment and heightening competitors.

Cost and Efficiency Remain Keys to EV Adoption

Undoubtedly, the mix of heightening competitors within the wider EV market, together with degrading financial conditions are most likely to bode unfavorably for NIO in the near term, as potential cars and truck purchasers focus on price and functionality on discretionary big-ticket purchases. This follows better-than-expected volumes observed at competitors Li Automobile and BYD, likely due to their particular organization methods’ efficiency in resolving the 2 core customer needs amidst the slowing Chinese economy. Nevertheless, NIO’s current release of updated designs throughout its line-up on the most recent NT 2.0 platform, matched by reduced price tag, might possibly much better resolve increasing require price, particularly in financially delicate lower-tier cities where future EV chances will end up being most focused.

Regardless of the federal government’s intro of beneficial monetary rewards for the EV sector previously this year, consisting of “ credit assistance” for qualified purchases, together with industry-wide advertising projects, EV sales have actually been warm in the very first half of 2023 compared to the exact same duration in 2015. New energy car sales in the very first 5 months of 2023 increased by 41% y/y, decreasing from 120% y/y development observed in the exact same duration in 2015. On The Other Hand, June NEV sales are most likely to have actually slowed down even more to development of 26% y/y, representing a plain downturn from the 130% y/y development observed in the previous year when need enhanced on the back of Shanghai’s introduction from COVID-induced lockdowns at the time.

Particularly, the relative outperformance in take-rates observed throughout Li Automobile and BYD, which provides competitively priced superior offerings throughout popular car sectors and much easier to adjust powertrains, indicates customers’ increased concentrate on price in their purchase choices, while likewise enhancing variety stress and anxiety as popular barrier to EV adoption. This is likewise in line with expectations that much of Chinese EV sales development moving forward will likely be driven by the release of bottled-up need throughout lower-tier cities, which are more cost delicate with fairly restricted ease of access to public charging facilities required to support the emerging type of transport – 2 aspects that BYD and Li Automobile’s organization designs can successfully resolve.

Nevertheless, we anticipate NIO’s intro of brand-new designs to be a much better structural service in conquering stated difficulties and bring back shipment volumes in the 2nd half. While costs of the brand-new designs have actually ended up being more competitive than they were previously this year, which might weigh even more on NIO’s ASP and, unintentionally, earnings margins, they might possibly incentivize much better take-rates by allowing capitalization of possible bottled-up need from potential purchasers who were not just claiming the updated versions, however likewise wanting to make the most of the present discount rates.

For example, the all brand-new ES6 five-seater – which has actually decreased its beginning cost from the previous RMB 368,000 to presently RMB 338,000, and represents NIO’s lowest-priced SUV offering – makes a better competitors versus competing BYD’s most recent Denza N7 five-seater SUV and Li Automobile’s Li L7 six-seater SUV, both of which are priced in the low RMB 300,000 variety, in regards to price and efficiency. The most affordable priced ET5 sedan based upon the NT 2.0 platform, which includes innovative functions covering double motors and ADAS in the basic trim, is likewise getting traction as proven by its dominant sales mix considering that launch, highlighting end market need for price and efficiency. And the most recent intro of the ET5 Touring, which boasts the exact same beginning cost as the basic ET5 at RMB 298,000, is anticipated to enhance the design’s attract a wider end market and diversify NIO’s end market direct exposure as competitors magnifies:

As the world’s very first wise electrical tourer, the ET5 Touring is created to cover varied situations for both specific and household users, considerably enhancing our competitiveness in the premium household car market … This is going to assist us to enhance our total item competitiveness, due to the fact that our company believe ET5 Touring can accommodate the varied requirements of people and the household users and this can assist us to enhance our competitive– of our item competitiveness in this particular market section.

Source: NIO 1Q23 Incomes Call Records.

And the awaited healing in volumes, assisted by the newest intro of more recent, competitively priced designs, might likewise contribute towards economies of scale and drive incremental production expense effectiveness to make up for the near-term rates difficulties, alleviating NIO’s direct exposure to effects of degrading financial conditions and heightening competitors in China. This is anticipated to drive a more apparent favorable influence on NIO’s margin growth efforts when cyclical tailwinds go back to support awareness of the greater cost potential customers of NT 2.0-based designs over the longer-term.

Essential Analysis

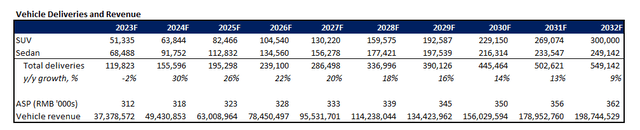

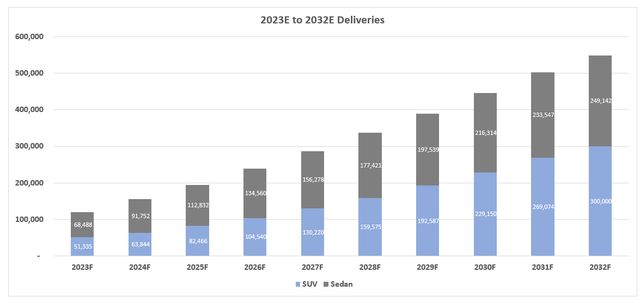

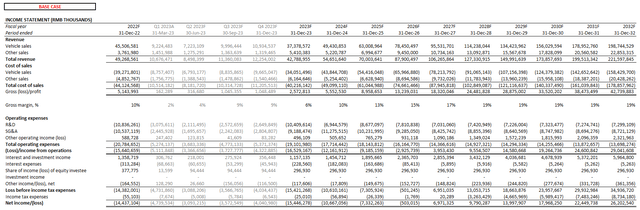

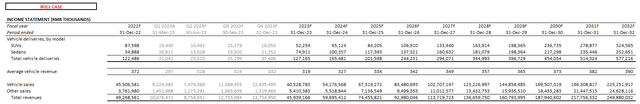

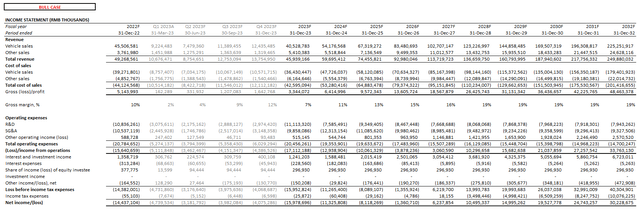

Thinking about NIO’s real 2nd quarter shipments, along with current information on the Chinese EV market along with the wider Chinese economy, our base case projection anticipates income to decrease on an annualized basis this year for the very first time considering that early 2020 at the beginning of the pandemic. While we anticipate shipment volumes to recuperate at a much faster rate in the 2nd half of the year compared to the warm 2nd quarter outcomes, buoyed mostly by the intro of brand-new competitively priced car designs, take-rates are most likely to stay in decrease offered restricted clearness on China’s near-term macroeconomic outlook along with a reasonably hard PY compare.

And over the longer term, thinking about the launch of the mass market ALPS sub-brand in 2H24, we anticipate NIO’s combined shipment volumes to broaden at a 10-year CAGR of 16%. The development presumption thinks about both NIO’s production capability along with the approximated rate of EV penetration in the Chinese car market from the present 30% variety towards more than 50% by mid-decade. While car ASP is anticipated to stabilize as cost war headwinds moderate gradually, the metric’s rate of development is most likely to be balanced out by the intro of lower-priced ALPS designs from the latter half of 2024 forward. As an outcome, income is anticipated to broaden at a lower typical rate of about 15% over the projection duration.

On the success front, thinking about the execution of more cost cuts following NIO’s very first quarter revenues call, the base case projection anticipates car gross margins to underperform management’s projection. Remember that management had actually anticipated greater costs on the brand new NT 2.0-based ES6 and ES8 SUVs, combined with production increase to scale, as a crucial chauffeur for margin re-expansion from the single digit portion variety in the very first quarter back towards 15% leaving 2023. Nevertheless, thinking about the lower beginning costs on the brand new SUV designs following the June cost cuts, our base case projection anticipates car gross margins to enhance at a reasonably modest rate towards the low double-digit variety leaving 2023, driven by expected scale in brand-new design take-rates as gone over in the foregoing analysis.

Paired with expectations for raised opex invest within the foreseeable future to support the ongoing ramp-up of NT 2.0 automobiles together with SOP preparations for the ALPS sub-brand, we anticipate NIO’s breakeven timeline to be more pressed out into 2027, compared to management’s self-confidence revealed previously this year in attaining success by 2024.

[NIO CFO Steven] Feng stated the business is “positive” about recovering cost at the group level next year. “Strong income development together with tightened up costs are the secret to enhanced success,” he stated.

Source: Bloomberg News

NIO _- _ Forecasted_Financial_Information. pdf

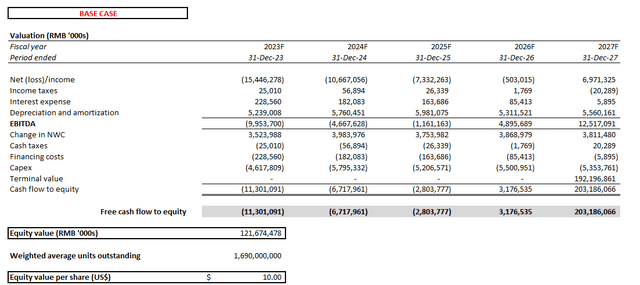

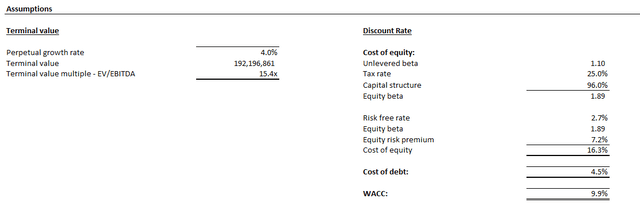

Appraisal Analysis

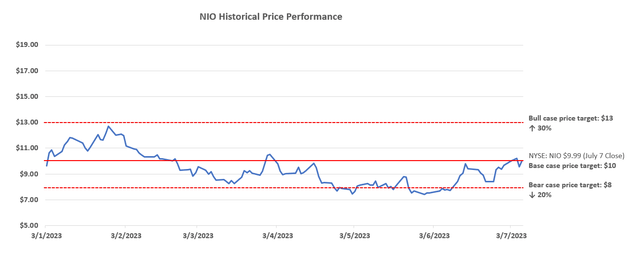

Making use of forecasted money streams taken in combination with our base case basic projection for NIO, with the application of a 10% WACC in line with the business’s capital structure and danger profile, the stock’s present cost at about $10 each (July 7 close) shows market’s rates of an indicated continuous development rate of 4% under the reduced capital analysis assessment approach.

Our company believe the stock’s newest rally has actually led to a much better reflection of NIO’s development potential customers, particularly with anticipation for much better penetration into emerging chances in the lower-tier cities after the upcoming start of productions on the ALPS sub-brand next year, in spite of near-term headwinds on success. Remember from our previous analysis that the stock is approximated to have actually been trading at a forecasted suggested continuous development rate in the 1% variety prior to the most recent rally. Our company believe the shares’ current gains have actually led to a well balanced danger profile in between NIO’s assessment and basic potential customers at present levels. And looking ahead, incremental benefits will likely depend upon more clearness from management on NIO’s development roadmap – especially concerning ALPS’ go-to-market technique for enhancing capitalization on emerging need in lower-tier cities – to make up for decreasing penetration in the premium section amidst heightening competitors over the longer term.

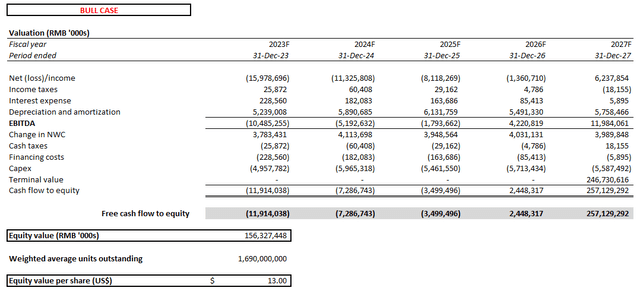

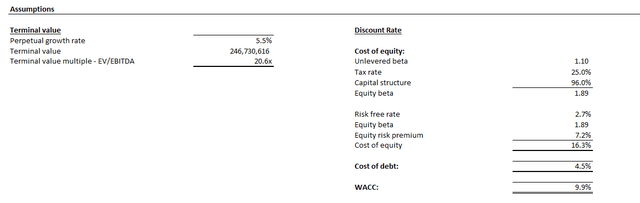

The advantage circumstance uses forecasted money streams taken in combination with a bull case basic projection that price quotes income growth at a 16% 10-year CAGR, driven by capacity for better-than-expected ASP growth and expense effectiveness recognized through scaling production ramp-up on NT 2.0 automobiles and the upcoming ALPS sub-brand over the longer term.

Using the base case WACC of 10%, together with an approximated continuous development rate of 5.5% in line with China’s rate of longer-term financial development to show NIO’s capacity for much better capitalization on EV chances ahead in its core domestic market, the bull case assessment reaches $13 each. This would represent upside possible of 30% from present levels at about $10 each (July 7 close).

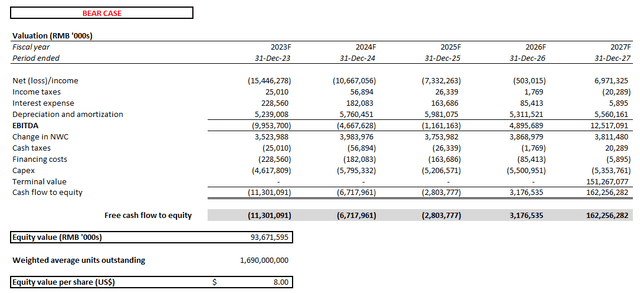

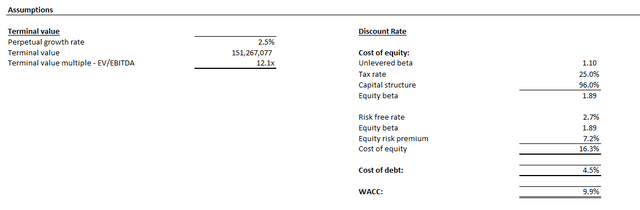

The disadvantage circumstance presumes the exact same base case basic price quotes however at a lower approximated continuous development rate of 2.5% to show macroeconomic threats dealing with China’s near-term development potential customers. Our disadvantage assessment costs the stock at $8.

The disadvantage circumstance keeps the hidden capital forecasts the same from the base case as development presumptions used currently think about the near-term difficulties to NIO’s operations due to short-term macroeconomic unpredictabilities, which have actually currently been conservatively decreased from management’s assistance. The lower terminal development presumption used remains in line with current information that reveals a more weakening of usage and a growing “ risk of deflation” in the Chinese economy, which might be an incremental several compression danger on the stock’s near-term assessment potential customers.

The Bottom Line

NIO is most likely to bear the force of the continuous EV cost war that is anticipated to last within the foreseeable future, particularly as the need environment deteriorates amidst a slowing post-pandemic financial healing in China. This follows restricted efficiency from current federal government policy assistance targeted at supporting EV need in current months. Customers’ level of sensitivity to costs is likewise shown in durable need for lower-priced, fairly much better value-for-money items provided by mainstream section competitors like BYD and Li Automobile, highlighting prioritization of price and efficiency among prospected purchasers, particularly amidst the unsure macroeconomic environment.

While we stay positive about NIO’s longer-term development potential customers offered its tested brand name awareness in the Chinese EV market and upcoming launch of a lower-priced sub-brand to enhance capitalization of budding chances throughout lower-tier Chinese cities, there is restricted break in the near term to check effects taking place from the continuous cost war. Paired with consistent macro-driven several compression threats, NIO Inc. stock’s near-term advantage capacity from present levels will likely be restricted.

In the meantime, we anticipate enhancements on the take-rate of just recently presented NT 2.0-based designs to be a chauffeur of scale within internal operations that can partly cushion the effect of the tough rates environment on NIO’s fundamental – this leaves NIO’s regular monthly shipment reports moving forward as essential focus locations for financiers through the rest of the year. Information encouraging of durable take-rates on the recently presented NT 2.0 designs will assist to keep toughness in the stock’s assessment at present levels, which costs in constant development in NIO’s margin growth efforts ahead in spite of short-term cyclical headwinds on the underlying organization’ basics.

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please understand the threats related to these stocks.