lerbank

” Truth is the leading reason for tension among those in touch with it” – Jane Wagner

Today, we put LGI Residences, Inc. ( NASDAQ: LGIH) in the spotlight. I have actually made an excellent area of coin trading in and out of this well-run house contractor given that the start of the pandemic, which assisted set off considerable migration out of the cities into the residential areas along with to other states.

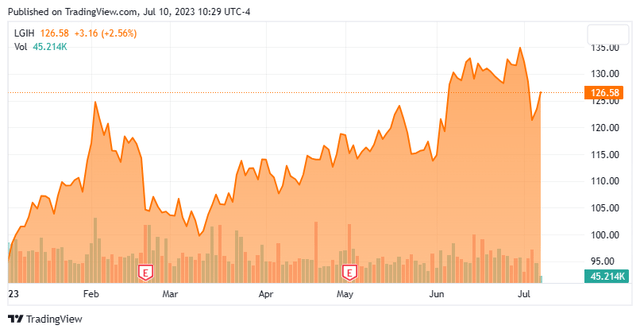

The business’s footprint was well-positioned for that occasion as it runs in a few of the fastest-growing states in the Union. Regardless of typical home loan rates nearing 7 percent, LGI Residences, like the majority of homebuilders, has actually delighted in an excellent 2023 in the market. The stock is up a 3rd year-to-date. Can the rally continue? An analysis follows listed below.

Business Introduction:

LGI Residences is based simply beyond Houston, TX. The business constructs entry-level houses and active adult houses under the LGI Residences trademark name along with high-end series houses under the Terrata Residences trademark name. Its neighborhoods are mainly in Texas, Arizona, Florida, Georgia, New Mexico, Colorado, North Carolina, South Carolina, Washington, Tennessee, Minnesota, Oklahoma, Alabama, California, Oregon, Nevada, West Virginia, Virginia, Pennsylvania, and Maryland. Presently, LGI House runs by means of 99 neighborhoods in 35 markets and 20 states. The stock presently trades simply north of $125.00 a share and sports an approximate market capitalization of $2.90 billion.

2021 Business Discussion

Very First Quarter Outcomes:

On Might second, the business published very first quarter numbers LGI House provided a GAAP earnings of $1.14 a share, 11 cents under expectations. Incomes fell almost 11% on a year-over-basis to $487.3 million, which was almost $20 million above the agreement. Typical list prices increased 4.5% from the very same duration a year ago to simply over $355,000.

Cancellation rates stay relatively consistent at simply under 16% while brand-new orders increased 12.5% from 1Q2022 to 2,219. The business’s order stockpile stood at 1,555 houses valued at $561.4 million. Significantly, this is the business’s most affordable order stockpile in over 4 years. The business had 1,366 house closings in the quarter, down almost 15% year-over-year. Management offered assistance that it anticipates it will have in between 6,300 to 7,000 house closings in FY2023 at a typical list prices of in between $345,000 and $360,000.

LGI Residences closed 557 houses in April, 633 in May, and 664 houses in June for an overall of 1,854 houses in the 2nd quarter as the business has actually had a strong Spring selling season it need to be kept in mind.

Considering that very first quarter results came out, BTIG ($ 77 cost target), JPMorgan ($ 90 cost target), and Wedbush ($ 89 cost target) have actually preserved Sell/Hold scores on the stock. Seaport Worldwide ($ 156 cost target) and JMP Securities ($ 130 cost target) have actually reissued Buy scores on the equity.

Simply over 15% of the stock’s total float is presently held short. A number of experts offered simply over $9 million worth of shares jointly in February of this year in the low to mid $100s. That is the only expert activity in the stock up until now in 2023.

LGI Residences ended the very first quarter with overall liquidity of almost $360 million. This consisted of $43 countless money on hand and simply over $315 countless readily available capability under our unsecured revolving credit center. After the very first quarter ended, management changed their revolving credit arrangement. This increased the credit center to $1.13 billion (Up $30 million). They likewise extended the maturity for $775 million through 2027. The business’s debt-to-capital ratio was 38.4% at the end of the very first quarter, down 500 basis points from completion of September. Lastly, book worth per share ended the quarter at $71.14.

Decision:

LGI Residences made $13.76 a share in earnings in FY2022 on earnings of $2.3 billion. The present expert company agreement has incomes being up to $7.61 a share in FY2023 as earnings increase some 7 percent to $2.47 billion. They see rather the recuperate in FY2024 as incomes grow to north of eleven bucks a share as earnings skyrocket by more than 25%.

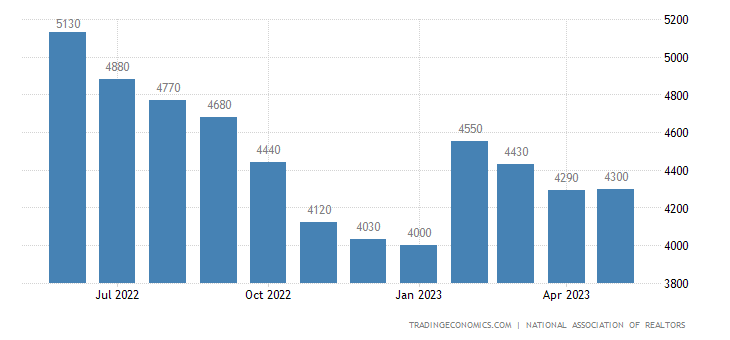

Trading Economics

Homebuilder stocks have actually had an impressive run in 2023 provided the increase in home loan rates and total financial unpredictability in the market. House rates (down 3.1% year over year in June) have actually held up rather well regardless of the fall in existing house sales. This is mainly due to the absence of stock (3 months’ supply since June) as couple of existing house owners wish to quit their 3 percent home loans even to secure substantial capital gains.

Nevertheless, if the nation gets in an economic crisis, which appears a most likely possibility over the next year; task development will reverse. This will minimize need and boost supply. I believe LGI Residences, Inc. is a splendidly handled company, however the homebuilding sector is infamously cyclical. Paying almost 17 times forward incomes (simply under the total market numerous) coming out of a financial contraction might totally be warranted. It simply isn’t heading into a possible economic downturn. Experts were taking some chips off the table in February when the stock was around 20% lower. Considered that, if I had actually presently had a stake in LGIH, I would be inclined to take revenues also.

” The eye sees just what the mind is prepared to understand” – Robertson Davies