SolStock

Summary

I suggest a buy score for Dutch Bros ( NYSE: BROTHERS). With constant shop openings, ingenious items, and a strong development trajectory, I anticipate brothers to continue growing at a greater rate than the market and outmatching its peers. While there are threats of market saturation and altering customer choices, the total outlook for Dutch Bros is favorable.

Company description

Dutch Bros is a chain of drive-through coffee bar that serves artisanal lattes and other drinks. Their specialized is espresso beverages, however they likewise use a variety of other cold and hot drinks.

Market

According to Fortune Company Insights, the U.S. liquid coffee market size is predicted to grow from $6.33 billion in 2022 to $ 9.61 billion by 2029, at a CAGR of 6.17% throughout the projection duration.

This development is really favorable for brothers, and I think is well supported by the regular coffee drinking nature of United States people. According to NCAUSA (National Coffee Association U.S.A.), the typical intake daily was 2 cups per capita. This relates to around 660 million cups of possible need every day.

Provided the marketplace size and the ease of entrant, this market has a great deal of rivals such as Starbucks, QSR chains that offer coffee (like McDonalds), Coffee Bean, and so on

Thesis updates

Regardless of increasing rates by 8% in the most current quarter, BROS’s SSS continues to decrease, making it a victim of the weak macro environment. However, I think the business will weather this storm, as underlying shop efficiency might not be as weak as at first believed. I wish to highlight that the cannibalization effect of 45 brand-new openings at 50% usage was the main factor for unfavorable SS. To me, the reality that management observed that underlying traffic patterns were flat compared to 4Q which March carried out far better than February shows that the healing momentum is getting steam. For that reason, in spite of financiers’ increased concentrate on development SSS profile, I think brothers will have the ability to sustain development above the market average in the years ahead.

In general, I prepare for much better development sequentially throughout the year, and brothers need to leave FY23 with above-average development rates, based upon management remarks that they are seeing healing in March.

Monetary analysis

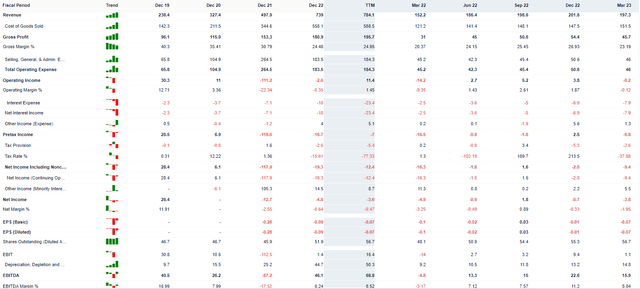

Gurufocus

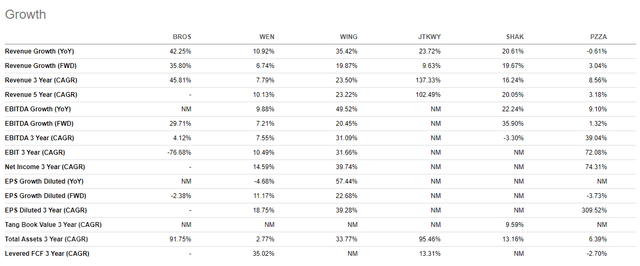

brothers have actually traditionally carried out far better than the market development rate with 40++% development rates. This was well supported by development in systems and SSS. I anticipate development to decrease this year, however still stay strong as it the current openings have actually recommended that there are still lots of locations for brothers to open their shops. SSS ought to be supported by capability to innovate brand-new items. All in, I anticipate development to stay above market levels.

brothers is a successful business, which is another favorable aspect on top of its high development nature. I anticipate earnings margins (EBIT) to enhance overtime as it leverages its set expense base. There is a possibility for more gross margin growth in addition to business grows overtime.

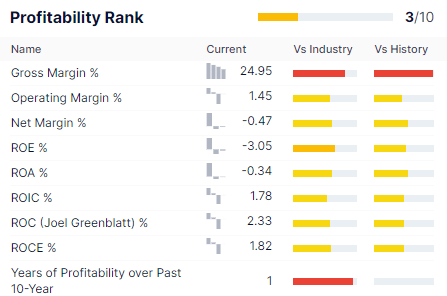

Gurufocus

At the present phase, BROS is still an even worse prospect when evaluated for success since of its high development nature. I anticipate this viewpoint to turn over time as soon as its development phase ends– which I do not believe will occur quickly. Management ought to concentrate on development provided the big chance readily available today.

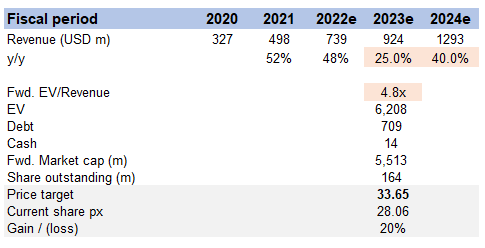

BROTHERS has $14 million in money and around $710 countless financial obligation, putting the business in a net financial obligation position. While net financial obligation to EBITDA (LTM basis) appears high, I believe it is much better to see if on net financial obligation to FY23 EBITDA, putting the net financial obligation to FY23 EBITDA ratio at around 6x. This is a high financial obligation level which I think will trigger some financiers to prevent the stock as a high economic crisis may put business at danger to raise capital. Keep in mind that this service has a great deal of repaired expense take advantage of too.

Assessment

Own design

I am forecasting brothers to grow at 25% for FY23 provided the unpredictability of the macro environment and 40% in FY24 on my expectation for a healing (development a little lower than FY22), which is still a significant quantity greater than the market development rate. This development will be supported by constant opening of brand-new shops and SSS as brothers raise rates and innovate brand-new items. I anticipate brothers to trade at the very same forward profits evaluation today at 4.8 x. As brother is growing much faster than peers, I think this evaluation is necessitated. My target cost is $33.65

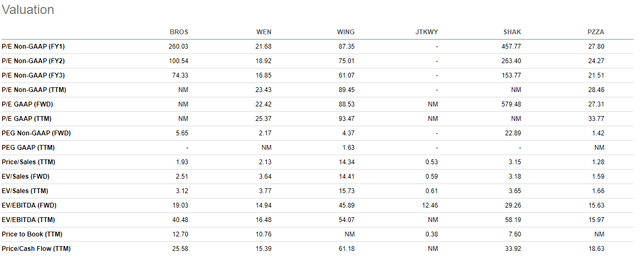

SeekingAlpha

SeekingAlpha

Threat

While there are some barriers to scale in the market (time and capital are needed), there are couple of barriers to entry. It just takes a couple of weeks to establish a service selling coffee and other takeout drinks, so the marketplace is quickly flooded with brand-new entrants.

In addition, there is constantly an opportunity that the food and drink market as a whole will fall back customer tastes. I think this danger is intrinsic to BROS.

Conclusion

Regardless of current difficulties in same-store sales due to cannibalization from brand-new shop openings, the business has actually revealed indications of healing and is anticipated to sustain development above the market average. Economically, Dutch Bros has actually traditionally exceeded the market and stays successful, with capacity for more margin growth. Nevertheless, the business brings a substantial quantity of financial obligation, which might prevent some financiers. Looking ahead, with its high development capacity, constant shop openings, and ingenious items, I anticipate brothers to grow at a quicker rate than its peers. While there are threats of market saturation and altering customer choices, the total outlook for Dutch Bros appears favorable.