Andreas Rentz/Getty Images News

Dear readers/followers,

RWE ( OTCPK: RWEOY) stays among the biggest energy business in the world – even if it’s just the second-largest in the nation of Germany. It’s nevertheless likewise among the 400 biggest business in the world, with roots returning over 100 years. It was among the very first business to get self-reliance from allied control in West Germany, went on to construct the very first nuclear reactor in the nation, and has actually gone on a broad, European shopping spree to wind up with among the biggest and most appealing tradition possession portfolios on the continent.

In this post, I plan to offer an upgrade for the business and where I see things go throughout 2023-2025.

Let’s start.

RWE – Plenty to like about energy/utility possessions

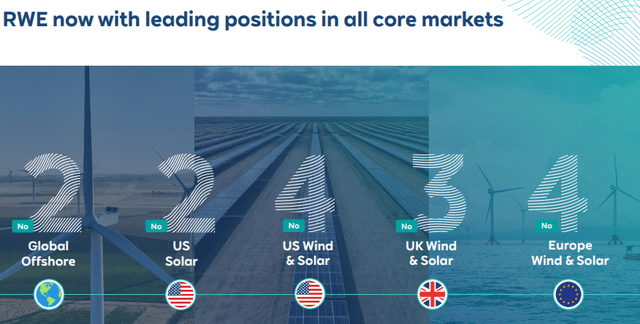

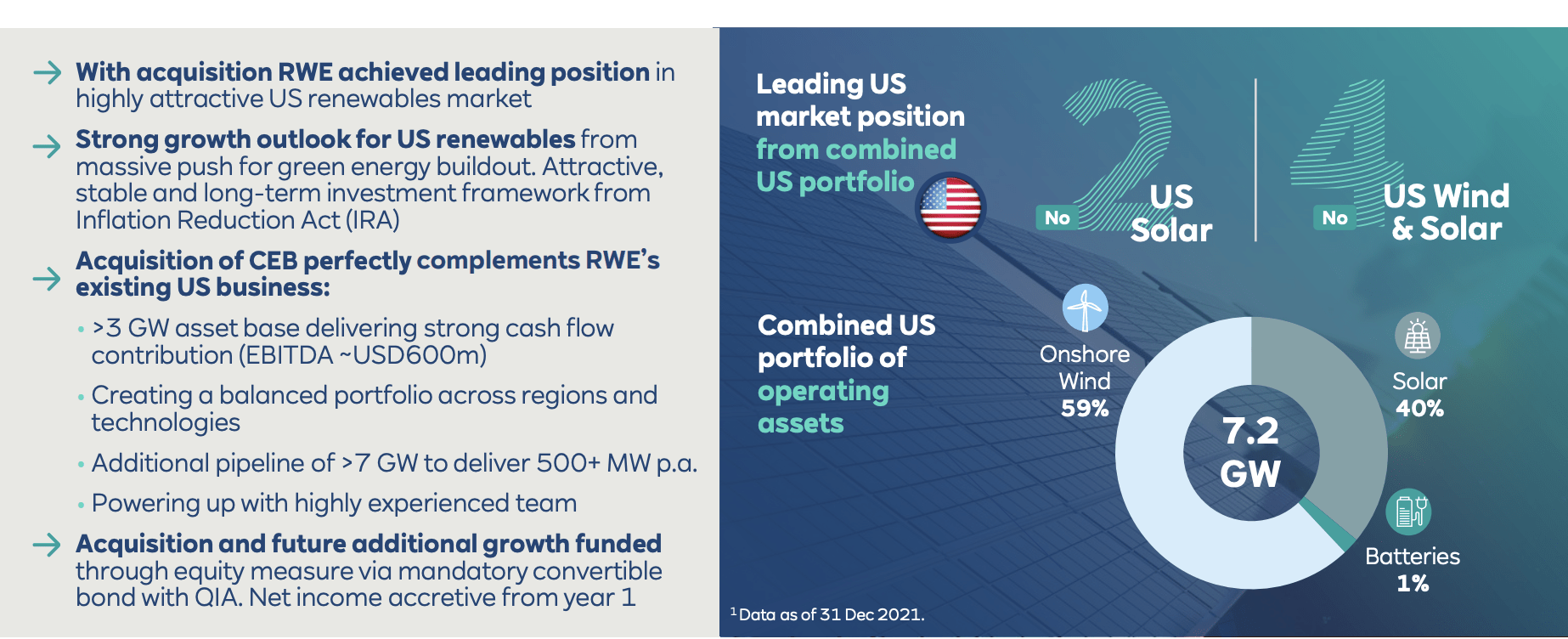

When I state “tradition”, I do not wish to provide you the photo that the business does not do renewables. I do not believe any one business might endure such a path in this market. What was as soon as thought about RWE, even by individuals with understanding in the market, is no longer what the business “is” today. The business has a really appealing set of sustainable possessions that appears to be growing year over year. What’s more, the business has currently end up being a leader in United States solar and Wind/Solar.

RWE IR (RWE IR)

The business, as soon as the champ of coal, has actually promised to leave the source behind within the next 7 years and currently has among the most appealing sets of sustainability scores for any tradition possession business gone renewables on the marketplace today.

Security stays exceptionally high. What else would you call BBB+ financial investment grade, with a take advantage of target listed below 3.5 x, which is presently already listed below 3x. The business has actually likewise embraced a dividend flooring of 50-60% which based upon existing revenues patterns puts business at a yield of 2-3%.

The business isn’t the most attractively-valued energy or energy business out there. However, energies aren’t as inexpensive as they had to do with a year back when I purchased the majority of my Enel ( OTCPK: ENLAY) or other stakes, which are presently up 35%+ consisting of dividends.

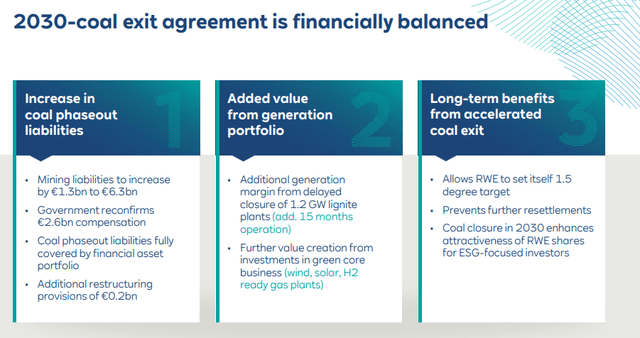

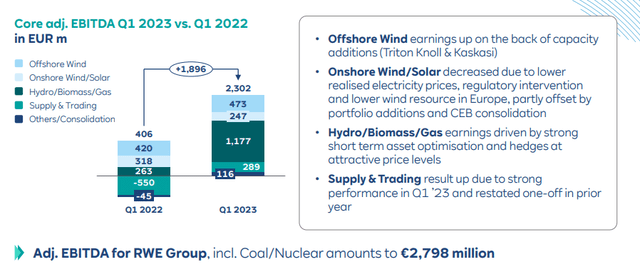

Nevertheless, this absence of outright undervaluation is easy to understand when seeing the business’s revenues enhancements. RWE surpassed its monetary targets in the 2022 financial regardless of all macro and difficulties, can be found in at an earnings of EUR3.2 B. The coal exit, which is frequently discussed, is really in lots of methods ahead of schedule and is currently well balanced economically.

The business has short-term steps to increase capability, with the last of the 3.1 GW capability going offline on the 31st of December 2029. The business has actually currently provided on a number of tasks, tactical M&A’s, and pipeline additions to diversify operations ahead of these modifications, leading to market management throughout the world and particular markets.

Its generation portfolio has actually been contributed to through matching wind and solar possessions, and due to carbon tax and other steps, the resulting ESG-friendly portfolio will lead to revenues development along with dividend development. The business’s EUR1/share dividend is a flooring for future years, so it must never ever dip listed below this level.

The business likewise validated the 2023E outlook, and provided extremely strong 1Q23 numbers, with a really appealing mix that is no longer even as near to coal-heavy as it as soon as was.

RWE is, when you look carefully at the business, remarkably steady for the shift it’s going through and is continuing to go through in the next 7 years. Over the previous 5 years, its share rate advancement has actually been close to direct and growing at 23% annually or 143% over 5 years. This still trounces the S&P 500 and other indices by a broad margin and makes me be sorry for not investing a lot more, and faster in the business. However it likewise implies that the business is not always all that wonderfully valued compared to chances offered in other sectors of the marketplace.

RWE today is an Essen-based market-leading operator of green generation possessions integrated with a strong, appealing industrial platform Its brand-new direct exposure to its varied and worldwide markets with EBITDA originating from core companies and less than a quarter from tradition is appealing – and no doubt why financial investment huge BlackRock ( BLK) holds a big stake in the business.

The business’s maturities are exceptionally well-laddered, with absolutely nothing developing prior to 2025, and the majority of it beyond 2028 – amply timed for the exit in coal, with the business’s loaning expenses most likely to stay regulated due to its green status moving forward. This is among the couple of companies where I do not always see the Green focus as an unfavorable since it leads to real, concrete benefits and financial enhancements for business.

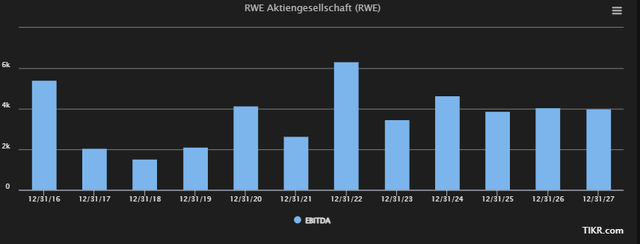

Nevertheless, let me make one thing clear since it ends up being appropriate when we take a look at appraisal. In the next 5-7 years, the business’s revenues profile will be unpredictable, and greatly affected by the market for energy costs that we see. The business’s EBITDA will change, and anything near to 2022A levels will not be seen once again for a long time. So for those of you investing and expecting a repeat of the 2022 efficiency, put that out of your mind. It’s impractical. 2022 EBITDA was at over EUR6B – I approximate that the business will be fortunate, based upon the decline in power costs and volatility along with modifications and shutdowns, to reach an annualized EBITDA of over EUR4.4 B – a minimum of up until 2026E. And the majority of experts following the business would concur with me on this point.

it’s a various RWE – however a much better RWE to buy the long term. However any sort of huge, triple-digit RoR is not likely outside the bounds of huge energy premiumization. If we do see energy premiumization, I will remain in the front row for huge returns offered my 10% direct exposure to the sector in my portfolio – nevertheless, I see it as not likely offered the lukewarm revenues patterns that the majority of energies and energy business really have more than time.

Likewise, keep in mind as a threat, RWE, offered its broad direct exposure, has a extremely complicated set of regulators from numerous countries and numerous regulative bodies, with renewables alone in numerous nations under more than 5 various ones. This together with among the most enthusiastic tradition prepares that I know, implies that I am rather cautious about when to “PURCHASE” and when to “HOLD” this specific service.

The existing projections for RWE are normally favorable if we see them as beyond the 2022 paradigm, which set an enormously favorable precedent that I would be prepared to bet cash upon so that it will not be duplicated. As RWE’s change has actually gradually approached increasingly more renewables and the strategy is gradually being carried out upon, we’re seeing more of a forecastable revenues and dividend nature, which is what we wish to be seeing. Once again, the business’s strategy quite works – however we do require to provide RWE time to really recognize it, and as they do, outperformance on the basis of EPS and dividends will not be sensible – not unless we see a comparable spike in rates and patterns as we saw in 2022.

RWE – Upgraded appraisal

The upgrade for RWE is reasonably basic. The thesis hasn’t materially altered, however we have actually collected some self-confidence and conviction in the general long-lasting advantage for the business – by long-lasting, I indicate to 2030 and beyond. I do not see any massive dangers or effects that might de-rail the course the business has actually taken. My previous PT for the business concerned around EUR49/share – and I will not be altering that in this post.

The upgrade for RWE is reasonably basic. The thesis hasn’t materially altered, however we have actually collected some self-confidence and conviction in the general long-lasting advantage for the business – by long-lasting, I indicate to 2030 and beyond. I do not see any massive dangers or effects that might de-rail the course the business has actually taken. My previous PT for the business concerned around EUR49/share – and I will not be altering that in this post.

That implies that RWE is still a “BUY” for me – however that “BUY” includes a variety of FYI notifications – such as the one to not anticipate huge outperformance on a forward basis since of it being, honestly, not likely in this environment.

S&P Global averages for RWE pertain to around EUR52.24/ share from 19 experts. Out of those 19, 18 are at a “BUY” or “Outperform” for the business in the longer term. That’s from a variety at a EUR48/share low target, and a near-EUR60/ share high target. I mainly concur with the basic evaluation made from the business here, though I see anything above EUR55/share to be rather too exceptional even for what the business provides here.

Despite the fact that other experts do not see a clear near-term advantage based upon revenues patterns, I consider it even more most likely that RWE will provide steady arise from completion of 2023E and upward – and this stays sufficient for me to hold a favorable thesis on the business.

Nevertheless, weak yield and other regulative dangers fundamental to the business in change suffice to make this far from the “finest” sort of financial investment in the sector today. I do think in the “BUY” – otherwise I would not be providing the ranking. However I likewise warn you that your real advantage might be not as high as you may anticipate – and with the yield, this has the prospective to press you listed below 10% annually, which is what I wish to be getting whenever I put cash to work.

The factor I bought Enel above RWE, along with other business, is that the relative advantage, regardless of what I consider as comparable levels of security, is merely greater. Even if a business is a “BUY”, it still requires to outshine other prospective financial investments to get my cash.

Which, RWE does not always do here either. It’s a terrific service with an excellent advantage, however it’s not the “finest” chance out there today.

Thesis

- RWE is amongst the class-leading sustainable business in the world, though with a still-existing tradition portfolio with direct exposure to lignite and other non-friendly (in ecological terms) fuel. The business is working to minimize this, and exit coal by 2030. It’s BBB+ ranked, has a well-covered yield of over 2%, and is set, as I see it, to support its revenues in the next number of years.

- Since of this, I see RWE as a “BUY” with an attractive conservative PT of EUR49/share for the native – listed below even the expert average, however still adequate to interest prospective financiers.

- I own RWE here – and I plan to gradually construct more as time passes and revenues can be found in.

Keep In Mind, I’m everything about:

- Purchasing underestimated – even if that undervaluation is minor and not mind-numbingly huge – business at a discount rate, permitting them to stabilize with time and harvesting capital gains and dividends in the meantime.

- If the business works out beyond normalization and enters into overvaluation, I gather gains and turn my position into other underestimated stocks, duplicating # 1.

- If the business does not enter into overvaluation however hovers within a reasonable worth, or returns down to undervaluation, I purchase more as time enables.

- I reinvest earnings from dividends, cost savings from work, or other money inflows as defined in # 1.

Here are my requirements and how the business satisfies them (italicized).

- This business is general qualitative.

- This business is essentially safe/conservative & & well-run.

- This business pays a well-covered dividend.

- This business is presently inexpensive.

- This business has a sensible advantage that is high enough, based upon revenues development or numerous expansion/reversion.

The business is not inexpensive here. Not based upon the projections that the business presently does have – however it’s still sufficient, based upon a EUR49/share rate target, to make up a “BUY” for me here.

Editor’s Note: This post talks about several securities that do not trade on a significant U.S. exchange. Please understand the dangers related to these stocks.