Olena Koliesnik/iStock by means of Getty Images

Intro

Retail financiers make choices occasionally and with little time to think about the complex ins and outs of our really complex SEC-created National Market System (NMS). Retail financiers appropriately long for simpleness. Market structure professional, Larry Tabb, explains that in a complicated world, simpleness is not constantly your buddy. I concur however with a proviso. When a crucial choice should be made, yet there is little time to make it, a basic option is even more helpful than a complex one.

On the other hand, producing a basic efficient system for retail usage is anything however easy. While the alternative thought about here would be easy for financiers to utilize, it is complicated itself. Customizing the NMS to satisfy financier requirements is just made complex.

What will it require to integrate simpleness with a much better offer for retail financiers? The retail system should assess retail requirements and construct pro-retail residential or commercial properties into the marketplace structure so that retail can enhance on an OTC fill from a wholesaler within the NMS with a couple of words to a retail broker.

The present securities market structure, the NMS, supplies retail financiers with one option – an afterthought in a system created to satisfy the requirements of computer-driven arbitrageurs. A worthwhile goal is to offer financiers with an option constructed for them just.

This series of short articles, starting with my earlier analysis of the stock exchange, wends its method through the worldwide monetary markets from a retail financier’s point of view. The short articles recognize monetary markets’ failure to resolve their essential function, sending out cost savings cheaply and effectively to their most efficient financial investment usage. A sign of Wall Street’s unfortunate fixation with self is that the crucial cost savings engine, retail financial investment, has actually ended up being an afterthought in the structure these days’s monetary markets.

Following the earlier short article that resolves the issues of the NMS, this short article details a method to develop effective options to the NMS that satisfy the requirement that markets for retail financiers should be both easy and substantial enhancements on the NMS from a retail financier’s viewpoint.

Ramifications for securities costs

The crucial ramification for winners and losers amongst the significant exchange management companies (ICE, CME Group, NASDAQ, CBOE) are:

- These companies are less dangerous now than their market price recommend. Their costs ought to be greater.

- A much better monetary market structure will raise the combined market price of the exchange supervisors significantly however all the increased worth will go to the innovator.

- When the innovator appears, threat will go back to better suited greater levels and the benefits increase too. Bottom line– a much better market structure will reward the winner more than it penalizes the losers.

The present retail market structure

Deep space of market individuals might be divided into 2 parts, full-time and periodic financiers. If investing is your full-time task, you do not mind a little problem. Equipped with a quick computer system filled with exclusive algorithms, you most likely welcome issues. However if, like the majority of us, investing is something you do occasionally, then simpleness is the path for you.

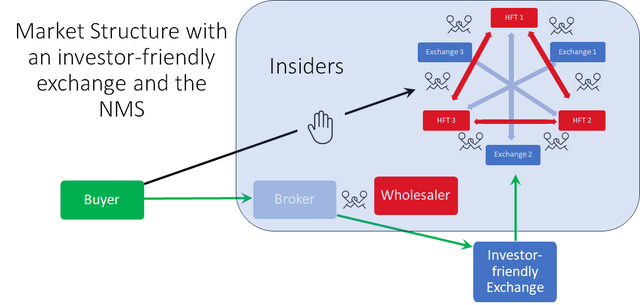

Hence, we require 2 systems – one for digital algorithm-driven companies (algo traders) and another for retail financiers. We have the best system for algo traders – the SEC’s NMS. However we ought to be doing a lot much better for retail financiers.

Retail financiers

Today, the retail variation of the NMS is so easy that it insults intelligence. A financier positions an order with her broker. Her broker hands it off to among the dominant wholesalers (broker-dealers that focus on filling retail orders OTC). The wholesaler fills the order at a below-market outsider’s cost. Then the wholesaler lays off the order for its own account at a much better cost. Lastly, the wholesaler pays the retail broker for quiting the order. The payments to brokers are called Payments for Order Circulation (PFOF). No system might be easier or more violent to retail.

Computer-driven high-frequency traders (HFTs)

The 2nd group served by the NMS is wholesalers/HFTs. As the marketplaces adjusted to electronic trading, the individuals most bought a market structure beneficial to themselves were the digital HFTs. They understood electronic trading produced a lucrative race to acquire a speed benefit. Equipped with computer system algorithms, HFTs co-located their devices with exchange deal engines and produced a market environment that rewarded the lots of small-margin arbitrage trades that were their specialized.

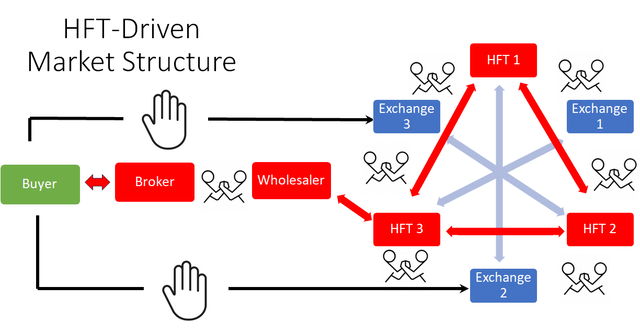

Their network of computer systems situated beside (co-located with) the exchange deal engines produced a market structure that appeared like the system explained by the graphic listed below.

Exchanges

The increase of the HFTs provided the exchanges with a choice. Should they pursue the HFTs, retail traders, or both? Driven by the much greater deal volume of HFTs the exchanges focused initially on HFT requires. Given that HFTs conduct arbitrage, that suggested including arbitrage options. So, the exchanges included more exchanges and produced brand-new complex orders, both actions meant to produce more arbitrage.

However there was a drawback to producing numerous exchanges, complex orders, and speed-of-light trading. Retail financiers and their brokers might not discover their method through the resulting mayhem securely (in such a way that would guarantee that the retail brokers fulfilled their SEC requirement to carry out at the very best cost readily available). Mayhem like this is anathema to retail. Nevertheless, the exchanges chose to deal with the HFTs, leaving retail financiers to discover another method to total deals.

HFTs/Wholesalers

Initially, HFT was a gold mine for getting involved broker-dealers. However as the HFT-generated revenues rolled in, the exchange management companies saw a chance to record a share of the HFTs’ revenues through greater exchange costs. So, arm-wrestling for a share of the arbitrage earnings started. Exchanges increased their share of the haul from arbitrage by increasing exchange costs, to the HFTs’ discouragement.

On The Other Hand, the HFTs, constantly alert to chance, saw that they might be the attendant of retail, chasing after trades through the NMS thicket for retail brokers. So, now a broker passes its retail orders to an HFT in the HFTs’ brand-new function, wholesaler retail order execution. The wholesaler fills retail orders at a below-market cost – yet not so low regarding draw the SEC’s attention. A share of wholesalers’ make money from off-market costs is passed back to retail brokers to motivate brokers to keep the great times rolling.

However as constantly with payments not reached at market value, wholesalers and retail brokers likewise arm-wrestled for their share of the outsider-insider cost spread.

There is the NMS in a nutshell. Retail financiers get outsider costs. Experts – retail brokers, wholesalers/HFTs, and exchanges – dicker over their particular shares of the distinction in between the expert costs wholesalers get and the outsider costs retail gets.

Requirements to construct a system for retail traders

According to SEC chair Gary Gensler, the SEC’s goals are to “enhance competitors and guarantee specific financiers are relatively dealt with.” The SEC should be exceptionally uneasy with the present system that serves retail financiers as an afterthought.

However it would not be tough to significantly enhance retail financier service, technically. The tough part is discovering the will to take this remarkable action. That action will not be taken by the SEC or another regulator. Just a personal effort will work. In what follows I will explain the procedure from the preliminary issuance of business securities up until financiers tuck the financial investment into their holdings.

Issuance

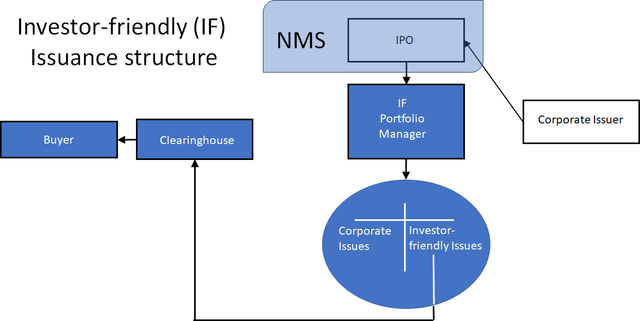

At first, it makes good sense to presume that business issuance patterns will not alter. The dominant IPO service providers (NYSE, NASDAQ) will continue because function. However later, it would benefit financiers if a mutual fund would provide investor-friendly asset-backed securities to be noted by an associated exchange.

The investor-friendly element of market structure

Development of an investor-friendly market consists of developing a method to offer financiers with a variation of the securities market that consists of:

- Brand-new securities that are more appealing to financiers than business initial problems.

- A universe of financial investments more economical to trade than NMS securities.

- A method of investing that does not leave out financiers from expert costs.

As soon as a market where every individual deals with the very same costs is produced, and where the marketplace structure is created to remove the costly elements of the trading and cleaning procedure that offer worth just to broker-dealers and market activists, retail financiers require just to define the retail exchange to prevent the elements of the NMS created for other type of traders. The retail-friendly market structure is shown in the graphic listed below.

Conclusion

This short article builds on my earlier description of the NMS, the SEC-created market structure that has actually been co-opted by HFTs and Wholesalers at the expenditure of retail financiers. It sums up the financial forces that drove the exchanges to deal with the requirements of HFT/Wholesalers at the expenditure of retail financiers. It then discusses the reasons that the NMS can not attend to the requirements of retail without development from monetary market individuals. The short article details some modifications that would much better satisfy retail financiers’ requirements. Lastly, it names the companies that will be the significant winners and losers moving forward. The following short articles will attend to retail financial investment in the market for financial obligation and the most likely long-run monetary market structure.