kokkai

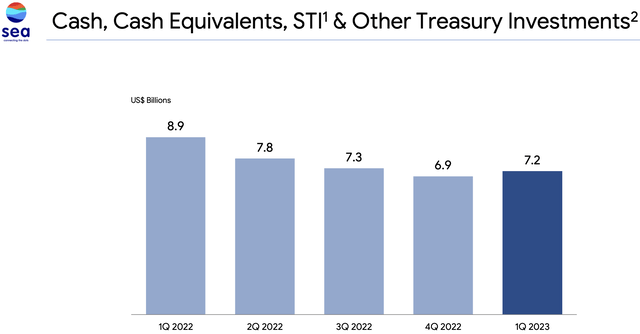

Sea’s Money & & Equivalents Start Increasing Due To Robust Free Capital Generation

Sea Ltd. Q1 2023 Profits Discussion

2 Definitive Vantage Points

In the interest of efficiently serving you, I think there are 2 definitive viewpoint for the Sea Limited ( NYSE: SE) (henceforth, simply Sea) thesis. We will discuss them listed below; after which, we will attend to the last sticking around Garena-related problem that business currently deals with, for which there seems light at the end of the tunnel. We will get to that later on.

- Sea now creates complimentary capital.

- Sea is probably the greatest it’s ever been as a business, while likewise trading near its least expensive evaluation ever as a public business (it was less expensive in late 2022). We explored this truth utilizing the TGI structure (which is a structure I have actually shown you in previous notes. In other words, it’s paradoxical that Sea would run from essentially its biggest position of strength ever, while trading at one of its least expensive evaluations in its business history. That is “The Best Paradox.”) We will discuss this today in this note.

As an aside, I have actually been thinking of “sticking around organization concerns” normally speaking, and I would state that, like a collaboration with a partner, one will inevitably discover “sticking around concerns” in whatever path or organization they pick.

Naturally, this harkens to the ageless saying:

The yard isn’t constantly greener on the other side.

Usually, perseverance, perseverance, and psychological perseverance are the service, rather than bailing to viewed greener pastures (where one will typically experience the exact same obstacles they experienced in their previous scenario). There’s subtlety here to be sure, however it is an approach by which I personally live.

With this in mind, let’s start!

Sea Ltd. Now Produces Free Capital

Since today, Sea has actually accomplished success. It now both creates complimentary capital, as additional evidenced by the previously mentioned growing money balance (which did not happen through funding activities, to be sure), and GAAP earnings.

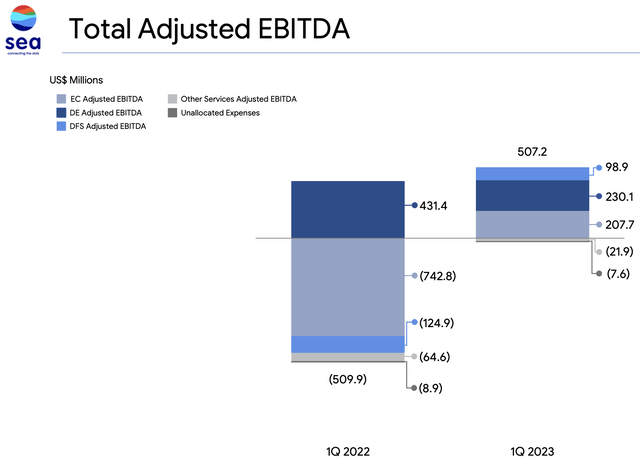

We can see these truths in the charts listed below:

Rough Approximation Of Free Capital (Required To Deduct CAPEX To Represent Left Out “D&A”)

Sea Ltd. Q1 2023 Profits Discussion

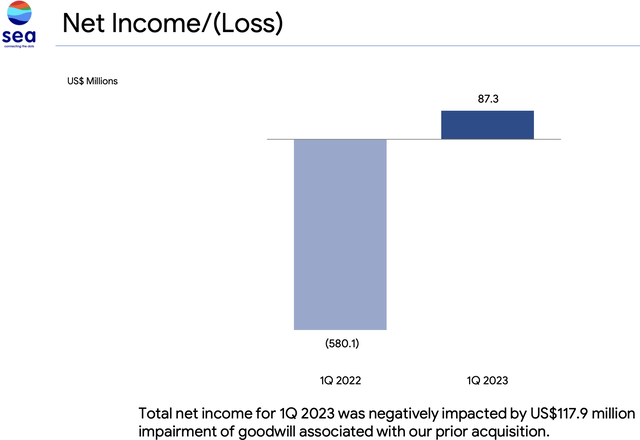

And, listed below, we can see that Sea now creates GAAP earnings. These GAAP earnings would have been bigger were it not for a one time write-down cost, in which Sea documented goodwill worth on the property side of its balance sheet to represent the decrease in worth of an acquisition it formerly made.

Sea Ltd. Q1 2023 Profits Discussion

So, in other words, Sea now creates robust complimentary capital, which it can utilize for a range of functions, e.g., the development of its cloud organization, which it just recently noted it may pursue.

Short Aside Regarding The Future Of Sea

Openly, while the cloud organization would be great, and, with the introduction of our most current AI innovation, it’s practically “really essential” for humankind, I would much choose CEO Forrest Li to concentrate on constructing out Shopee Express (generally satisfaction by Amazon however in SE Asia) where Shopee catches most of the 1P market in SE Asia (to the level possible! Essayons!).

I do believe Mr. Li comprehends this and is making great development in this regard.

In the past, I adamantly voiced my annoyance with Sea’s entryway into LatAm, as I thought it was a pointless waste of investor capital that was abutting the areas of 2 of the most “customer-centric” services in the world, i.e., MercadoLibre ( MELI) and Amazon ( AMZN), both of which I have actually owned and studied carefully.

Sea has actually considering that recognized as much as well, eventually withdrawing from most of its LatAm markets and the EU, much to the relief of investors, I’ll include.

Today, my hope is that Mr. Li acknowledges the moat that he might develop by constructing out a huge self-governing logistics network: the objective must be to develop “completely self-governing storage facilities,” where he take full advantage of the capability to develop customer surplus in SE Asia.

I think Sea’s logistics network must look like a realistic “superintelligence.”

Naturally, this is simply my 2c, however I think it would be the most sensible usage of investor capital since today, by which to enhance the customer surplus for those served.

I do hope that Sea starts constructing computing centers too, as that would pay for business low-cost calculate, with which its self-governing factories would run, and it would support the development of the AI/global information neighborhood that I have actually hoped would emerge considering that I started sharing my concepts openly.

Let’s now rely on the 2nd perspective.

Thinking About Sea Through The TGI Structure

- TGI Structure = The Best Paradox structure, which I used in late 2022 to examine a variety of services. It successfully mentioned that lots of services, consisting of Sea, were running from their biggest positions of strength, while at the same time trading at their most depressed evaluations in their business histories. I considered it significantly paradoxical that these services traded at such lofty evaluations in the late 2010s and early 2020s when they ran from weaker positions.

With Sea now producing robust complimentary capital, we might include another pillar to the relatively enormous paradox that has actually been the marketplace’s trading of business over the last 60 months approximately.

As I have actually shared just recently, I mention Mr. Market with just ideal deference.

I do not indicate to disparage Mr. Market in any sense. All of us get things incorrect sometimes, and I am no complete stranger to this truth.

However, in my evaluation, which I think to be unbiased truth, Mr. Market’s rates of Sea has actually been relatively paradoxical. And, as we understand, the fantastic paradox we have actually seen has actually been approximately associated with “the fantastic chance.”

With these concepts since our platform, I will not belabor Sea’s fantastic paradox; rather, I will share Whipping The marketplace’s operate in detailing it:

- The Best Paradox 10 (SE) (S)

- Keep in mind that you need not check out that note to totally understand the thrust of this note to you today.

To quickly sum up the concepts provided because note, as you consider it, you will discover that Sea has actually accomplished practically amazing accomplishments of development.

I think that, if you shared the metrics provided in the above note in a vacuum: sans share cost information, sans debate of LatAm, sans The Whatever Bubble of 2021, sans the current bank failures sped up by the fastest repricing of credit in the history of America, the observer would conclude that Sea is favorably in its biggest position of strength ever, after having actually accomplished merely awesome accomplishments of entrepreneurial success and development.

It is my belief that the observer would mention, “Merely amazing … How did they do it ?! Exists a method I could purchase into this organization practically amazing organization? Who are the business owners who developed this?”

Naturally, this is merely my point of view, though one in which I emphatically think. And, obviously, there is share cost information, 24/7 news, and so on, and all of the predispositions that connect to it.

Now, with all of that being stated, it’s not all sunlight and roses. Let’s now check out some concerns that Sea has actually dealt with and might deal with even more.

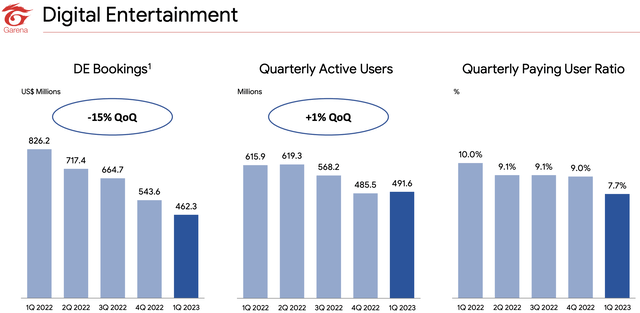

Garena’s Sales Collapse

Sea Ltd. Q1 2023 Profits Discussion

On the topic of Garena’s sluggish movement sales collapse, I shared the following:

In my eyes, it was a terrific quarter, excepting the ongoing monetary bleed in DE (detailed above). That stated, we’re still producing ~$ 1B in capital from that section each year. That’s great. We’re showing running take advantage of in our ecommerce organization and FinTech organization. That’s great.

Money balance continues to grow as business creates complimentary capital. Lots to like, though I will report back on management’s commentary on DE reservations.

[I believe management has the right plan, which entails optimizing for user experience first; then, monetizing in the years and decades ahead. Game franchises, when properly stewarded, last much longer than most realize!]

So earnings in the Q had to do with $200M ex the write-down. So SE is trading at about 50X? or thereabouts EV/fcf.

[If we annualize Sea’s GAAP net income, it currently trades at about 45X EV/net income. Note that Sea is still very much a “growth business” that is aggressively reinvesting into its business, as we briefly explored above. I do not believe paying about a 2% fcf/EV yield is egregious in light of this reality, and this reality, i.e., Sea is reinvesting in its business, will likely produce growth reacceleration in the years and decades ahead.]

On the topic of Garena’s collapsing sales, I indicate it’s bad … no doubt.

However it’s not completion of the world.

BTM’s membership count has actually been decreasing for [nearly] years!

I’m not grumbling! I’m not giving up! I’m still [giving it my all]!

( as I think SE and its group are doing!)

[And I have 100% faith that Beating The Market’s subscription count, like Garena’s sales, will begin trending in the right direction in due course. Business is non-linear; sometimes fairly viciously so. We explored these ideas together and more in this note.]

Beating The Marketplace Talks: Core Economic Facilities Channel.

In summary, I think Sea has the best method to protect the stability and fanbase of Free Fire, and, as such, Complimentary Fire’s reservations will go back to development and/or stability eventually in the years ahead.

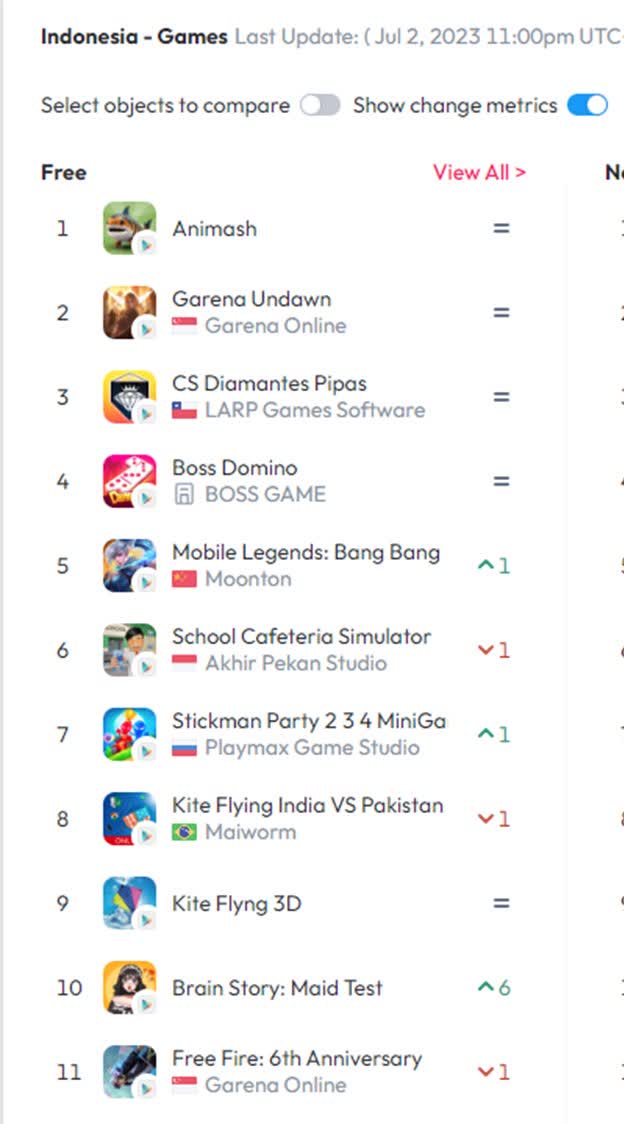

Additionally, Garena’s most current hit video game title, Undawn, seems carrying out well according to current information:

Google Play Shop Google Play Shop

Approximately speaking, Sea trades at about 29x EV/Garena’s money from ops today.

There’s Shopee and Sea Cash and Sea advertisements and Shopee Express, and future services that Sea will layer on too. Nevertheless, in my evaluation, we’re just spending for Sea’s, rather especially, really effective video game studio that’s currently experiencing some non-linearity.

Let’s now quickly think about Sea Advertisements and Sea Cash, both of which are important to the financial investment thesis for Sea.

Sea Advertisements And Sea Cash

Our initial note on Sea explored its digital advertisement aspirations (to name a few subjects), which Whipping The marketplace continues to highlight to this day. For example, I have actually been just recently sharing concepts such as,

Still the very best time in 15 years to be considering this channel and ( GOOG).

MACS’ digital advertisement development will likely be awesome, and I really seldom see any person speak about it.

Which is odd … due to the fact that in between Roku ( ROKU)/ The Trade Desk ( TTD)/ Linked Television and MACS, I do not understand that there are more amazing locations in the digital advertisement market.

Find Out More About Beating The marketplace’s MACS Acronym Here

And I think we can determine Sea pulling on this digital advertisement lever through information points such as (focus included):

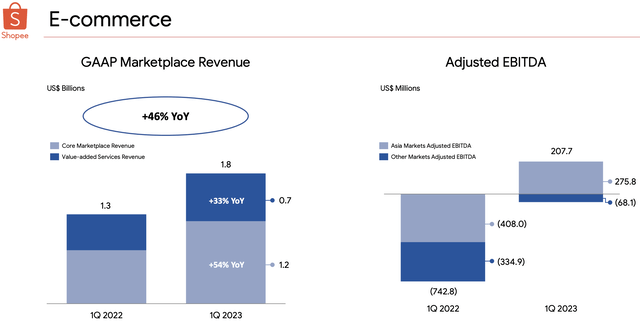

” Core market income, primarily including transaction-based costs and marketing incomes, was up 54.3% year-on-year to US$ 1.2 billion.”

Forrest Li, CEO, Sea Ltd.’s Q1 2023 Profits Call

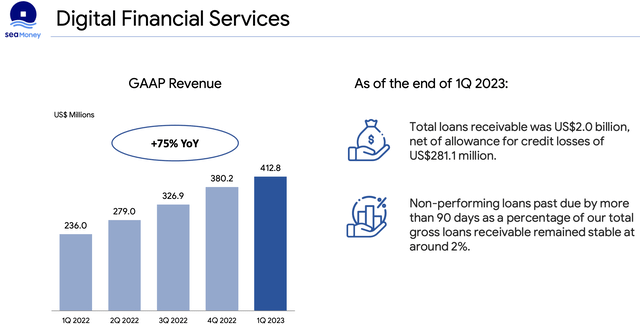

Relying On Sea Cash, our 2nd deal with Sea focused around its FinTech aspirations.

In TGI 10, we more granularly showed the “practically amazing” development Sea’s FinTech organization had actually experienced over the last 5 approximately years (remember Sea’s services are 5-10 years of ages, and they currently created well over $10B in rewarding income. I am delighted for what the future will bring for Sea).

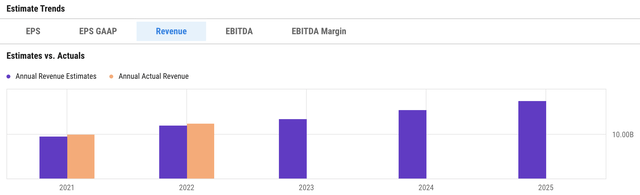

Sea’s Sales Price quotes, Fwd. 3 Years

Which work was asserted on our initial assessment of Sea’s FinTech organization.

Today, Sea Cash is significantly bigger than where it stood when we initially started protection of this industry.

Sea’s Current Company Efficiency

Sea Ltd. Q1 2023 Profits Discussion

Since Might 20th, 2023, it’s most likely that Sea runs at an annualized run rate of really approximately $2B in rewarding monetary services sales.

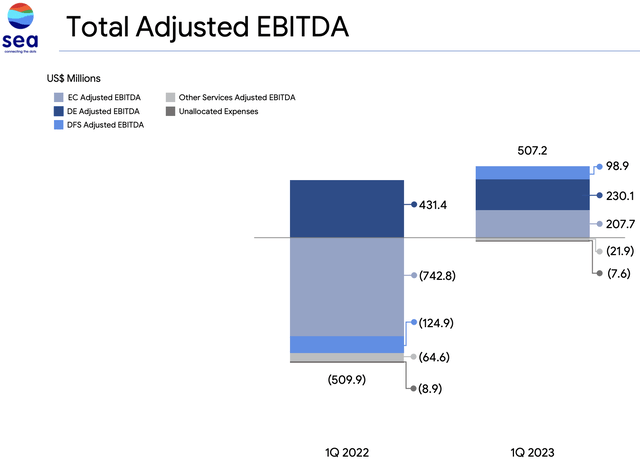

Sea Cash produces about $100M in adjusted EBITDA (approximately complimentary capital, as there is no capex and Sea has little interest cost)

Sea Ltd. Q1 2023 Profits Discussion

Now, this is fantastic, however I do not think the marketplace is totally pricing this truth in.

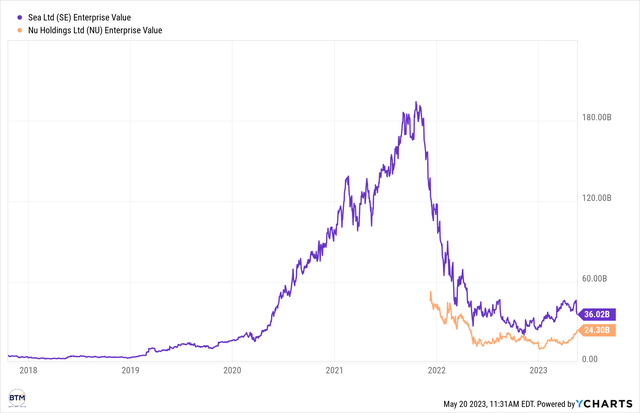

To highlight this concept through some objectively rough information, in LatAm, Nu Holdings Ltd. ( NU) trades at about $24B in business worth. Nu runs at about $3.5 B in annualized income run rate, and it has about the exact same variety of users as Sea Cash (really approximately, 60M to 70M).

Sea & & Nu’s Business Worths

Utilizing this as a point of recommendation, Sea Cash must trade at about $15B to $20B in business worth.

Today, the totality of Sea trades at about $36B in business worth (remembering its big net money position, which grew in Q1 2023).

Because of how well Sea’s ecommerce department has actually been carrying out, I think that this represents rates that may be a bit too cynical; particularly due to how quickly Sea might grow as soon as we emerge from this really fast rates of interest treking cycle.

The Unbelievable Efficiency Of Sea’s Ecommerce Company, Q1 2023

Sea Ltd. Q1 2023 Profits Discussion

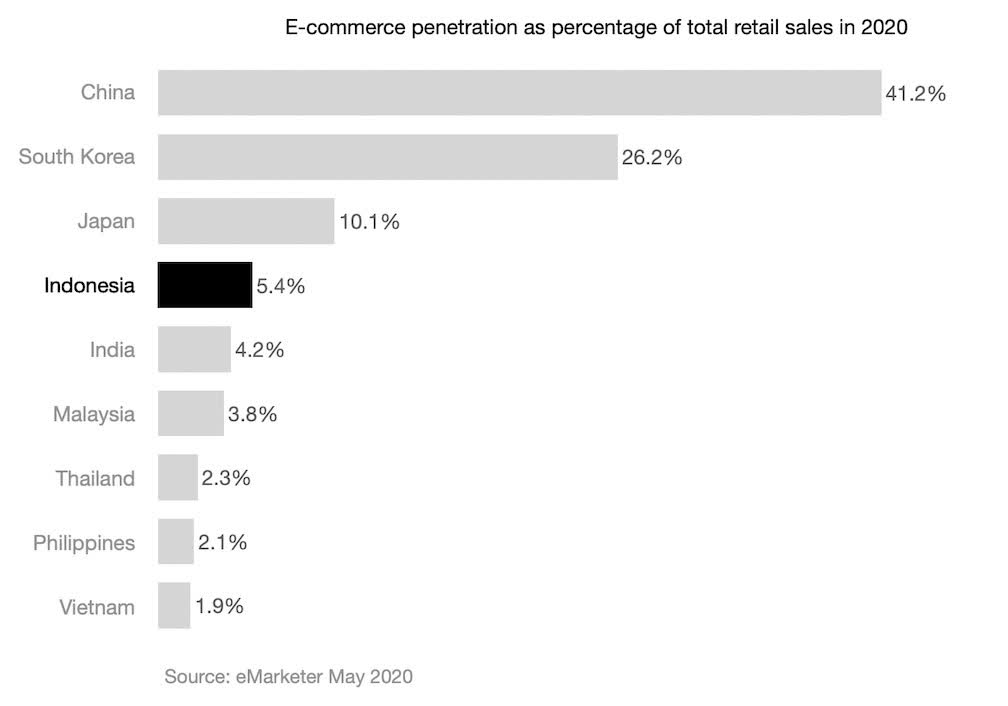

Shopee’s Long Roadway Ahead, Graphically Depicted

eMarketer

In other words, I think Sea must approximately trade at over $50B in business worth today, were the marketplace really pricing in the net present worth of what I think will be robust money streams for years to come.

Concluding Ideas

With monday.com Ltd. ( MNDY) and Sea now producing robust complimentary capital sustainably, we can continue to build up these services with higher self-confidence.

We have actually constantly thought these to be a few of the very best services in the world.

Now, with robust, continual complimentary capital, along with amazing development (particularly as soon as we get on the opposite of all the bank failures and the fastest repricing of credit in U.S. history); along with vibrant cultures, there’s definitely a lot more of an aspect of “letting these names ride on auto-pilot” into the future.

There’s likewise the really amazing component of these business now having robust capital whereby they might even further reinvest and even further speed up development in the future.

In other words, I am really delighted with the efficiency of Sea; Garena’s collapsing sales regardless of.

Must you desire more work from me on business of Sea, I would motivate you to check out the list below notes:

Thank you for reading and have a terrific day.