-

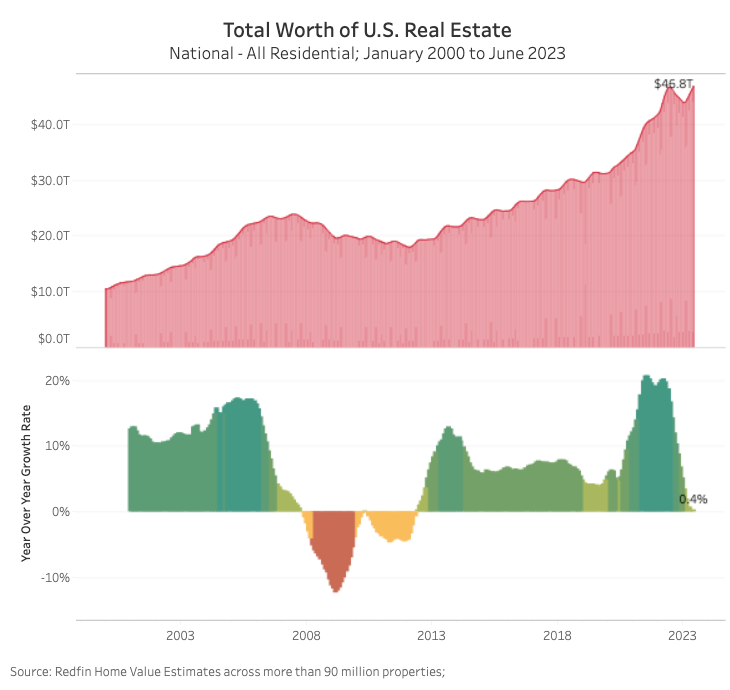

The overall worth of U.S. houses struck a record $47 trillion in June as a deficiency of homes for sale propped up worths.

-

Cost effective markets consisting of Little Rock and Milwaukee saw the greatest dives in worth, while expensive West Coast cities and pandemic boomtowns dealt with big drops; L.A. has actually shed $153 billion because last summer season.

-

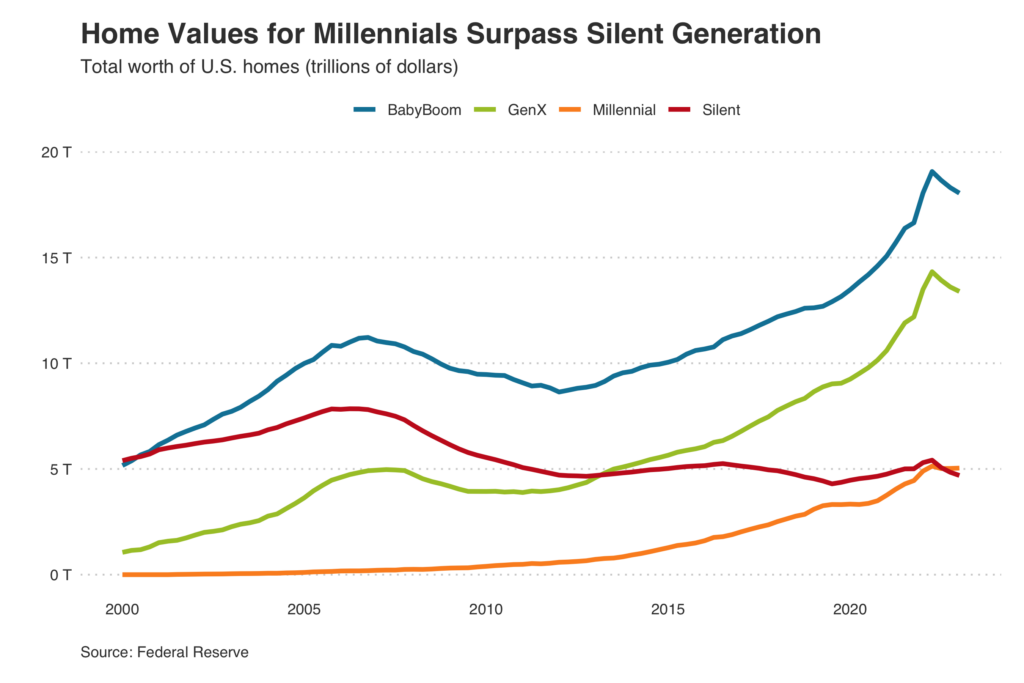

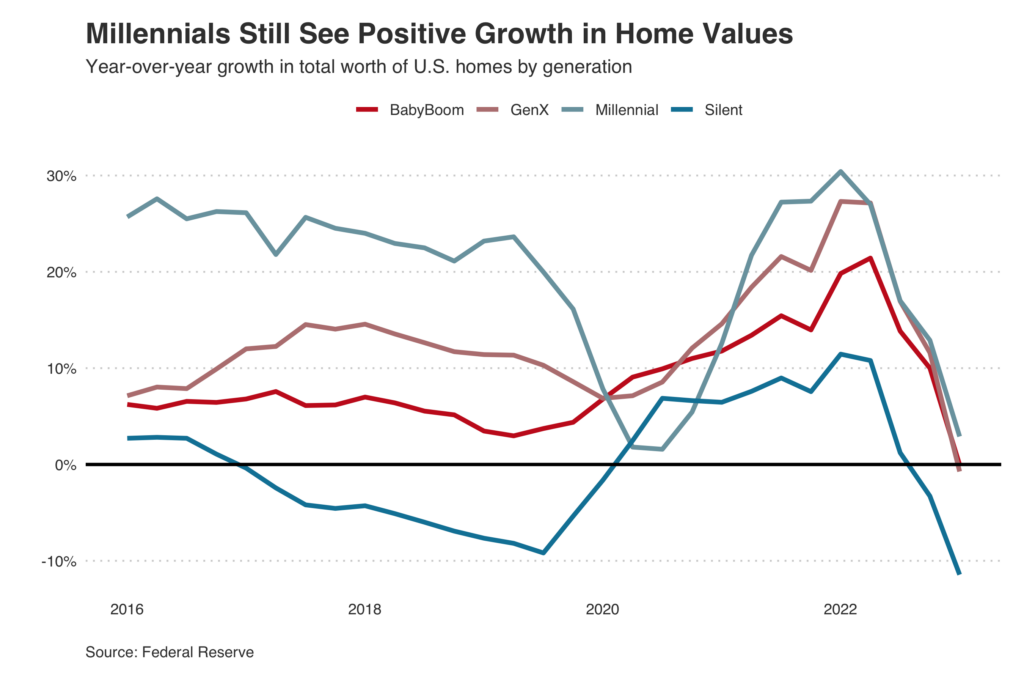

Millennials got more worth than any other generation, exceeding the Quiet Generation in overall worth.

-

Asian property owners were disproportionately impacted by home-value decreases; lots of reside in the West, which saw an outsized drop in worth.

-

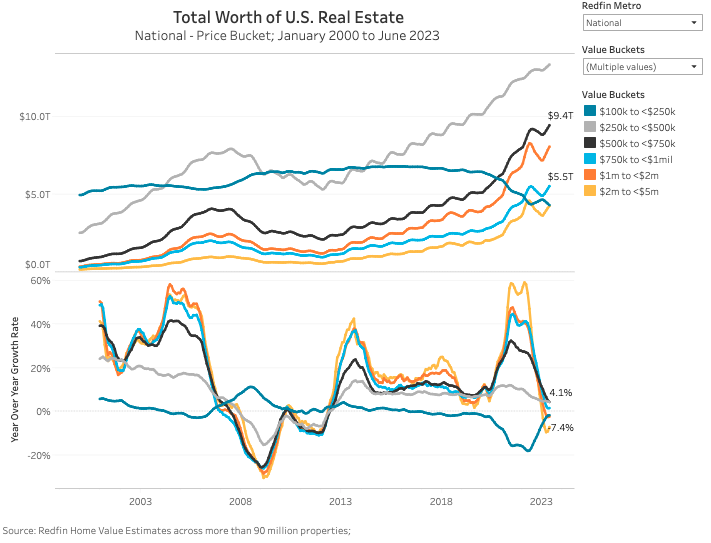

High-end houses are declining, while houses worth in between $250,000 and $750,000 are publishing gains.

The overall worth of U.S. houses struck a record $46.8 trillion in June, surpassing the previous all-time high of $46.6 trillion set a year previously, as a lack of houses for sale propped up real estate worths. That’s according to an analysis of the Redfin Quote on more than 90 million U.S. homes. This information goes through modification.

The worth of U.S. houses increased 0.4% ($ 166.2 billion) from a year previously in June and 19.1% ($ 7.5 trillion) from 2 years previously. The real estate market has now balance out the $2.9 trillion decrease in worth– triggered by increasing home loan rates– that happened from June 2022 through February 2023.

Today’s real estate market is special due to the fact that house worths are at a record high despite the fact that need is slow. Regardless of lukewarm need, there aren’t adequate houses to walk around due to the fact that so couple of property owners are offering. This imbalance in between supply and need is keeping worths afloat.

” The supremacy of the 30-year set rate home loan in America is propping up house worths,” stated Redfin Economics Research study Lead Chen Zhao “Lots of property owners scored an unbelievable offer throughout the pandemic: a 3% home loan rate for the rest of their 30-year loan. Now they’re sitting tight due to the fact that moving would indicate handling a rate that’s two times as high. This suggests purchasers who remain in the marketplace now are fighting for a really little swimming pool of houses, avoiding house worths from plunging.”

In other nations, variable-rate home loans are more typical than fixed-rate home loans, suggesting the “ lock in” result is much less typical.

Approximately 9 in 10 property owners with home loans have a home loan rate under 6%, which is almost a complete portion point listed below today’s 6.96% average. As an outcome, simply 1% of the country’s houses have actually altered hands this year– the most affordable share in a minimum of a years. The variety of homes for sale in the U.S. dropped 15% year over year to an all-time low in June, the greatest yearly decrease in almost 2 years.

” The U.S. real estate market has actually ended up being a system of winners and losers,” Zhao stated. “The winners are property owners who purchased in the past home loan rates began increasing; they continue to develop equity despite the fact that property buyer need has actually slowed. The losers, unfortunately, tend to be newbie purchasers. They’re going into the marketplace at a time when it’s costly to obtain cash, house rates are near their record high, and there are really couple of homes to select from.”

West Coast Tech Hubs, Pandemic Boomtowns Saw Most Significant Drops in House Worth

There are 32 U.S. cities where aggregate house worth decreased from a year previously in June, bucking the nationwide pattern. Eleven of those 32 remain in California and 7 remain in Texas. This analysis consists of the 100 most populated city locations for which there sufficed information.

The worth of houses in Austin, TX fell 9.6% year over year to $388.1 billion in June– a bigger decrease than any other city. Next came Oakland, CA (-8.7%), Seattle (-8.1%), San Francisco (-7.8%) and Los Angeles (-6.6%). Completing the leading 10 are San Jose, CA, Phoenix, Oxnard, CA, Las Vegas and Sacramento, CA

Expensive West Coast markets like San Francisco and Seattle have actually experienced outsized decreases due to the fact that they’re amongst the most costly markets in the country, suggesting house worths had more space to fall. Ratings of remote employees left these locations throughout the pandemic looking for more area and much better bang for their dollar, adding to the drop in worth. In addition, the West Coast has actually been struck hard by tech layoffs. Numerous purchasers in expensive seaside markets likewise got sticker label shock after seeing the effect of raised home loan rates on paper; in a city like San Francisco, a greater rate can relate to a month-to-month real estate costs that’s countless dollars more costly.

The circumstance is rather comparable in pandemic boomtowns; house worths overheated, leaving many individuals evaluated. Worths rose in Sun Belt cities consisting of Austin, Phoenix and Las Vegas due to the fact that ratings of remote employees relocated. Now, house worths in those locations are returning down to earth.

” Periodically, an unique home will get several deals, however that’s not the standard in Austin any longer,” stated regional Redfin Premier realty representative Carmen Gioia “ Purchasers are going shopping however taking their sweet time, in part due to the fact that there’s a lot stock. I’m cautioning my sellers that it might take a couple of weeks to offer, even if their house is priced well.”

In dollar terms, Los Angeles saw the greatest decrease in aggregate house worth, publishing a $152.6 billion year-over-year decrease in June. It was followed by Oakland (-$ 85.8 billion), Seattle (-$ 82.7 billion), Phoenix (-$ 58.4 billion) and San Francisco (-$ 57.5 billion).

Fairly Budget-friendly Markets Published the Most Significant Gains in House Worth

The worth of houses in Little Rock, AR climbed up 8.8% year over year to $63.7 billion in June– a larger boost than any other city. Next came Camden, NJ (8.7%), Milwaukee (8.5%), Wilmington, DE (8.5%), Bridgeport, CT (8.3%), Greenville, SC (7.8%), Hartford, CT (7.6%), Charleston, SC (7.2%), Greensboro, NC (7.2%) and Columbia, SC (7.1%).

House worths in these locations didn’t get too hot almost as much as they performed in locations like Phoenix and San Francisco throughout the pandemic, suggesting they have space to increase. In a bulk of the 10 previously mentioned markets, the common house still costs listed below the nationwide average of $ 426,056 That’s most likely reinforcing property buyer need, due to the fact that less individuals are evaluated.

In dollar terms, Atlanta saw the greatest dive in aggregate house worth, publishing a $40.1 billion year-over-year boost in June. It was followed by Boston ($ 33.4 billion), Miami ($ 30.3 billion), New Brunswick, NJ ($ 22.6 billion) and Montgomery County, PA ($ 21.4 billion).

Millennials Now Hold More House Worth Than the Quiet Generation

The overall worth of U.S. houses owned by millennials increased 2.9% year over year to $5 trillion in the very first quarter of 2023– the most current duration for which generational information is readily available– a larger boost than any other generation. That’s the 2nd quarter in a row that Millennials have actually held more worth than the Quiet Generation, on a modified basis. The worth of houses owned by the Quiet Generation fell 11.4% to $4.7 trillion. On the other hand, the worth of houses owned by Generation X dropped 0.7% to $13.4 trillion, and the worth of houses owned by Infant Boomers was flat, at $18 trillion.

The Quiet Generation has actually lost house worth as a lot of its members have actually died or moved into retirement community. Millennials have actually gotten worth due to the fact that they remain in prime homebuying age, which suggests they’re acquiring considerably more houses than they remained in current years. Millennials now comprise the greatest piece of the homebuying pie, acquiring approximately 60% of houses purchased with home loans over the last a number of years.

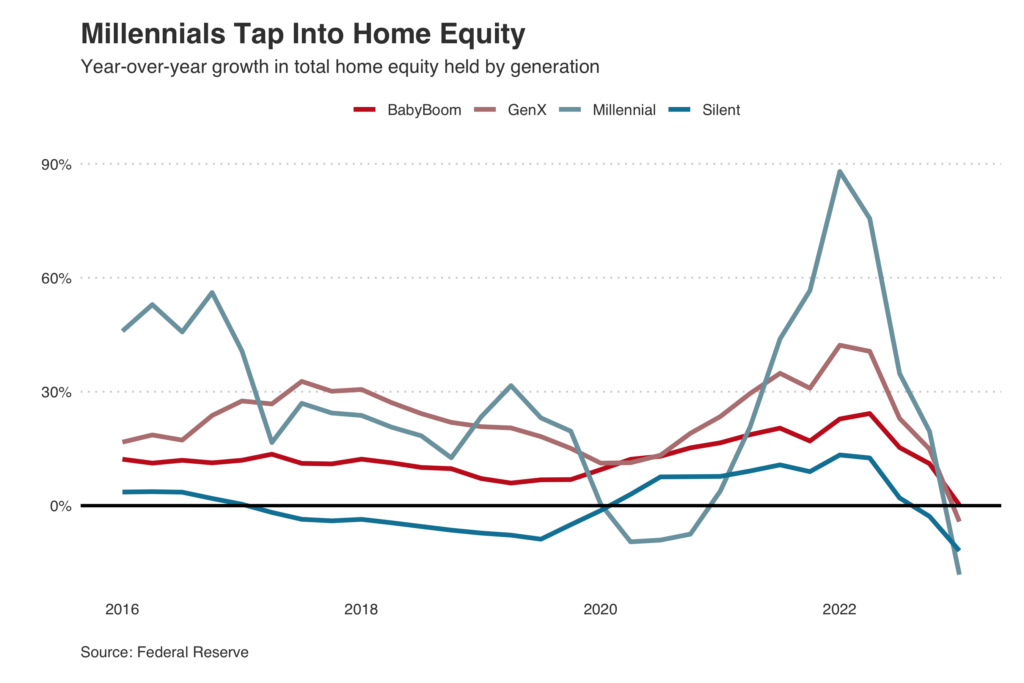

Remarkably, Millennials have lost house equity. Millennial house equity decreased 18.2% year over year in the very first quarter– a larger decrease than any other generation. That’s most likely due to the fact that Millennials are taking advantage of the house equity they got throughout the pandemic– through items like house equity credit lines ( HELOC)– to settle charge card financial obligation and trainee loans and financing house remodellings, Zhao stated.

House Worths Held Up Much Better in Suburbs and Backwoods Than in Urban Locations

The overall worth of houses in metropolitan locations fell 0.9% year over year to $10.2 trillion in June. On the other hand, the worth of houses in the suburban areas increased 0.2% to $29.1 trillion and the worth of houses in backwoods increased 2.6% to $7.4 trillion.

The suburban areas returned into style throughout the pandemic while cities fell out of favor– mostly due to the shift to remote work and the real estate price crisis. While cities have actually recovered to some degree as companies have actually asked employees to go back to the workplace, lots of Americans still work from another location, incentivizing homebuying in distant, economical locations.

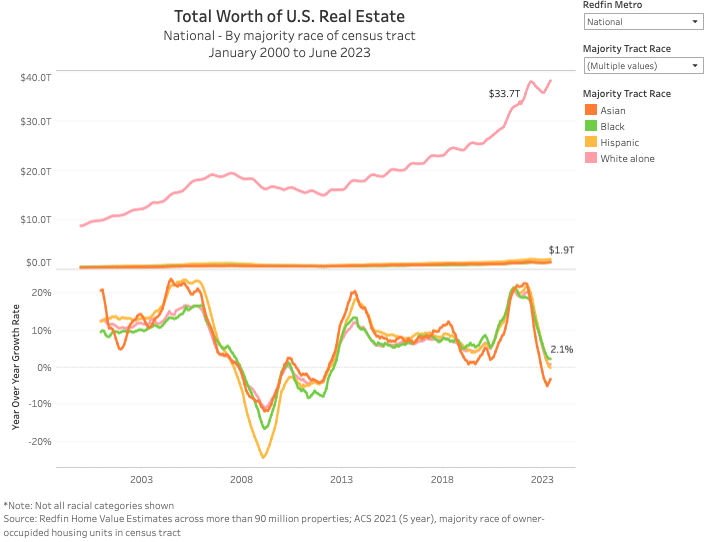

Asian Areas Experienced an Outsized Drop in House Worth

The overall worth of houses in communities that are majority Asian fell 3.3% year over year to $1.3 trillion in June. By contrast, bulk Hispanic/Latino communities saw a 0.3% decrease (to $1.9 trillion), while bulk white communities experienced a 0.7% gain (to $38.1 trillion) and bulk Black communities saw a 2.1% boost (to $1.3 trillion).

One factor Asian property owners might be losing more worth is lots of survive on the West Coast, which has actually seen a reasonably big dropoff in house worth, Zhao stated. Nearly half of Asian Americans reside in the West, with almost a 3rd in California alone, according to a 2021 report from Bench Proving Ground.

Residences Worth In Between $250,000 and $750,000 Saw Most Significant Dive in Worth

The overall worth of houses worth in between $500,000 and $750,000 increased 4.1% year over year in June, and those worth in between $250,000 and $500,000 saw a 4% gain. By contrast, houses worth in between $2 million and $5 million experienced a 7.4% drop in worth, and houses worth in between $1 million and $2 million saw a 2.6% decrease.

A lot of the nation’s high-end houses lie in expensive West Coast markets, which have actually seen outsized drops in house worth. The high-end real estate market has actually likewise been struck specifically hard– especially in the Bay Location and Seattle– as economic crisis worries and high house rates have actually triggered customers to avoid high-end items.

Approach

This analysis approximated present (June 2023) house worths utilizing the Redfin Quote, MLS information and public records. The Redfin Price quote covers more than 90 million single-family houses, apartments, townhouses and multifamily homes, and is readily available in most however not all parts of the U.S. Historic worths were imputed utilizing public records and MLS information on rate per square foot patterns by postal code (or city, county or state when zip-code information was inadequate). Both existing houses and new-construction houses are consisted of in this dataset, which goes back to the year 2000. Residences are not contributed to the dataset up until they are very first developed or offered.

Residences are identified to be rural, rural or metropolitan based upon classifications for the census system of the residential or commercial property from the U.S. Department of Real Estate and Urban Advancement (HUD). HUD has a design that explains area types based upon actions to the 2017 American Real Estate Study.

House worths by race/ethnicity are based upon a category of the house’s census system. We categorized a census system as Black, Hispanic/Latino, Asian or white if more than 50% of owner-occupied families were owned by Black, Hispanic/Latino, Asian or white property owners from 2017 through 2021, according to owner-occupied family race information from the five-year American Neighborhood Study. A census system was categorized as combined race if no race had higher than 50% of the owner-occupied family share in the system.

House worths by generation are based upon the Distributional Financial Accounts information from the Federal Reserve.