chameleonseye

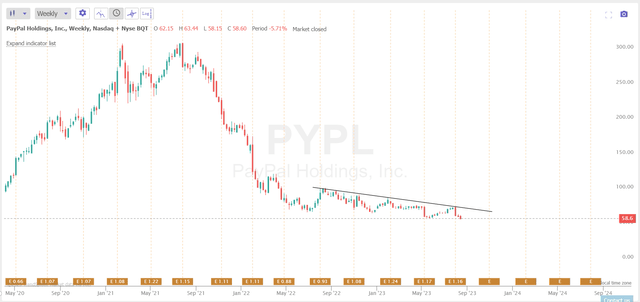

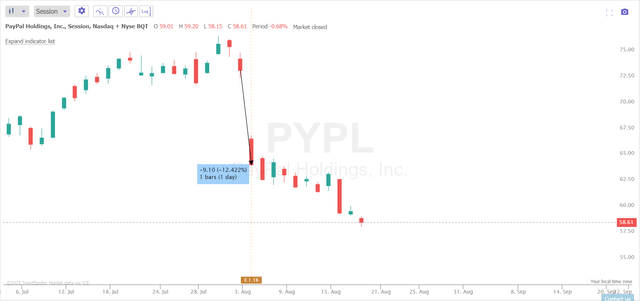

The last and only time I blogged about PayPal Holdings, Inc ( NASDAQ: PYPL) wanted its Q1 FY2023 report in May, after which PYPL stock fell almost 13% in one day and after that continued to fall, losing another 10% or two after that heavy dip.

In my Might short article, I argued that PYPL was not that underestimated even after such an enormous correction. My assessment analysis at the time led me to conclude that PYPL needs to just yield about 20% over the next 5 years, implying the stock needs to just grow by 3.72% yearly. That was too low for a “Buy” suggestion.

A couple of days earlier, the business reported on Q2 FY2023 results, and a few of my forecasts came to life. In any case, the drop is not over yet:

TrendSpider Software application, author’s notes

Today, I wish to upgrade my protection and reassess my previous forecasts based upon what we saw in PYPL’s Q2 financials.

Q2 Outcomes And What They Triggered

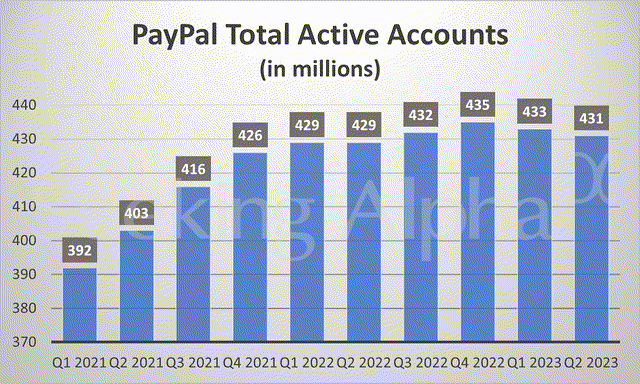

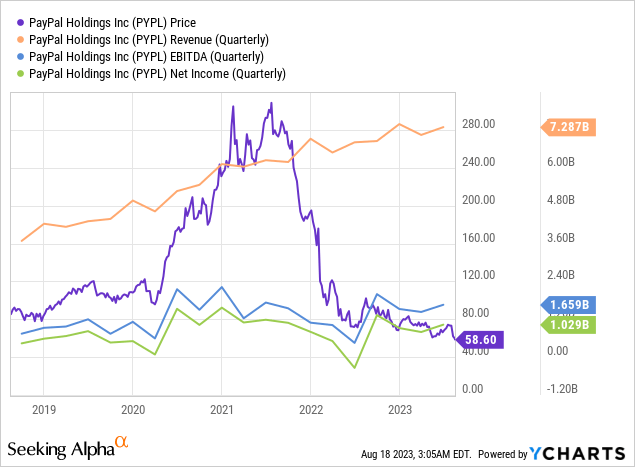

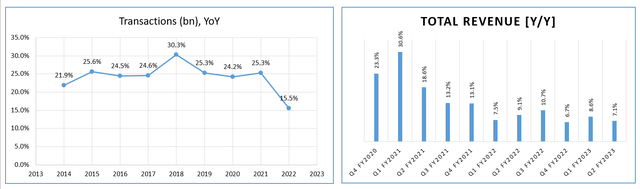

PayPal’s Q2 results, released on August 3, 2023, revealed Non-GAAP EPS of $1.16 in line with expectations, and profits of $7.3 billion pounding quotes by $30 million[7.4% YoY growth] Overall payment volume struck $376.5 billion, up 11%, and deals grew by 10%. Active accounts reached 431 million. The management supplied FY2023 assistance with GAAP EPS of ~$ 3.49 (+67% up from $2.09 in FY2022) and Non-GAAP EPS development of ~ 20% to ~$ 4.95 (+19.8% up from $4.13 in FY2022).

You would believe that the outcomes need to make financiers pleased – simply take a look at the forwarding boost in EPS[according to the guidance] However on the day the PYPL report was launched, the stock plunged >> 12% and has continued to edge lower since:

TrendSpider Software application, author’s notes

Why is it taking place?

The decrease can be generally credited to an ongoing reduction in active represent the 2nd successive quarter:

Financiers fear that PYPL will continue to lose market share as an outcome of this inexorable decrease. Up until now, no clear effects can be originated from the accurate monetary outcomes.

As Argus Research study expert, Stephen Biggar, composed in his note [August 3, 2023 – proprietary source], the business has actually modified its marketing technique to focus less on brand-new users and more on higher usage by existing users. Over the previous couple of years, the company broadened its “Purchase Now Pay Later On” [“BNPL”] offering by presenting short-term installation items in the U.S. and UK. It likewise introduced a brand-new service allowing consumers to trade cryptocurrencies utilizing their PayPal accounts.

In my viewpoint, the issue with PYPL depends on its bad unit-economics metrics, along with in the exceedingly high assessment that financiers at first gave up the hope of rapidly dominating the marketplace in brand-new sections.

Let’s very first upgrade my design with the Q2 numbers – they will assist me describe exactly what I indicate by bad system economics.

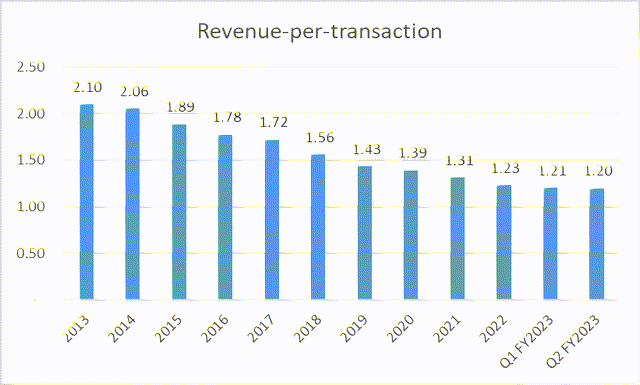

Excel, author’s work Excel, author’s work

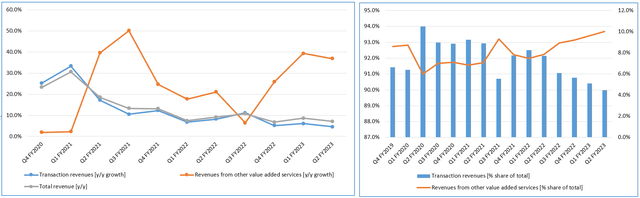

As you can see, although in outright terms PYPL’s profits has actually grown at a CAGR of 15.1% given that 2013, the revenue-per-transaction ratio has actually been falling by ~ 5.2% yearly.

Still, the development in the “Earnings from other value-added services” that you might see in the infographic listed below does not include any concrete incremental development or diversity, as the share of this sector in the profits structure has actually just grown to simply 10% of combined profits figure:

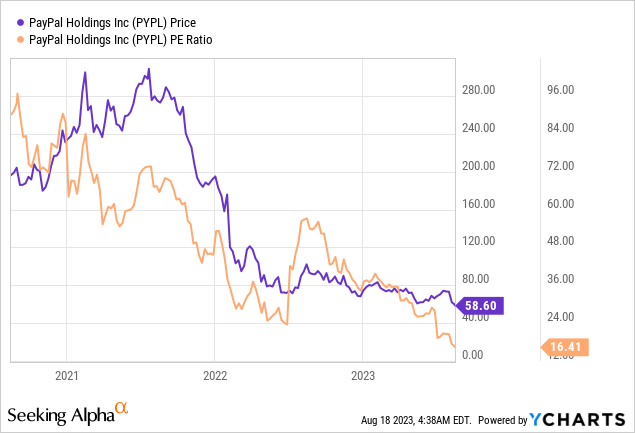

So we see that the business’s brand-new jobs do not actually bring strong total top-line development. PYPL’s earnings continue to decrease as the addressable market ends up being increasingly more saturated. Here is where the frustrating photo of falling assessment metrics originates from. The P/E ratio, for instance, has actually fallen from ~ 40-40x in FY2022 to simply ~ 16x as financiers discount rate PYPL’s capability to grow as highly as it was anticipated formerly:

As last time, let’s presume the PYPL will have the ability to grow its user base by just 2% YoY over the next 5 years[which is already better than the decline in Q1 and Q2] Then my earlier forecasts on PYPL’s essential system financial metrics need to still hold:

| Year | Users [M] | Deals [B] | Sales [$M] | Revenue-per-transaction |

| 2023 | 441.66 | 24.98 | $ 29.22 | 1.17 * |

| 2024 | 450.49 | 27.97 | $ 32.07 | 1.15 |

| 2025 | 459.50 | 31.33 | $ 35.2 | 1.12 |

| 2026 | 468.69 | 35.09 | $ 38.64 | 1.10 |

| 2027 | 478.07 | 39.3 | $ 42.41 | 1.08 |

| Presumptions [YoY] | +2% | +12% | -2% |

Source: Author’s work [* – the ratio will decline by 5.2% in FY2023]

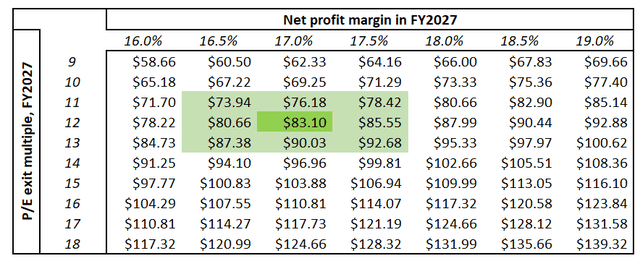

Despite the fact that last time my forecast of an exit several P/E of 12x was slammed by SA readers, I think this number is the most affordable to determine the reasonable worth of PYPL. Why? Initially, we use the required concept of conservatism due to the fact that there is constantly the temptation to purposefully come to the conclusion that fits our prejudiced brain. Second, nobody has actually canceled business cycle. The older the business gets, the harder it ends up being to grow, and appropriately, the bigger the discount rate to assessment need to be. It is really crucial to include here that another presumption is stitched into this presumption: PYPL will not grow as quickly as it did prior to 2022.

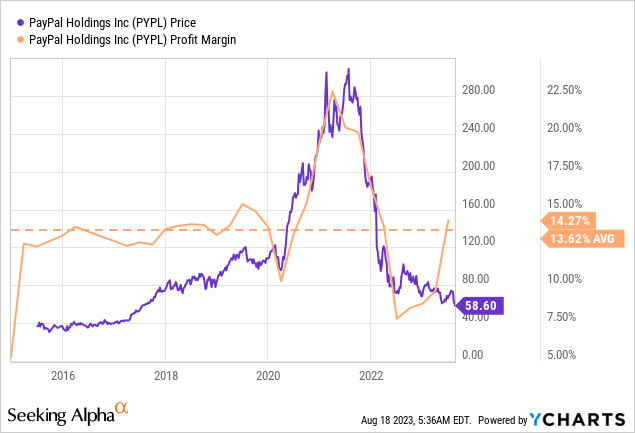

Let’s presume that the net margin is raised above the long-lasting average versus the background of the maturity of business cycle. Let’s state from the present 14% to 17%, 200 basis points greater than I presumed formerly.

Then, my upgraded assessment design yields a benefit of 36% by the end of FY2027, which represents a CAGR of ~ 6.3% given that today:

In basic, under conservative presumptions, PYPL stock is presently underestimated. However if we believe in a probability-like context, then with such an upside capacity, PYPL presently has no margin of security, based upon the above estimations. Approximately comparable returns can be discovered in the financial obligation market today. So why would a financier pay too much for the equity danger in this specific case is not totally clear to me.

The Decision

I am ready internally that a number of the readers will disagree with my viewpoint. Stocks that are falling quickly however still have strong TTM financials constantly draw in worth hunters. The bottom line here, nevertheless, is that the TTM numbers inform us absolutely nothing about the future. The truth is that in spite of its best shots, PYPL is losing market share and its development continues to stagnate quarter-on-quarter, leading to ever-lowering assessment multiples.

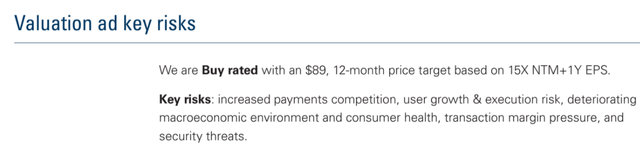

Maybe the brand-new CEO can turn things around. Goldman Sachs equity research study experts just recently released a note (August 14, 2023 – exclusive source) inviting the visit of Alex Chris – a previous executive of Intuit ( INTU) – to this position. They think that Chris’ comprehensive experience in item advancement, little and medium organization (SMB) services, and payments will benefit PayPal. Chris’ option is credited to his performance history of providing outcomes, establishing item techniques, comprehending consumers, and structure talented groups.

By the method, the bank has a method brighter anticipated for PYPL’s assessment:

Goldman Sachs (August 14, 2023 – exclusive source)

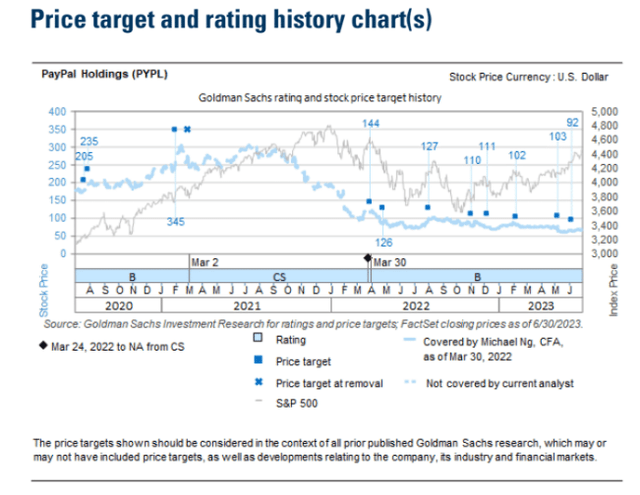

So perhaps I’m incorrect. However up until now they have actually been incorrect:

Goldman Sachs (August 14, 2023 – exclusive source)

It will be really amazing to see what brand-new actions the brand-new management will take and how the business will be straightened into a brand-new stage of development. Numerous big business as soon as prospered in doing this, however there is a danger that PayPal will not be successful. If you want to take that danger now, I want you the very best of luck. However I remain on the sidelines.

Thank you for checking out!