Justina Worrell, 47, works part-time as a cooking area assistant in an Ohio retirement home. She has spastic paralysis, an intellectual impairment, and a heart condition that needed she get a synthetic heart valve at age 20.

A year earlier, she was making $862 a month and getting about $1,065 in month-to-month Social Security impairment advantages when a letter showed up from the federal government. The Social Security Administration had actually been overpaying her, the letter stated, and desired cash back.

Within 1 month, it stated, she ought to send by mail the federal government a check or cash order.

For $60,175.90.

” Social Security must be to assist individuals, not to damage them,” stated Addie Arnold, Worrell’s auntie and caretaker.

The Social Security Administration is attempting to recover billions of dollars from much of the country’s poorest and most susceptible– payments it sent them and now states they never ever must have gotten.

Throughout the 2022 , the firm clawed back $4.7 billion of overpayments, while another $21.6 billion stayed exceptional, according to a report by SSA’s inspector general

One effect is an expensive collection effort for the federal government and a possibly destructive experience for the recipient.

” We have an overpayment crisis on our hands,” stated Rebecca Vallas, a senior fellow at the Century Structure believe tank.

” Overpayments press currently having a hard time recipients even deeper into hardship and challenge, which is straight disadvantageous to the objectives” of safety-net programs.

The Social Security Administration decreased an interview demand from KFF Health News and Cox Media Group and would field concerns just sent by e-mail.

The firm decreased to state the number of individuals have actually been asked to pay back overpayments.

” We do not report on the variety of debtors,” representative Nicole Tiggemann stated in a declaration.

The firm turned down a Might 2022 Flexibility of Info Act ask for paperwork of every overpayment notification sent out over numerous years, and a March 2023 appeal is pending.

Jack Smalligan of the Urban Institute, who has actually studied on Social Security, approximated that countless individuals have actually gotten notifications stating the firm overpaid them.

Many are on impairment, and numerous can not pay for to pay back the federal government, Smalligan stated.

Overpayments can arise from Social Security slipping up or from recipients stopping working to abide by requirements, deliberately or otherwise. However much of the fault lies within the system– for instance:

- Guidelines are intricate and difficult to follow.

- Limitations on what recipients can conserve or own have actually not been changed for inflation in years.

- The Social Security Administration does not have sufficient staffing to stay up to date with its work, much of which is done by hand.

- The system has integrated lags in examining details such as recipients’ earnings and relies greatly on information sent by recipients themselves.

That’s the photo that emerges from firm workers, supporters for the handicapped, policy research study, SSA publications, reports by the inspector general, records of private cases, and interviews with more than a lots individuals in 5 states who got payment notifications.

The Social Security Administration is needed to be an excellent steward of the cash delegated to it. That implies keeping overpayments to a minimum– and recuperating them when they take place, the inspector general has actually composed

When the firm identifies it has actually paid too much, SSA can eventually recover cash from recipients by, for example, lowering or stopping their month-to-month advantage payments, garnishing salaries, and obstructing federal tax refunds

The firm tracks its overpayments through quarterly ” payment stability scorecards.” In the latest scorecard for one Social Security program, the firm stated $265 countless overpayments in the 2022 were “within the firm’s control.” Simply put, the firm blamed itself.

” We understood details however stopped working to act, or we took inaccurate action when the recipient or third-party supplied inquired,” the scorecard stated.

A much bigger source of overpayments because program, the firm stated, was that recipients did not report details, such as modifications in their salaries or properties.

By the time the firm captures an error, years can pass. In the meantime, the recipient is most likely to have actually invested the cash, and the quantity included can grow to frustrating percentages.

” We comprehend getting notification of an overpayment might be disturbing or uncertain and we deal with individuals to browse the overpayment procedure,” Tiggemann, the firm representative, stated by e-mail.

The firm’s payment precision is high, Tiggemann stated, however offered the volume of payments it problems– practically $1.2 trillion in the 2021 — “even little mistake rates amount to considerable incorrect payment quantities.”

Tiggemann kept in mind that the SSA is establishing a program to tap payroll information from outdoors sources. The firm prepares to utilize that details “when suitable” to immediately change the quantities it pays recipients, she stated.

Congress licensed that task practically 8 years earlier.

Twisted Safeguard

When individuals hear “Social Security,” they might think about retirement advantages– the month-to-month payments the federal government problems to countless retired employees and enduring relative under the Old-Age and Survivors Insurance coverage program.

However the Social Security Administration does far more than problem those checks, and its clawbacks for overpayment typically include payments under other programs with complex eligibility requirements.

With specific advantages, just how much cash– if any– recipients are due monthly can alter as their situations alter.

The majority of the overpayments include the Supplemental Security Earnings program, which supplies cash to individuals with little or no earnings or other resources who are handicapped, blind, or a minimum of 65.

In the 2021 , more than 7% of that program’s investments were overpayments, according to the firm’s latest yearly monetary report.

Some overpayments include the Impairment Insurance Coverage program, which helps handicapped employees and their dependents

Lori Cochran, a recipient disabled by numerous sclerosis, stated she got tripped up by a life insurance coverage policy she took over from her mom.

After she examined her financial resources with a Social Security agent, she stated, she got a letter stating she owed $27,000.

” I began having, like, heart palpitations,” she remembered.

Cochran stated she didn’t understand the insurance coverage had a money worth of $4,000.

The firm informed her that, for each month she held the policy, she wasn’t entitled to any of her $914 month-to-month advantage, she stated. The firm stated it would recover the $27,000 by subtracting $91.40 from each of her future checks. At that rate, she would be paying it back “method into my senior age,” she stated

Cochran has actually asked SSA to reevaluate. In the meantime, she squandered the life insurance coverage policy– just to find out that, rather, she might have signed a paper stating she had no objective of cashing it out.

” So now I’m entrusted no life insurance coverage,” she stated. “When I pass away, my child will have no cash to bury me.”

A ‘Kafkaesque Minefield’

If recipients think that an overpayment wasn’t their fault, that the claim is unreasonable, or that paying the cash back would trigger challenge, they can ask the SSA to waive payment.

They can likewise work out to repay what they owe slowly.

Cheryl Bates-Harris of the National Impairment Rights Network suggested that individuals who get overpayment notifications appeal, since the details in the notifications might be unreliable.

However attempting to solve an overpayment includes plunging into a “Kafkaesque minefield,” stated Darcy Milburn, director of Social Security and healthcare policy at the Arc, which promotes for individuals with specials needs.

Another recipient called Lori explained her journey through the minefield on the condition that her surname be kept. She supplied a copy of an administrative law judge’s judgment in her case.

In 2017, SSA notified her that, given that 2000, she had actually been paid too much $126,612, according to the judge’s judgment.

” I practically tossed up when I opened that letter,” she stated “Myself and my other half resembled, we resembled frenzied.”

According to the judge’s judgment, the federal government based its computation on her invoice of employees’ settlement advantages in addition to impairment advantages. She argued that she had actually informed the SSA about the employees’ compensation. Lori worked for the U.S. Postal Service till she hurt her back.

As her battle unfolded, the federal government minimized her month-to-month advantage checks and after that stopped them. She and her other half offered their automobile and their home and moved from Florida to Georgia, where the expense of living was lower.

She stated she added charge card financial obligation and called legal representative after legal representative however was informed no lawyer would assist since there was no cash to be made from a Social Security case. Then she discovered one through legal help.

After 6 years of fighting SSA, consisting of numerous appeals, Lori dominated. An administrative judge ruled in her favor and cleaned away the financial obligation.

Lori had actually invested her advantage cash in the belief she was entitled to it, the judge composed, and “needing payment would protest equity and excellent conscience.”

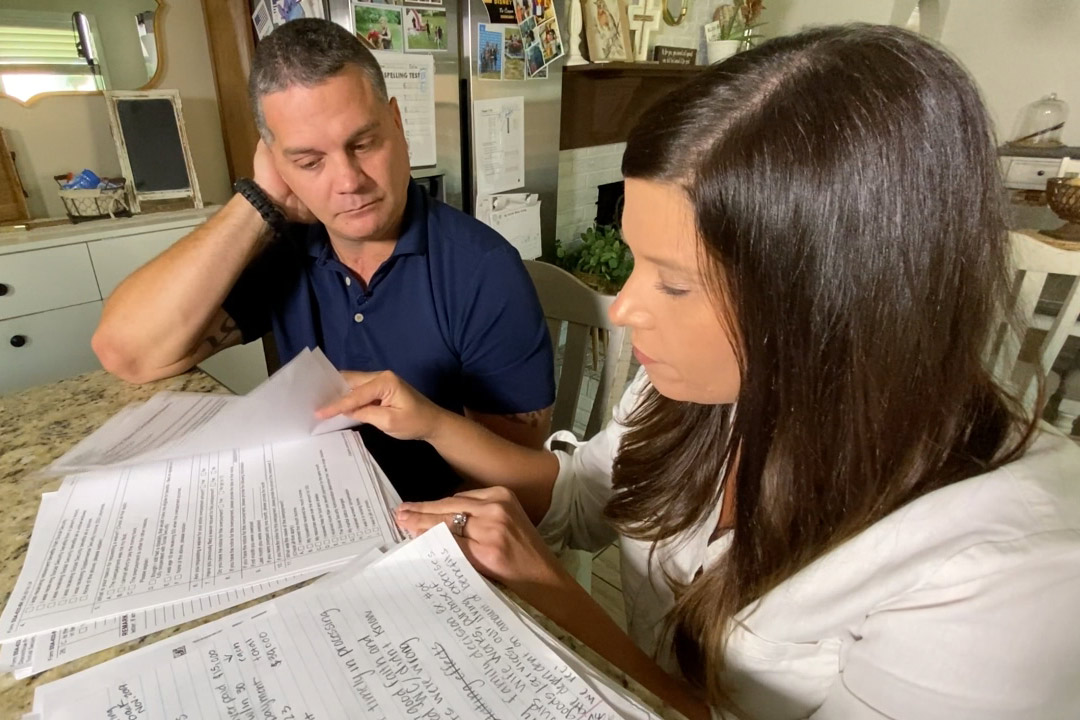

A household in Covington, Georgia, had a comparable experience.

In 2018, Matt Cooper was shot in the face while working as a policeman there. Ever since, he and his other half, Kristen, have actually depended upon Social Security payments to assist support their 2 young kids.

” Every choice that we produced our household was based upon the advantages that we were expected to get,” Kristen Cooper stated

However the Social Security Administration just recently required the household repay $30,000 and minimized the kids’s advantages. Cooper stated the firm stopped working to properly include her other half’s employees’ settlement in its computations.

” Scenarios like this shown up and it simply restores a level of anger and simply the requirement to secure my household,” she stated. “The system has absolutely let us down.”

Far Too Late

Alex Hubbard, 30, has autism and stated he operates in a mailroom to keep hectic.

” I like to be hectic since I do not wish to be tired in your home,” he stated

In 2019, Hubbard got an overpayment notification for $11,111.43.

” I’m expected to report my salaries, however I simply do not understand how, how it works,” stated the Seattle local.

The firm has actually cut off his advantages, Hubbard stated, however it would have been much better if it had actually stopped them prior to he owed all that cash.

” They must have let me understand, like, years back that I owed back that much,” Hubbard stated.

Now, the firm is attempting to gather the cash from his mom, who is not able to handle his advantages given that having a stroke, Hubbard stated.

Handling the Social Security Administration can be exasperating, recipients stated.

Letters from the firm do not offer clear descriptions, and, if individuals on the getting end of overpayment notifications can get across a human, firm workers offer irregular responses, recipients stated.

SSA workers spoke with for this post, speaking as union leaders, stated they can relate.

Recipients “battle getting across a firm that has actually all however ended up being non-responsive to the general public at this moment due to understaffing,” stated Jessica LaPointe, a claims expert in SSA’s Madison, Wisconsin, field workplace and president of a union council representing Social Security workers.

Tiggemann, the firm representative, pointed out the difficulty of “staffing losses and resource restraints” in her composed declaration.

In a March 2023 budget plan message, SSA’s acting commissioner, Kilolo Kijakazi, stated SSA was “ restoring” its labor force after ending the 2022 “at our least expensive staffing level in over 25 years.”

Brand-new employees require a long period of time to get up to speed, workers stated. Complicated guidelines trigger difficulty for workers and recipients alike.

Members of the general public “frequently battle to actually comprehend what they’re expected to report,” LaPointe stated.

Guidelines for the Recipients

Impairment advantages are suggested for individuals who can’t do a great deal of work.

For handicapped individuals who aren’t blind, the federal government usually draws the line at making $1,470 or more each month.

It’s not simply bank balances or income quantities and so forth that can impact an individual’s advantages. In the SSI program, if a member of the family provides meals or a location to remain, that can count as “ in-kind assistance“

Part of the difficulty with SSI, critics state, is that limitations on the properties that recipients are enabled to hold without surrendering advantages have not been changed given that 1989. The possession restricts stand at $2,000 for people and $3,000 for couples.

Had the possession restricts been indexed for inflation given that 1972, when the program was developed, they would be practically 5 times as much as they are today, according to a July 2023 report by scientists at the Center on Budget Plan and Policy Priorities.

Keeping eligibility for SSI advantages leaves individuals with little cash to draw on– not to mention to pay back a big financial obligation to the federal government.

A bipartisan group of legislators presented a costs on Sept. 12 to raise the limitations.

The SSDI and SSI programs consist of guidelines suggested to motivate individuals to work. Nevertheless, “if recipients try work, they are most likely to be challenged with an overpayment, and it is most likely to be big,” Smalligan and Chantel Boyens of the Urban Institute stated in a March 2023 report commissioned by the Social Security Board Of Advisers.

‘ In a Really Bad Location’

Justina Worrell’s auntie and caretaker Addie Arnold, 69, who took her in when she was orphaned as a kid, stated neither of them has $60,175.90 to pay back the federal government.

The August 2022 letter requiring payment of that quantity was not the very first or latest thing they have actually gotten from the Social Security Administration about possible payment mistakes. The matter includes 2 streams of advantages– one from the account of Worrell’s departed dad, and another associated to her impairment, Arnold stated.

” I have actually been puzzled since this begun,” she stated.

A February 2023 letter from the SSA declaring to discuss how “we paid her [Worrell] $7,723.40 excessive in advantages” consists of difficult-to-decipher information returning to 1996.

The SSA has actually dropped its claim on a few of the more than $60,000 it looked for a year earlier, however the majority of stays exceptional, Arnold stated.

Arnold thinks part of the issue is that Worrell’s company asked her to work extra hours at the retirement home, where she runs a dishwashing machine and brings trays.

” She is so scared of losing her task that she will do whatever they ask her to do. That becomes part of her mindset,” Arnold composed in a letter attracting the Social Security Administration.

” I really do hope and hope that she is enabled to remain on SSI,” Arnold composed, “since she needs to continue to live and without it she will remain in an extremely bad location.”

Press reporters adding to this examination: Josh Wade, Cox Media Group; Justin Gray, WSB-TV, Atlanta; John Bedell, WHIO-TV, Dayton, Ohio; Shannon Butler, WFTV-TV, Orlando, Florida; Amy Hudak, WPXI-TV, Pittsburgh; Jesse Jones, KIRO-TV, Seattle; Ted Daniel, WFXT-TV, Boston; Madison Carter, WSOC-TV, Charlotte, North Carolina; Ben Becker, WJAX-TV, Jacksonville, Florida