Strategy A, a carbon accounting and ESG (ecological, social, and governance) reporting platform for corporations, has actually raised $27 million in a Series A round of financing led by U.S. VC huge Lightspeed Endeavor partners.

Technically the financing is an extension of a $ 10 million Series A round it revealed almost 2 years earlier, implying for all intents and functions this is the closing of a $37 million Series A round, taking its overall raised to $42 million throughout its 6 year history. However maybe more significantly, its newest round likewise consists of involvement from some significant names from the business world, consisting of Visa, Deutsche Bank, and BNP Paribas’ VC arm Opera Tech Ventures, amongst many other angel financiers.

” The seriousness of the environment crisis, integrated with the intricacy of browsing net-zero journeys for companies, made it essential for us to bring onboard top-tier financiers now,” Lubomila Jordanova, Strategy A creator and CEO, discussed to TechCrunch.

Scoping out

Established out of Berlin in 2017, Strategy A (a referral to the ‘ no fallback’ environment action mantra) is among many VC-backed start-ups to emerge out of Europe with the express objective of assisting business determine (and cut) their carbon footprint. The seasonal issue, it appears, is that even with the very best will on the planet, cutting carbon emissions can be challenging unless a business makes a genuine effort to find precisely what their emissions are, and where they remain in the supply chain.

A study in 2015 from Boston Consulting Group (BCG) discovered that 90% of companies didn’t determine their greenhouse gas emissions “adequately.” As typical, so-called “ scope 3 emissions” were determined as a significant stumbling block, where a business stops working to attend to emissions down through its supply chain including partner companies. While it holds true that scope threes are harder to determine compared to scope 1 (which describes emissions straight under a business’s control), there is growing pressure for companies to attend to emissions throughout their network.

This is essential for a variety of factors, however primarily since lots of companies’ carbon footprint is mainly comprised of scope 3 emissions. For instance, a Coca-Cola bottling partner– Coca-Cola European Partners (CCEP)– has formerly approximated that 93% of its emissions were scope 3.

Furthermore, instead of boiling down, worldwide energy-related Co2 emissions are still increasing, growing 0.9 percent in 2022

” As the environment crisis is specified in big part by the development of emissions, among the most immediate difficulties, and the only financially feasible option, is to quickly lower the emissions curve, particularly for business,” Jordanova stated.

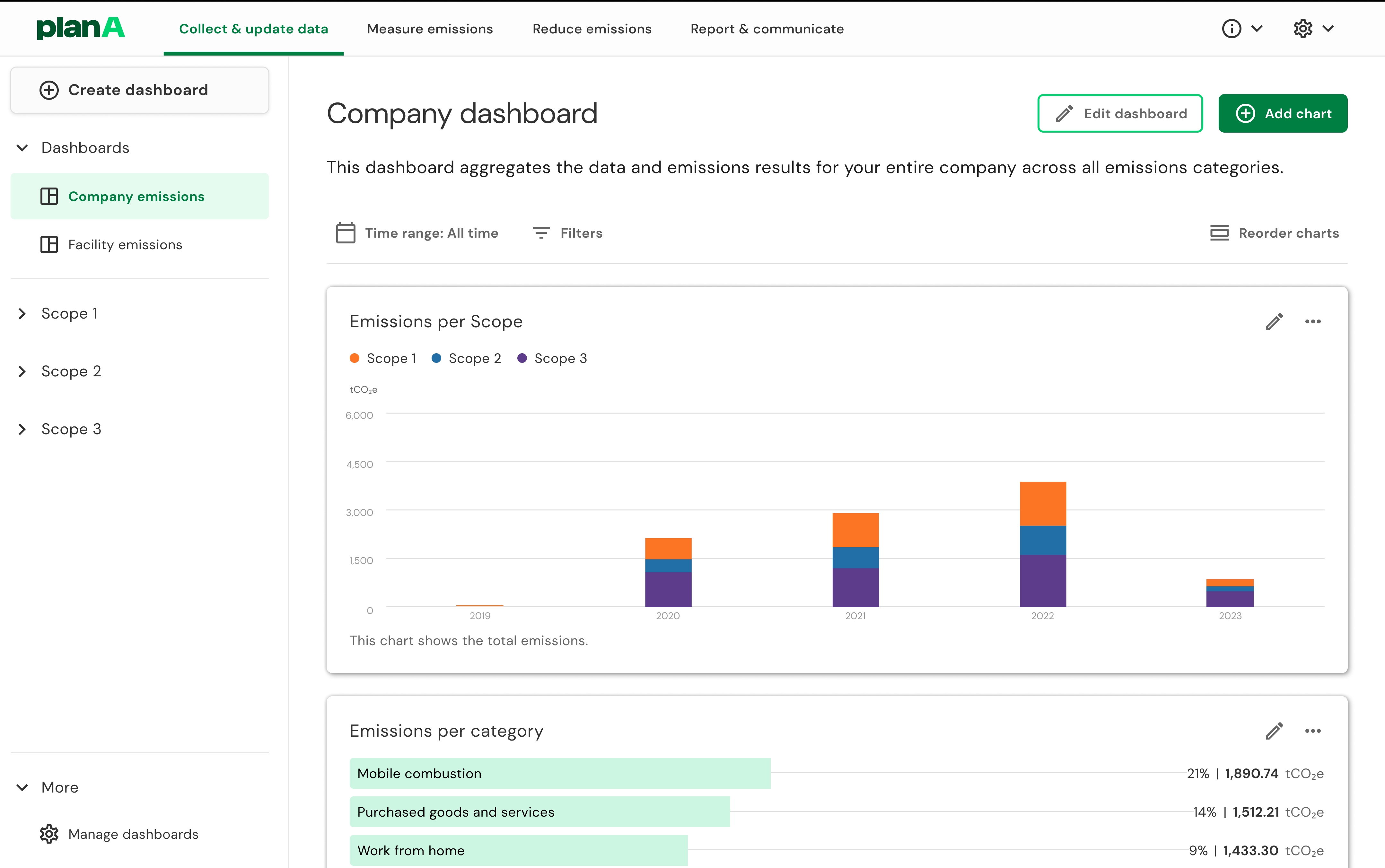

Therefore, Strategy A has actually established a SaaS-based sustainability platform that makes it possible for business to self-manage their net-zero efforts– this consists of gathering information, determining emissions, setting targets, and decarbonization preparation. Most importantly, it consists of mapping emissions information throughout all scope 1, 2, and 3, and aligning them with worldwide clinical requirements and methods, consisting of the Greenhouse Gas Procedure and the Science Based Targets Effort ( SBTi).

While the core Strategy An item is a web app, consumers– that include BMW, Deutsche Bank, KFC, and Visa– can likewise plug straight into Strategy A by means of API, which works for incorporating company and emissions information from throughout myriad applications such as company travel software application and company intelligence (BI) tools.

Strategy A: Sustainability Platform Emissions control panel Image Credit: Strategy A

Today, Strategy A counts 120 workers throughout Berlin, Paris, and London, and with its fresh money injection Jordanova stated that it prepares to “double down” on that with a variety of brand-new hires.

” The financing now declares our next development stage,” she stated. “With the fresh capital, we will double our headcount to broaden our market penetration in Europe with a strong concentrate on France, the U.K., and Scandinavia, in addition to deepen our platform abilities.”

Environment emergency situation

While the financing landscape is rather dry nowadays beyond a swath of seed phase rounds, climate-tech start-ups appear to have actually fared reasonably well, though general financing in the area is still down on in 2015 The information recommends this is mainly due to a decrease in later-stage financing from Series B onwards, with early-stage patterns looking a little much better.

Nevertheless, ESG information start-ups in specific appear to be in need. Environment information start-up Persefoni last month revealed $ 50 million in fresh financing, which follows 2 other European competitors Sweep and Greenly which raised $73 million and $ 23 million respectively, albeit in 2015. Somewhere else, ESG information management start-up Novisto protected $20 million in Series B moneying a couple of months back

While moneying throughout the start-up sphere is down, it still appears that financiers still see environment tech more positively compared to lots of other sectors, with the general share of VC dollars growing from 10% to 13% in the previous year, according to Dealroom information And this, according to Jordanova, is down to numerous aspects. While other markets have actually suffered due to macroeconomic aspects and moving financier choices, environment tech is growing (reasonably) due in big part to the seriousness of the speeding up environment emergency situation which is causing more guideline and pressure being loaded on business to alter course prior to it’s far too late.

” European federal governments have actually carried out policies and policies favouring tidy tech, providing rewards and aids to bring in financiers,” Jordanova stated. “Big corporations are likewise making sustainability dedications, driving financial investments in start-ups that line up with their objectives.”

Lightspeed’s London partner Julie Kainz stated that environment will “most likely be among the most appealing financial investment styles” in the coming years. “Fixing the environment difficulty has actually strongly carried on the tactical program of federal governments, corporations and the public; and we highly think that the pressure from customers will just continue to increase,” Kainz informed TechCrunch by e-mail.