clovercity

Financial Investment Thesis

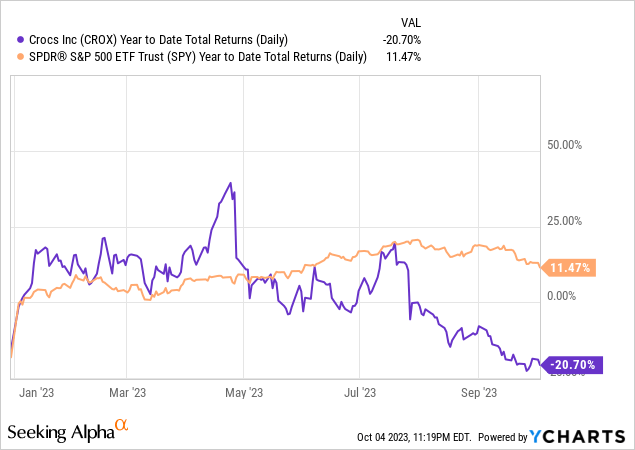

Crocs Inc ( NASDAQ: CROX) has actually had a rough 2023, with shares toppling 43.50% from their 52 week high of $151.32 with a YTD efficiency of -20.70%.

This bad rate action mainly comes from the market disliking their 1Q2023 and 2Q2023 revenues. While the business boasted unbelievable profits development and earnings margins, Wall Street was laser concentrated on their unstable assistance and penalized CROX for their weak 3-5% YoY profits development assistance. I initially covered the stock back in March, score it a strong buy due to its strong leading line development and finest in class success.

Regardless of the bad rate action, I restate my score of STRONG BUY By diving into their strong 2Q2023 numbers and using a DCF design, I’ll assist discuss why I think CROX is an incredible buy ahead of their 3Q2023 revenues.

Reviewing their Earnings Declaration

CROX Overall Incomes ( Put together by Author utilizing Looking for Alpha)

Taking a look at their earnings, we can see that CROX has actually grown earnings significantly given that 2016. After CEO Andrew Rees signed up with the business, earnings have actually escalated from a weak $1.036 B to a shocking $3.55 B in 2022. It is naturally crucial to point out that FY22’s 53.70% profits development is inorganic due to the HEYDUDE acquisition That being stated, natural development has actually been exceptional over the previous 6 years.

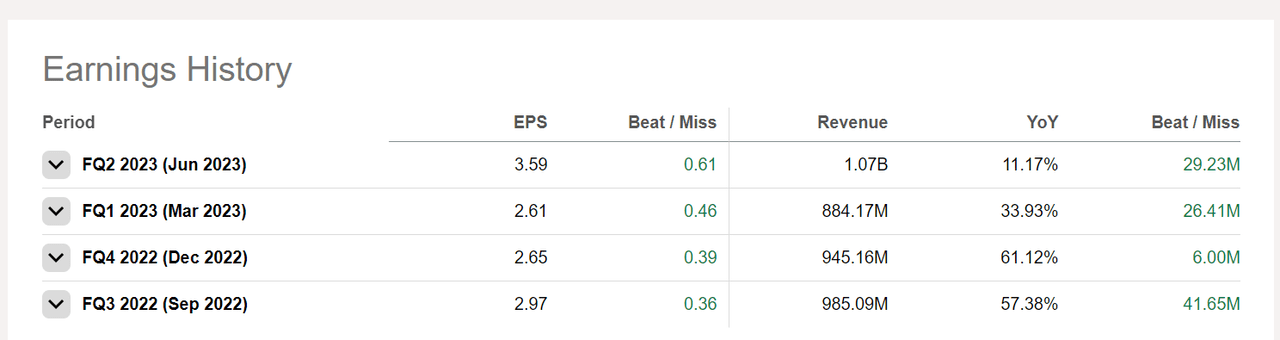

Utilizing the business’s upgraded assistance after their 2Q2023 revenues, we have actually an approximated $4.065 B for FY23 earnings at the high-end of their assistance. Taking a look at their revenues history, we see that CROX has actually regularly offered conservative assistance and beaten stated assistance throughout their revenues release.

Put together by Author utilizing Looking for Alpha

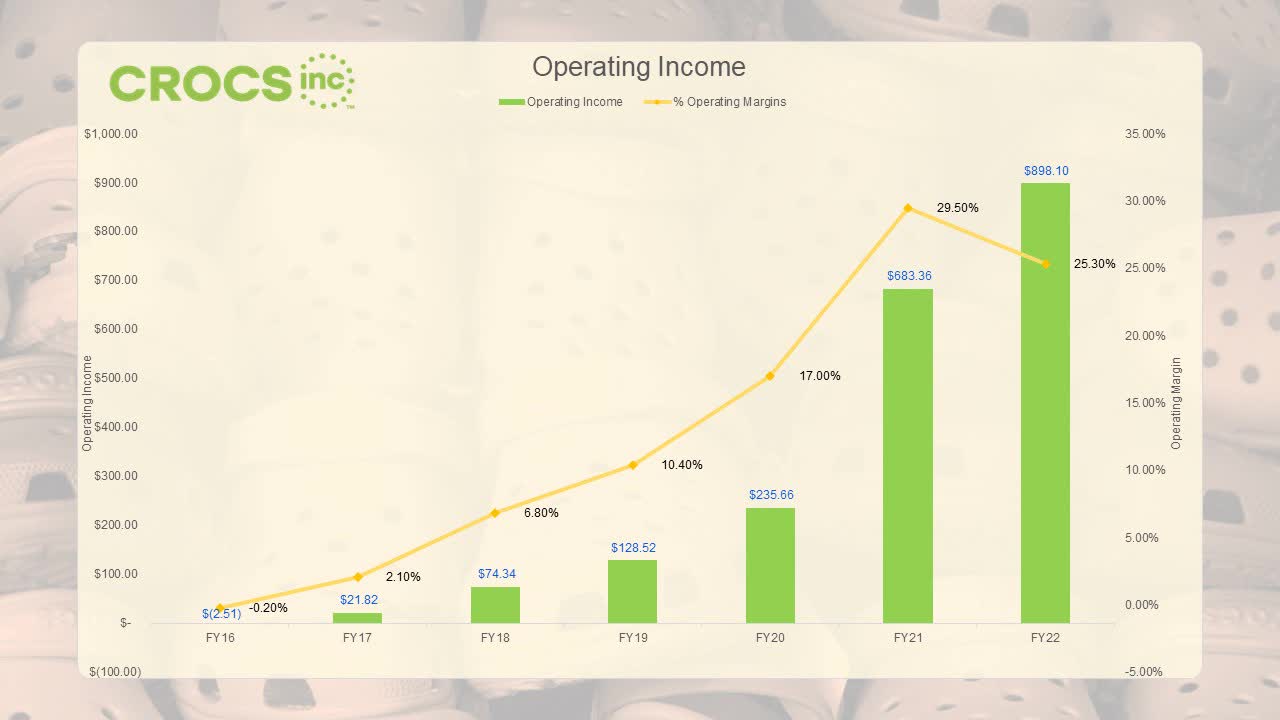

Much more outstanding has actually been CROX’s operating earnings. Running Earnings has actually grown from a simple -0.2% margin to a stunning 25.3%. Additionally, CROX has actually assisted for an adjusted operating margin of 27.0% for the FY23. Their long term assistance is 26.0% for future years. While this might appear astounding to wall street, CROX has regularly proven quarter over quarter it is regularly efficient in finest in class earnings margins.

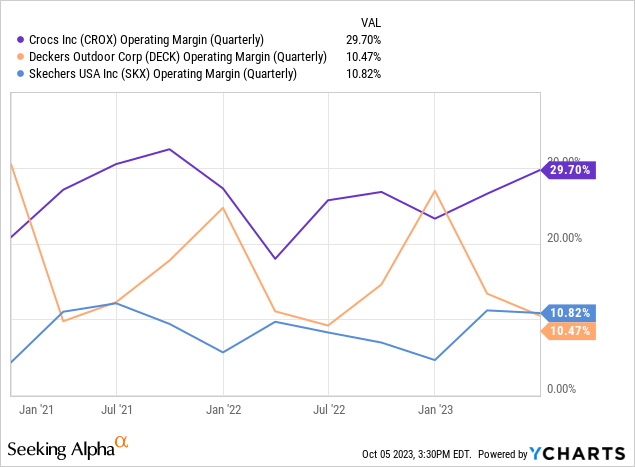

Taking a look at other shoe rivals such as Deckers Outdoor Corp (NYSE: DECK) and Skechers (NYSE: SKX), we can see that CROX has the greatest success, quickly vanquishing the competitors. This high earnings margin comes from the low expense of items to produce their core items such as Blockages and Jibbitz beauties.

Taking Full Advantage Of Investor Worth

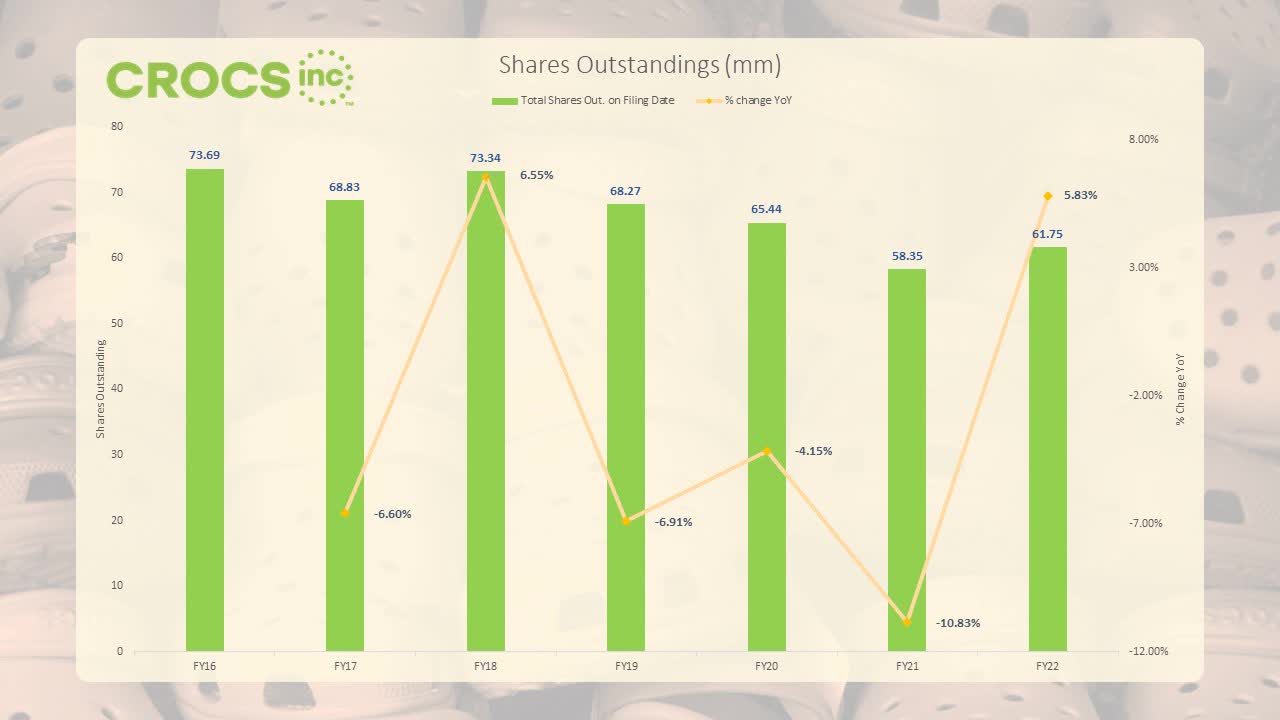

Put together by Author utilizing Looking for Alpha

Lastly, CROX has actually revealed its devotion to investors, redeeming 16% of their impressive shares over the previous 6 years. Management comprehends how to assign capital and how to appropriately reward their investors through the use of buybacks.

To sum up, CROX is shooting on all cylinders: unbelievable profits development, unbelievable earnings margins, and unbelievable management.

2Q2023: The Dissatisfaction That Never Ever Was

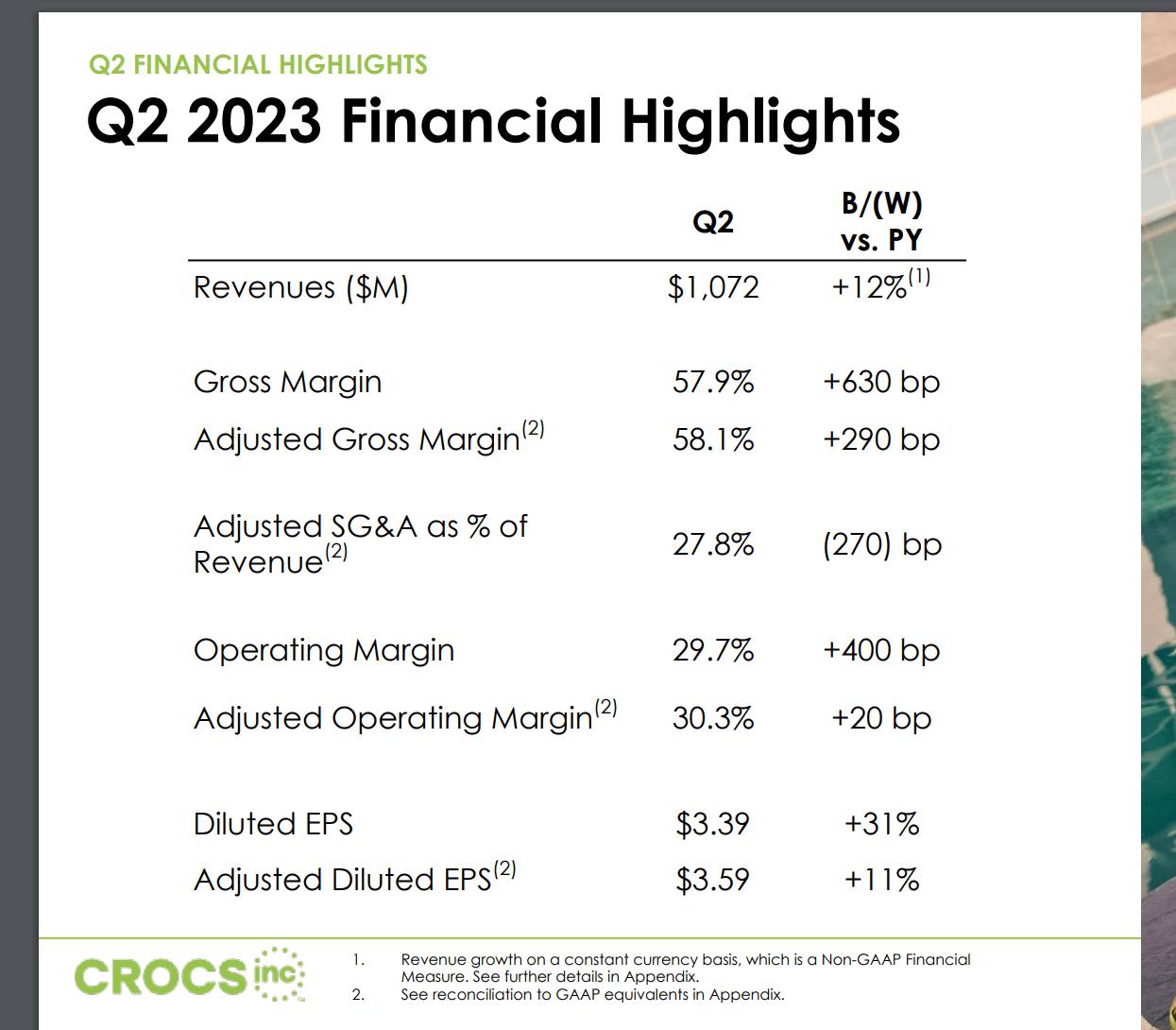

CROX had a frustrating rate action after their 2Q revenues, with shares toppling 14.9% after the revenues release. Let’s spend some time to break down this revenues report.

CROX 2Q2023 Incomes Discussion

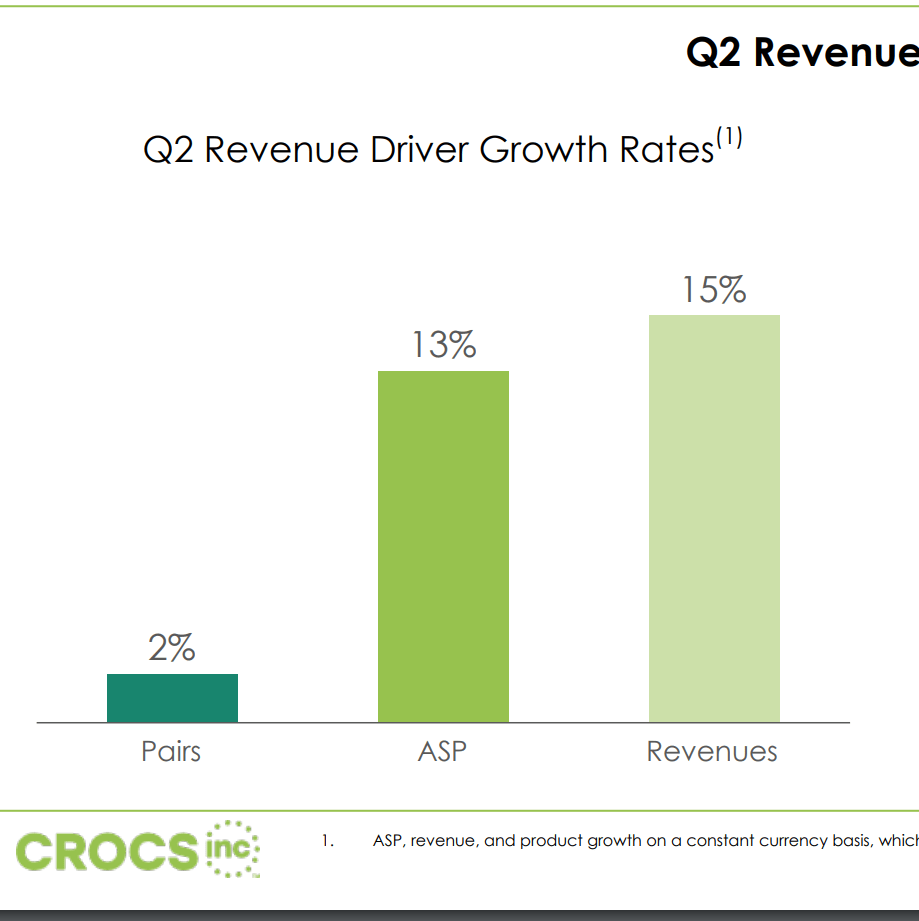

The Crocs brand name was unbelievable this quarter, contributing mainly to the leading line development with 15% CC development. HEYDUDE was extremely frustrating, just growing 3% YoY. Andrew Rees addresses this in the revenues call, associating this to wholesale concerns due to the absence of brand name history however states that this is a minor blip in an extremely brilliant future. Rees has actually grown CROX greatly throughout the years so I tend to think this and will not check out excessive into this.

Ever Since, while our wholesale partners are extremely delighted with the efficiency of HEYDUDE and a number have actually called us out in their current revenues, lots of beware in regards to future reservations based upon their general market outlook and absence of historic information on HEYDUDE’s efficiency. Lastly, as we formerly shared, we expect constrained circulation abilities, especially associated to simultaneously in the back half of the year due to ERP and storage facility shifts. Even with this decreased near-term profits outlook, the HEYDUDE brand name is obtaining brand-new consumers and is getting penetration in tactical accounts and on the coasts. We stay extremely positive about the long-lasting capacity of the brand name on a worldwide basis.

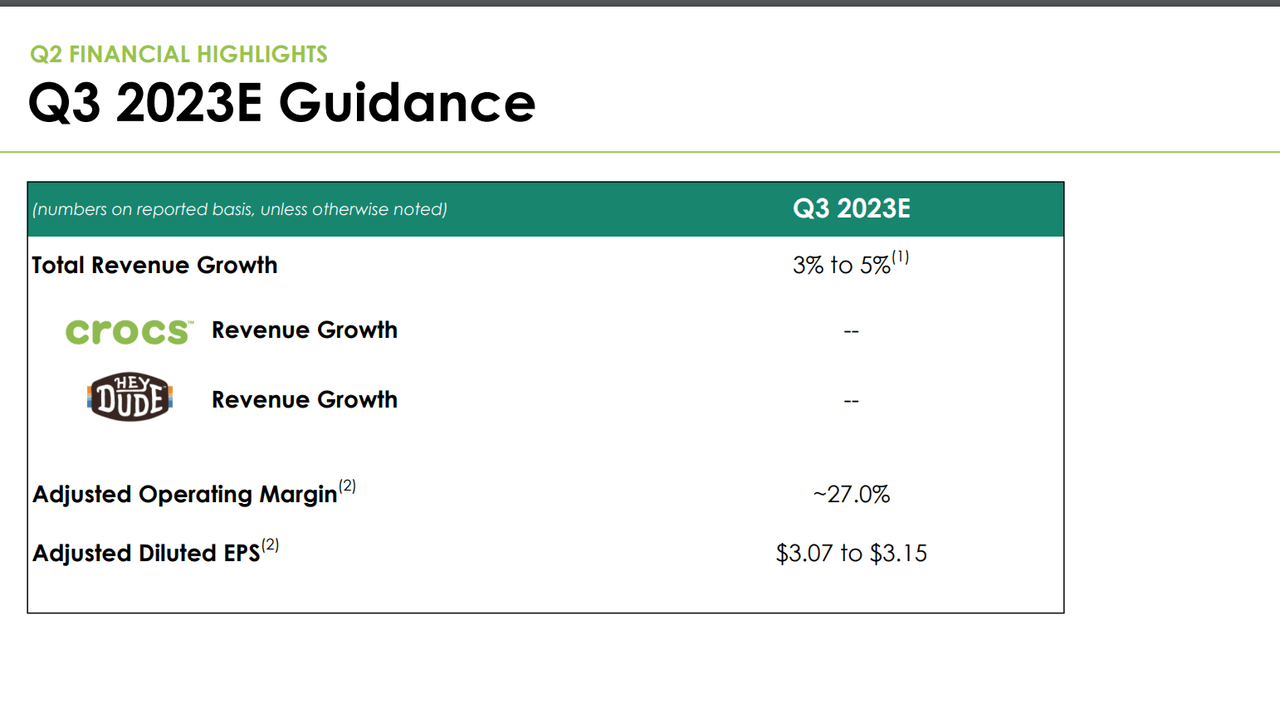

Taking a look at 3Q assistance, I comprehend why the marketplace sold CROX as development is looking extremely anemic at simply 300 to 500 basis points YoY:

CROX 2Q2023 Incomes Discussion

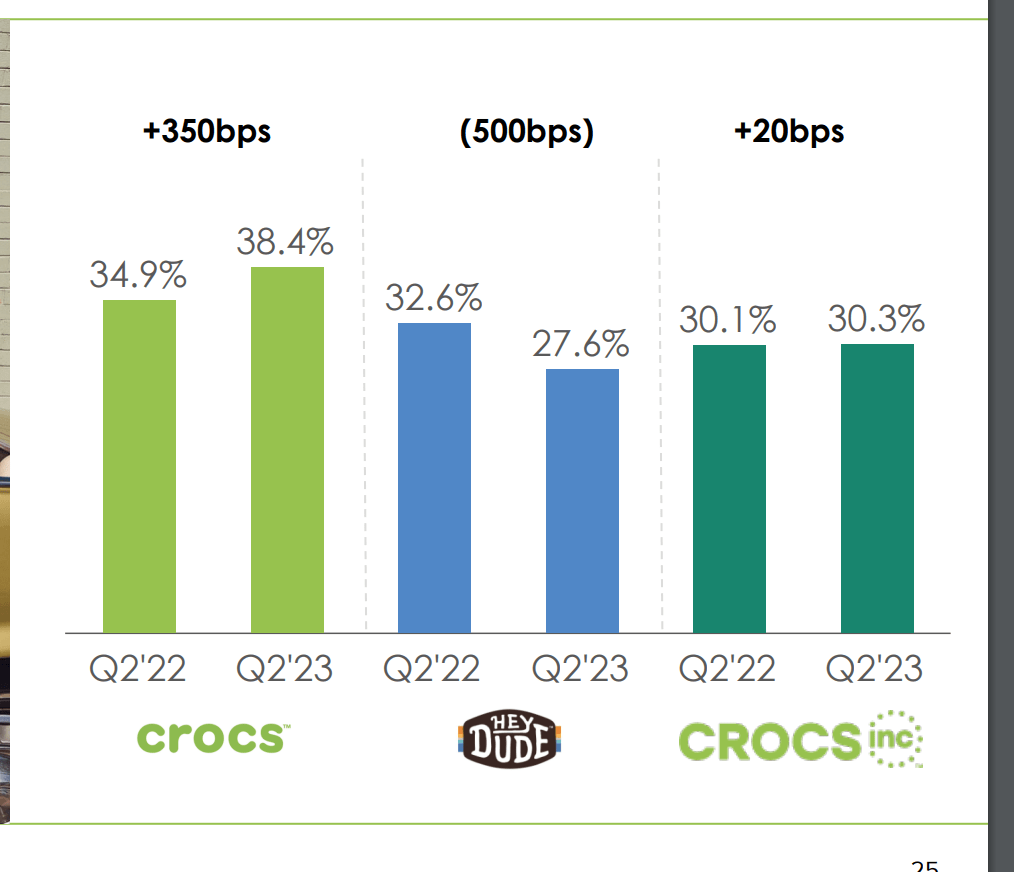

Taking A Look At how the Crocs brand name is carrying out, I tend to think that HEYDUDE will probably be unfavorable YoY and Crocs will stay an outperformer and bring HEYDUDE’s weight. Regardless of this, my primary focus is on their success. Their strong 27.0% changed running margin implies CROX will stay versatile, enabling them to pay for their financial obligation or redeem shares greatly underestimated shares.

CROX 2Q2023 Incomes Discussion

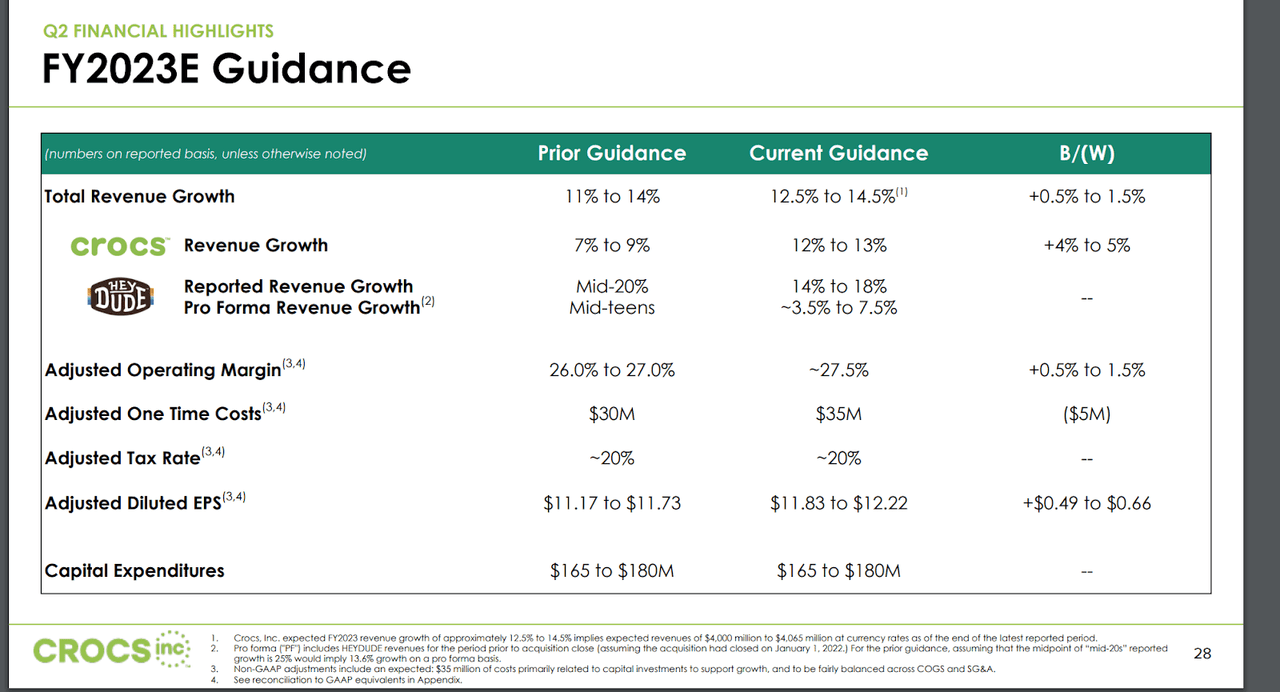

Lastly, I’m assured by Rees raising their FY23 outlook: increasing leading line assistance and even raising their changed operating margin by a massive 150 basis points. While 3Q might appear like a frustration, it’s suffice to state that CROX as a whole will have their finest year ever.

Put together by Author utilizing Looking for Alpha

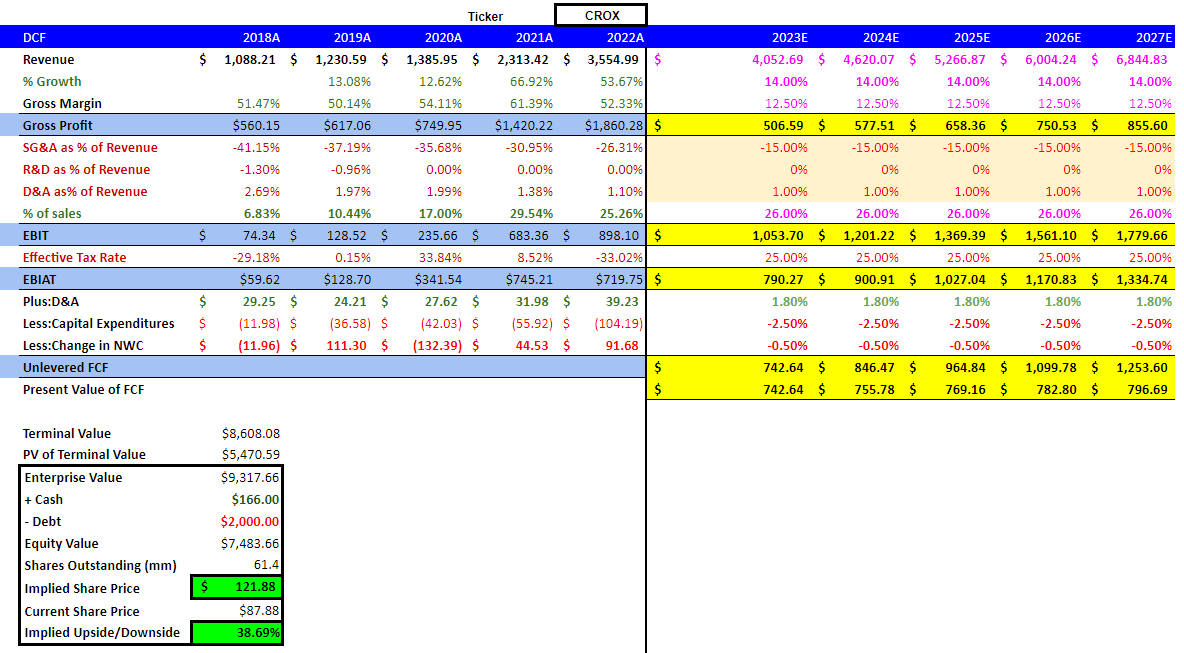

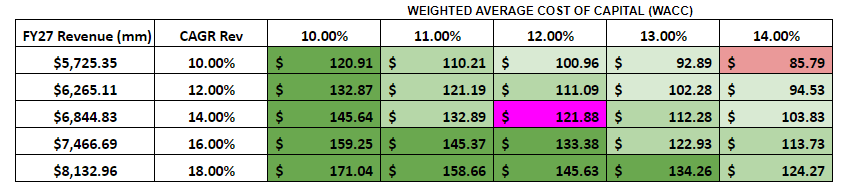

Turning towards appraisal, I have actually utilized a DCF appraisal to see where CROX stands. Utilizing conservative expectations, my design reveals that CROX is presently 38.69% underestimated. My presumptions were 14% leading line development and 26% EBIT margins. I kept D&A, CapEx, and NWC at the 5 year averages of 1.8%, -2.5%, and -0.5%, respectively. My terminal development rate was 3% due to the strong organization earnings and my WACC was set at 12% due to high yields, high financial obligation with high efficient rates of interest, and CROX’s high beta.

CROX 2Q2022 Incomes Discussion

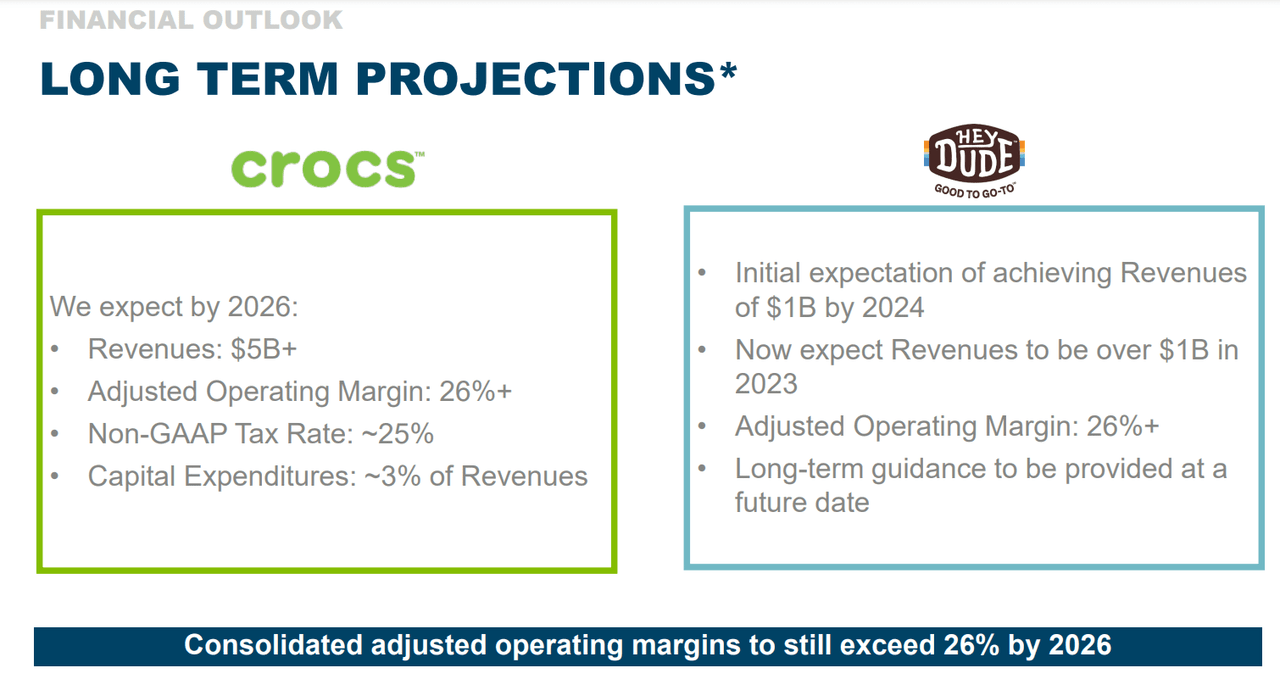

As a pointer, CROX has actually vowed to reach 6B in profits by FY26 while preserving their operating margin at 26% and my design presumes CROX’s management will perform their desired strategy.

Put together by Author utilizing Looking for Alpha

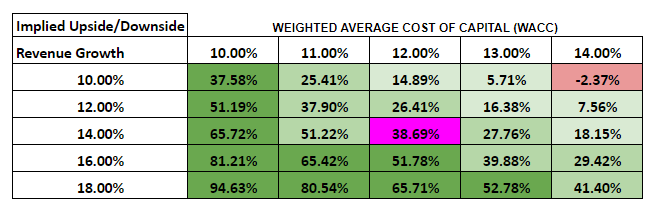

I likewise produced a level of sensitivity table revealing numerous results for CROX. Must earnings surpass management expectations or rates of interest reduce permitting a lower WACC.

Put together by Author utilizing Looking for Alpha

As we can see in lots of scenarios, CROX is very underestimated, perhaps 94.63% underestimated if CROX performs at the greatest level. In a not likely circumstance where CROX underperforms, we would see minor drawback of -2.37% to reasonable worth.

Threats

Put together by Author utilizing Looking for Alpha

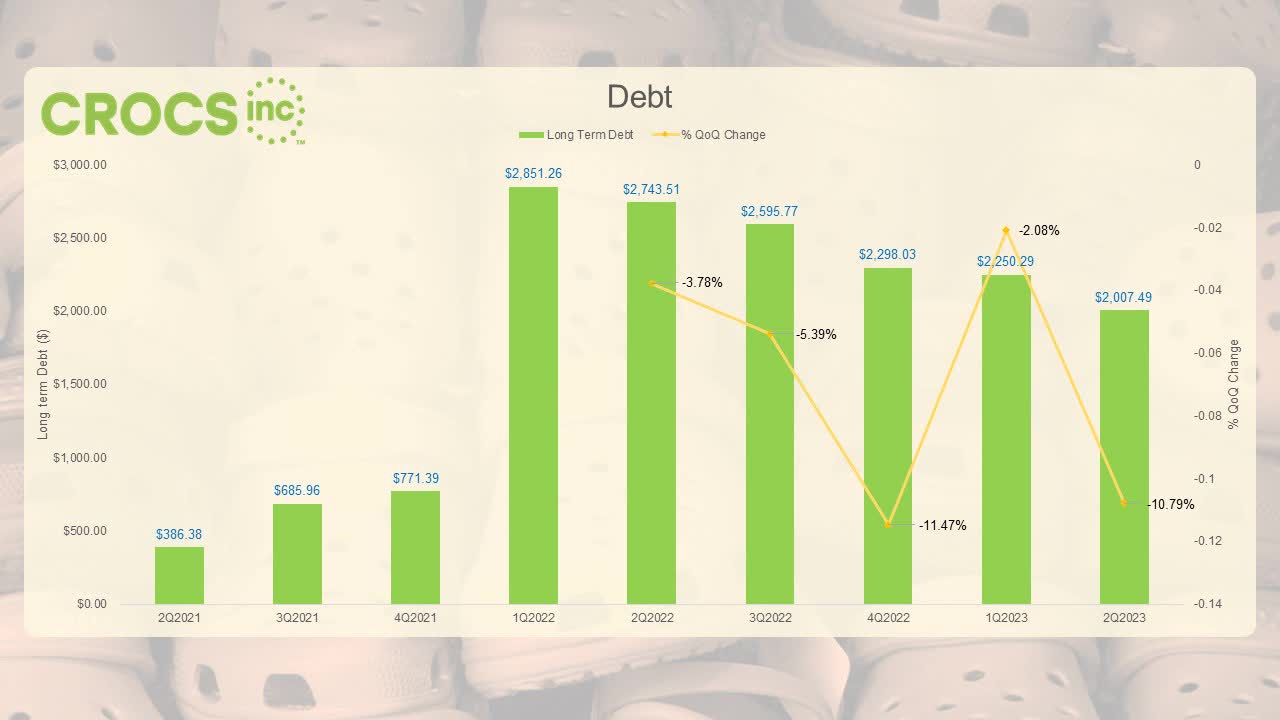

The most apparent threat for CROX would be the business declaring bankruptcy. Their balance sheet is extremely leveraged, with $2B in financial obligation (since the most current quarter) vs their $166m money on hand. They raised approximately $2B in financial obligation due to the HEYDUDE acquisition however have actually been extremely persistent in paying it down. Management comprehends how debilitating financial obligation interest is with today’s rates being high. As such, they have actually assigned the majority of the earnings produced towards paying it down. As CROX continues to deleverage, I think their development story will end up being less riskier and the rate action will most certainly show that.

Very Little Volume Development

CROX 2Q2023 Incomes Discussion

When we look even more into 2Q revenues, we see that the Crocs brand name 15% profits development was not really natural. Volume development was just 2%, and 13% of the development was credited to Typical Offering Rate raises throughout the board. While this can technically be viewed as bullish due to consumers continue to purchasing regardless of the ASP boost, it is not sustainable and the Crocs brand name will require to reveal increased volume generation to support their development story.

HEYDUDE

CROX 2Q2023 Incomes Discussion

Lastly, the greatest threat is HEYDUDE continuing to dissatisfy. As abovementioned, their profits grew just 3% YoY and their operating margin shed a massive 500 basis points. It is not totally unexpected provided the hard environment however however, CROX purchased HEYDUDE as a development lever and it is carrying out rather improperly. Once again, I have total faith in Rees to reverse HEYDUDE however for now, it is dragging down the CROX. If CROX has the ability to display in 3Q2023 HEYDUDE is pulling its weight, I ‘d picture the story around CROX would alter totally.

Summary

CROX continues to outshine. Its core organization, Crocs brand name, has actually revealed exceptional development. Management continues to vigilantly pay for financial obligation, grow earnings, and stay extremely lucrative. While HEYDUDE is presently a threat to business, it is very important to keep in mind that Crocs is 75% of CROX’s overall earnings. Management has actually revealed repeatedly they understand how to carry out at the greatest level, and I think they will turn HEYDUDE around.

My DCF appraisal reveals that CROX is substantially underestimated and the existing share rate does not properly show their strong profits development and finest in class success. As an outcome, I continue to restate my STRONG BUY score ahead of 3Q2023 revenues.