primeimages

S&P 500 revenues start with the huge banks and financials beginning to report next week, with Friday, October 13th, ’23 being the day 4 to 5 larger financials report, all of which will be covered this weekend.

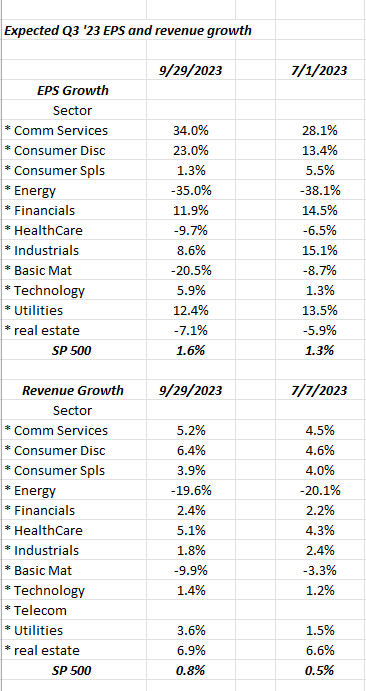

The above spreadsheet table reveals what the numbers appear like for how Q3 ’23 anticipated EPS and profits development by sector developed as Q2 ’23 outcomes were reported for the S&P 500. (Keep in mind, although we remain in the calendar fourth quarter ’23, we are waiting for arise from Q3 ’23 operations.)

What’s fascinating is that taking a look at the bottom half of the above table, 9 of the 11 sectors for the S&P 500 saw favorable modifications to anticipated profits development for Q3 ’23, with the significant exceptions of industrials and raw materials.

The energy sector saw favorable profits modifications for Q3 ’23 as Q2 ’23 unfolded, even as the typical stocks saw a drubbing.

How did Q3 ’22 look a year ago?

The 3rd quarter ’22 S&P 500 EPS and profits development were +4.4% and +11.7%. That profits development number for Q3 ’22 was the last double-digit portion development for the S&P 500, after a string of 7 quarters of double-digit profits development for the benchmark beginning with Q1′ 21.

The point is, compensations or compares get a lot easier for the S&P 500 moving forward, beginning with Q4 ’23. Q4 ’22 saw S&P 500 EPS development drop to -3.2%, while profits development was +5.8%.

Looking once again at Q3 ’23, innovation’s anticipated development even for complete year ’23 is still difficult to fix up with the so-called “spectacular 7” or the leading 10 mega-cap names in the S&P 500, in regards to their YTD ’23 efficiency.

The monetary sector is still trying to find near 10% EPS development in Q3 ’23, after printing +9.3% and +7% in Q2 ’23 and Q1 ’23.

All information is sourced from IBES information by Refinitiv.

More to come this weekend.

Thanks for reading.

Editor’s Note: The summary bullets for this short article were picked by Looking for Alpha editors.