Sundry Photography/iStock Editorial through Getty Images

Financial Investment Thesis

Have you ever considered the building of a dividend earnings financial investment portfolio with a decreased danger level that intends to attain an appealing Overall Return, while including both high dividend yield and dividend development business? To integrate these objectives is the essence and goal of The Dividend Earnings Accelerator Portfolio.

With recently’s incorporation of Apple (NYSE: AAPL) into The Dividend Earnings Accelerator Portfolio, we aimed to enhance the portfolio concerning danger and benefit. I think that Apple supplies financiers with a fairly low danger level while providing an appealing predicted yearly rate of return, making the business from Cupertino an exceptional risk/reward option for financiers. Due to Apple’s appealing risk/reward profile, I prepare to obese the Apple stock within The Dividend Earnings Accelerator Portfolio.

Nevertheless, the addition of Apple into The Dividend Earnings Accelerator Portfolio likewise triggered the Weighted Average Dividend Yield [TTM] of the portfolio to reduce to 3.66%.

For this factor, I have actually been concentrating on choices that might assist us to raise the portfolio’s Weighted Average Dividend Yield [TTM], considering that among the portfolio’s goals is to assist you produce a substantial quantity of additional earnings through dividend payments.

Among the markets in which you can typically discover business that can pay a fairly appealing Dividend Yield is the Integrated Telecommunication Solutions Market: both Verizon (NYSE: VZ) and AT&T ( NYSE: T) presently pay a fairly appealing Dividend Yield (while Verizon’s Dividend Yield [FWD] stands at 8.17%, AT&T’s is at 7.40%).

Although I think about Verizon the a little more appealing option when compared to AT&T (due to its greater Dividend Yield [FWD], its greater Dividend Development Rate, and its greater Income Development Rates), I have actually chosen to choose AT&T over its rival.

The factor for this is that SCHD (NYSEARCA: SCHD) represents the biggest percentage of The Dividend Earnings Accelerator Portfolio and this ETF is currently purchased Verizon (with a percentage of 3.90%). I did not desire the concentration danger to end up being too expensive for financiers of The Dividend Earnings Accelerator Portfolio.

Nonetheless, I do not think that AT&T is such an appealing risk/reward option as Apple is, for instance. I think that the danger level for AT&T financiers is not especially low (shown by the business’s reasonably high Overall Financial obligation to Equity Ratio of 142.91%), and I think that the benefit for AT&T financiers is reasonably minimal (due to the business’s minimal development point of view).

For this factor, I prepare to underweight the AT&T stock within The Dividend Earnings Accelerator Portfolio. AT&T’s presently reasonably high percentage of the general portfolio will reduce within the coming weeks, when extra business will be included.

Nevertheless, I think AT&T can play a substantial function in the portfolio to assist increase portfolio’s Weighted Average Dividend Yield and reduce its volatility and danger level.

The Dividend Earnings Accelerator Portfolio

The Dividend Earnings Accelerator Portfolio’s goal is the generation of earnings through dividend payments, and to each year raise this amount. In addition to that, its objective is to obtain an enticing Overall Return when investing with a decreased danger level over the long-lasting.

The Dividend Earnings Accelerator Portfolio’s decreased danger level will be reached due to the portfolio’s broad diversity over sectors and markets and the addition of business with a low Beta Element.

Listed below you can discover the attributes of The Dividend Earnings Accelerator Portfolio:

- Appealing Weighted Average Dividend Yield [TTM]

- Appealing Weighted Average Dividend Development Rate [CAGR] 5 Year

- Fairly low Volatility

- Fairly low Risk-Level

- Appealing anticipated benefit in the type of the anticipated substance yearly rate of return

- Diversity over property classes

- Diversity over sectors

- Diversity over markets

- Diversity over nations

- Buy-and-Hold viability

AT&T’s Competitive Benefits

Brand Name Image

AT&T is ranked 22 nd in the list of the world’s most important brand names, while rival Verizon is ranked 8 th within the very same ranking.

AT&T’s appealing ranking reveals that the business can charge premium costs from its clients, offering the business with an one-upmanship over rivals. This likewise assists to avoid other business from going into AT&T’s service section.

Strong Client Base

AT&T has a broad consumer base, which assists produce a steady and foreseeable earnings stream, offering the business with another competitive benefit.

Economies of Scale

AT&T has economies of scales, suggesting that the business has actually cost benefits over smaller sized rivals (for instance, due to the business’s lower typical expenses). These benefits offer AT&T with a financial moat over competitors that prepare to enter its service field.

Broad Item Portfolio

AT&T has a broad item portfolio, making it possible for the business to balance out the outcomes of one department with those of another department. AT&T compares the following sections in which it runs:

- Movement

- Organization Wireline

- Customer Wireline

AT&T’s broad item portfolio permits the business to bundle services and to do cross-selling, leading to another competitive benefit for the business.

Each of the business’s competitive benefits adds to the financial moat that AT&T has more than rivals. Strong competitive benefits are important for any business, considering that they assist to make it through over the long-lasting, securing the invested cash of financiers.

The presence of AT&T’s competitive benefits has actually been essential to consist of the business in The Dividend Earnings Accelerator Portfolio.

AT&T’s Assessment

Affordable Capital Design for AT&T

At AT&T’s existing stock cost of $15.00, my DCF Design suggests an Internal Rate of Return of 8.6% for the business. In the table listed below, you can discover the Internal Rate of Return for AT&T as according to my DCF Design when presuming various purchase costs.

|

Purchase Rate of the AT&T Stock |

Internal Rate of Return as according to my DCF Design |

|

$ 10.00 |

13% |

|

$ 11.00 |

12% |

|

$ 12.00 |

11% |

|

$ 13.00 |

10% |

|

$ 14.00 |

9% |

|

$ 15.00 |

9% |

|

$ 16.00 |

8% |

|

$ 17.00 |

7% |

|

$ 18.00 |

6% |

|

$ 19.00 |

6% |

|

$ 20.00 |

5% |

Source: The Author

AT&T’s Dividend and Dividend Development and the Forecast of its Yield on Expense

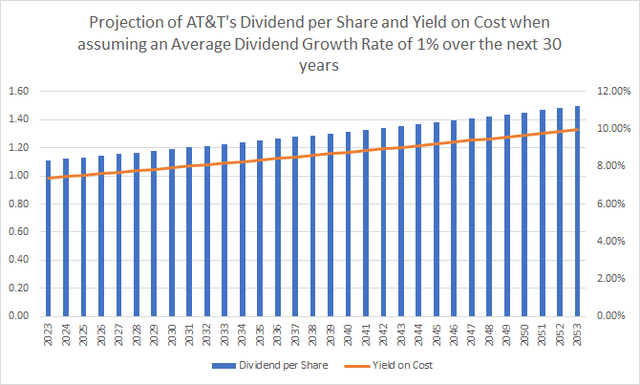

The graphic listed below programs a forecast of AT&T’s Dividend and Yield on Expense when presuming a Typical Dividend Development Rate of 1% for the following thirty years. The business’s reasonably low Payment Ratio of 44.05% adds to the truth that I think AT&T can be able to raise its dividend by a minimum of 1% each year.

Presuming that you were to buy AT&T at its existing stock cost of $15.00, you would have the ability to possibly reach a Yield on Expense of 8.17% by 2033, 9.03% by 2043, and 9.97% by 2053. Presuming the very same Dividend Development Rate of 1%, you might recover your preliminary financial investment through dividend payments by 2035 (withholding taxes have actually not been consisted of in this estimation).

AT&T compared to its Peer Group

In the following, I will compare AT&T to Verizon, T-Mobile (NASDAQ: TMUS), BCE (NYSE: BCE) and Swisscom AG ( OTCPK: SCMWY). It can be highlighted that amongst these 5 choices, T-Mobile is the biggest in regards to Market Capitalization: while T-Mobile’s Market Capitalization stands at 164.35 B, Verizon’s is 136.84 B, AT&T’s is 107.31 B, BCE’s is 34.87 B, and Swisscom AG’s is 30.70 B.

When it concerns Assessment, AT&T appears to be the most appealing choice amongst its peers: this is because of AT&T’s P/E [FWD] Ratio of 6.43, which lies listed below the among Verizon (P/E [FWD] Ratio of 7.16), and considerably listed below the among T-Mobile (19.06) and BCE (17.62 ).

AT&T likewise appears to be the most appealing choice when it concerns Success: this holds true, considering that its EBIT Margin of 23.02% is greater than the among Verizon (EBIT Margin of 22.73%), T-Mobile (19.07%), BCE (22.30%) and Swisscom AG (21.14%).

Both Verizon (Dividend Yield [FWD] of 8.17%) and BCE (7.49%) have a somewhat greater Dividend Yield [FWD] than AT&T (7.40%). Both likewise have actually revealed considerably more Dividend Development than AT&T: while BCE’s 5 Year Dividend Development Rate [CAGR] stands at 10.52%, Verizon’s is 2.03%, and AT&T’s is -5.88%.

I think that Verizon would offer financiers with the very best mix in between dividend earnings and dividend development, integrated with a decreased danger level (Verizon has a 60M Beta Element of 0.33 compared to AT&T’s, which is 0.75).

Nevertheless, considering that SCHD is the biggest position of The Dividend Earnings Accelerator Portfolio, and Verizon has a percentage of 3.90% within the ETF, I have actually chosen to consist of AT&T in The Dividend Earnings Accelerator Portfolio at this minute in time, in order to reduce concentration danger. In the future, nevertheless, I will likewise think about including Verizon into the portfolio.

|

T |

VZ |

TMUS |

BCE |

SCMWY |

|

|

Business Call |

AT&T |

Verizon |

T-Mobile |

BCE |

Swisscom AG |

|

Sector |

Interaction Solutions |

Interaction Solutions |

Interaction Solutions |

Interaction Solutions |

Interaction Solutions |

|

Market |

Integrated Telecommunication Solutions |

Integrated Telecommunication Solutions |

Wireless Telecommunication Solutions |

Integrated Telecommunication Solutions |

Integrated Telecommunication Solutions |

|

Market Capitalization |

107.31 B |

136.84 B |

164.35 B |

34.87 B |

30.70 B |

|

P/E GAAP [FWD] |

6.43 |

7.16 |

19.06 |

17.62 |

– |

|

Dividend Yield [FWD] |

7.40% |

8.17% |

0.47% |

7.49% |

4.04% |

|

Dividend Development 5 Year [CAGR] |

-5.88% |

2.03% |

– |

10.52% |

0.86% |

|

Successive Years of Dividend Development |

0 Years |

18 Years |

– |

3 Years |

1 Year |

|

Income 3 Year [CAGR] |

-11.49% |

1.34% |

14.96% |

1.94% |

-0.41% |

|

EBIT Margin |

23.02% |

22.73% |

19.07% |

22.30% |

21.14% |

|

Return on Equity |

-5.97% |

23.39% |

9.05% |

11.16% |

15.61% |

|

60M Beta |

0.75 |

0.33 |

0.55 |

0.49 |

0.16 |

Source: Looking For Alpha

Why AT&T lines up with the financial investment method of The Dividend Earnings Accelerator Portfolio

- AT&T presently has a Totally free Capital Yield [TTM] of 16.95%, which reveals us that the business’s existing stock cost is not based upon high development expectations, lining up with the method of The Dividend Earnings Accelerator Portfolio.

- My DCF Design presently suggests an Internal Rate of Return of 9% for AT&T at the business’s existing cost level, suggesting that the benefit can be reasonably appealing for financiers.

- AT&T presently pays investors a Dividend Yield [FWD] of 7.40%. The business’s Payment Ratio stands at 44.05%, suggesting that there is a lot of space for dividend improvements and suggesting that the business must not cut its dividend in the future (a dividend might have a strong unfavorable effect on the business’s stock cost, impacting the Overall Return of The Dividend Earnings Accelerator Portfolio adversely).

- The addition of AT&T into The Dividend Earnings Accelerator Portfolio assists us to raise the portfolio’s Weighted Average Dividend Yield [TTM], increasing the quantity of additional earnings that you can produce through dividend payments, when again lining up with the method of The Dividend Earnings Accelerator Portfolio.

- Nevertheless, I wish to mention that I prepare to underweight the AT&T position in The Dividend Earnings Accelerator Portfolio. This holds true, due to the fact that I think that the danger level for financiers is reasonably high and the benefit for financiers is restricted (due to the business’s minimal development point of views). The truth that AT&T is presently among the biggest positions of The Dividend Earnings Accelerator Portfolio is just a short-term element. The concept behind The Dividend Earnings Accelerator Portfolio is to just obese those sort of business that are most appealing in regards to danger and benefit.

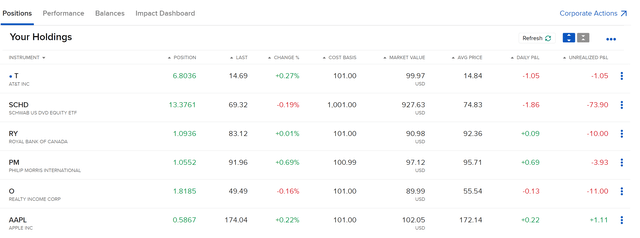

Financier Advantages of The Dividend Earnings Accelerator Portfolio after Investing $100 in AT&T

Through the acquisition of shares of AT&T for the quantity of $100, we have actually handled to raise the Weighted Average Dividend Yield [TTM] of The Dividend Earnings Accelerator Portfolio. Now, the portfolio’s Weighted Average Dividend Yield [TTM] stands at 3.90%. Nevertheless, through the acquisition, the portfolio’s 5 Year Weighted Average Dividend Development Rate [CAGR] has actually a little reduced to 10.24%.

Through the acquisition of AT&T we have not just raised the Weighted Average Dividend Development Rate of the portfolio, we have actually likewise reduced the portfolio’s danger level. Evidence of this is AT&T’s low 60M Beta Element of 0.75, which suggests that we can minimize portfolio volatility by consisting of AT&T in The Dividend Earnings Accelerator Portfolio.

Given that a number of business that become part of The Dividend Earnings Accelerator Portfolio have a 60M Beta Element listed below 1, The Dividend Earnings Accelerator Portfolio supplies financiers with a decreased danger level. This matches with the financial investment method of The Dividend Earnings Accelerator Portfolio: the portfolio supplies you with a decreased danger level, while assisting you to produce an appealing additional earnings through dividends and to increase this quantity each year.

Danger Elements

Such as discussed previously in this analysis, it can be highlighted that we have actually handled to minimize The Dividend Earnings Accelerator Portfolio’s volatility and danger level by the addition of AT&T (which has a 60M Beta Element of 0.75).

Nonetheless, financiers need to consider various elements that represent danger elements for AT&T financiers:

AT&T’s extreme competitors and its minimal Development Viewpoint

Among the danger elements that I see for AT&T financiers is the business’s strong competitors with business such as Verizon and T-Mobile. Over the last few years, T-Mobile has actually revealed considerably greater Development Rates than AT&T: while AT&T has actually revealed a 5 Year Income Development Rate [CAGR] of -5.17%, Verizon’s is 0.81%, and T-Mobile’s is 13.45%. These numbers likewise show AT&T’s minimal development point of view, which I think about to be a substantial danger element for its financiers.

A Possible Dividend Cut

Another danger element for AT&T financiers is a possible future dividend cut. A dividend cut would most likely have a substantial effect on the business’s stock cost, which would than impact adversely the Overall Return of The Dividend Earnings Accelerator Portfolio. For these factors, we intend to prevent any dividend cut of a position that becomes part of our financial investment portfolio. With a present Payment Ratio of 44.05%, I think that the possibility of a dividend cut for AT&T in the future is reasonably low.

AT&T’s Financial obligation Level

AT&T has a fairly high Overall Financial obligation to Equity Ratio of 142.91%. In addition to that, it deserves discussing that the business has a Baa2 credit score from Moody’s. Responsibilities with this score undergo a moderate credit danger. These metrics and attributes enhance my viewpoint not to obese the AT&T position in a financial investment portfolio.

Last ideas about the dangers for AT&T financiers

Through the acquisition of AT&T for The Dividend Earnings Accelerator Portfolio, AT&T ended up being briefly among the portfolio’s biggest positions.

Nevertheless, with extra acquisitions for The Dividend Earnings Accelerator Portfolio, I prepare to minimize AT&T’s general portfolio portion. I think that AT&T is not appealing enough in regards to danger and benefit to obese the business in a financial investment portfolio. Nevertheless, I think that AT&T can play a crucial function in our portfolio to increase the portfolio’s Weighted Average Dividend Yield and minimize its volatility, adding to reduce the portfolio’s danger level.

Conclusion

With the previous acquisition of Apple for The Dividend Earnings Accelerator Portfolio, we have actually enhanced the portfolio in regards to danger and benefit. I highly think that Apple is among these choices that offer financiers with a fairly low-risk level (assisting us increase the possibility of making exceptional financial investment choices) while providing an appealing predicted yearly rate of return.

By consisting of AT&T into The Dividend Earnings Accelerator Portfolio, we have actually now handled to increase the portfolio’s Weighted Average Dividend Yield [TTM] and to reduce its volatility and danger level. AT&T presently pays a Dividend Yield [FWD] of 7.40% and has a 60M Beta Element of 0.75, suggesting that it can add to decreasing portfolio volatility.

Now, The Dividend Earnings Accelerator Portfolio supplies financiers with a Weighted Average Dividend Yield [TTM] of 3.90% and a Weighted Average Dividend Development Rate [CAGR] of 10.24%. These metrics show that The Dividend Earnings Accelerator Portfolio mixes dividend earnings with dividend development.

Isn’t it excellent to be able to invest with a decreased danger level, to integrate dividend earnings with dividend development, and to pursue an appealing Overall Return at the very same time?

This is the goal of The Dividend Earnings Accelerator Portfolio! The Portfolio supplies you with stability and security (assisting you sleep well while investing), uses appealing dividend payments integrating both high dividend yield and dividend development business, and permits you to build up wealth in both bullish and bearish market circumstances.

Are you still thinking of executing the financial investment method of The Dividend Earnings Accelerator Portfolio, or have you currently began its execution?

Author’s Note: Thank you for checking out! I would value hearing your viewpoint on my choice of AT&T as the 6th acquisition for The Dividend Earnings Accelerator Portfolio. I likewise value any ideas about The Dividend Earnings Accelerator Portfolio or any tip of business that would suit the portfolio’s financial investment method!

Editor’s Note: This post goes over several securities that do not trade on a significant U.S. exchange. Please understand the dangers related to these stocks.