Andrii Yalanskyi

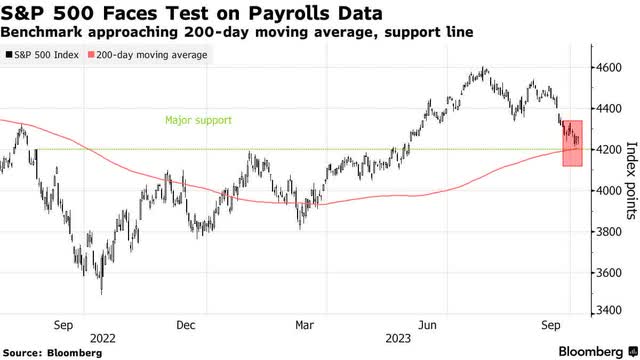

While long-lasting rate of interest supported, the significant market averages all edged lower, as financiers brace for today’s tasks report, which experts state will assist figure out whether the Fed holds constant or raises rates once again at its November conference. Weekly joblessness claims stay stubbornly low with simply 207,000 filing in the most recent week, however the number financiers ought to concentrate on tomorrow is wage development. If wage development continues to moderate, that ought to defeat a tasks number that is more powerful than anticipated. In addition, the modifications to previous regular monthly overalls have actually been leaning south for a number of months, which informs us that the labor market is cooling.

I continue to believe this dispute about whether the Fed will raise rates once again is unreasonable, however so long as Fed authorities hesitate to acknowledge the development we have actually made on the inflation front, they will lean hawkish. That will feed the bearish story of greater for longer rates. Allegedly, greater rate of interest are the death knell of this growth and booming market, however couple of acknowledge that our economy is not as conscious increasing rates as it has actually been throughout previous company cycles.

It holds true that when rate of interest increase quickly, customers tend to invest less on items and services, organizations tend to invest less on devices and broaden, business revenues are adversely affected, and joblessness boosts. This mix can lead to a financial contraction, which is why a lot of anticipate one. Yet there are elements of this company cycle that go underappreciated, which I believe will assist us prevent such a contraction.

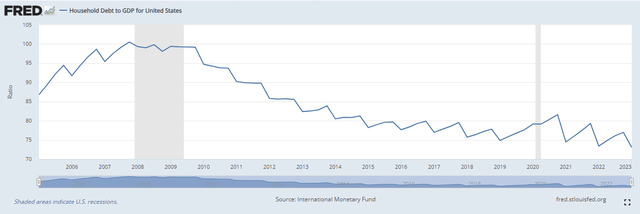

For all the issue about overleveraged customer balance sheets, family financial obligation as a portion of U.S. gdp has actually fallen from more than 100% throughout the Great Financial Crisis in 2008 to a two-decade low of 77%. This is an outcome of more accountable financing requirements and more reasoned customers. Yes, we are seeing a boost in delinquency rates for charge card and car loans, however these are falling more detailed in line with pre-pandemic levels. The stimulus-induced levels of 2021-2022 were not sustainable. The photo of general family financial obligation informs a far better story.

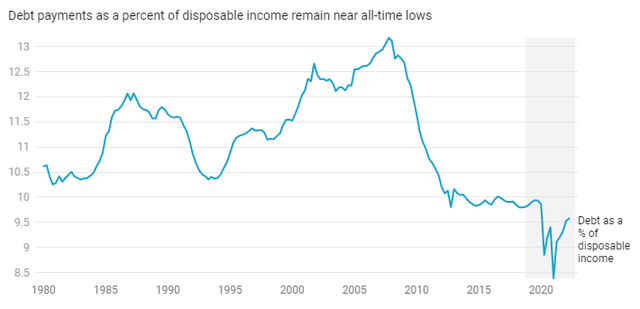

I keep becoming aware of how charge card financial obligation has actually gone beyond $ 1 trillion That’s a huge number that is bound to terrify anybody, however it needs to be seen in the context of the size of the general economy, which regularly grows, and the expense to service the financial obligation. There has actually been a remarkable decrease in the quantity of after-tax earnings needed to service arrearage. The financial obligation maintenance ratio fell from a record high 13.2% to an all-time low throughout the pandemic, and it stays near a multi-decade low of 9.6%.

The decrease in impressive stock of financial obligation is the factor that the 520 basis points in rate boosts by the Fed over the previous 18 months just led to a 1.5% boost in the portion of non reusable earnings needed to service that financial obligation. This is assisting to sustain customer costs levels, and extend the growth, however it isn’t simply the customer who is less conscious modifications in financial policy.

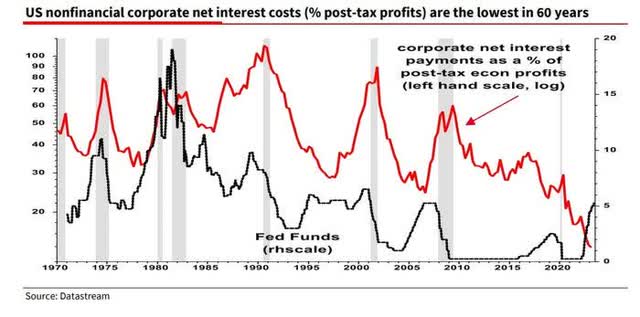

Business financial obligation has actually seen comparable modifications. The stock of impressive business financial obligation as a share of GDP at 43% is not far from its 2008 peak of 45%, however as a portion of business net worth it is at a 50-year low. In addition, the financial obligation impressive is predominately repaired rate and longer term with typical maturities varying from 4 to ten years, depending upon possession class. The portion of investment-grade financial obligation developing after 2028 has actually increased to 56%, while the portion of high-yield financial obligation depends on 42%. This indicates that business America is likewise less conscious increasing rate of interest. In truth, the Fed’s rate-hike project has actually been a windfall for many sectors of the S&P 500, due to the fact that net interest expenses as a portion of post-tax revenues have actually collapsed.

Throughout the ultra-low rates of interest duration from 2020-2022, corporations re-financed arrearage at repaired rates for longer terms in the exact same method that property owners re-financed home mortgages. When the yield curve inverted, due to the rise in short-term rates, corporations began making substantial amounts on their money balances in the exact same way that retail financiers are benefiting from cash market funds. This is increasing business revenues and assisting to sustain capital costs, as net interest expenses have actually plunged to a 60-year low.

I believe the outlook for rate of interest to be greater for longer is a farce, offered the inbound high-frequency financial information. Regardless, customers and corporations are far less conscious increasing rate of interest than they have actually remained in the past. With the Fed’s rate-hike cycle having most likely concluded, and the disinflationary pattern undamaged, a soft landing is looking more likely with each passing month. The correction in stocks over the previous 2 months in mix with the sharp increase in long-lasting rate of interest is developing a great deal of doubt, however an economic downturn and bearish market are still not in the numbers.

Editor’s Note: This post covers several microcap stocks. Please understand the dangers related to these stocks.