BlackJack3D

We’re updating Microsoft Corporation ( NASDAQ: MSFT) to a buy. We now see a more beneficial risk-reward profile for the stock towards H2FY24. While we comprehend and formerly shared financier issues over slower cloud development last quarter and the weaker international IT investing environment in 2H23, our company believe the macro headwinds have actually been priced into the stock and outlook for Q1 2024.

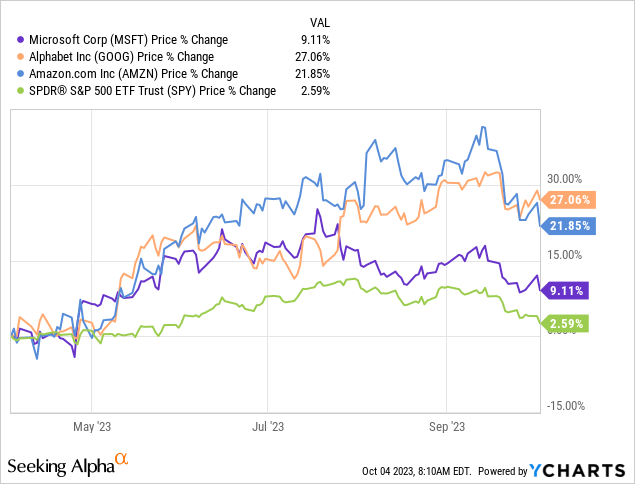

The stock is down approximately 8% given that our upgrade to keep in late July, reasonably in line with the S&P 500 ( SP500). Microsoft has actually underperformed the peer group over the previous 6 months however a little surpassed the S&P 500. Our upgrade is based upon our belief that the macro unpredictability has actually been priced in. Now, Microsoft Corporation is much better placed to utilize the A.I. development chance as it generates income from Microsoft 365 Copilot beginning November 1st, sticking an extra $30/month cost on Copilot for business clients.

The following chart lays out MSFT’s stock efficiency versus Alphabet ( GOOG) ( GOOGL), Amazon ( AMZN), and the S&P 500.

YCharts

Our primary issue for Microsoft in 1H23 was financiers being too thrilled and prematurely about A.I. tailwinds without thinking about the softer cloud costs environment and macro weak point affecting other core sections. We believe financiers awakened to the materiality-softer cloud costs environment last quarter when Azure cloud development slowed to 26% Y/Y from 27% a quarter previously. The stock was up approximately 42% in 1H23; in contrast, given that 2H23 started, the stock is down 7%, underperforming the S&P 500 down 5%. We see a clearer course to outperformance towards 2024 and advise financiers check out entry points at existing levels.

A.I. money making is here & & need gets in other places, too

We believe Microsoft is now much better placed to experience monetary outperformance driven by A.I. due to the prices of Copilot combined with the broad set up base of Microsoft 365. The Microsoft 365 A.I. membership service includes A.I. to the business’s Workplace items, consisting of Word, Excel, and Groups; the membership will cost an extra $30 monthly, which would increase the regular monthly rate for business clients by as much as 83%. We believe this 83% boost will serve as an increase in income from repeating memberships and drive top-line development for Microsoft towards H2FY24. While we continue to anticipate the weaker international IT investing environment to continue due to greater rates of interest, we do not see clients cutting down on their A.I. financial investments in 2024.

We have actually been awaiting Microsoft to generate income from A.I. to update the stock back to a buy and now think the minute is here; Microsoft now has an one-upmanship over Alphabet’s Bard and other chatbots in the software application area. We see a progressive however successful A.I. development runway for the business into H2FY24.

Furthermore, we believe the PC market remains in healing for 2024, and Microsoft will experience a reacceleration in More Individual Computing income in H1FY24 as an outcome; we likewise see tailwinds from the Win7 EOL advantage. We now anticipate the PC overall addressable market, or TAM, to increase 5% Y/Y in 2024 to around 263M systems; this is not an impressive number, however it is a significant boost, thinking about the 2023 PC TAM contracted substantially this year.

What about Azure’s slower development?

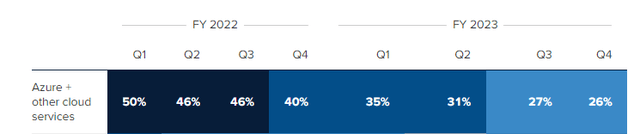

Azure cloud development has actually slowed in FY23, constant with our expectations in 1H23; the following lays out Azure and other cloud services’ Y/Y development in FY22 and FY23 – the slower development is not due to any imperfection from Azure however due to softer cloud costs QoQ in the post-pandemic environment.

MSFT Azure section results FY22/FY23

Management now guides for 25% to 26% Y/Y development for Azure in Q1 2024; we anticipate Azure development to stay in the double-digit variety however continue to see slower costs due to the greater rate of interest environment. We believe information center and cloud costs is still under pressure into 1H24 however believe Microsoft’s A.I. money making and supporting Azure development portion much better position the business to outshine.

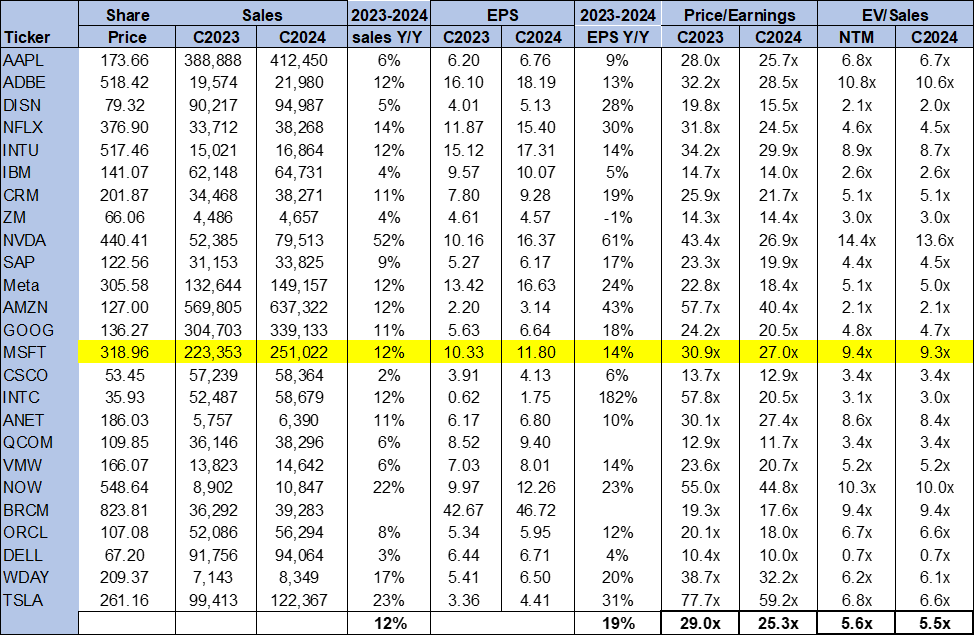

Assessment

The stock is trading well above the peer group average, however we believe the greater evaluation is warranted. On a P/E basis, the stock is trading 27.0 x C2024 EPS $11.80 compared to the peer group average of 25.3 x. The stock is trading at 9.3 x EV/C2024 Sales versus the peer group average of 5.5 x. We comprehend financier issue over the evaluation premium, however think the A.I. money making tailwinds combined with the PC healing position Microsoft as a development stock and validate the greater several.

The following chart lays out MSFT’s evaluation versus the peer group.

TSP

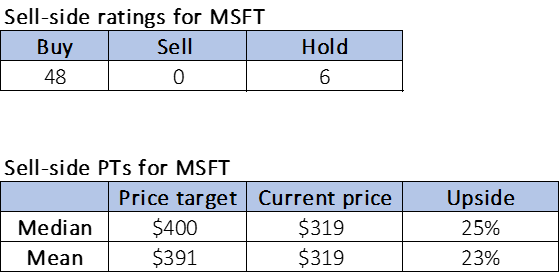

Word on Wall Street

Wall Street shares our bullish belief, which does not occur frequently. Of the 54 experts covering the stock, 48 are buy-rated, and the staying are hold-rated. The stock is presently priced at $319 per share. The average sell-side rate target is $400, while the mean is $391, with a prospective 23-25% benefit.

The following charts describe MSFT’s sell-side rate targets and scores.

TSP

What to do with the stock

We’re updating Microsoft to a buy; we see appealing entry points into the stock towards 2024 and think the macro weak point has actually been priced into both the stock and outlook for H1FY24. We believe Microsoft is much better placed now to utilize its position as an early mover in the A.I. area with the OpenAI collaboration on ChatGPT as the business takes combined relocate to generate income from A.I. into monetary outperformance. We see a more beneficial risk-reward profile for the stock towards H2 FY24.