marchmeena29/iStock by means of Getty Images

Graham’s knowledge used to IRM

Let me begin with an overarching view initially prior to diving into the information of Iron Mountain Incorporated ( NYSE: IRM). Under the existing macroeconomic environment, I think disadvantage defense by means of protective stocks is even more crucial than pursuing development. Versus this more comprehensive view, the thesis of this post is to argue IRM is NOT a great option as a protective stock under existing conditions. I will make my argument following the classic knowledge of Ben Graham.

Initially, Graham strongly thought that stock assessment ought to be anchored by rates of interest, and he established a number of techniques for financiers to examine stock assessment based upon rates of interest. As an example, the following is an approach priced quote from his book The Intelligent Financier:

Our standard suggestion is that the stock portfolio, when gotten, ought to have a general earnings/price ratio-the reverse of the P/E ratio-at least as high as the existing top-quality bond rate. This would indicate a P/E ratio no greater than 13.3 versus an AA bond yield of 7.5%.

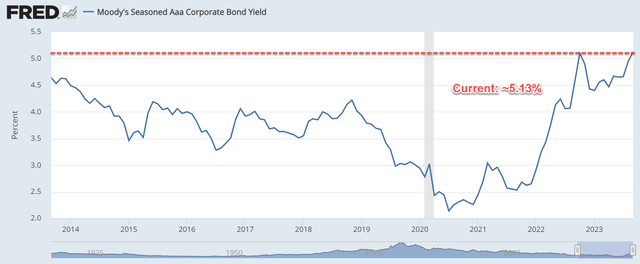

As you can see from the chart below, AAA bond rates (based upon Moody’s Seasoned AAA bonds) are near the greatest level in a minimum of a years, hovering around 5.13%. According to Graham’s knowledge above, this would indicate a P/E ratio no greater than 19.5 x.

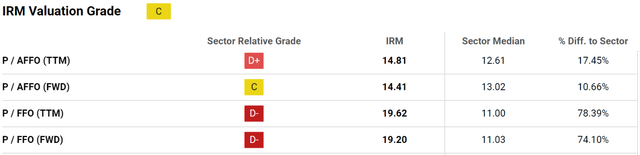

Now back to IRM, its P/FFO (the equivalent of P/E for REIT stocks) remains in a series of 19.2 to 19.6 x depending upon if you utilize the TTM or FWD basis. In either case, its P/FFO ratio is too near Graham’s standards and provides little margin of security.

A few of you might argue that in regards to P/AFFO several, the stock is trading well listed below Graham’s standard of 19.5 x. It holds true that its P/AFFO now beings in a series of 14.4 to 14.8 x as displayed in the 2nd chart listed below.

To resolve this remark, my counterarguments are primarily twofold. Initially, a number of the changes in AFFO feel rather subjective to me and might misshape its real financial profits. 2nd and more crucial, IRM’s credit ranking is no place near AAA (its credit rankings remain in the BB- to Ba3 variety). And as an outcome, it should not be benchmarked versus the AAA bonds rate to begin with. In fact, as detailed in the area instantly below, its monetary strength is another location that I am worried about.

Graham on protective stocks

Obviously, it is very important to keep in mind that the above assessment guideline (or actually, any assessment guideline) ought to be simply among numerous aspects that we think about when making financial investment choices. Back to Graham’s knowledge, he likewise highlighted other aspects such as the quality of the business’s profits, monetary strength, long-lasting development record, and so on. All these insights are distilled in his Intelligent Financier as a list for choosing “protective stocks.” At the top of his list is the following one:

Is the business big, popular, and conservatively funded? The particular metrics to try to find are steady f inancial strength, constant capital structure, and a strong performance history of dividend payments.

Whether the business is a big and popular gamer includes a little bit of subjective judgment. On the one hand, it is a leading company of records, files, and information-management services. Nevertheless, on the other hand, financiers should know that this sub-sector is a reasonably small part of the economy in the grand plan of things. At the exact same time, its standard paper company is dealing with development problems (paper records storage still is its core company presently) in our view. You can see more information on this in our earlier short articles Management has actually been attempting to develop out its infotech information centers. However this will need ongoing heavy financial investment (more on this in the danger area). In regards to dividend performance history, the business has actually been paying and growing the dividend consecutively given that 2010. A performance history of 13 years is a bit too brief for my taste. However it is a great start.

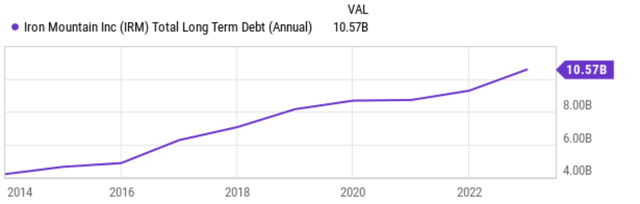

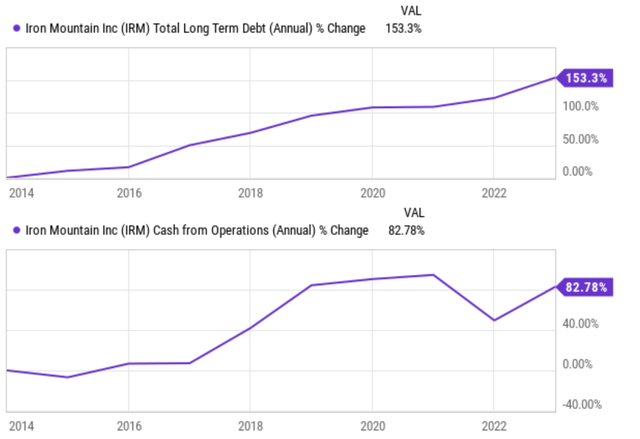

My larger issue is with IRM’s existing financial obligation. And on this front, we do have more quantitative procedures for more unbiased evaluation. As seen in the leading panel of the chart below, its financial obligation has actually been increasing quickly. It has actually grown from about $4B to the existing level of $10.6 B in the previous ten years. Obviously, this will not be a concern if its profits have actually likewise grown at the exact same rate.

Regrettably, this is not the case, as seen in the next chart listed below. The chart reveals IRM’s financial obligation development (leading panel) and profits development in regards to operation money (bottom panel) in the previous years. As seen, IRM’s overall long-lasting financial obligation increased by 153.3% from 2014 to 2022. In contrast, its money from operations increased just by 82.78% throughout this duration. The financial obligation development has actually far surpassed its profits development.

Other dangers and last ideas

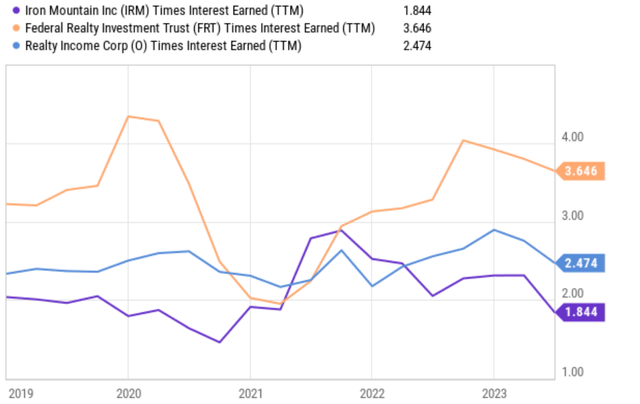

The monetary stretch would trigger other dangers in the method I see things. As discussed above, IRM’s financial obligation development has actually surpassed its profits development. To make things even worse, the previous couple of years have actually likewise experienced a series of rate of interest walkings, even more contributing to its loaning expense. As an outcome, RM’s interest protection, as displayed in the chart below, is just about 1.84 x now. It is near the most affordable point in 5 years and likewise significantly listed below that of other property financial investment trust (” REIT”) stocks.

Such extended financials can likewise restrict its capital allotment options. As previously mentioned, management has actually been attempting to develop out its infotech information centers as a method to diversify its heavy dependence on paper records. On the favorable side, I see this reasonably brand-new location as an appealing development engine for the future. At the exact same time, its core paper record sector is still creating healthy capital to bridge the transition/expansion.

Nevertheless, this effort into information centers will need ongoing CAPEX Financial investment for several years. The extended financial resources might restrict management’s capability to pursue this growth. In the meantime, time is not on IRM’s side, as competitors is heightening both from other entrants and likewise from more recognized cloud information center companies.

All informed, I see the negatives as the more powerful force under existing conditions. To summarize, my leading issues are twofold. Initially, its existing assessment provides little margin of security, specifically when benchmarked versus bond rates following the approach Graham established. Second, I do not see it as a protective stock offered its extended monetary strength and the unpredictability of its development efforts.