Phiromya Intawongpan

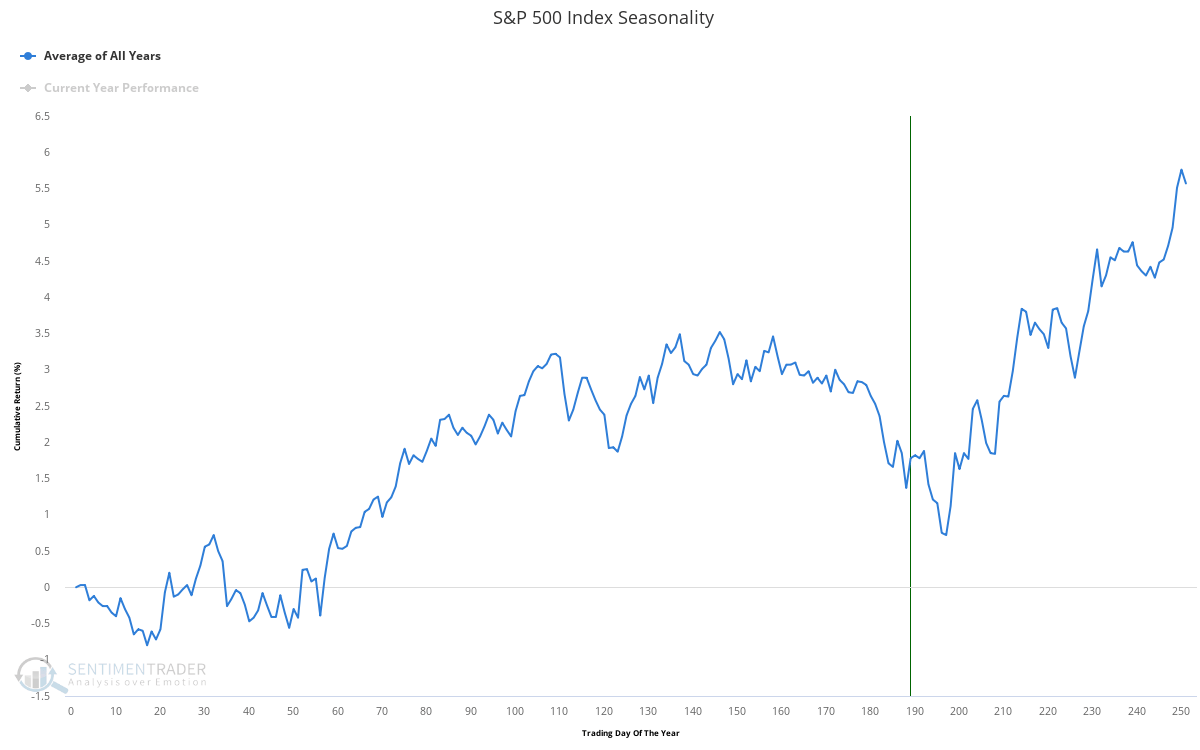

One: The window of weak point is closing

In my previous Chart Book, I went over how we were going into a window of weak point following the mid-September quarterly alternatives expiration. The last 2 or two weeks in September and the very first week of October usually represent a window where the structurally favorable circulations of Vanna and Appeal that are normally present throughout regular market conditions (a vibrant exacerbated this year due to the suppression of volatility through record structured item issuance) go on vacation for a longer than typical amount of time. Therefore, this duration sees the opening of a window where bearish basic and macro circulations have the ability to press markets to where they ought to appropriately be.

So far, this window of weak point has actually played out to a tee. The concern now ends up being whether we have actually seen enough of a correction to presage another leg higher into year end or whether this is the resumption of the bearish market the macro and basic outlook for equities recommends is called for.

While I am not always encouraged we are visiting a blow-off top into year-end, I do think it stays the most likely circumstance than a full-blown market crash in the short-term. This predisposition is based around the ramifications of seasonality, which is years such as 2023 have substantial structural reasons it matters for markets, consisting of:

-

There stays a good supply of alter and volatility, implying bullish Vanna and Appeal circulations will be effective throughout the last months of the year.

-

These circulations ought to get in the marketplace throughout the November to December duration where there is the greatest variety of public vacations for the year, implying there is less time in which markets are open (approximately 65% of the volume-weighted time compared to other months). Therefore, more of the equity circulations have the prospective to be controlled by favorable Vanna and Appeal circulations.

-

Efficiency chasing by hedge fund and equity supervisors who have actually lagged the index all year, and see this correction as a purchasing chance to get some alpha as we liquidate the year.

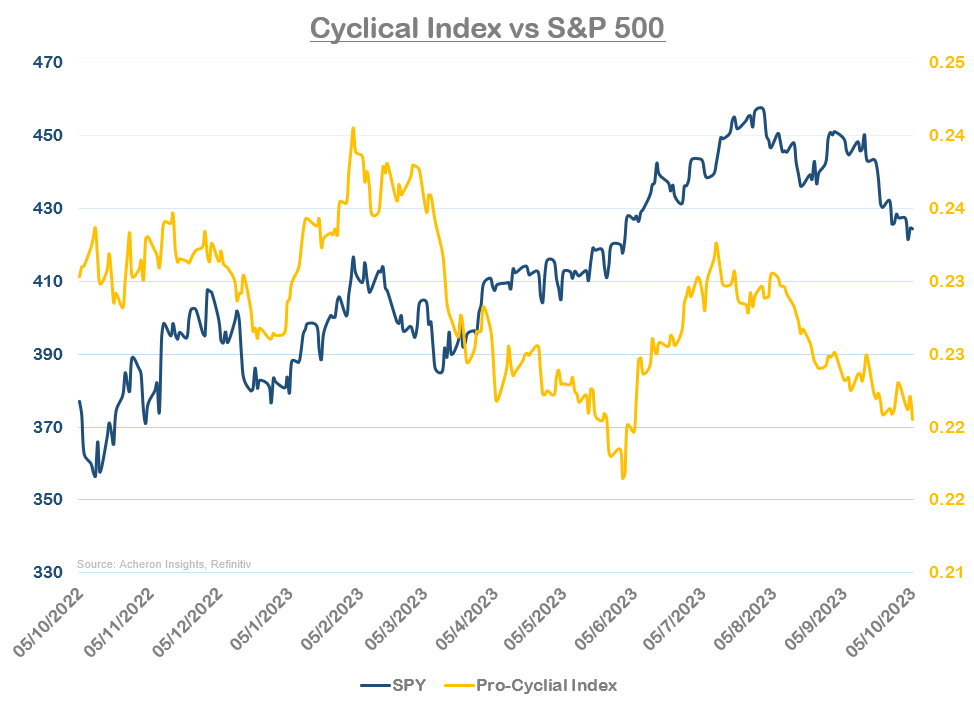

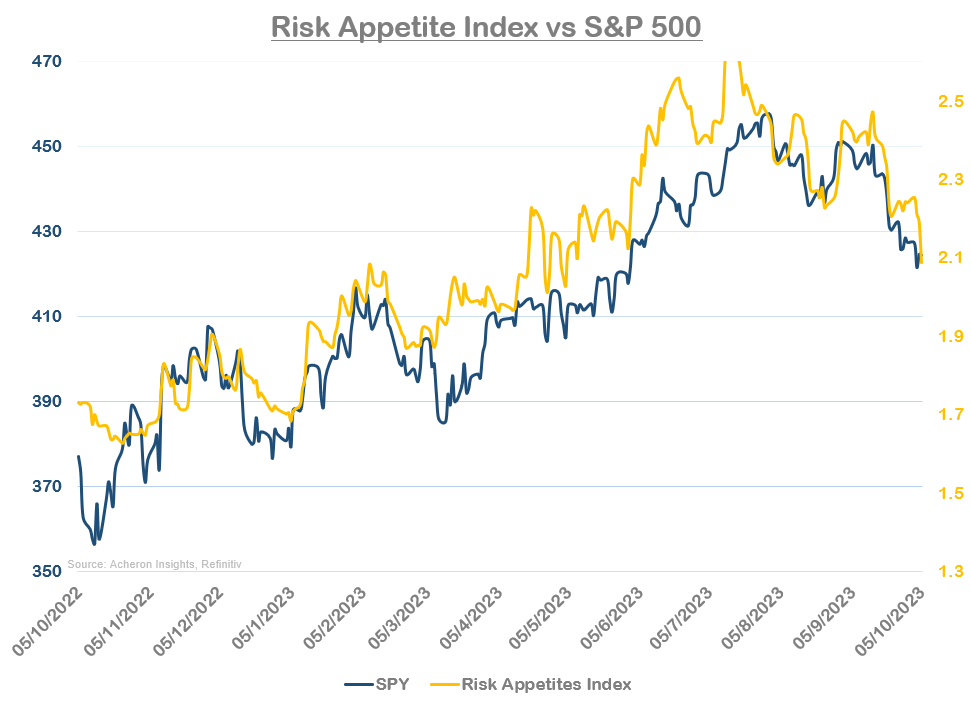

2: Blended signals for market internals pt. 1

Taking a look at market internals, we presently aren’t being offered any product bullish or bearish signals. My Cyclical Index has actually fixed in-line with the marketplace after disconfirming much of the post-April rally, while my Threat Appetites Index has actually likewise moved lower in-line with the marketplace. Ideally, I wish to see some sort of favorable divergences prior to announcing any year-end rally is ensured.

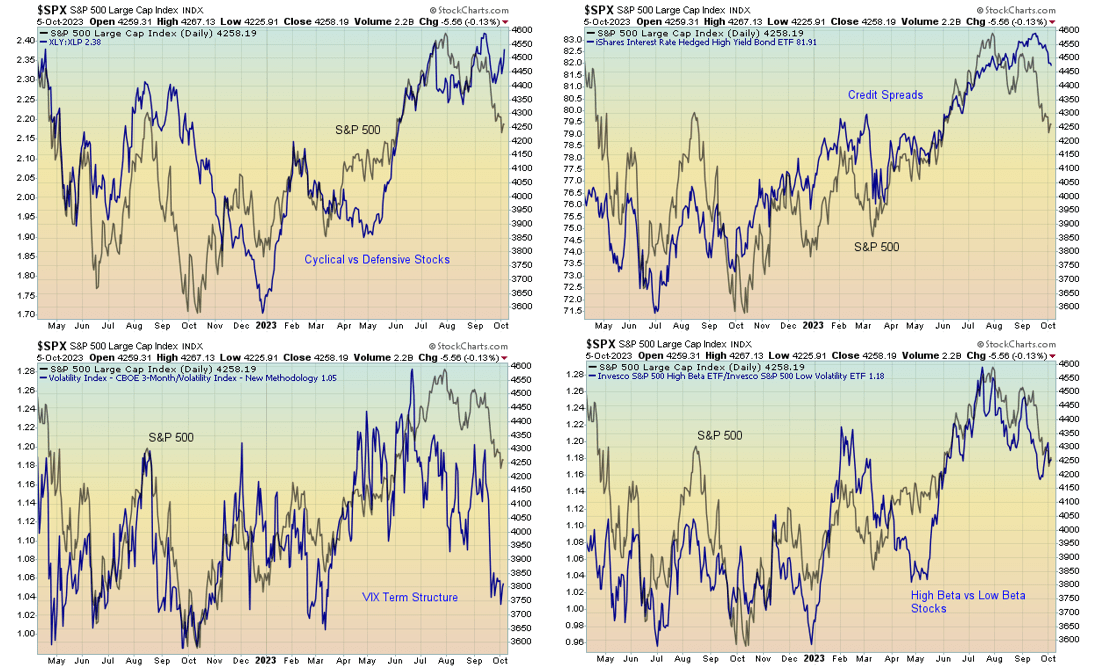

3: Blended signals for market internals pt. 2

Digging much deeper into a few of the specific market internals indications themselves, we can see the cyclicals vs defensives ratio is especially helpful of this being a tradable low, with credit spreads likewise sending out a comparable message.

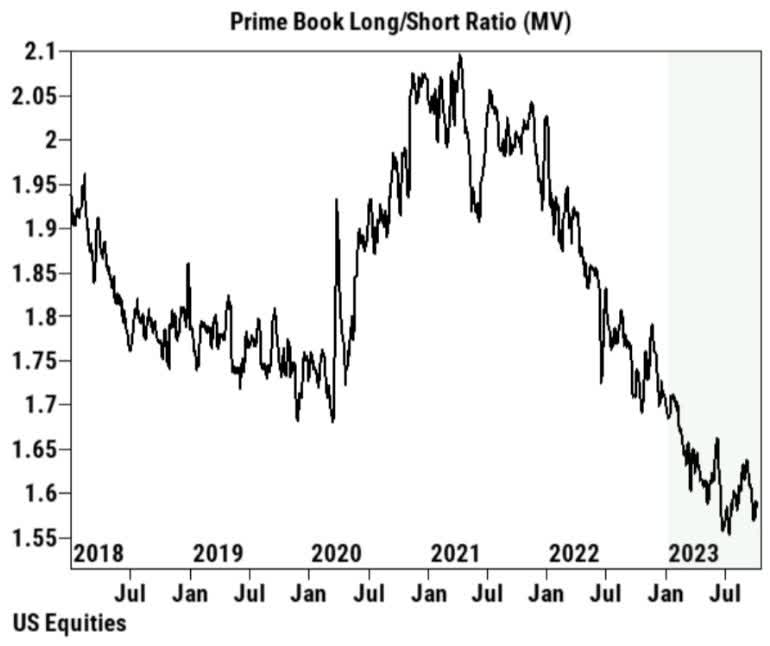

4: A reset in placing

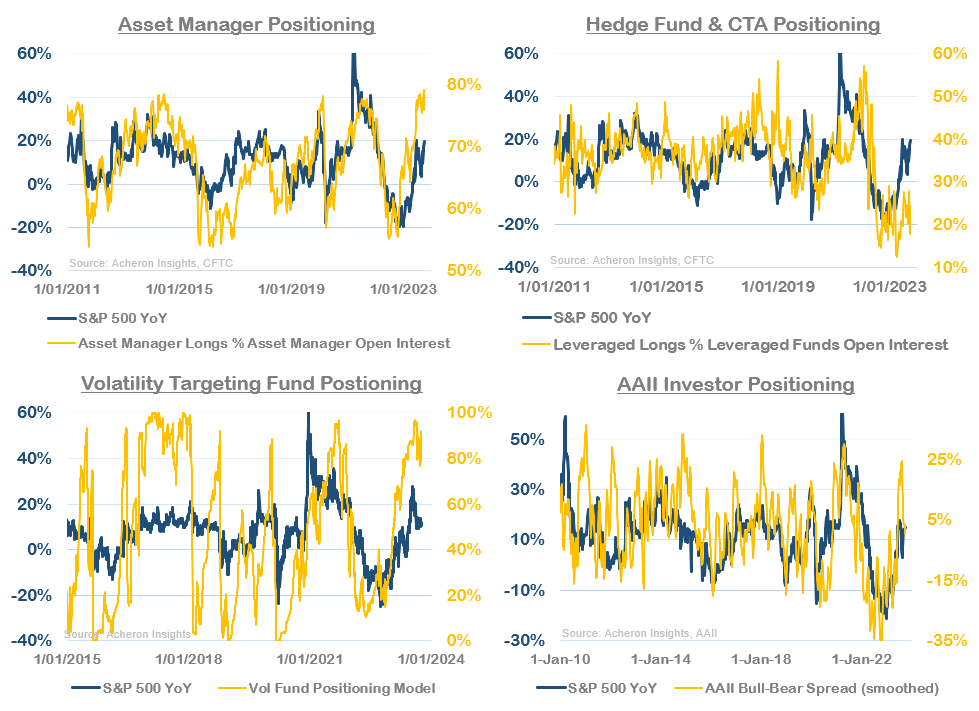

From a placing viewpoint, this correction has actually gone a long method to minimize a few of the extreme bullishness we were seeing a number of months back. While possession supervisors and volatility targeting funds are still long the marketplace, hedge funds, CTA’s and financier belief is much more neutral.

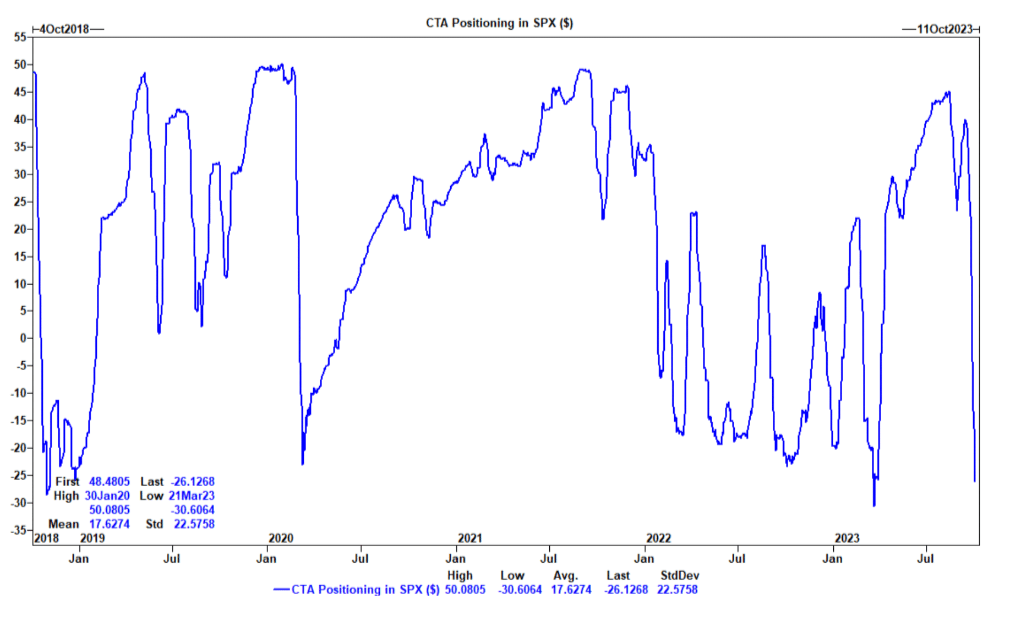

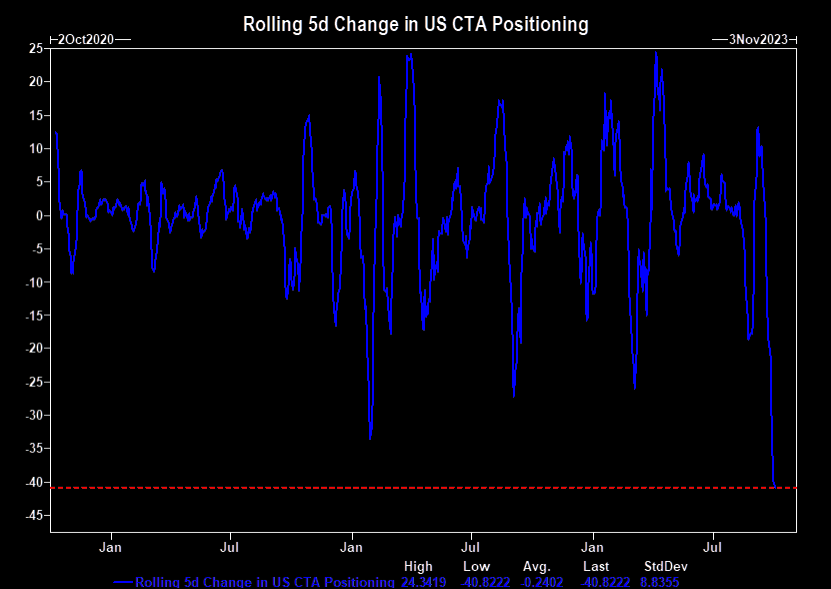

5: Big relax for CTA’s

Most significantly, this sell-off has actually seen a huge relaxing in CTA placing towards equities. Quickly the biggest in a number of years, CTA’s have actually gone from substantially obese to now substantially brief the marketplace. Much of the fuel they offered this sell-off is now tired.

Source: Goldman Sachs

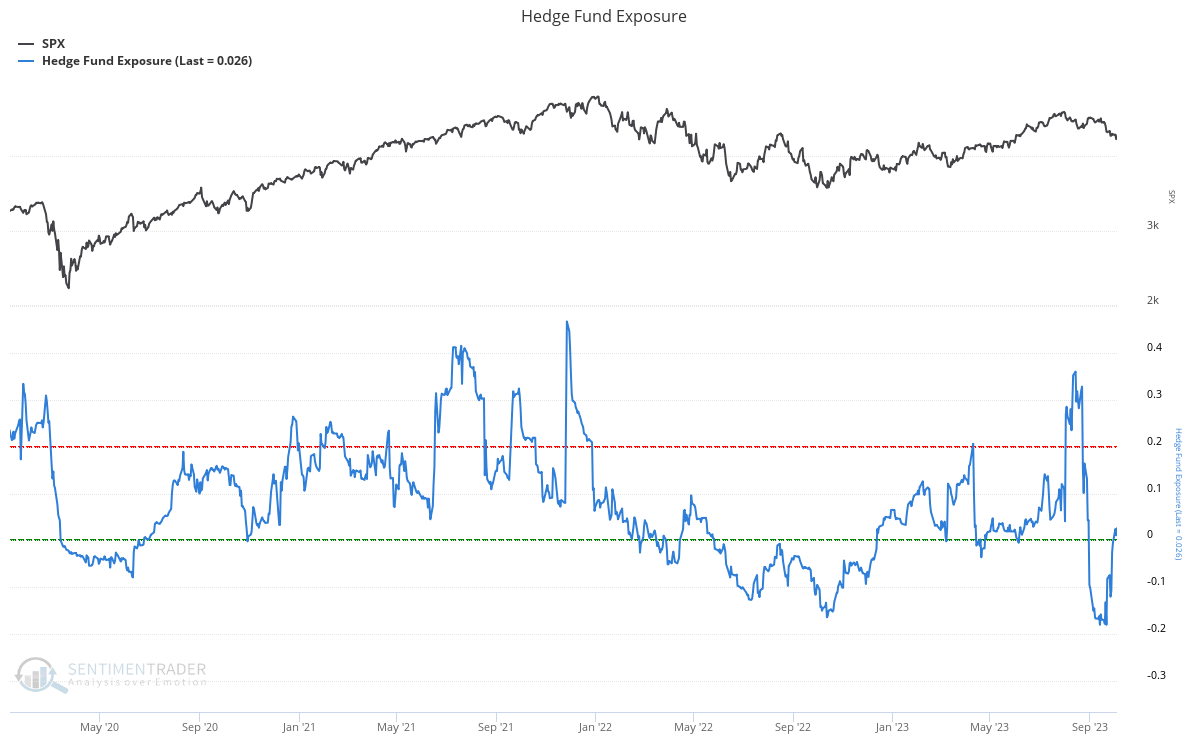

6: And, a huge relax by hedge funds

The exact same can be stated of hedge funds, whose direct exposure to the marketplace has actually gone from materially net-long to net-short. Whilst we have actually seen a pick-up in hedge fund direct exposure over the previous number of weeks, their positioning stays fairly benign and ought to we see a rebound over the next couple of weeks that sees shorts get squeezed, leveraged gamers such as hedge funds and CTA’s might supply a lot of fuel to fire a blow-off top into year end.

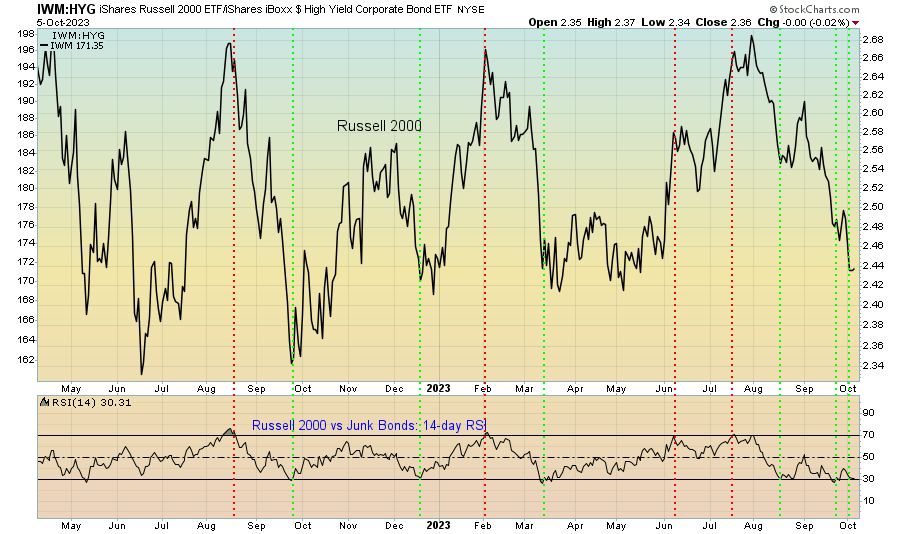

7: A buy signal for little caps?

Another pattern worth keeping in mind is I am seeing a variety of short-term buy signals start to appear. One such example is the Russell 2000 vs scrap bonds ( HYG) RSI, which has actually reached severe oversold area. This usually accompanies short-term relocations greater for little caps at least.

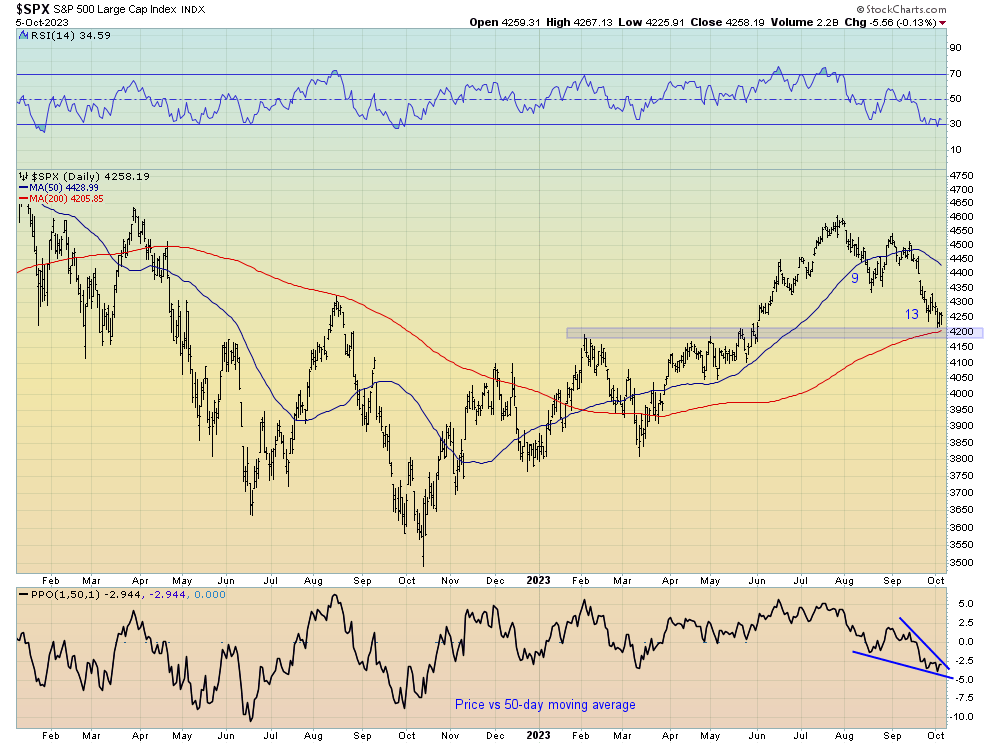

8: S&P 500 sitting at assistance

From a technical viewpoint, the S&P 500 has actually fixed back to a significant assistance level around 4,200. Offered this level likewise accompanies the 200-day moving average, it looks like an affordable location for the marketplace to stage a bounce. At the minimum, the phase is set for another unpredictable month in October.

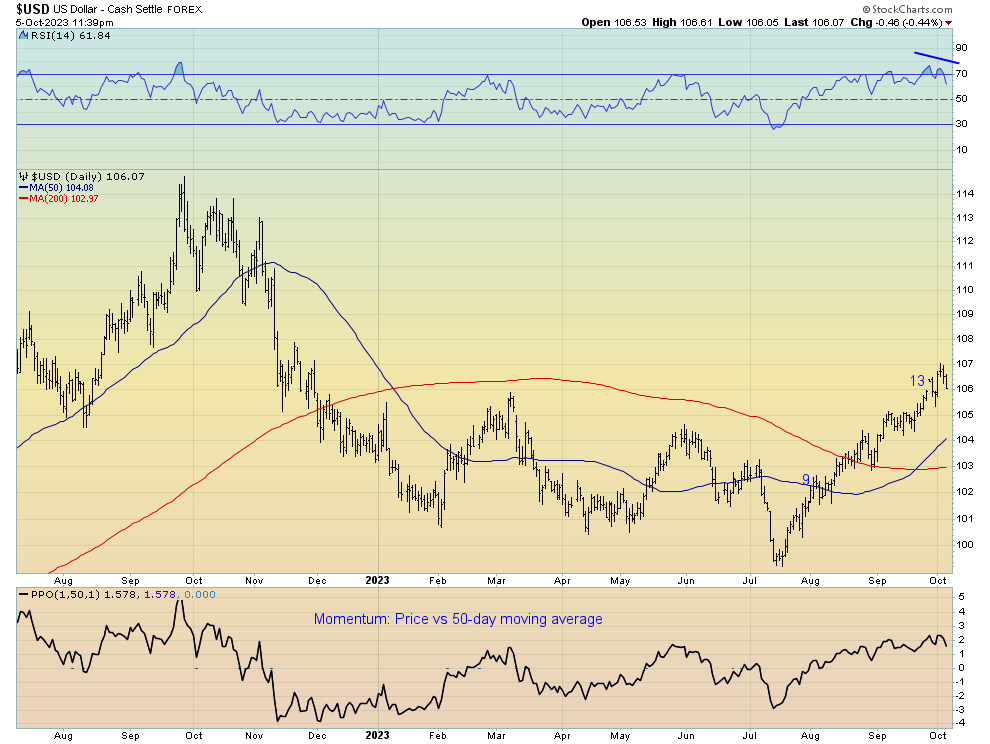

9: The dollar damaging ball

At the centre of this current chaos in both the stock exchange and bond market has actually been the quick increase in the dollar because mid-July. A greater dollar is extremely bad for liquidity, so any relocation lower in the DXY in the weeks or months ahead ought to assist to supply some calm in risk-assets. Though I stay bullish the dollar over the medium-term, I ‘d anticipate some sort of combination and/or pull-back is called for offered how one-directional it has actually sold current months.

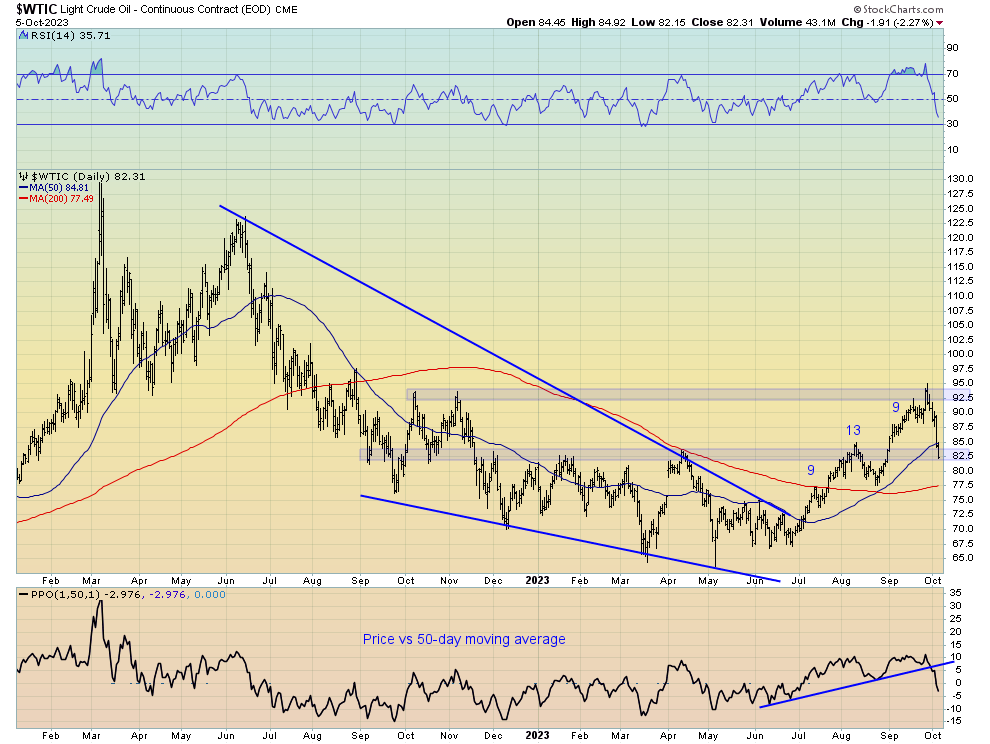

10: A huge correction in crude

Another market advancement worth mentioning has actually been the quick correction in petroleum this previous week. Although I was anticipating a relocation lower in oil costs (as comprehensive here), the truth it has actually occurred this rapidly is rather worrying, specifically offered we have actually apparently lost the 200-day moving average.

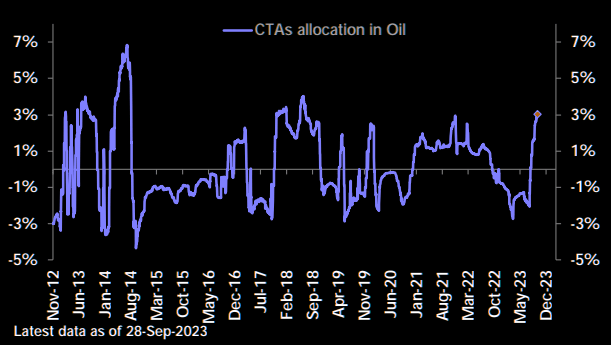

Eleven: CTAs are to blame

Among the main reasons I have actually been anticipating oil to remedy was as outcome of the degree to which hedge funds and CTA’s had actually gotten themselves long oil in current weeks. CTA’s in specific were the most obese oil they had actually remained in years.

In general, the basic outlook for oil stays mainly favorable for the next couple of months, and there stays a good opportunity we see WTI once again evaluate the mid-to-low $90s prior to the year is out. The present washout of speculative positioning ought to just support this case, it’s now a matter of whether WTI can discover assistance around $82 or $75.

Editor’s Note: The summary bullets for this post were picked by Looking for Alpha editors.