AlexSecret

Thesis summary

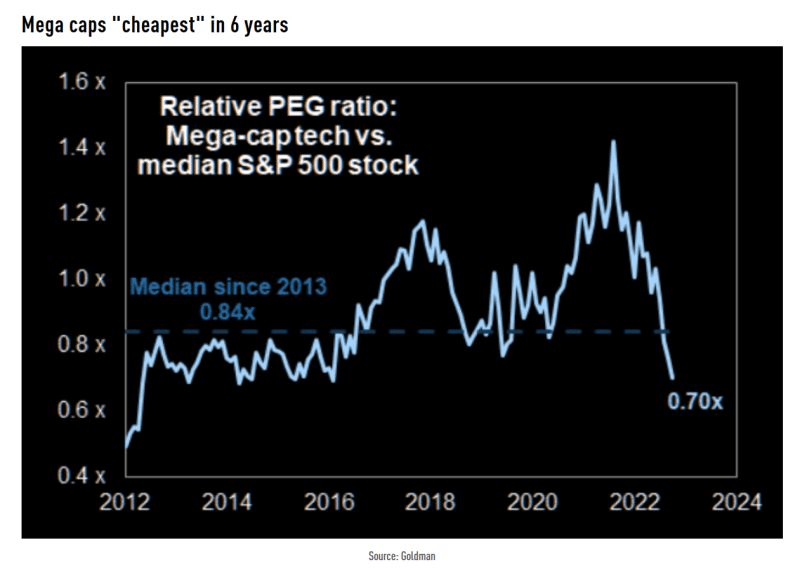

Mega-caps stocks have actually been accountable for the majority of the marketplace gratitude, however that does not in fact imply they are pricey. If we take a look at PEG particularly, they are rather inexpensive.

Offered what’s to come, there’s a legitimate reason mega-caps must trade at a premium.

Out of the Splendid 7, Alphabet ( NASDAQ: GOOGL) stands apart, in my viewpoint, as using the very best worth and the most appealing outlook.

Mega-caps are reasonably inexpensive

This year, we have actually experienced the birth of the Splendid 7, an extension of the initial FAANG club.

The stunning 7 consist of Alphabet, Microsoft ( MSFT), NVIDIA Corporation ( NVDA), Apple, Inc ( AAPL), Amazon.com ( AMZN), Tesla ( TSLA), and Meta Platforms ( META)

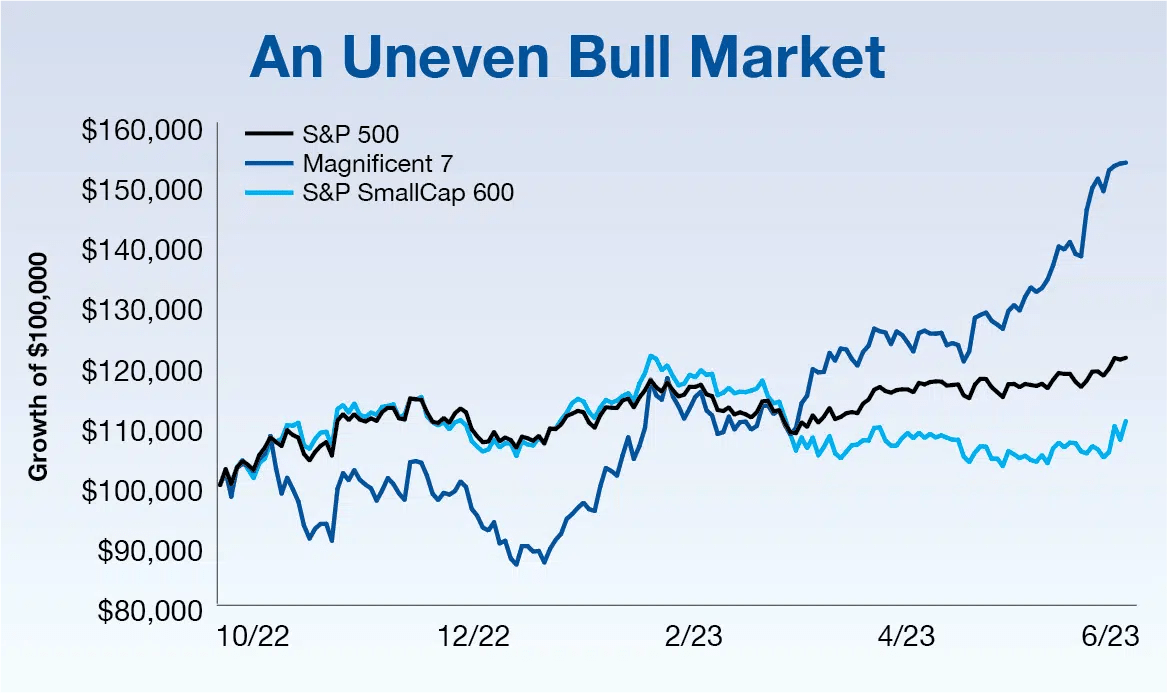

Mega-caps vs S&P (Consultant financial investments)

It’s simple to see in this chart that the mega-cap stocks have actually significantly outshined the more comprehensive market. In reality, small-cap stocks in the Russell 2000 ( IWM) are now practically flat over the in 2015, while META is up over 100% in the very same period.

However even if the stocks have actually rallied does not imply they are miscalculated. In reality, they may be traditionally underestimated after the last sell-off.

PEG mega-caps vs S&P (Goldman)

Determining the PEG of the Mega Cap tech stocks vs the S&P 500. The stunning 7 in fact have a typical PEG of 1.3, compared to a typical PEG for the more comprehensive market of 1.9. This is the steepest “discount rate” because 2013 and is presently listed below the average over the last 10 years.

Splendid 7; royal rumble

From what I can see, the PEG ratio utilized by Goldman Sachs ( GS) is the Non-GAAP FW PEG.

Now, if we accept that the stunning 7 deserve purchasing, which is the very best in the pack?

|

GOOGL |

META |

TSLA |

AMZN |

AAPL |

NVDA |

MSFT |

|

|

PEG Non-GAAP (FWD) |

1,39 |

1,03 |

3,24 |

1,54 |

2,74 |

1,23 |

2,28 |

|

EV/EBITDA (FWD) |

13,42 |

11,24 |

46,67 |

14,31 |

21,19 |

38,70 |

19,96 |

|

Price/Cash Circulation (TTM) |

17,23 |

14,17 |

59,40 |

21,19 |

24,01 |

91,42 |

27,06 |

|

Profits 5 Year (CAGR) |

18,50% |

19,97% |

47,03% |

20,92% |

8,51% |

22,44% |

13,94% |

|

EPS Watered Down 3 Year (CAGR) |

27,57% |

1,45% |

200,38% |

-0,96% |

21,81% |

44,84% |

18,89% |

Source: Looking For Alpha

The table above compares all of the stunning 7 on numerous metrics.

Based Upon the PEG, META stands apart as the most appealing, followed carefully by NVDA and GOOGL.

META when again wins on EV/EBITDA, with GOOGL being available in at a close second. These 2 business when again master regards to Price/cash circulation, and we can see rather a significant distinction. While META and GOOGL trade at 14x and 17x capital the next finest stock is AMZN at 21.

In regards to profits, TSLA and NVDA remain in a league of their own. The quick development over the last 5 years has actually likewise equated into really high EPS development. Tesla grew EPS by 200%, NVDA by 44.8%, and in 3rd location, GOOGL.

Each financier has his own set of choices, however if you ask me, GOOGL is the mega-cap tech stock that provides the very best balance of development, evaluation and is most likely the very best set-up for what follows.

GOOGL is well established for what follows

Greater rates have actually been driving down the marketplace. It appears like greater for longer could in fact be a lot longer, so how should financiers get ready for this brand-new environment?

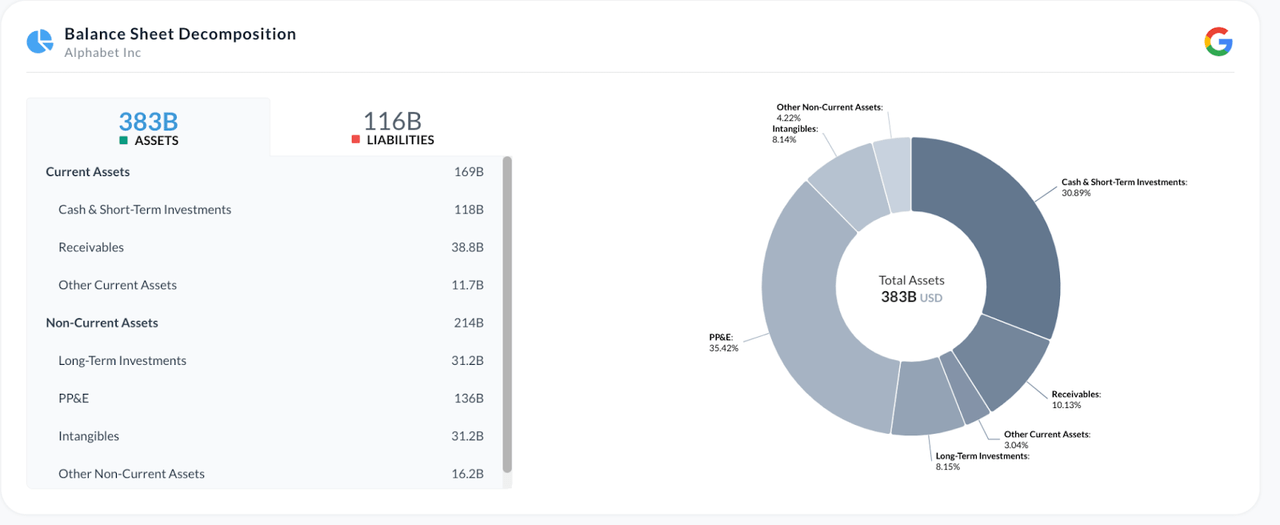

If credit is going to be tight, and this might potentially result in an economic crisis, then a strong balance sheet is a must.

Look No More than GOOGL.

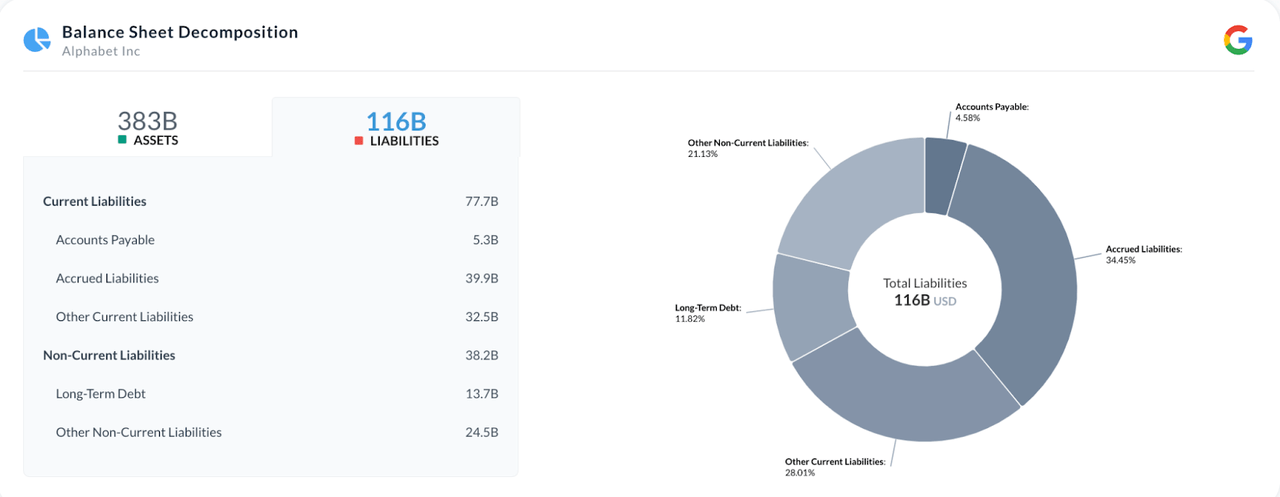

Google properties (Alpha spread out) Google liabilities (Alpha spread out)

With $383 billion in properties and just $116 in liabilities, GOOGL has a fortress balance sheet. The business likewise boasts $118 billion in money and short-term financial investments.

These will can be found in really convenient in the coming years. 1 month T-bills are paying 5.56% today. This implies GOOGL might be including over $6.5 billion annual simply from holding T-bills.

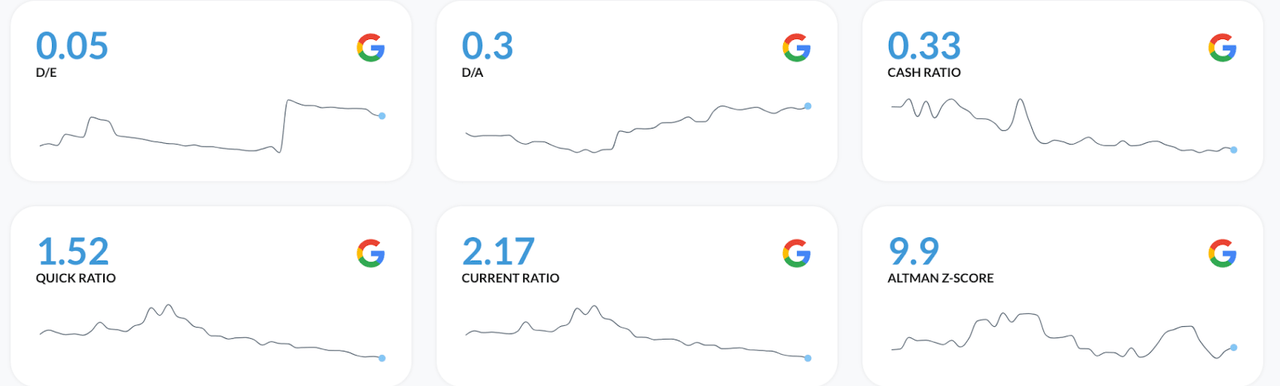

Solvency ratios (Alpha spread out)

GOOGL is exceptionally strong in all solvency procedures, and in reality, it is the greatest of the stunning 7.

|

GOOGL |

META |

TSLA |

AMZN |

AAPL |

NVDA |

MSFT |

|

|

Debt/Free Capital |

1,70 |

3,59 |

12,68 |

14,62 |

3,03 |

2,22 |

4,35 |

|

Long Term Debt/Total Capital |

8,92% |

20,70% |

6,56% |

42,44% |

57,84% |

24,70% |

24,71% |

|

Present Ratio |

2,17 |

2,32 |

1,59 |

0,95 |

0,98 |

2,79 |

1,77 |

|

Quick Ratio |

2,02 |

2,20 |

0,97 |

0,67 |

0,81 |

2,23 |

1,54 |

Source: Looking For Alpha

GOOGL has the very best debt/FCF and LT financial obligation to Capital. It is beaten by META and NVDA on existing and fast ratio, however this is not as essential.

The other terrific feature of GOOGL is its profits diversity.

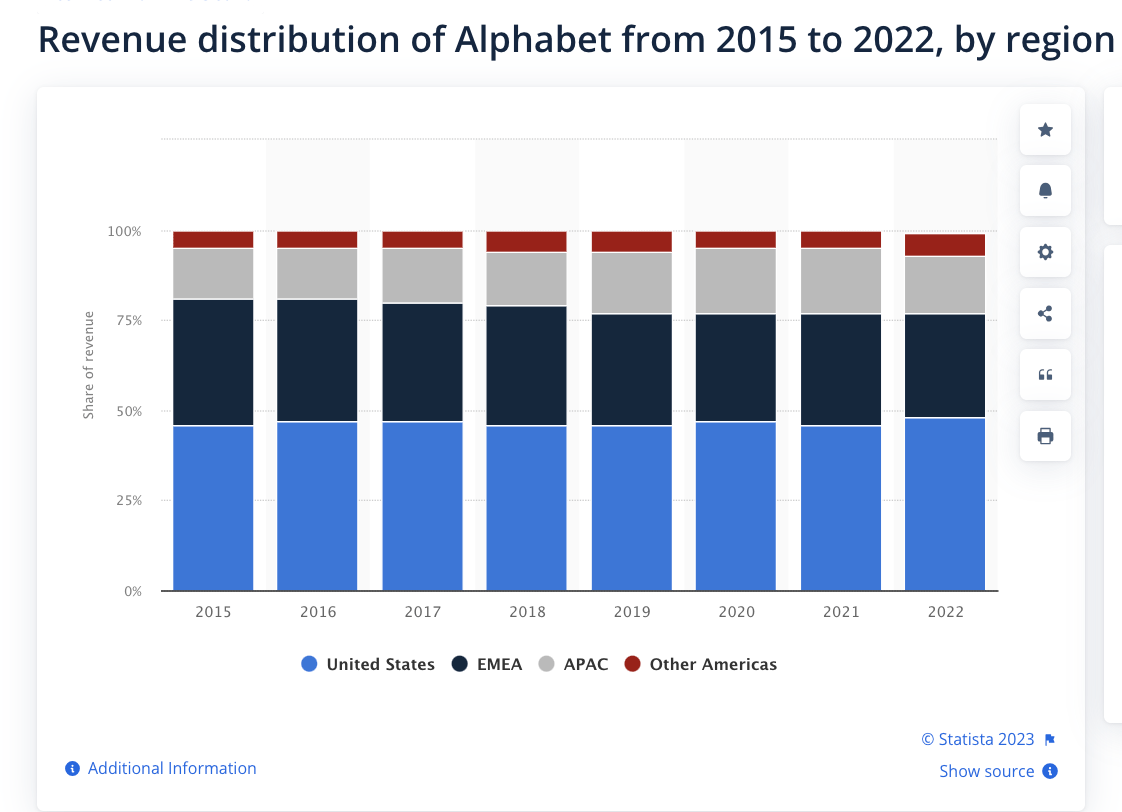

Alphabet profits circulation (Statista)

Though half the profits still originate from the United States, it has a strong existence in Europe, The Middle East and Africa, and likewise in ASIA.

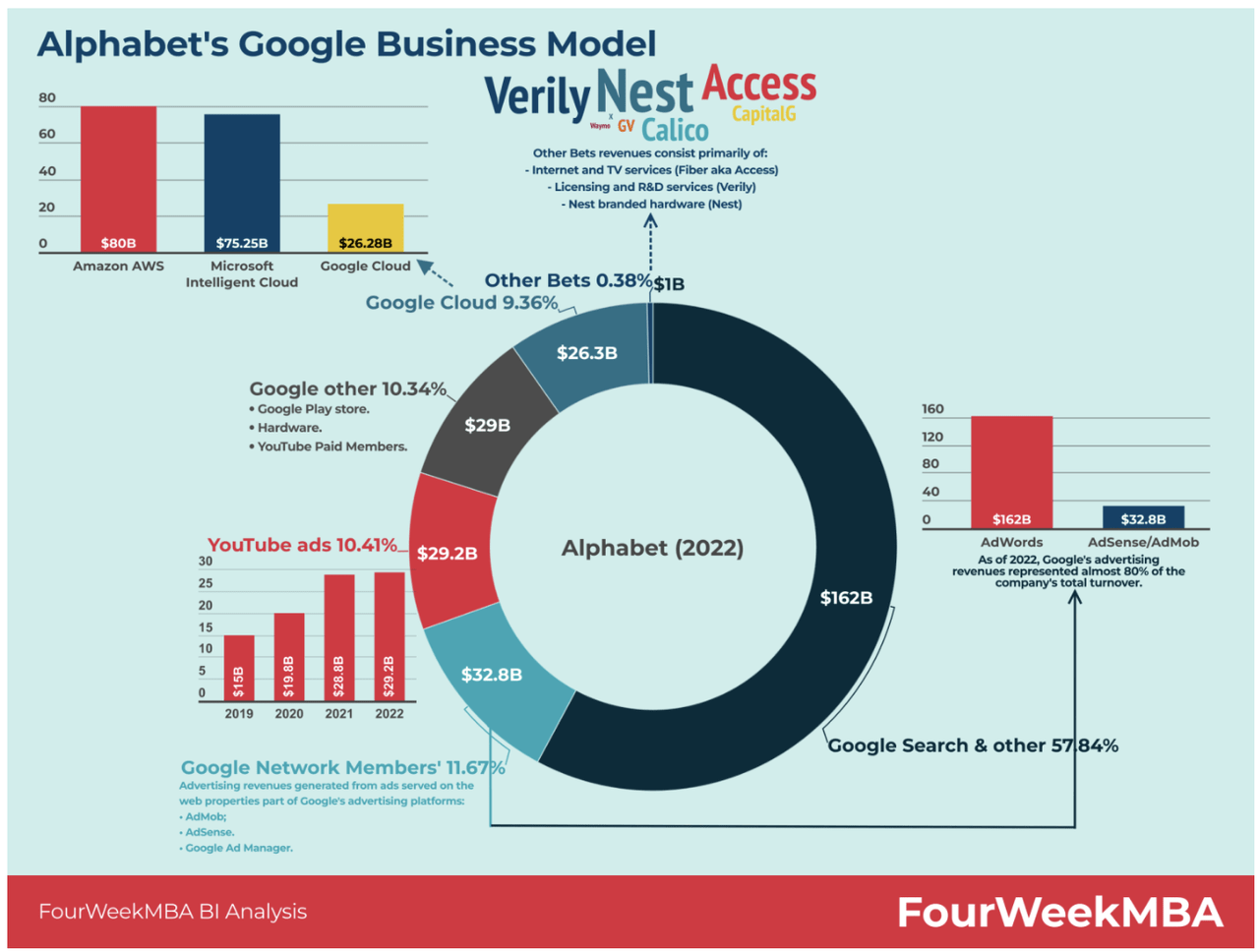

The profits diversity does not just use to locations however likewise to its sections:

Alphabet profits by sector (FourweekMBA)

While a little over half of profits still originates from advertisements, there are a great deal of other sources of profits, consisting of Google Cloud, YouTube, and Google Other.

Google is a lot more than simply an advertisement business. It has an international footprint and basically a monopoly on the web. 93% of all web traffic goes through Google. This business is not going anywhere.

Threats

The only genuine threat with Google does not originate from the marketplace however from regulators. Google is too huge for numerous nations’ taste, making it a target in numerous suits. Simply last month, UK customers introduced a multi-billion pound claim versus the business.

However the reality that GOOGL can simply shrug these off is a testimony to simply how effective this business is.

Last Ideas

I believe there’s an excellent reason the stunning 7 have actually rallied while other stocks have not. For much better and for even worse, the huge are growing, and there is no larger than GOOGL. This is a must-own stock, in my viewpoint, and it produces a great economic downturn play thanks to its strong balance sheet and profits strength. GOOGL is maybe the greatest conviction stock in my End Of The World Portfolio.