adamkaz

The Power Corporation of Canada ( OTCPK: PWCDF) is a Montreal, Quebec-based management and holding business which concentrates on an international circulation of monetary services throughout the insurance coverage, retirement, wealth management, and financial investment management verticals.

Intro

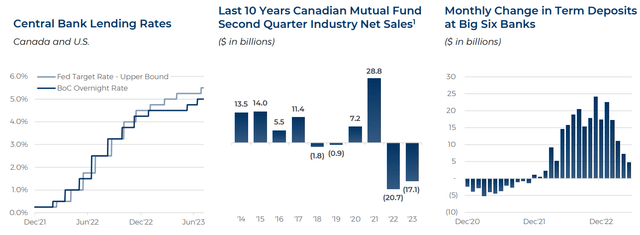

As a holistic monetary business, Power Corp is affected by and for that reason centres their method around macro tailwinds and headwinds in the monetary sector. For example, as the Fed target rate increases, Power Corp has actually changed its position to minimize concentrate on utilize and concurrently minimize the expense of capital.

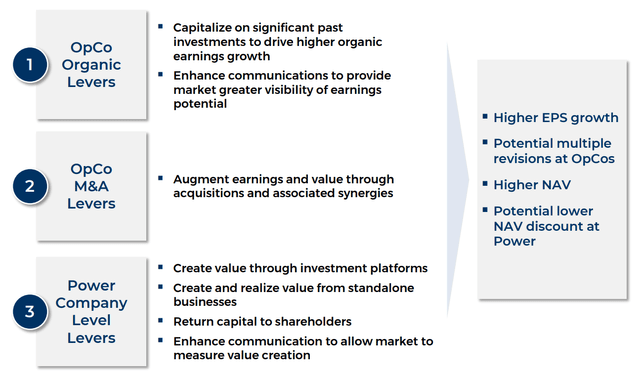

Regardless of macro headwinds, Power Corp has actually continued performing their tripartite development method, with a broad-based strategy surrounding natural and inorganic development together with higher-level synergies at the corporation level. For example, with an existence throughout the monetary services pipeline, Power Corp is efficiently able to source capital throughout all platforms, use a varied however focused skill swimming pool, and make it possible for exceptional demand-side relationships with private and institutional customers.

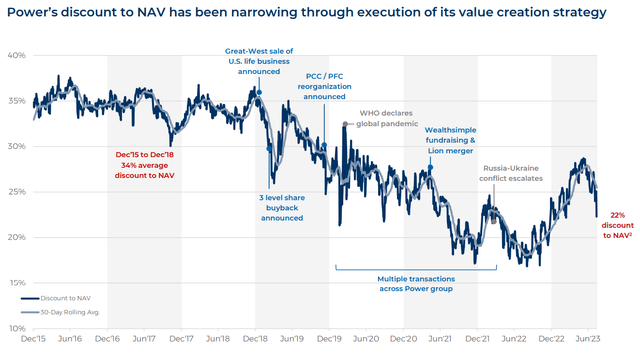

As such, the combined worth of the latter method, together with Power Corp’s moderate undervaluation on a net present worth and net property worth basis, led me to rank the stock a ‘purchase’.

Assessment & & Financials

Past Year Rate Action & & Q2 Outcomes

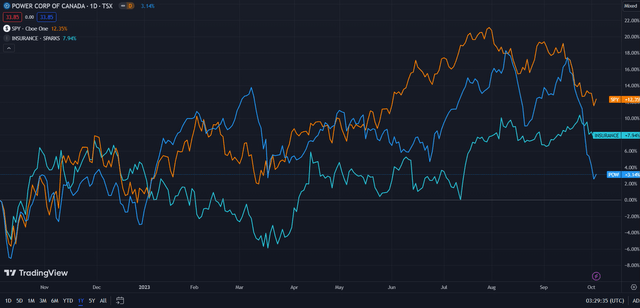

In the TTM duration, Power Corp’s stock- up 3.14%- has actually experienced poorer cost action to both TradingView’s Insurance coverage Index- up 7.94%- and the wider market, as represented by the S&P 500 ( SPY)- up 12.35%.

Power Corp (Dark Blue) vs Market & & Market (TradingView)

While the basic insurance coverage market- which Power Corp is most comparable to has actually underperformed due to the decreasing worth of their currently held bonds, Power Corp has actually seen especially bad cost action as convergent rates of interest and inflationary pressures squeeze retail customers and put retirement issues- with Power Corp’s non-insurance retirement items at the leading edge of the business’s development goals- at the backburner.

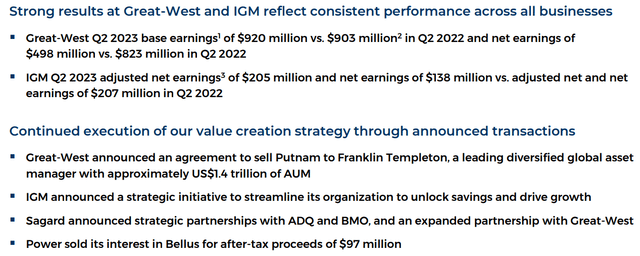

With this in mind, in Q2′ 23, Power Corp accomplished earnings of $10.43 bn- a boost of 2.84% YoY, together with an earnings of $514.00 mn- a 4.81% decrease- and a totally free capital of $678.00 mn- a 76.87% decrease mostly driven by lowered operating capital.

To include context, in 2022 as an entire, Power Corp accomplished earnings totaling up to $72.65 bn in addition to a $1.97 bn earnings and complimentary capital of $6.70 bn.

Power Corp Stays Undervalued

According to my reduced capital analysis, at its base case, the net present worth of Power Corp is $37.70, significance, at its existing cost of $34.24, the stock is presently underestimated by 9%.

My design, computed over 5 years without continuous development built-in, presumes a discount rate of 9%, stabilizing the business’s lower equity threat and its debt-heavy cap structure. Furthermore, to stay conservative, I approximated a 5-year forward typical profits development rate of 6%, lower than the routing 5-year average of 9.75%, with my forecasts decreased due to greater interest costs and basic recessionary pressures.

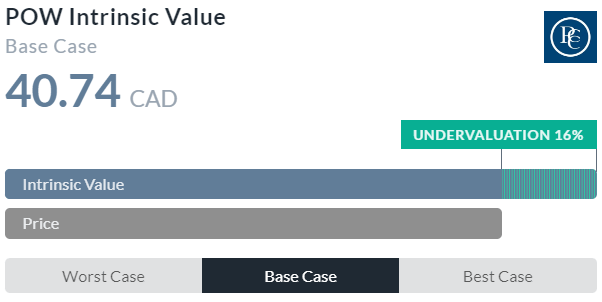

Alpha Spread

Alpha Spread’s intrinsic appraisal tool, which averages Alpha Spread’s internal reduced capital and relative appraisal, supports my thesis on Power Corp’s undervaluation, approximating an intrinsic worth of $40.74, a 16% undervaluation.

Hence, balancing out my DCF and Alpha Spread’s intrinsic worth, the reasonable worth of Power Corp is $37.49, a 12.5% undervaluation.

Even on a net property worth basis Power Corp stays essentially underestimated with per share NAV at $48.86 since completion of Q2′ 23, compared to $46.89 at the end of Q1′ 23.

Power Corporation Sees Multi-Sided Development – Driven by Acquisitions- Which Might Translate to Dividend Slopes

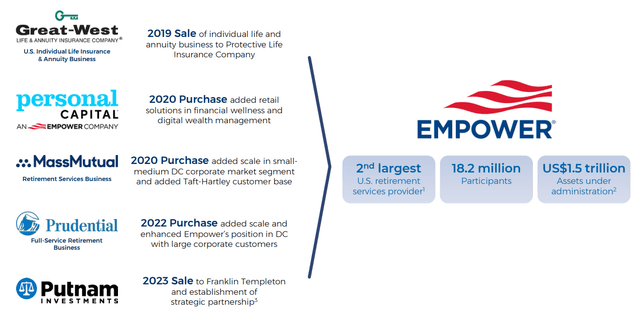

Central to Power Corp’s success stays its combination into the customer monetary lifecycle, with its deep-rooted conventional insurance coverage companies, individual monetary health tools, shared fund sections, and so on all supporting its synergetic growth of the ‘Em power’ retirement company, which has actually developed itself as the 2nd biggest United States retirement providers. By offering a varied variety of monetary services, Power Corp’s Empower sector has the ability to efficiently cross-sell services and lock in customers throughout high-margin items for several years to come.

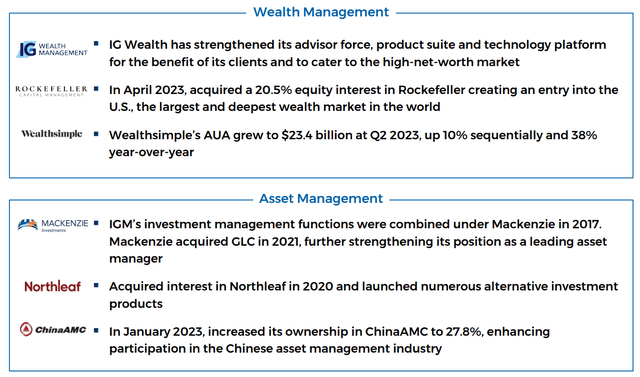

In parallel with this, Power Corp has actually strongly concentrated on the nonreligious growth of the margin-expanding sections of wealth management and property management, with its quickly growing digital broker, Wealthsimple, at the centre of this method. In Addition, Power Corp has actually transferred to obtain a 20.5% interest in Rockefeller Capital Management together with a broadened footprint in ChinaAMC, increasing capital market gain access to and synergistic advantages throughout the board.

The latter tactical focus has actually allowed Power Corp to support its $680mn quarterly dividend, together with an opportunistic share bought program and fortress monetary position. The business’s knowledgeable capital implementation method therefore empowers financiers for long-run income-driven worth together with progressive, accretive share cost development.

For that reason, by using a strong dividend chance in congruence with the low overall beta, retired people can rest simple understanding that they have actually protected a strong risk-adjusted earnings stock, not as vulnerable to volatility- specifically worrying interest rate-driven volatility- and at a discount rate too.

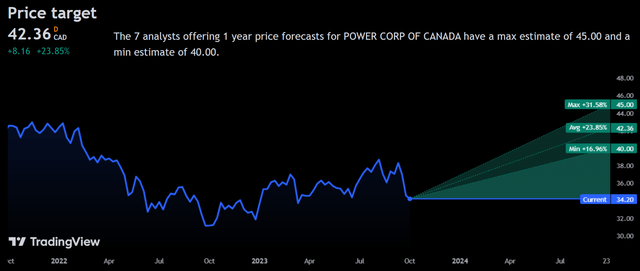

Wall Street Agreement

Experts typically echo my favorable view on the stock, approximating a typical 1Y cost target of $42.36, a 23.85% boost.

Even at the minimum projected cost target of $40.00, experts see a cost slope of 16.96%.

I think this shows Wall Street’s viewpoint on the functional strength of Power Corp and its unjust mischaracterization as solely an insurance provider by the remainder of the market.

Dangers & & Difficulties

Consistent Interest Rates Might Reduce Funding Capabilities & & Relative Worth of Earnings Stocks

While Power Corp might see a more uncontrollable cost base due to its greater financial obligation levels and increasing rate of interest, the business’s demand-side development is simply as delicate. The expense of capital increases not simply for any of Power Corp’s institutional customers, however retail customers also, who might cut long-run cost savings and retirement strategies to satisfy short-term requirements. As such, sticky rate of interest might compress the supply of capital and the need for Power Corp’s services in the long run.

Diverse Profits Base Might Compress Development Abilities

While the suite of monetary items Power Corp uses is core to its macro method, its extensive development throughout these various sections presents the business to extra regulative intricacies and to a higher variety of third-party threats. As such, specifically in the greater rate environment in which the business discovers itself, development in various verticals might expose the business to various threat profiles.

Conclusion

Looking forward, Power Corp’s much safer earnings personality and tactical development make it the perfect dividend/growth hybrid choice for long-lasting financiers.

Editor’s Note: This post talks about several securities that do not trade on a significant U.S. exchange. Please know the threats related to these stocks.