The improving of the world economy and the worldwide (political) order remains in full speed. It is a long procedure, the concrete result of which doubts ahead of time and connected with many imponderables. Nonetheless, there are effective elements, such as the shift in financial, market and military weight, that are driving the readjustment in the (geo) political arena. And this readjustment is likewise shown in the modification in gold circulations. They are significantly moving from West to East, given that “Gold goes where the cash is,” as James Steel specifically put it.

The reserve banks of the states of the East are amongst the greatest purchasers of gold– likewise within the West

This is likewise shown in the continuing interest of reserve banks for gold, particularly in non-Western nations. 2022 saw the biggest purchases of gold by reserve banks given that records started more than 70 years back, at 1,136 loads. The very first half of 2023 saw an extension of this pattern. Regardless of a weaker 2nd quarter, reserve bank purchases in the very first half of the year set a brand-new half-year record. Reserve banks increased their gold reserves by an overall of 378 loads from January to June. The previous half-year record from 2019 was hence somewhat surpassed. China made the biggest purchases, followed by Singapore, Poland, India and the Czech Republic. So even in the West, it was nations in the East that made extra purchases.

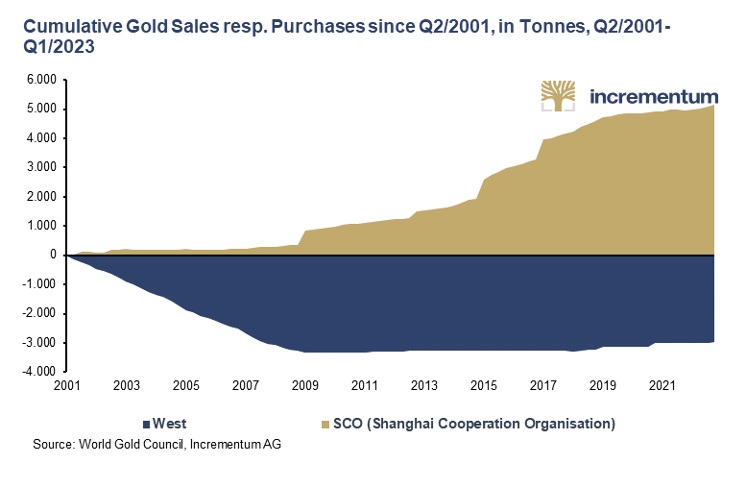

The following chart reveals the level to which institutional need for gold has actually moved to the East. It compares the cumulative gold sales of Western reserve banks with the cumulative gold purchases of the Shanghai Cooperation Company (SCO or SOC) given that 2001.

Taking A Look At the BRICS, we likewise see a striking overlap, with reserve banks from 4 of the 5 BRICS nations– Brazil, Russia, India and China– purchasing a cumulative 2,932 tonnes of gold over 2010– 2022.

Holdings of United States Treasuries are lowered

In turn, the BRICS continue to minimize their share of the skyrocketing United States federal government financial obligation. Simply put, gold is ending up being increasingly more intriguing as a reserve possession due to the fact that United States Treasuries have actually been ending up being less and less intriguing as a currency reserve for more than a years. The militarization of cash by freezing Russia’s forex reserves simply days after Russia’s intrusion of Ukraine in late February 2022 included focus to this procedure, however did not kick it off.

The BRICS now hold just 4.1 percent of all United States federal government financial obligation, compared to 10.4 percent in January 2012. That is a decrease of more than 60 percent. The remainder of the world has actually lowered its direct exposure to United States federal government financial obligation by much less. In January 2012, the remainder of the world held 22.0 percent of all United States federal government financial obligation on their books; presently, they hold 19.3 percent. That is a reduction of more than 12 percent.

The East is broadening its facilities for gold trading

Nevertheless, the East is not just stockpiling on gold and mining gold itself on a big scale. China and Russia have actually ranked amongst the leading 3 gold producing countries for many years.

Nations such as China, the United Arab Emirates and even Russia are broadening their gold trading facilities. This is to develop a long-term facilities for the detour of gold trading from gold trading centers in the West such as London, New York City and Zurich. This affirms to the altering understanding of functions: The East significantly no longer sees itself as a consumer of Western facilities, however provides the facilities itself.

Secret advancements consist of:

- SGE & & SFO NRA: Cooperation in between the Chinese and Russian gold markets

For a long time now, China and Russia have actually been striving to connect their gold markets through cooperation in between the Shanghai Gold Exchange (SGE) and the Russian monetary authority, the National Financial Association (NFA). The NFA is a Russian expert association representing the whole Russian monetary sector, consisting of the Russian rare-earth elements market.

In the face of Western sanctions, Russian gold exports to China have actually currently risen given that mid-2022. As 3 Russian banks– VTB, Sberbank and Otkritie– are currently members of the SGE International Board of the SGE, which was established in 2014, this cooperation in between the gold markets of Russia and China is most likely to heighten in the future.

- Subscriptions in gold-related organizations

As gold streams from west to east and the significance of eastern gold markets boosts, these markets will likewise have higher representation and impact in the worldwide organizations that represent the gold market, such as the LBMA and the World Gold Council (WGC).

In 2009, just 6 Chinese refineries were on the LBMA’s Great Shipment List, today there are thirteen. While simply 15 years ago there was just one routine (complete) member of the LBMA from China, the Bank of China, there are now 7. China’s growing impact is likewise shown worldwide Gold Council. In February 2009, just one Chinese gold manufacturer belonged to the WGC; now there are 4.

- India International Bullion Exchange (IIBX)

In addition to its advanced OTC gold trading market, India has actually likewise developed a trading facilities for gold futures agreements on the Multi Product Exchange of India Limited (MCX). In July 2022, the India International Bullion Exchange (IIBX), supported by the Indian federal government, was formally opened for trading area gold agreements backed by physical metal. IIBX lies in an unique financial zone in present City in the Indian state of Gujarat, and the gold underlying the agreements is kept there. One objective of IIBX is to permit competent purchasers to import gold straight into India without the requirement for banks or licensed firms. Up until now, nevertheless, trading volumes have actually been very little.

- Facility of a Moscow World Requirement

At the end of February 2022, when sanctions versus Russia were enforced by the West instantly after the start of the Ukraine war, the London Bullion Market Association (LBMA) omitted the 3 Russian banks VTB, Sovkombank and Otkritie. A couple of days later on, the LBMA got rid of all 6 Russian rare-earth elements refiners from the LBMA Great Shipment List and the CME Group did the same, getting rid of the exact same refiners from the list of authorized COMEX refiners.

As an outcome, Moscow revealed in July 2022 that a brand-new facilities for rare-earth elements trading independent of the LBMA and COMEX would be developed. According to Moscow, this is planned to break the supremacy of London and New york city in worldwide rare-earth elements rates. This proposition requires the intro of a Moscow World Requirement (MWS) for rare-earth elements trading, comparable to the LBMA’s Great Shipment List, the facility of a brand-new worldwide rare-earth elements exchange in Moscow based upon the MWS, the Moscow International Valuable Metals Exchange, and the development of a brand-new gold cost repairing based upon the MWS so regarding develop gold rates and referral rates various from those of the LBMA and COMEX.

Personal gold need shifts to the east

EAST’S increased interest in gold is likewise obvious in the non-governmental sector. Chinese customer need, for instance, increased from 292.6 loads to 824.9 loads (2022) given that the turn of the centuries. This is a boost of 181%. Yearly customer need in India has actually likewise increased given that the turn of the centuries, albeit from a currently high level in 2000. China and India, which together represented just 28.7% of customer need in 2000, represent nearly half of worldwide customer need (48.4%) in 2022 and together obtained 1,600 lots of gold in 2015.

Customer Need for Gold– 2000 vs. 2022

| 2000 | % of Worldwide Need | 2022 | % of Worldwide Need | 2022 vs. 2000 in Tonnes |

2022 vs. 2000 in % |

|

| India | 723.0 | 20.4% | 774.0 | 23.4% | 50.0 | 7.0% |

| China | 292.6 | 8.3% | 824.9 | 25% | 532.3 | 181.9% |

| Japan | 105.1 | 3.0% | 4.3 | 0.1% | -100.8 | -95.9% |

| Middle East | 457.9 | 12.9% | 268.2 | 8.1% | -189.7 | -41.4% |

| Türkiye | 177.4 | 5.0% | 121.5 | 3.7% | -55.9 | -31.5% |

| United States | 368.5 | 10.4% | 256.6 | 7.8% | -111.9 | -30.4% |

| France | 19.0 | 0.5% | 19.9 | 0.6% | 0.9 | 4.5% |

| Germany | 15.6 | 0.4% | 196.4 | 5.9% | 180.8 | 1,159% |

| Italy | 92.1 | 2.6% | 17.8 | 0.5% | -74.3 | -80.6% |

| UK | 75.0 | 2.1% | 35.6 | 1.1% | -39.4 | -52.5% |

| Rest of Europe | 142.4 | 4.0% | 115.1 | 3.5% | -27.3 | -19.2% |

| Other | 1,076.0 | 30.4% | 669.1 | 20.3% | -406.9 | -37.8% |

| Worldwide Need | 3,544.6 | 100.0% | 3,303.3 | 100.0% | -241.3 | -6.8% |

Source: World Gold Council, Incrementum AG

Current advancements point in the exact same instructions. In the very first 8 months of the existing year, Asian gold ETFs increased their holdings by 7.7%, while The United States And Canada and Europe taped outflows of 2.3% and 6.1%, respectively. Considerably, in the bars and coins require sector, Turkey and Iran changed Germany and Switzerland in the leading 5 in the very first half of the year. China now leads this sub-segment of gold need– in the very first half of 2022, Germany was still in the lead– followed by Turkey, the United States, India and Iran. This is due to the fact that while need for bars and coins in Turkey shot up from 9.5 loads to 47.6 loads in the 2nd quarter of 2023, it fell by around 3 quarters in Germany.

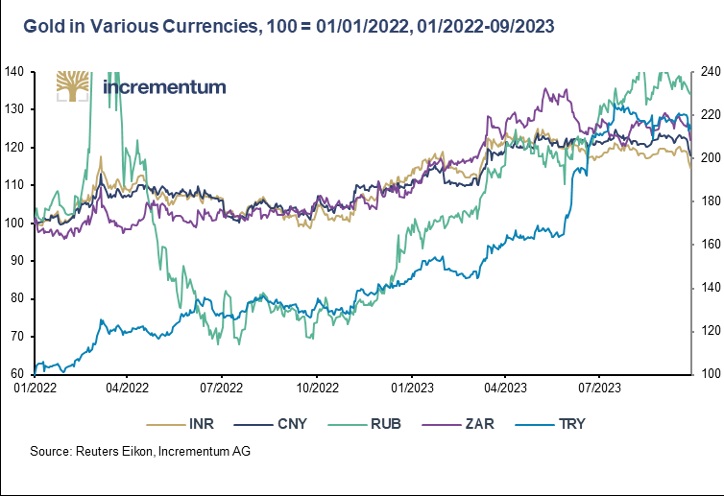

The cost of gold in currencies of the East has actually increased substantially

Since completion of September, gold was 14.6% greater in Indian rupees than at the start of 2022, 18.0% greater in Chinese renminbi, 34.3% greater in Russian rubles, 22.1% greater in South African rand (all left-hand side) and 114.0% greater in Turkish lira (right-hand side). Gold hence remarkably shows its value-preserving homes in tough (geo) political and macroeconomic scenarios in these nations.

The substantially increased premium on the gold cost in China given that July is an apparent indication that there is a structural scarcity of gold in the Chinese market and hence an expression of the strong need for gold in the Middle Kingdom, which is having problem with extensive financial issues.

Conclusion

This shift in need from West to East can be observed not just amongst federal governments or government-related entities, however likewise amongst institutional and personal financiers. Gold is streaming to where it is most valued and where financial success and cost savings rates have actually increased. In the medium term, the shift in need need to for that reason discover assistance from the greater development potential customers in Asia and the Middle East. “Ohne Geld, ka Musi” (” Without cash, no music”)– this is how the vernacular creates this financial truism in German. And as the IMF’s newest financial development projection suggests, the sub-region of emerging and establishing Asia will grow at a forecasted 5.2% this year and 4.8% next year, while the West will grow much less highly. This will likewise result in a shift in impact on rates from West to East.

**********