Ignore bank doom loop stories over domestic home loans. Rather put the spotlight where it belongs.

Not Residential!

A reader asked me to discuss Peter Schiff: Banks Have a Larger Property Issue Today Than They Performed in 2007.

Banks are more susceptible to the real estate market now than they remained in 2007.

Many people in the mainstream will belittle that declaration. They’ll inform you that the scenario is really various today. After all, we do not have a huge issue in the subprime home loan market. We’re not seeing a huge spike in defaults. That holds true. The issue is various this time. And it’s in fact even worse.

So, what’s the issue?

As Peter Schiff discussed in a current podcast, the issue this time is the home loans themselves.

As Peter mentions, a 3% home loan is a substantial possession for the customer. However it’s a substantial liability for the lending institution. So, defaults would benefit the banks. They might in theory reclaim the home and resell it to someone else and compose a home mortgage at a much greater rate.

So, this is an extremely various crisis. However it’s even worse due to the fact that they’re losing cash on every home loan they have whether they enter into default. … So, this is larger. It is a larger issue for the banks. They’re losing more cash, and they will lose more cash now than they performed in 2008. That implies we’ll require an even larger bailout. All these ‘too huge to stop working’ banks have an even larger issue now than they did then, and it’s going to take an even larger round of QE to bail them out. The issue is how’s the Fed going to do that when inflation is as high as it is and going greater?

T otal Silliness

For beginners, banks tend to securitize home loans they stem or discard them on Fannie Mae.

2nd, couple of will be leaving. There is excessive equity for a default crisis as taken place in 2007.

Third, the Fed has a liquidity program (BTFP discussed listed below) to assist banks paper over losses.

Works on banks have actually stopped. If bank runs begin once again, it will not be because of domestic home loans.

Fed’s Emergency situation Liquidity Program

The Fed began the BTFP program in the wake of the collapse of Silicon Valley Bank.

Little local banks overleveraged in long term treasuries and were clobbered by paper losses and after that bank runs.

In action, the Fed accepted protect the banks from losses by using swaps at par worth, neglecting the losses.

BTFP Terms

- Qualified Security– Direct responsibilities of particular U.S. federal government firms, consisting of the U.S. Department of the Treasury, government-sponsored business such as Fannie Mae and Freddie Mac, and the Federal Mortgage Banks. In addition, mortgage-backed securities released and/or completely ensured by Ginnie Mae, Fannie Mae and Freddie Mac are qualified.

- Loan Terms– Organizations might obtain approximately the worth of qualified security promised. Security is valued at par, i.e., without any hairstyles. Loans can be prepaid at any time without charge. The rate is repaired for the life of the loan (approximately one year) and is computed by including 10 basis indicate the over night index swap rate. The rate is released daily on the Discount rate Window site Advances will be offered till March 11, 2024, or longer if the program is extended.

Liquidity, Not Solvency Concern

This is a liquidity problem, not a solvency problem. The United States is not going to default and the treasuries are not useless. The Fed wished to stop bank runs and did so by an approach that conceals losses.

Nevertheless, the paper losses are still genuine, even if concealed in reports. This has an influence on banks determination to make loans in an increasing rate of interest environment.

For additional conversation, please see The Fed’s Emergency situation Liquidity Program, BTFP, is Over $100 Billion, What’s Going On?

Industrial Real-Estate Doom Loop

The Wall Street Journal reports Real-Estate Doom Loop Threatens America’s Banks, however the loop is business.

Bank OZK had 2 branches in rural Arkansas when ceo George Gleason purchased it in 1979. The Little Rock lending institution today has billions of dollars in business real-estate loans, consisting of for residential or commercial properties in Miami and Manhattan, where it is assisting money the building of a 1,000-foot-tall workplace and high-end domestic tower on Fifth Opportunity.

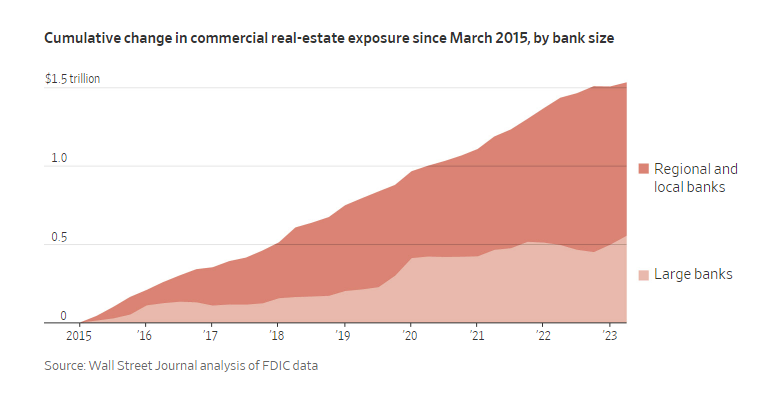

Regional banks throughout the nation followed a comparable playbook, making a pig of on business real-estate loans and associated financial investments in huge cities over the previous years.

With the business real-estate market now in crisis, those trillions of dollars in loans and financial investments are a looming risk for the banking market– and possibly the more comprehensive economy. Banks’ direct exposure is even larger than frequently reported. The banks remain in threat of triggering a doom-loop circumstance where losses on the loans activate banks to cut financing, which causes additional drops in home rates and yet more losses.

The doom-loop circumstance is beginning to play out in huge cities where workplace jobs have actually skyrocketed. Real-estate financiers that are not able to re-finance their financial obligation, or can just do it at high rates, are defaulting. The lending institutions, no longer getting the financial obligation payments, frequently need to make a note of the worth of those home loans. Often the bank winds up owning the home.

” The pipes is blocked today,” stated Scott Rechler, president of real-estate financier RXR. “Which is going to develop a backup that will ultimately overflow on the business real-estate markets and on the banking system.”

United States Regional and Little Banks’ CRE Direct Exposure Might Pressure Rankings

Fitch reports United States Regional and Little Banks’ CRE Direct Exposure Might Pressure Rankings

U.S. banks with less than $100 billion in possessions are more prone to degrading business realty (CRE) principles than bigger banks, which might contribute to rankings pressure, offered their greater relative direct exposure as a portion of possessions and overall capital, Fitch Rankings states.

The tight financial environment has actually put pressure on many CRE residential or commercial properties’ security worths and deal volumes while structural modifications in need for workplace have actually negatively affected tenancy for that possession class. These elements increase credit danger for banks that have CRE loan concentrations, and are anticipated to have an influence on possession quality in CRE loan portfolios of U.S. banks.

Banks with more focused CRE direct exposure to workplace markets, especially those with much weaker job patterns, deal with moderate tension over the near- to medium-term. For instance, bigger cities, consisting of San Francisco, Houston, Dallas/Ft. Worth, Washington DC and Chicago had high workplace job rates since 1Q23.

BTFP Qualified Security

Look once again at the BTFP qualified security. It consists of Fannie Mae, Freddie Mac, Ginnie Mae. It does not consist of business realty, or any other sort of bank loans.

CRE and other kinds of bank loans are solvency problems.

By protecting home loans and Treasuries, the Fed consisted of any domestic home loan crisis.

The huge issue for banks is business however the domestic real estate market remains in disarray.

How the Fed Ruined the Real Estate Market and Produced Inflation in Pictures

The Fed has a huge issue of its own making on its hands that will make inflation more difficult to manage.

For conversation, please see How the Fed Ruined the Real Estate Market and Produced Inflation in Pictures

The Fed damaged the real estate market, however this will have very little influence on banks. Industrial realty is the essential problem.