The worldwide monetary device is in chaos, and you wish to have to behave NOW to offer protection to your wealth. On this video, Lynette Zang breaks down the alarming tendencies within the bond marketplace, exposing the hidden dangers that would wipe out your financial savings. From the destabilization of the Treasury marketplace to the upward push of inflation, Lynette connects the dots so you’ll be able to offer protection to your wealth.

CHAPTERS:

0:00 Sensible Cash

1:48 Basis of the International Markets

5:05 Adulthood Bonds

11:11 Whoâs Purchasing?

19:38 Treasury Ache Deepens

21:31 Loose-Cash Technology

26:52 10-Yr Treasury Yield vs. Spot Gold

35:35 Get started Your Technique!

SLIDES FROM VIDEO:

TRANSCRIPT FROM VIDEO:

As we method the yrâs finish, a seismic shift is unfolding within the monetary device. And that is massive as a result of that is the transition this is going to do away with and care for the issue they have got over pension price range, retirement price range, marketplace makers, insurance coverage corporations. Oh, letâs see, who’s the person whoâs making an investment in all the ones? How in regards to the regular public? And thatâs gonna be an enormous drawback. I talked to you only in the near past about what was once going down within the bond marketplace, and but now we have concerned to a brand new level of it the place the ten yr treasury, the basis of the worldwide device, has change into totally unanchored. Is that this new information? Heck no. We mentioned it long ago in 2015 and 2016, 2008, etcetera. And Iâm gonna display you the way we have been warned about it. So the good cash positions into the gold and silver to offer protection to you whilst the dumb cash selections up the slack because the good cash leaves. Weâre gonna discuss all of that. Youâre gonna see it crystal transparent and what to do about it, arising.

When you have now not but arrange your technique and performed it, click on that Calendly hyperlink underneath as a result of obviously, obviously, obviously time is operating out. As this debt bubble bursts larger and larger. You don’t seem to be gonna know in regards to the lack of your selection till itâs too overdue. So whilst you nonetheless have alternatives, get it accomplished.

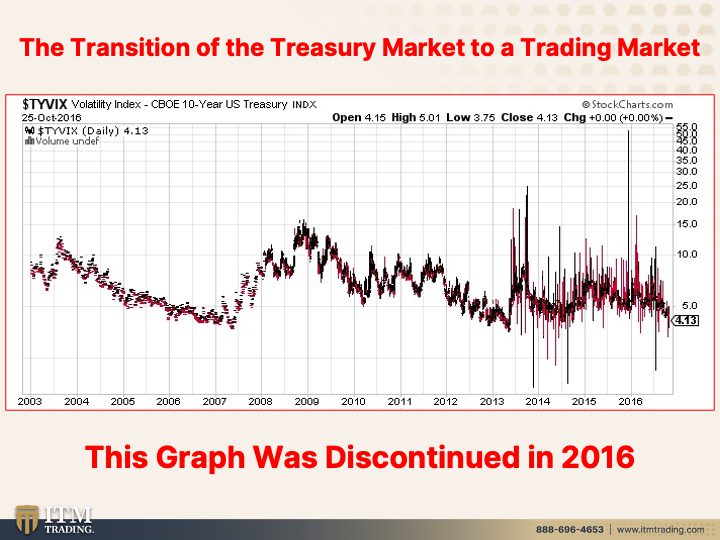

Letâs move to movie. I gotta display them what on the earth is going on. K. Now, I’ve proven you this transition from the treasury marketplace. The USA Treasury marketplace intended to be essentially the most liquid and strong marketplace on the earth. It underpins the worldwide monetary device. It’s the basis. Iâve proven you this chart ahead of they took it clear of us in 2016, however what youâre having a look at is the cost motion within the 10 yr treasury notice or bond. The ten years. It’s extra of a notice, however I donât wanna digress from that.

What I wanna display you is how over right here, between 2000 and approach ahead of that, itâs a little bit sprint, proper? And what that suggests is that the cost motion of the treasuries was once very, very secure. Thatâs what you need in a basis. You wish to have a pleasant secure underpinning, consider your own home on one thing this is transferring. Does that paintings? No, it doesnât. Your own home is gonna collapse. Then 2008 took place, and what went from a touch was a line, and the cost volatility within the treasuries was larger. Then transfer over to right here to 2013 and you spot huge shifts in it. Neatly, we all know that there was once a liquidity factor with the treasuries in 2015. Thatâs when this began arising. Nevertheless it was once already in 2013. You’ll be able to see it. Take a look at this. Take a look at, have a look at this worth motion and what kind of the costs trade. They usually took it clear of us in 2016 as a result of God forbid, you’ll have a transparent device to turn you whatâs truly going down within the treasury marketplace. And letâs move now to 2023. However between 2015 and 2023, now we have had various issues and problems that experience arise within the liquidity, which is the power to shop for and promote treasuries with out transferring the cost considerably. Why did they hand it over to the buyers? As it was once so significantly necessary that banks become profitable and so they make way more cash via buying and selling those property. So the whole lot beginning within the early eighties, truly beginning in 71 once we passed the regulate of inflation over to these central bankers who know what they know debt and so they know rates of interest and so they donât give a crap about you. So you’ll be able to see from this one chart when the treasury marketplace was destabilized and was once passed over to treasuries, making it even worse, that is the basis of the worldwide markets. Now, possibly you and I couldnât see it since they took that clear of us, however now we have been feeling it, and I’ve been speaking about this.

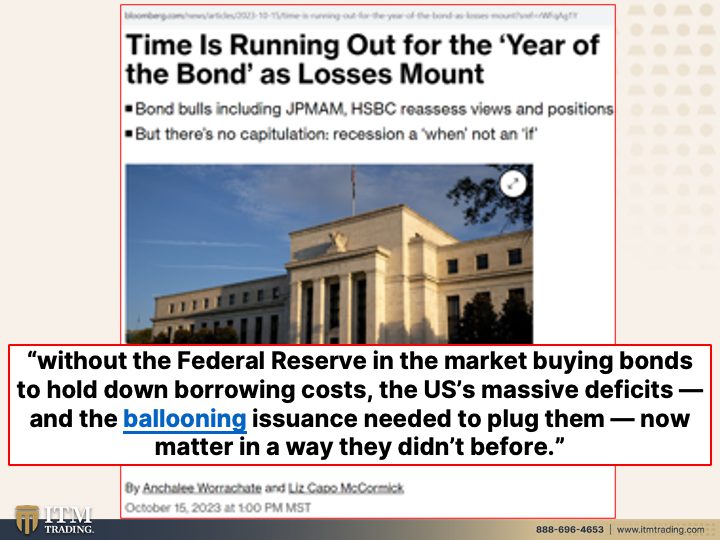

Let me take you present, I simply sought after to just remember to guys understood, as a result of time is operating out. This was once intended to be the yr of the bond. Why? As a result of they felt that there can be a disaster and the Fed would pivot and decrease rates of interest. So forgive me if I do that, and also you already get it, however that is rates of interest. That is the marketplace worth of the bonds, proper? So they have got driven rates of interest down, which driven the marketplace worth of the bonds up till they began going the other approach. They usually did it impulsively. They usually did it temporarily. Iâm so happy that Financial institution of The us got here out and stated, oh sure, our held to adulthood bonds, financial institution of The us got here out these days and stated, no, no, weâre now not gonna take any losses on our hell to adulthood bonds. Yeah, nominally, if presuming there isn’t a run at the financial institution that forces them to must liquidate what theyâre conserving to adulthood, they’re going to get the nominal worth again. So in many ways that may be justified. However we’re in disaster mode presently. No longer the next day, now not 3 weeks, now not 3 years, now not two decades. Presently, and I’m hoping you’ll be able to see this as itâs about to get an entire lot worse. âpurpose What was once even stabilizing the marketplace up to it was once was once fed purchasing, proper? Thatâs what 3rd global nations do. However the feds began purchasing our govt bonds in, in 99, the top of 99, 2000 as a result of there have been, or 2002, as a result of there weren’t sufficient consumers out there. It had already, the liquidity within the basis of the worldwide markets was once already eroding with out the Federal Reserve and the marketplace purchasing bonds to carry down the ones borrowing prices. In different phrases, push down rates of interest. The USA huge deficits and the ballooning issuance had to plug them now subject in some way they didnât ahead of. As a result of we’re on the finish of this recreation. And this rubbish manner completely not anything. As soon as the general public loses self assurance, and formally, you don’t have any buying energy left. Itâs simply that straightforward.

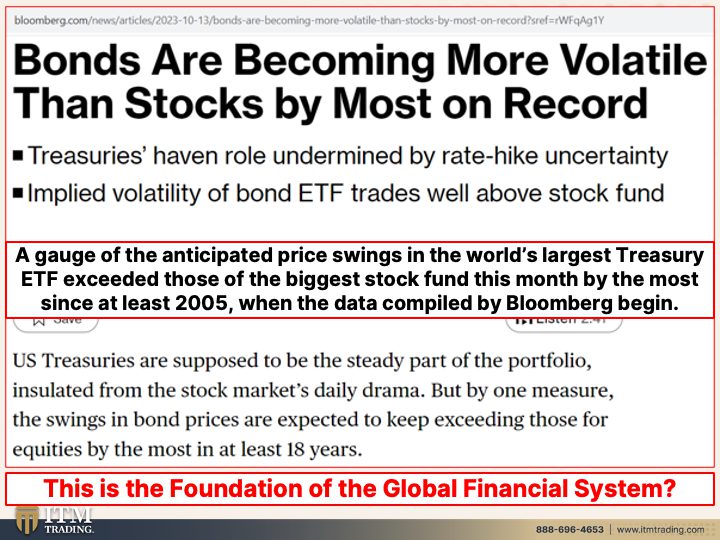

Bonds, that is the section, oh my God. So from 2013 to these days, these items occur slowly as a result of once they occur temporarily, then you definately realize and you’re making other alternatives. But when it occurs slowly, you donât realize. You suppose the whole lot is okay. And hunky dory. In order that they use derivatives and the Fed buys the bonds. They do all of those accounting tips to make issues appear strong once theyâre truly now not. Bonds are fitting extra unstable than shares purchase essentially the most on list. OMG bonds are meant to be the secure, the quote unquote secure haven asset, particularly the treasury bonds. For the reason that Federal Reserve can print the cash that they want or the federal government can, can print the cash that they want to pay off you what that cash will purchase you. Thatâs a special tale as a result of it’ll move to 0. Itâs that shut as soon as. Itâs virtually there. Now, simply that little little bit of self assurance. So US treasuries are meant to be the secure a part of the portfolio, insulated from the inventory marketplaceâs day by day drama, however via one measure, the swings and bond costs are anticipated to stay exceeding the ones for equities via essentially the most in a minimum of 18 years. As a result of thatâs once they began monitoring it. How about virtually traditionally, ever, that is all belief control that bonds are secure. Theyâre now not, theyâre now not. A gauge of the predicted worth swings on the earthâs greatest treasury E T F. In order thatâs a gaggle of the treasury bonds. Expenses notes exceeded the ones of the largest inventory fund this month via essentially the most in since a minimum of 2005 when the information compiled via Bloomberg started. K? So that is, Iâm telling you, this isn’t historical norm via any stretch of the creativeness. That is what they name diversification. You’ve shares, you could have bonds, youâre assorted. No youâre now not. Theyâre all according to this crap and debt. And that debt bubble has been pierced via elevating the charges which the Fed was once pressured to do to struggle the fricking inflation that they created. Are you kidding me? And do you spot any one coming in to take duty and personal their crap? No, you don’t. You spot finger pointing and different issues arising in order that they are able to move, smartly, thatâs why. And thatâs why No, my pals, that is why you’ll be able toât do this with this. However you’ll be able to do this with this straightforward peasy, no issues in any way. That is the basis. I will not pressure this sufficient. That is the basis of the worldwide monetary device. In case your basis goes like this, are you staying in that space or are you getting out? In my view, Iâm getting out, however I were given out after I first noticed it.

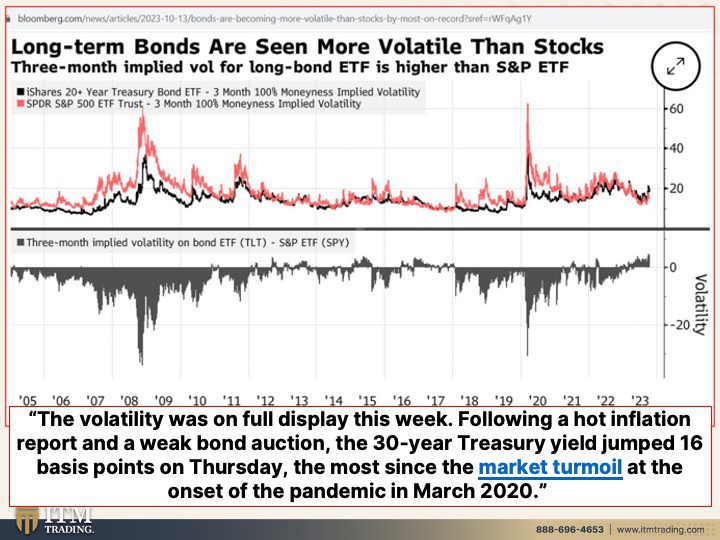

Lengthy-Time period bonds are observed extra unstable than shares. Letâs check out this as a result of that is the 20 yr treasury bond ETF, 3 months, one hundred percent. Moneyness implied volatility. I imply, severely, what youâre having a look at is the basis of this that you simplyâre operating for and also youâre the use of as your device of barter. And you’ll also be making an attempt to put it aside for one thing someday. Perhaps an training. Hmm, possibly retirement, possibly one thing else. Why? Since youâre dropping all buying energy. Thatâs what this inflation displays you. The volatility was once on complete show that was once closing week following a scorching inflation record and a susceptible bond public sale. The 30 yr treasury yield jumps 16 foundation issues. That would possibly not appear to be so much, however thatâs massive in what is meant to be very strong, proper? Essentially the most because the marketplace turmoil on the onset of the pandemic in March of 2020. However Paul Krugman says, inflation has been tamed. Itâs everywhere other people. It ainât over other people. You continue to have a minute to get in position. You sitting on this stuff, you sitting within the inventory marketplace, the bond marketplace, excellent success to you, as my mom would say, excellent success to you since you don’t seem to be gonna farewell.

Beware the brand new treasury consumers as a result of possibility will have to be transferred. The previous treasury consumers have been extra strong. They have been, they have been central financial institution chiefs. They have been governments as a result of the USA greenback as the arena reserve foreign money, they needed to grasp greenback denominated property of their reserves. K? However theyâre going away. Even our federal reserve, I imply, they are going to flip round and feature to shop for it once more, however extra worth delicate traders like hedge price range are piling in. Hmm. Neatly, you are saying, smartly why? Why do I care? You already know, truly in regards to the hedge price range and oh, via the best way, werenât the hedge price range, those that were given bailed out from Silicon Valley Financial institution and the ones different regional banks? However donât name it a bailout, they only werenât in a position but so that you can realize that, that banks are going to be bailed in. Youâll lose no matter wealth you grasp in that device. Youâll lose it even though they donât as itâll lose all buying energy. Take your, you recognize, select your drugs. Thatâs why I select bodily gold, bodily silver in my ownership. And why I imagine you will have to too. As a result of there’s a transferring call for as they shift the chance from the few to the numerous, which is simply the suitable dimension to fail. And also you, my buddy, are within the many.

So whoâs purchasing much less? K? The Federal Reserve international traders, business banks and dealer sellers, you’ll be able to see that the Fed bought off 213 billion within the treasuries via the top of 2023. In the event that they proceed at the trail theyâre on, they’re going to have bought off 720 billion. In order that they ainât purchasing. Overseas traders went from a good a plus of 376 right down to 275 billion. Business Banks have been additionally promoting. So foreigners have been purchasing. However business banks, that suggests J.P. Morgan, Financial institution of The us, Wells Fargo, the ones are all business banks with ties at once to the Federal Reserve. And via the best way, all the ones regional banks and group banks are relying upon those business banks as are you recognize, the any one that plays that, that serve as. So minus 83 billion to minus 170 billion. So greater than double and dealer sellers. So those are meant to be the marketplace makers. A lot of these entities are meant to stabilize that worth, which they arenât doing anyway and havenât been doing, particularly since 2008. And particularly since 2013. They went from purchasing 72 billion to a large whopping goose egg. No longer a dime. No longer a dime. So whoâs purchasing? letâs check out this. Oh my goodness. Pension price range an insurance coverage corporations the place they have been promoting minus 41 billion, theyâre now purchasing 150 billion. So those are the institutional traders which can be making an investment your hard-earned cash. Do you spot this possibility switch? Who else is purchasing? K, mutual price range from 20 billion to 2 75 billion. You’ll be able toât make these items up. And cash marketplace price range. So weâve had a flood of other people dashing into cash marketplace price range as a result of theyâre paying you a little bit little bit of curiosity. And thatâs going from minus the place they have been promoting 751 billion to a plus 600 billion. More or less seems like the cash markets are purchasing the entire treasuries that this fed is promoting. Hmm, isnât that fascinating? Hmm. Hmm. Isnât that fascinating? Do you spot this possibility switch? Do you spot it? I’m hoping you do as a result of for those who simplest percentage one chart but or one slide, you gotta percentage this one with your folks and your neighbors. If you wish to have to print it out, ask your advisor at ITM, theyâll print it out. In case you donât wanna do this, move at the weblog. You’ll be able to pause it, you’ll be able to print it out. Lack of understanding does now not make you immune. It merely leaves you susceptible. And they have got been shifting the chance from the few to the numerous. And that is the general blow off. We, the treasury marketplace is totally deed the entire, wait, Iâm going again to right here. All the standard consumers that truly arenât delicate to costs. The central banks in international traders, business banks, dealer sellers, theyâre going away. And you’ve got pension price range and insurance coverage corporations, however itâs assured. Neatly glance to your documentation as a result of the ones promises are simplest as excellent because the claims paying talent. Thatâs it. Thatâs counterparty possibility other people. Thatâs counterparty possibility. What runs no counterparty possibility. Bodily gold, bodily silver to your ownership. And thatâs in accordance, thatâs GR to me. However extra importantly, this is in step with essentially the most tough financial institution in all the global, the Financial institution for World Settlements, this gold is the one, the one monetary asset that runs no counterparty possibility. All this different rubbish that they would like you to suppose youâre assorted in. Itâs all counterparty possibility. And also youâre having a look proper at it. Whatâs counterparty possibility? Thatâs counterparty possibility. The claims paying talent. And feature we now not been witness over this closing yr or in an effort to price range going, nope, you’ll be able toât have your a refund. Nope. In case you donât grasp it, you donât personal it and your belief manner 0 in a courtroom of regulation 0. And itâs getting worse upper for longer.

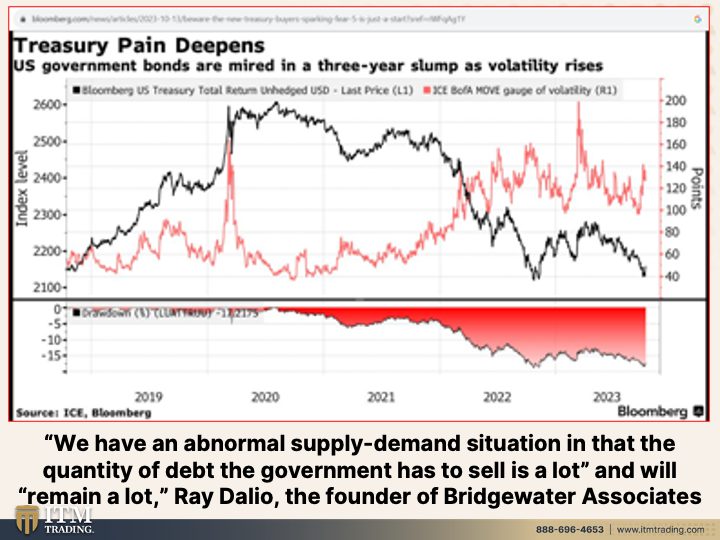

US govt bonds are mired in a 3 yr hunch as volatility rises. Thatâs now not excellent. We talked in regards to the bond vigilantes, who’re the bond vigilantes? As a result of thatâs the best way they are saying it. The bond vigilantes are challenging to be paid extra to take the chance. Yeah, the ones are bond buyers. And also you noticed once they considerably got here into the marketplace in 2013. So you were given them getting out if you are stepping into. Yeah, thatâs gonna figure out actual smartly. What do you suppose? We’ve got an bizarre provide call for scenario and that the volume of debt the federal government has to promote is so much and can stay so much. Oh, however donât fear. Money owed and deficits, ah, they donât subject. Yeah, they subject. And thatâs in step with Ray Dalio. However thatâs additionally in step with me, and thatâs in step with each economist in the world. The treasury is operating massive deficits. And we have been instructed see you later that it doesnât subject. Wager what? It issues since youâve were given this rates of interest. Take a look at this. K? Is that what you need your basis to appear to be? No longer what I need my basis to appear to be. I need it to appear to be this. I grasp it and I personal it in conjunction with Meals, Water, Power, Safety, Barterability, Wealth Preservation, Group and Refuge. And, and glance, I do know that Iâm truly keyed up and, and most likely one of the most contemporary movies Iâve accomplished, you’ll be able to see how keyed up I’m. However thatâs as a result of Iâm seeking to provide you with a warning and I’m hoping youâre listening to me. I truly hope youâre listening to me.

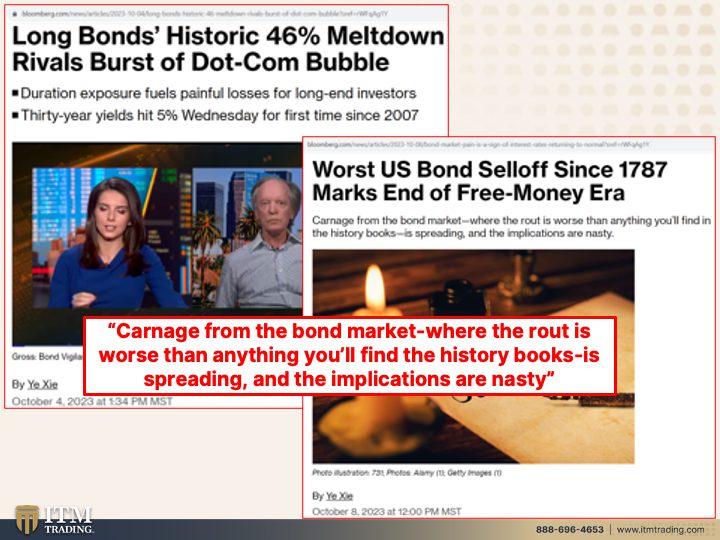

Lengthy bonds historical, 46% meltdown. Competitors burst of.com bubble. Yeah. You suppose? Worst US bond unload since 1787, now not 1987, now not even 1887. 1787. You suppose that marks the top of the loose cash technology? What that truly manner, what theyâre seeking to inform you is get to turn and canopy. Get a secure haven asset. Cling it, personal it. You stay it on this. Thatâs what youâre having a look at as a result of thatâs what creates this. This can be a debt-based foreign money. Thanks such a lot. And boy, hasnât the wealth already transferred? Have we heard in regards to the distinction between source of revenue and wealth? Thatâs gonna get an entire lot worse as a result of that’s the design carnage from the bond marketplace the place the course is price than anything else youâll in finding within the historical past. Books is spreading and the consequences are nasty. What else do you wish to have to grasp to get to protection and to just remember to can live to tell the tale via growing the power to ha to care for a cheap way of life? As a result of everyoneâs gonna be impacted via this. Even those who personal gold and silver, now, theyâre gonna be an entire lot much less impacted as a result of theyâre gonna have actual cash to shop for what they want. That is what I exploit for barterability. So group, group, we need to come in combination as a result of we vote with our wallets. What are you going to vote for? That is my vote. In addition to meals, water, power, safety, barterability, wealth preservation, group and safe haven. Get it accomplished or change into a part of the group. So one particular person can do something, the opposite particular person can do some other factor. And you’ll be able to come in combination to assist each and every different as a result of thatâs what group is all about. And we’d like each a world group and we’d like a area people. And thatâs what thriverscommunity.com is all about. Come and assist us. Time is operating quick.

Wider conflict in Center East might tip the the arenaâs financial system into weâre already going right into a recession level. Hands donât glance within the reflect and personal your section in it. You turn in central banks, you turn in governments. Iâm sorry, Iâm so indignant at them as a result of their process is to lie and lie and lie some extra. Conflict at all times accompanies a foreign money regime shift. Glance over right here. Can I, And Iâm, Iâm telling you whatâs going down within the Center East is horrendous. Itâs horrendous. However I willât take a seat right here and inform you that there wasnât a plan for it. Similar to Russia and Ukraine, I willât take a seat right here and inform you that as a result of theyâre all a part of the IMF. All the ones treasury secretaries, all the ones central financial institution chiefs, they get in combination steadily and they have got an time table and they have got a plan and so they execute it slowly, however they would like distance. They are saying it in virtually each unmarried record I ever learn from them. They would like distance between their coverage alternatives and the way it’s offered to the general public as a result of they are not looking for you or me to grasp that itâs coming from them. Letâs move cashless. Letâs have the retail public introduce that. And so much were complying. I favor those that favor money myself as a result of that is simply going to be the excuse for the hyperinflation that somewhat truthfully has already begun. And plenty of suppose, and Iâm considered one of them, however many of us suppose that we’re already in Global Conflict III. And as Ron Paul stated, there isn’t a accident that the technology of worldwide wars and perpetual wars went. K. This isnât a precise quote went hand in hand with the technology of perpetual central banking as a result of up till in fact 1927, each central financial institution had a constitution. In different phrases, their existence span was once both 15 to two decades. And firstly the Federal Reserve was once additionally born with that constitution. two decades that mightâve put it at, Hmm. What date was once that? 1933. And in 1927, for the primary time ever, a central financial institution was once proficient a perpetual constitution. And that is the place we’re. However who did that assist? Who did that receive advantages? No longer you or me.

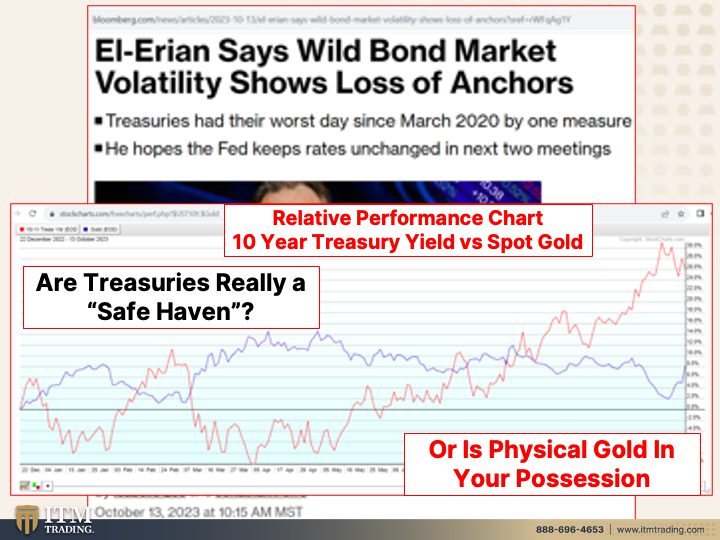

And in case you have mainstream popping out and speaking in regards to the wild bond marketplace, volatility displays the lack of anchors and treasuries had their worst day since March via one measure, he hopes the Fed helps to keep charges unchanged within the subsequent two conferences as a result of is that gonna truly make things better? No, it’s not. That bubble has already popped. And our long term is within the fingers of buyers. And you’ll be able to say that a method buying and selling for a little bit little bit of belongings or a little bit little bit of pickup on this rubbish. And you’ll be able to say it in differently, traitors. As a result of our founding fathers sought after excellent cash. No longer this crap that traditionally has been debased over 4,800 occasions. Yeah, yeah. I imply, to me, that is simply heartbreaking as a result of I’ve kids and I’ve grandchildren. Iâll have great-grandchildren and so will you as a result of everyone is our youngsters and our grandchildren and our great-grandchildren. And we need to come in combination to mention no. And time is operating out to try this. What youâre having a look at here’s a relative efficiency chart between the ten yr treasury yield as opposed to spot gold. K? As a result of in concept, smartly actually, gold will pay no curiosity. It doesnât must. Itâs the most secure darn factor that you’ll be able to do. So, hi there, the treasury bond, this can be a debt software and that will pay you those. Oh, wouldnât you moderately have extra of those? You donât must have any curiosity in this. Itâs the most secure darn factor you’ll be able to do. However on the similar time, inflation via design erodes what you’ll be able to purchase with this. So that youâre getting paid much less and no more for the paintings that you simply do with out you figuring out it. And now the unions are challenging extra money for the reason that inflation is extra evident. The upward push of the folk has begun. Are we gonna have a revolution? Neatly, I’m hoping itâs now not a violent revolution. I’m hoping we vote with our wallets and say no to their CBDCs, their virtual surveillance financial system, their talent to plant issues to your head in order that they are able to regulate the whole lot you do. Or put, put it to your earbuds that you simplyâre taking note of. Perhaps Iâm old-fashioned. I grew up in a time the place privateness mattered. However I additionally suppose that the enjoy of the transition from a minimum of a quasi gold again foreign money right into a complete fiat debt-based foreign money, I’ve that historical past. I bear in mind what that was once like. You guys which can be in the market which can be a equivalent age as child boomers, needless to say. Have in mind how chaotic it was once? Have in mind the Vietnam Conflict? Have in mind the inflation and the inventory markets decline and the whole lot else that was once happening? Civil rights, girlsâs lib, plenty of issues so that you can center of attention on in order that youâre now not that specialize in how they bought you down the river. Nixon stated, Hi there, for those who simply purchase American, the whole lotâs excellent. Lies, lies, lies. As a result of their process is to stay you susceptible. My process is that will help you make trained alternatives that places your highest curiosity. First, meals, water, power, safety, barterability, wealth preservation, group and safe haven. Do you truly suppose that treasuries are a secure haven? âpurpose theyâre now not Financial institution of The us. Oh wow. We, we donât look ahead to any losses on our well being to mature. This is such rubbish. Those business banks are drowning in losses from their treasury portfolio. The worst course since 1787. Itâs not anything. Itâs simply that those who create the ones spinoff, the ones possibility betts regulate, whether or not or now not there may be an tournament from it and so theyâre opaque markets, we willât see it till itâs too overdue. However all, the whole lot Iâm appearing you these days, the whole lot, the whole lot that Iâve been appearing you for years and years and years is appearing you the deterioration of the basis. I donât know the way to make it extra visual till itâs too overdue so that you can make alternatives. So for those who havenât clicked that Calendly hyperlink, do it. Get it accomplished, get it performed. Get your wealth. You do no matter you need. I willât truly inform you what to do. However your wealth held in that is in danger. It’s in danger. And this black swan tournament, this disaster that may do away with your talent to correctly get to protection can occur any 2d. And Iâm now not gonna realize it one 2d ahead of, and no doubt youâre now not gonna know one 2d ahead of, no counterparty possibility. The one monetary asset, gold, bodily gold to your ownership is the one monetary asset that runs no counterparty possibility. The counterparties are bailing. You’ve the entire possibility. What are you going to do about it? I imply, Iâm simply, Iâm simply as severe as a middle assault. Itâs going down. Other folks, the time to attend is long gone. I donât care what the spot marketplace does. Let it move up. 52 dollars, let it move down. 52 dollars. This is only a paper marketplace designed to control what you do. Forestall taking note of them.

I simply did a video thatâll move out, I donât know, possibly this Thursday or the next Thursday at the tendencies and methods to determine the patterns as a result of I feel all of us want a reminder. Take a look at that video. Get to protection. Now that basis goes like this and itâs visual to people who know, click on that Calendly hyperlink. Get your technique performed as a result of you must have what you wish to have to your goals. And thatâs what we do other than any one else. And this technique is according to my research of currencies and foreign money existence cycles. Going again to 1987 is after I first began learning it. Ask your banker, ask your dealer, have you ever ever studied foreign money existence cycles? And if they are saying sure, I need you to invite âem the straightforward query, then inform me how cash is created and supported on this device. And if they begin providing you with a operating round and all this gobbledy move, smartly, blah, itâs âpurpose they donât know. Right hereâs the solution. What helps this? Federal Reserve? Federal Reserve notice, this debt software is the overall religion. So that you gotta believe the federal government and credit score the federal governmentâs talent to develop extra debt, which theyâre announcing even overtly in mainstream media is declining.

They gotta get you to shop for that debt. So what does the mainstream media pop out? Oh, smartly, youâre gonna make such a lot cash with this technique for the reason that fedâs gonna pivot and drop charges down. Perhaps they’re going to, however theyâre preventing for his or her credibility and that makes them much more unhealthy.

So for those who havenât accomplished it but, you’re making, be sure to subscribe as a result of we’re in a truly dicey position presently. Depart us a remark. Please assist us unfold this data. Give us a thumbs up and percentage, percentage, percentage, percentage, percentage. I can be very in a while popping out with that 5 minute video. I feel I were given it dialed in via now. So keep tuned. And in fact on those pattern cycles and the place we’re, weâre gonna be breaking them down into itty bitty movies. So that youâre gonna be capable of percentage the ones too. Now Iâm pooped, however Iâm telling you Iâm truly disappointed and I’m hoping I will impart how important. It’s important to get it accomplished as temporarily as you’ll be able to. One thing is best than not anything, however coming in combination in group in order that you donât must do all of it. âpurpose Frankly, I gotta inform you, I donât suppose you could have the time to do all of it. Iâve been operating in this in earnest since 2010 was once after I controlled to shop for this belongings and delivery that meals, water, power, safety, barterability, wealth preservation, group and safe haven. Iâve been purchasing gold in earnest since 2002 when the formulation, the patterns simply instructed me that the top was once coming. Do I care that I ignored out on a few of these rallies? No, I donât give a crap as a result of Iâm a technician and Iâm a long-term strategist. I wanna know now not whatâs going down these days as a result of thatâs inappropriate to me. I wanna know whatâs gonna occur the next day so I will get into place to live to tell the tale it and thrive via it. And thatâs the place we’re presently. You’ll be able to get into place to live to tell the tale this and in fact pop out the opposite aspect of it higher. Nevertheless itâs now not gonna occur except you get into the location in order that youâre in the suitable position on the proper time with the suitable asset.

And with that, I need you to bear in mind, monetary shields are manufactured from bodily metals. Undoubtedly now not paper or lame guarantees. âpurpose They know theyâre screwing you. They realize it. Till subsequent we meet. Please be secure in the market. Bye-Bye.

SOURCES: