” It is tough to get a male to comprehend something, when his income depends upon his not comprehending it.”

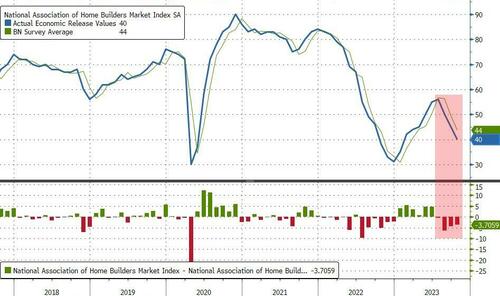

The quote – credited to Upton Sinclair – summarize the blind optimism that has actually controlled homebuilder self-confidence information for the last 6 months. However truth is truly beginning to sink in and today’s information for October reveals another huge dissatisfaction as the heading NAHB self-confidence index printed at 9-month lows (down 5 to 45, vs 49 exp). That is the fourth straight regular monthly miss out on in a row (and 5 advantage surprises) …

Source: Bloomberg

Alicia Huey, NAHB chair, stated in a declaration: ” Contractors have actually reported lower levels of purchaser traffic, as some purchasers, especially more youthful ones, are evaluated of the marketplace due to the fact that of greater rate of interest.”

Procedures of existing and predicted sales, in addition to a gauge of potential purchaser traffic, likewise dropped to their most affordable levels given that the start of the year.

Source: Bloomberg

Including that “ greater rates are likewise increasing the expense and accessibility of contractor advancement and building and construction loans, which damages supply and adds to decrease real estate price,” Huey stated.

Source: Bloomberg

Home builder belief in all 4 significant United States areas decreased from a month previously.

In order to get purchasers to close handle the existing high interest-rate environment, lots of contractors are providing monetary rewards. The share of contractors providing all kinds of purchaser rewards increased to 62% this month, matching the cycle high reached in December.

And if property buyer self-confidence is anything to pass, homebuilder self-confidence has a long method to go to capture down to the severe truth of practically 8% home mortgages (when typical home mortgage holders’ rates are around 3-4%) …

Source: Bloomberg

If controling price lower was The Fed’s objective, they stopped working.

” The real estate price crisis can just be fixed by including extra obtainable, economical supply,” stated NAHB Chief Financial expert Robert Dietz.

” Improving real estate production would help in reducing the shelter inflation element that was accountable for majority of the general Customer Rate Index boost in September and assist the Fed’s objective to bring inflation pull back to 2%. Nevertheless, unpredictability concerning financial policy is adding to price obstacles in the market.”

And do not anticipate them to be constructing homes at the very same speed (structure authorizations will plunge) …

And the abrupt awareness by homebuilders that this is more than temporal – and their margins can’t keep taking in rewards permanently – then the genuine discomfort is yet to come.

Packing …